Key Takeaways

- Data center REITs are the landlords of the digital age, owning the physical infrastructure that powers cloud computing, AI, and your favorite online services.

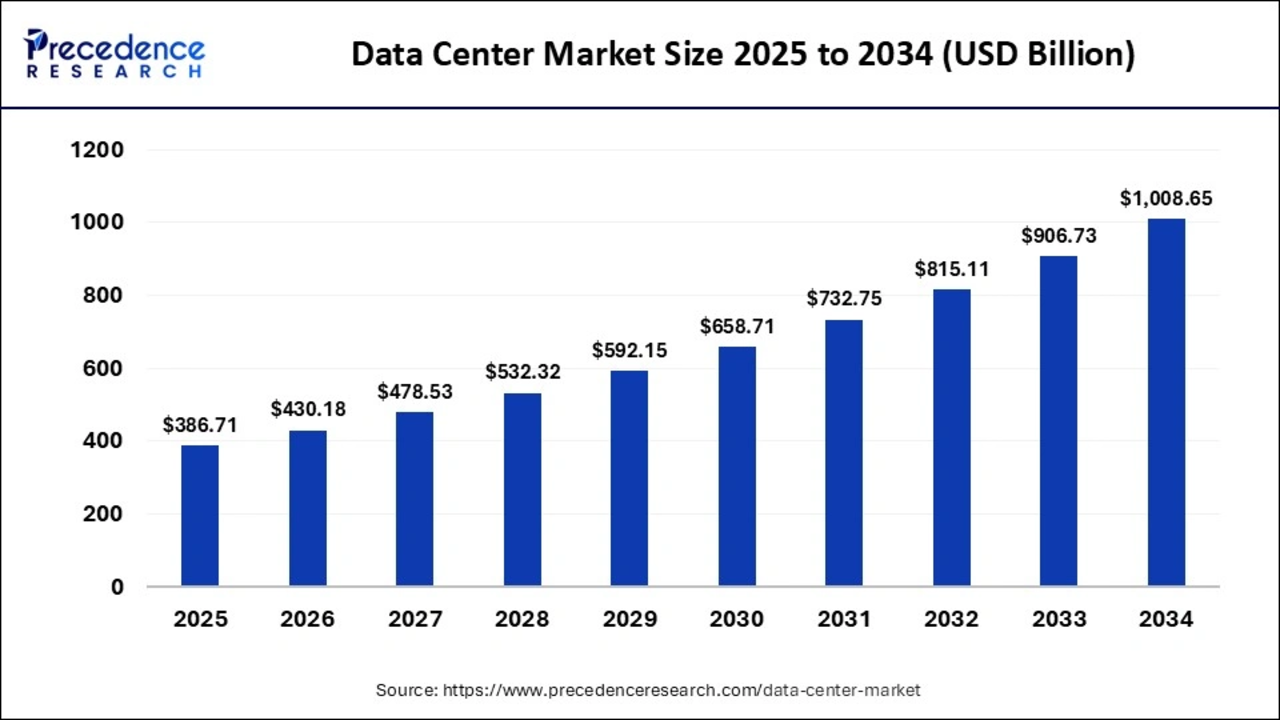

- The explosive growth of artificial intelligence and big data is creating unprecedented demand for data storage and processing, directly benefiting these companies.

- When evaluating data center REITs, you should focus on their financial health, the quality of their tenants, their power and location strategy, and their plans for future growth.

- Industry leaders like Equinix (EQIX), Digital Realty (DLR), and the rapidly transforming Iron Mountain (IRM) are top data center REITs for you to watch.

