Takeaways

- Bitcoin mining stocks provide an alternative investment with an exposure to cryptocurrency markets with potential for dividend income and price appreciation.

- Stock selection criteria include hashrates, energy efficiency, mining sustainability moves, and growth plans.

- Comps like MARA, RIOT, CLSK, CORZ, and HUT lead the market with high hashrates and sharp operationals.

- You should prioritize firms with strong financials, tech advancements, and a focus on renewable energy sources.

- AI-driven trading strategies and ETF exposure can boost investment outcomes in the volatile Bitcoin mining sector.

Introduction

You may be curious about how to invest in Bitcoin without directly purchasing the cryptocurrency? Here, Bitcoin mining stocks provide a solution. These companies mine Bitcoin and lead to the blockchain’s security while generating revenue. These comps provide dividends and high stock price growth potential. The volatility of direct crypto investments can be complex, but mining stocks allow you to jump into the crypto value boom through stock markets.

What Are Bitcoin Mining Stocks?

Bitcoin mining stocks represent shares in publicly traded comps (listed) that operate specialized chips based data centers to solve complex math problems, validating transactions on the Bitcoin (BTC) network. In return, these guys earn Bitcoin rewards, which form a major portion of their topline.

Unlike direct Bitcoin ownership, investing in these stocks allows you to benefit from the cryptocurrency’s growth without managing digital wallets and engaging in crypto exchanges. Comps like MARA and Riot derive topline by mining BTCs and diversifying into businesses like data center hosting and high-performance computing (HPC).

Why Invest in Bitcoin Mining Stocks?

Investing in Bitcoin mining stocks has advantages that make them a vital addition to your portfolio. Firstly, you gain exposure to Bitcoin’s price movements without the complexities of owning and securing cryptocurrency. Apart from that many mining companies distribute profits as dividends, and their stock prices can appreciate with Bitcoin’s value and operational leads.