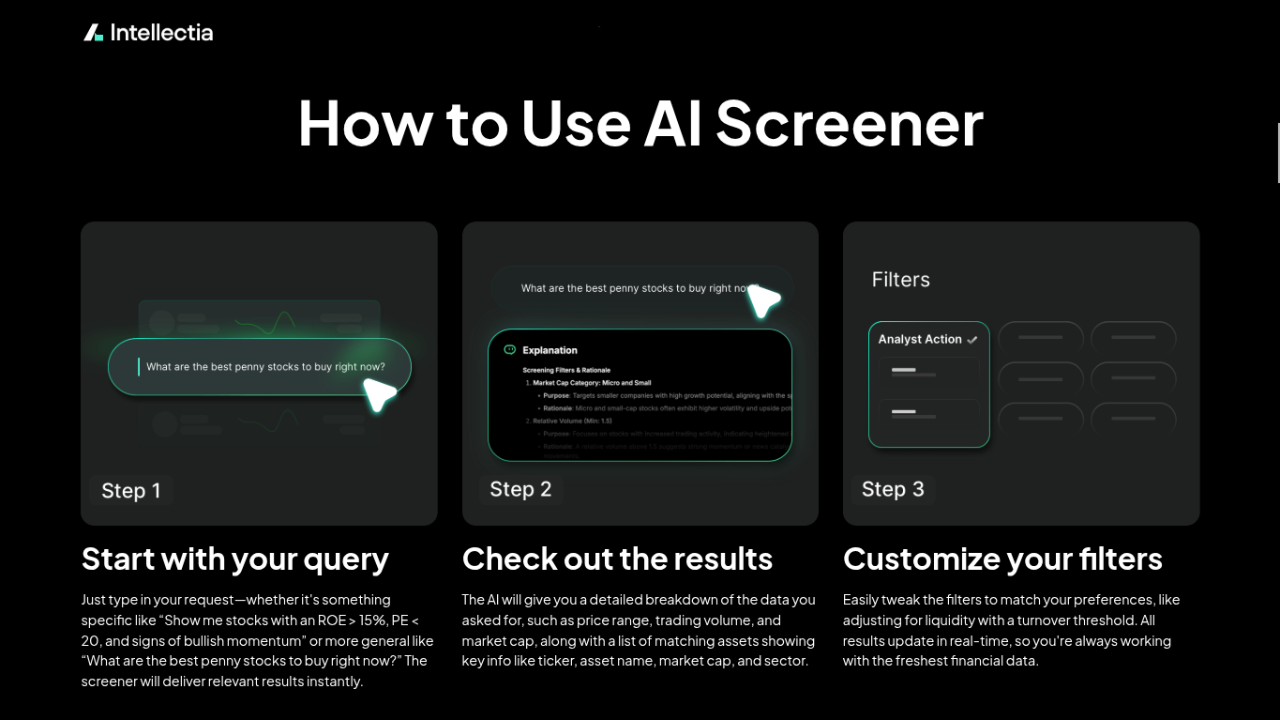

- You can use AI-powered tools like Intellectia.ai stock screeners, stock pickers, and swing trading signals to effectively navigate your investment strategy in this dynamic sector.

Introduction

Have you ever wondered how the digital world actually works? Every time you stream a movie, join a video call, or use an AI chatbot, you are tapping into a vast network of physical buildings that store and process that information. The insatiable demand for data has created a modern-day gold rush, and finding the right way to invest can feel overwhelming.

Many investors see the explosive growth in tech but overlook the critical real estate that makes it all possible. By focusing on a specific type of real estate investment trust (REIT), you can directly profit from this digital expansion.

This is where data center REITs come into play. This guide will show you what these unique companies are, how you can evaluate the top players, and which ones are leading the market. Get ready to discover a powerful way through intellectia.ai to invest in the backbone of the digital age.

What Are Data Center REITs?

Data center REITs are companies that own, operate, and manage the physical buildings and infrastructure that house servers, networking equipment, and data storage systems. Think of them as the landlords for the internet. They provide secure, climate-controlled spaces with reliable power and connectivity for a wide range of customers.

The core business model revolves around leasing this specialized space. These aren't your typical office leases; they are often long-term contracts with built-in rent escalations, providing a steady and predictable stream of income.

Advantages of Investing in Data Center REITs

- Exposure to Tech Growth: You get a direct investment in the growth of AI, cloud computing, and 5G without picking individual tech stocks.

- Stable Income: Long-term leases with high-credit tenants like Amazon, Google, and Microsoft provide reliable cash flow.

- Attractive Dividends: As REITs, they are required to distribute at least 90% of their taxable income to shareholders, often resulting in consistent dividends.

Risks to Consider

- High Capital Costs: Building and maintaining data centers is incredibly expensive, requiring significant ongoing investment.

- Power Constraints: These facilities consume enormous amounts of electricity, and securing sufficient power in key markets is a major challenge.

- Tenant Concentration: While tenants are high-quality, some REITs may rely heavily on a small number of hyperscale clients, creating risk if one were to leave.

Criteria to Evaluate the Best Data Center REITs

Not all data center REITs are created equal. When analyzing your options from a data center REITs list, you should focus on a few key criteria to identify the strongest players.

Financial Strength

Instead of traditional earnings, you should look at metrics like Funds From Operations (FFO) and Adjusted Funds From Operations (AFFO), which are better measures of a REIT's cash flow. A healthy balance sheet with a manageable debt-to-EBITDA ratio is also crucial for funding future growth.

Tenant Base and Contract Quality

The best data center REITs have a diversified roster of creditworthy tenants. Look for companies that serve the biggest names in cloud computing (hyperscalers), enterprise, and telecommunications. Long lease terms with built-in annual rent increases ensure a stable and growing revenue stream.

Geographic and Power Strategy

Location is everything. The most valuable data centers are in major connectivity hubs with access to robust fiber optic networks and, most importantly, abundant power. A company's ability to secure land and power for future projects is a critical indicator of its long-term success.

Growth Pipeline and Expansion

A strong growth pipeline—meaning land already owned and projects under construction—gives a company visibility into its future earnings. Top data center REITs are constantly acquiring land and developing new facilities to meet the relentless demand for capacity.

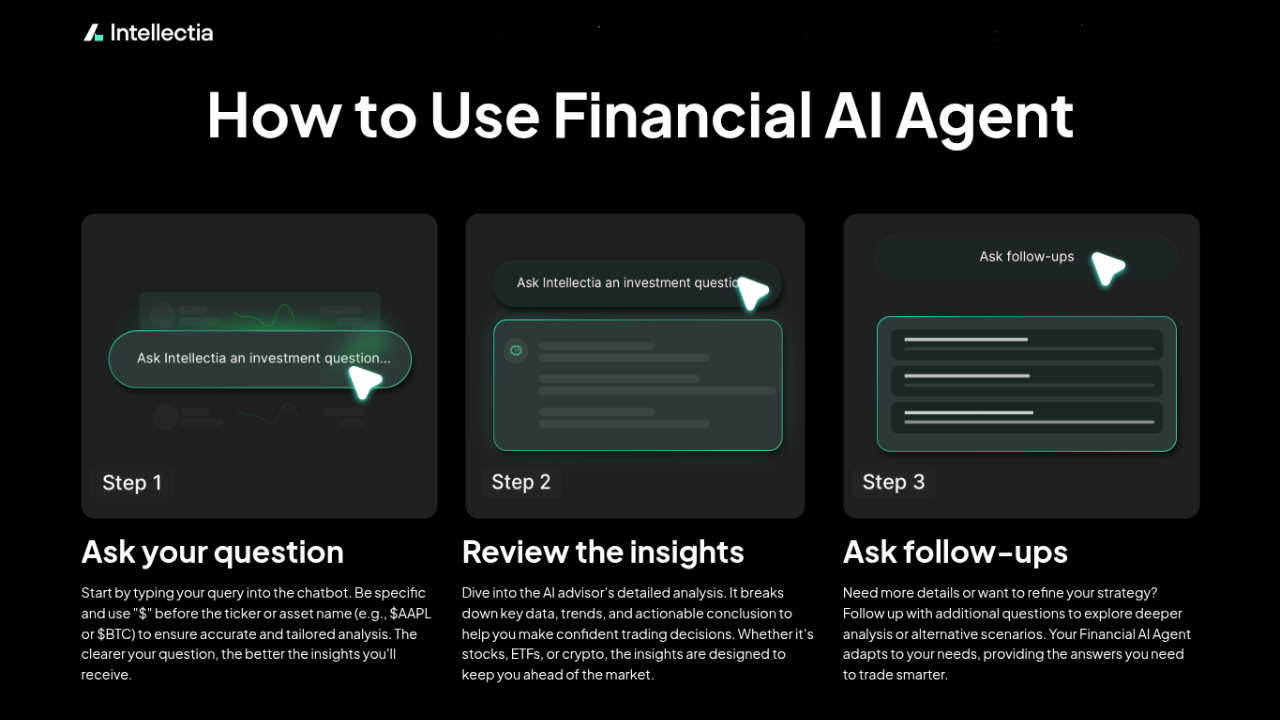

Ready to find your next big trade? You can use Intellectia.ai’s powerful AI agent that analyzes thousands of data points to identify top-performing REIT stocks in the data center space.

Top Data Center REITs to Watch

While there are many players, three companies stand out for their scale, strategy, and market position. This comparative look will help you understand what makes each of these top data center REITs unique.