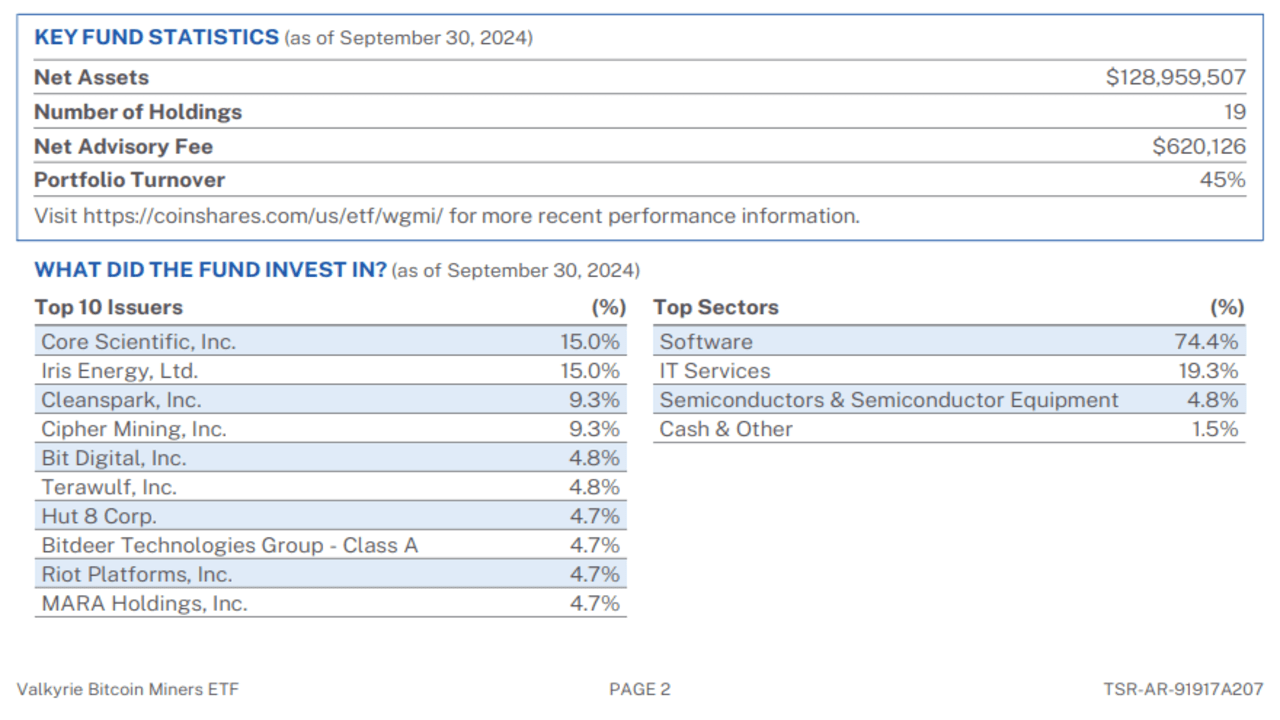

Moreover, growing interest from institutional investors and the availability of Bitcoin-related ETFs like the Valkyrie Bitcoin Miners ETF, derive demand for mining stocks. These stocks directly operate in tech and energy sectors that logically bring in diversification beyond traditional crypto investments.

However, the sector is not without risks. There are Bitcoin price volatility, macro issues (like Trump Tariffs), regulatory uncertainties, and high energy costs that can hurt the value of these investments.

Source: Valkyrie Bitcoin Miners ETF_ Annual Report

Criteria for Selecting Best Bitcoin Mining Stocks

To identify the top Bitcoin mining stocks, consider a specific criteria that includes hashrate capacity and sharpness, energy sources and sustainability moves, tech and infrastructure advancements, and company growth plans and expansion strategies.

In detail, first measure exahashes per second (EH/s) as a higher hashrate indicates greater mining power and possible rewards amid increasing Network Difficulty. Then check for joules per terahash (J/TH) that reflects energy usage per unit of mining power. After that, enlist comps that are using renewable energy sources like hydro and solar to reduce costs and to be in line with environmental regulations.

Now for long-term viability, keep an eye on advancements like immersion cooling and custom firmware that can improve mining efficiency and bottomline. Finally, ideal comps should have clear plans to boost hashrate, expand facilities, and diversify topline.

Source: blockchain.com

Top 5 Best Bitcoin Mining Stocks to Watch

Below is an overview of the selected Bitcoin mining stocks that is followed by detailed profiles for each.

| Company Name | Ticker | Sector | Market Cap | Key Strengths |

|---|---|---|---|---|

| MARA Holdings | MARA | Technology | $4.95B | High hashrate, sustainable energy use |

| Riot Platforms | RIOT | Technology | $2.72B | Large-scale operations, immersion cooling |

| CleanSpark | CLSK | Technology | $2.53B | Low-carbon energy, aggressive expansion |

| Core Scientific | CORZ | Technology | $2.45B | Diversified services, carbon-neutral |

| Hut 8 Mining | HUT | Technology | $1.39B | Renewable energy, AI data center ventures |

MARA Holdings (MARA)

MARA Holdings is a big player in Bitcoin mining. As of FY24, MARA had a hashrate of 53.2 EH/s. It is one of the highest in the BTC mining industry. MARA has expectations of more increases in the rate in FY25. The company focuses on energy sustainability and utilizing renewable sources like solar and wind. Mara is also converting excess natural gas from oil fields into power for its data centers. MARA’s latest tech advancements include liquid immersion cooling and proprietary firmware (boosting mining efficiency).

Financially, MARA had $656.38M in revenue and a net income of $541.25M, with a profit margin of 82.46%. Analyst price targets range from $13 to $30. This is suggesting potential upside from its current price of $14.01. Overall, choose MARA if you prioritize high hashrate and a focus on sustainable energy.

Source: Intellectia.ai MARA 2024 Financials

Riot Platforms (RIOT)

Riot Platforms leads in Bitcoin miners by operating large-scale facilities in Texas and Kentucky. Its hashrate reached 31.5 EH/s in December FY24. There are projections to hit 46.7 EH/s by the end of FY25 and 65.7 EH/s by 2026. Riot has historically relied on natural gas and coal. But, now it’s investing in renewable projects like a deal with Reformed Energy for waste-to-energy solutions.