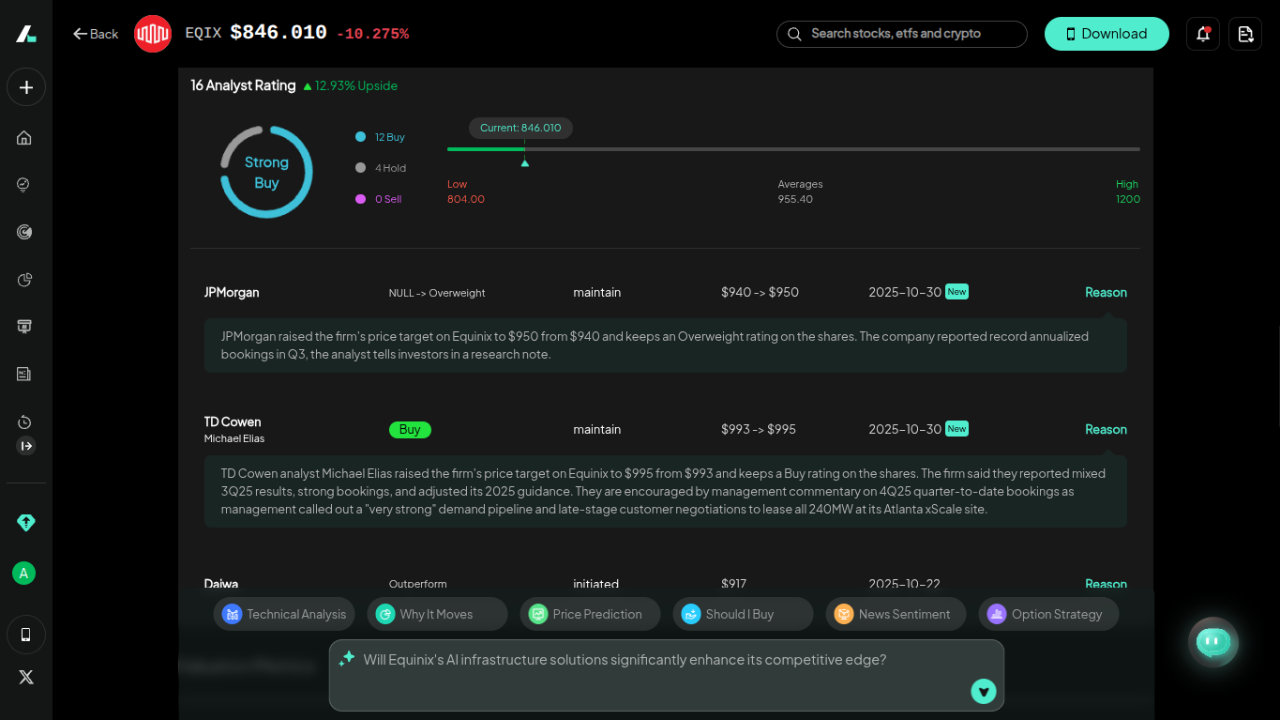

Equinix (EQIX)

Equinix is the undisputed global leader in retail colocation and interconnection. It operates a network of over 260 data centers where thousands of businesses connect to each other and to cloud providers. This creates powerful "network effects," making its facilities indispensable hubs for digital commerce.

In its third-quarter 2025 earnings, Equinix reported record annualized gross bookings of $394 million, a 25% year-over-year increase. The company announced a bold strategy to double its capacity by 2029, supported by a developable capacity of approximately 3 gigawatts.

Equinix's strength lies in its ecosystem. By being the meeting point for networks, clouds, and enterprises, it has created a competitive moat that is difficult to replicate. For businesses requiring low-latency connections to a multitude of partners, Equinix is often the only choice.

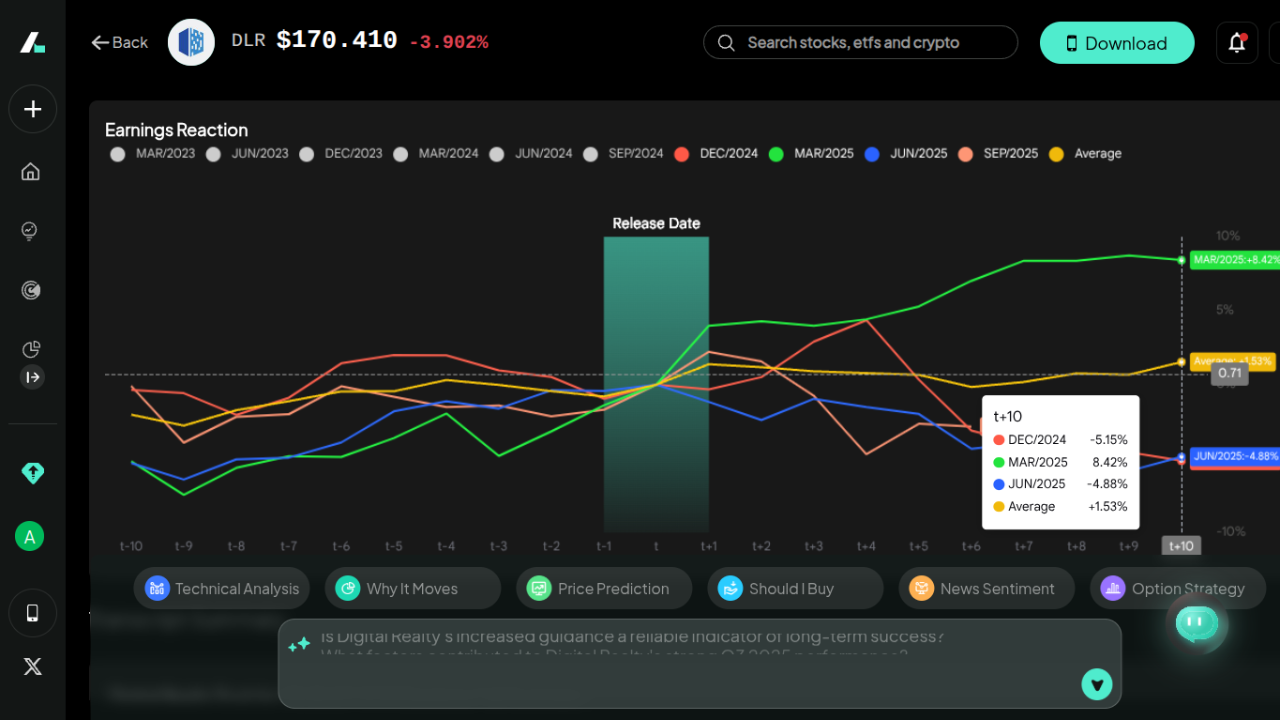

Digital Realty Trust (DLR)

Digital Realty is a giant in the data center world, with a massive global portfolio of over 300 facilities. The company is a key partner for hyperscale clients, providing the large, scalable campuses needed to power cloud platforms and large-scale AI model training.

Digital Realty delivered a record core FFO of $1.89 per share in Q3 2025, a 13% year-over-year increase. The company's backlog grew to $852 million, providing strong visibility into future revenue. Crucially, over 50% of its quarterly bookings are now driven by AI-related demand, and it has a 5-gigawatt power bank to support future workloads.

DLR's sheer scale and global presence make it a go-to provider for the world's largest technology companies. As AI deployments continue to demand enormous capacity, Digital Realty is perfectly positioned to capture this massive wave of growth.