Riot employs immersion cooling in its new Corsicana facility, boosting mining efficiency. Financially, Riot had $376.66M in revenue and a net income of $109.4M, with a profit margin of 29.05%. Analyst price targets average $17.25 relative to its current price of $7.63, indicating growth potential. Riot is good for those seeking large-scale operations with long-term expansion plans.

Source: Intellectia.ai Riot 2024 Financials

CleanSpark (CLSK)

CleanSpark stands out for its focus on sustainability. It is using 94% low-carbon energy sources, including nuclear, hydro, and solar, primarily in Georgia. CleanSpark hit a hashrate of 42.4 EH/s in March FY25 and is now aiming for 50 EH/s by mid-FY25. The company is expanding into Wyoming, Tennessee, and Mississippi, with new facilities incorporating immersion cooling for enhanced efficiency.

Financials include $467.49M in revenue and a net income of $67.12M, with a profit margin of 16.07%. Analysts project a one-year price target of $20.43, compared to its current price, suggesting room for growth. CleanSpark is a top choice for environmentally conscious investors focused on progressive mining practices.

Source: Intellectia.ai CleanSpark 2024 Financials

Core Scientific (CORZ)

Core Scientific has a diversified business model that includes self-mining, hosting, and HPC services. Its hashrate was approximately 19.1 EH/s in March FY25, with a focus on maintaining efficiency. Core Scientific claims to be 100% net carbon-neutral and using a mix of grid power and renewable sources like wind and solar.

The company had $510.67M in revenue but faced a net loss of $1.315B, reflecting issues post-bankruptcy restructuring. Analyst price targets average $18.54, compared to its current price of $8.24, indicating significant upside potential. Choose Core Scientific if you value diversification and carbon-neutral operations.

Source: Intellectia.ai Core Scientific 2024 Financials

Hut 8 Mining (HUT)

Hut 8 Mining is a vertically integrated operator focusing on Bitcoin mining and emerging AI data center ventures. Its hashrate reached 9.3 EH/s in March FY25, with plans to hit 24 EH/s by Q2 FY25 through a major fleet upgrade. Hut 8 prioritizes renewable energy based on hydro and nuclear power in its Canadian facilities that enhances cost efficiency.

Financially, the company reported $162.38M in revenue and a net income of $338.93M, with an impressive profit margin of 204.38%. Analysts estimate a one-year price target of $28.12, suggesting strong growth potential. Hut 8 is suitable for investors interested in renewable energy and diversified revenue streams.

Source: Intellectia.ai Hut 8 2024 Financials

Strategies for Bitcoin Mining Stocks Traders

To assess returns from BTC mining stocks, one can consider trading strategies boosted by AI-tools.

- AI Day Trading: Use AI algos to analyze real-time market data and execute trades based on short-term price moves. Intellectia.ai’s Day Trading Center provides tools for this.

- AI Swing Trading: Identify med-term trends using AI to optimize entry and exit points, balancing risk with reward. One can explore Intellectia.ai’s Swing Trading Features for sharp insights.

- ETF Exposure: Invest in ETFs like the Valkyrie Bitcoin Miners ETF to diversify across multiple mining stocks that can reduce individual company risk.

- Technical Analysis: Leverage Intellectia.ai’s Stock Technical Analysis to study chart patterns and indicators for sharp decisions.

- Stock Screening: Use Intellectia.ai’s AI Screener to filter stocks based on hashrate, financials, and energy sustainability metrics.

These strategies are based on Intellectia.ai’s advanced analytics that can help you channelize the volatile Bitcoin mining stock market.

Conclusion

Bitcoin mining stocks offer a solid opportunity to invest in the crypto ecosystem while benefiting from traditional stock market advantages (like dividends and price appreciation). MARA, Riot, CleanSpark, Core Scientific, and Hut 8 Mining are among the best Bitcoin mining stocks in FY25. Each of these comps are excelling in hashrate, energy sustainability, and topline diversification. By focusing on the criteria—hashrate capacity, energy sources, tech advancement, and growth plans—you can make investment choices. The sector’s high volatility requires careful analysis, and tools like Intellectia.ai can provide AI-based insights to boost trading strategies.