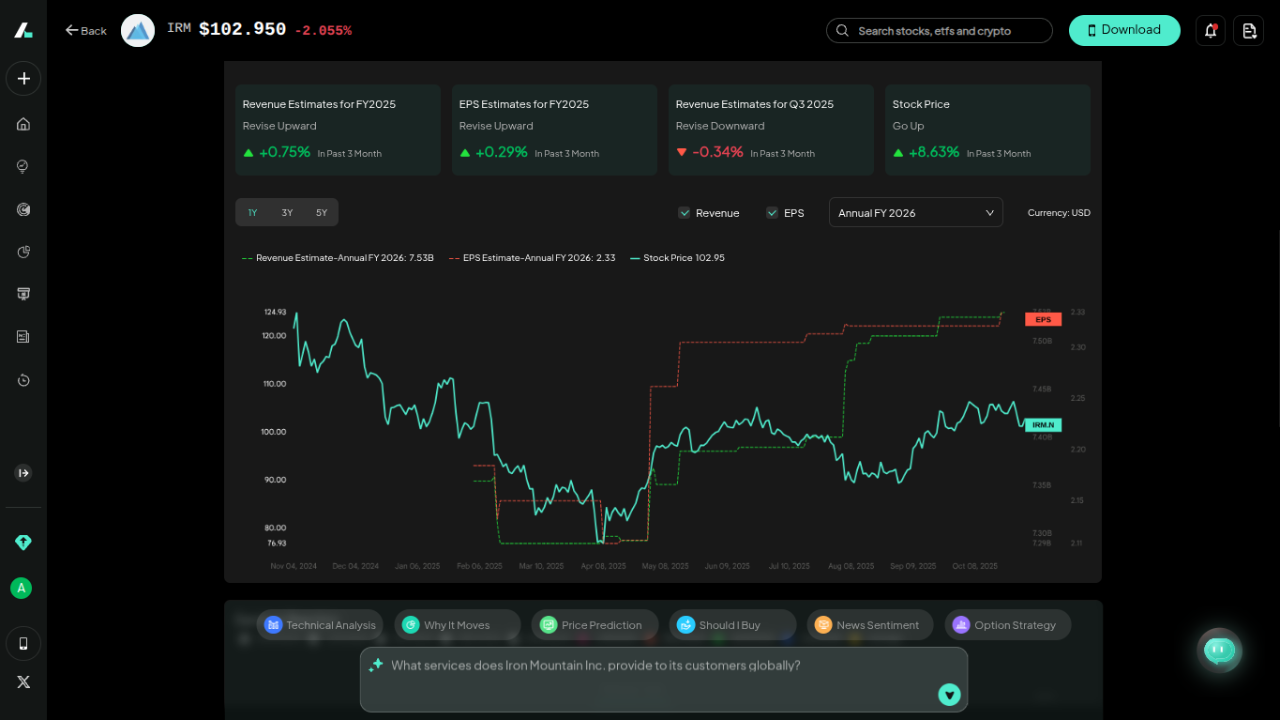

Iron Mountain (IRM)

Iron Mountain is a fascinating transformation story. Traditionally known for physical document storage, the company is leveraging its global base of 240,000 customers to rapidly expand into higher-growth areas. Its data center, digital solutions, and asset lifecycle management (ALM) segments are becoming powerful growth engines.

Iron Mountain's "growth portfolio" is expanding at over 20% annually and is projected to account for nearly 30% of total revenue. Its data center business alone is approaching $800 million in annual revenue, with analysts forecasting it to exceed $1 billion in 2026. The company has 450 megawatts of capacity currently operating, with a development pipeline of another 900 megawatts.

Iron Mountain offers a unique, diversified investment. Its stable and profitable records management business provides the cash flow to fund its aggressive expansion into the data center market. This hybrid model offers a potentially different risk-reward profile compared to pure-play data center REITs.

Investment Strategies for Data Center REITs

Once you've identified promising data center REITs, you need a strategy. How you invest will depend on your goals, risk tolerance, and timeline.

Direct REIT Investment

The most straightforward approach is to buy shares of individual companies like EQIX, DLR, and IRM through a brokerage account. This allows you to build a concentrated position in the companies you believe have the most potential.

Long-Term Growth vs. Short-Term Trading

A long-term strategy involves buying and holding shares to capitalize on the multi-year trends of AI and cloud adoption. For more active investors, short-term trading can capture momentum. You can supercharge your strategy by using tools like Intellectia.ai's AI swing trading signals, which analyze market data to identify potential entry and exit points.

Consider ETFs for Broader Exposure

If you prefer diversification, you can invest in exchange-traded funds (ETFs) that hold a basket of data center and other infrastructure REITs. To find the right one for you, use an AI Screener to filter ETFs based on their holdings, expense ratios, and performance, ensuring they align with your investment criteria.

Balancing Your Portfolio

A balanced approach might involve a core holding in a market leader and smaller positions in companies with different growth profiles. To discover new opportunities that match your risk appetite, you can use an AI stock picker, which sifts through thousands of stocks to find those with the highest potential.

Conclusion

The digital transformation is not just a trend; it's a fundamental reshaping of the global economy. Data center REITs represent the essential physical foundation of this new era, making them one of the most compelling real estate investment opportunities today.

By understanding their business models and focusing on the strongest players, you can position your portfolio to benefit from the powerful, long-term tailwinds of AI, cloud computing, and big data. Ready to dive deeper and find your next winning investment? Sign up for Intellectia.ai to get daily AI stock picks, advanced trading signals, and market analysis. Subscribe today to stay ahead of the curve and build a smarter portfolio.