Key Takeaways

- The Artificial Intelligence market is projected to become a multi-trillion dollar industry, creating a massive opportunity for long-term investors.

- Leading AI companies differentiate themselves through strong revenue growth, essential data and compute infrastructure, and a relentless pace of innovation.

- NVIDIA and Microsoft represent the foundational pillars of the AI boom, providing the core hardware and cloud platforms that power the revolution.

- Companies like Palantir, Super Micro Computer, and Salesforce are carving out dominant positions by integrating AI into critical enterprise software and infrastructure.

- Using AI-powered tools can help you analyze market data, identify top performers, and build a resilient long-term AI stock portfolio.

Introduction

Have you watched the AI sector explode and wondered which companies are built to last versus which are just riding a wave of hype? You’re not alone. Many investors are trying to figure out how to navigate this technological gold rush, seeking the best AI stocks for long-term investment without getting burned by short-term volatility.

The key is to look beyond the headlines and analyze the companies building the fundamental infrastructure and integrated software that will power industries for the next decade. By focusing on market leaders with scalable business models, you can position your portfolio to capture the immense growth ahead.

This article provides a clear framework for identifying these long-term winners. You will learn the essential criteria for selecting top-tier AI stocks and get an in-depth look at five companies poised to dominate the market through 2026 and beyond.

Why Invest in AI Stocks for the Long Term?

Investing in AI for the long term isn't just about betting on technology; it's about investing in a fundamental shift in how the global economy operates. The companies at the forefront of this change are positioned for sustained, multi-year growth that short-term trading often misses.

Exponential Market Growth of Artificial Intelligence

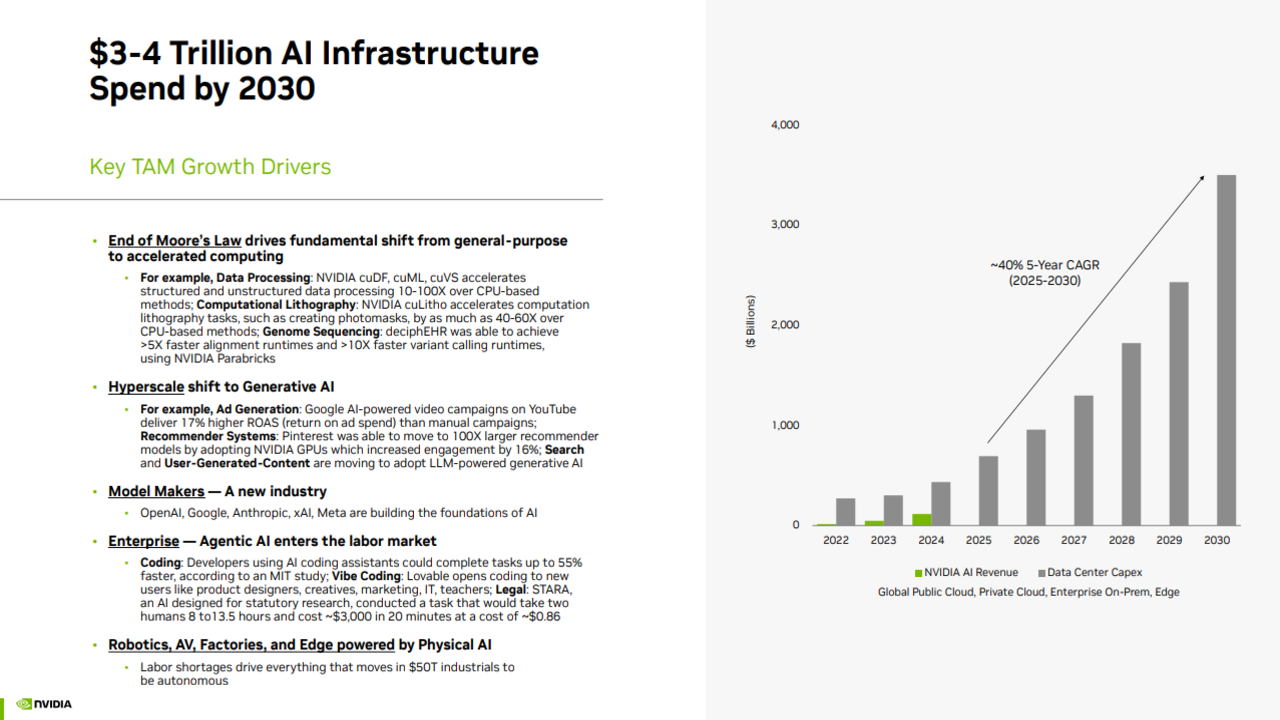

The scale of the AI opportunity is staggering. NVIDIA’s CEO, Jensen Huang, anticipates a $3 trillion to $4 trillion AI infrastructure spend by the end of the decade. This isn't just a forecast; it's a reflection of the massive build-out happening right now as companies race to develop AI capabilities.

This industrial revolution is fueling unprecedented demand for everything from specialized chips to cloud computing and intelligent software. Investing in the leaders of this build-out allows you to participate in this generational wealth-creation opportunity.

AI’s Role in Next-Generation Productivity

Artificial intelligence is becoming the new engine of productivity. Companies across every sector are deploying "agentic AI" — intelligent agents that can automate complex tasks, analyze data, and enhance human decision-making. Salesforce CEO Marc Benioff describes this as the arrival of the "agentic enterprise," a complete transformation of business operations.

This shift creates durable, long-term demand for the platforms that enable it. As businesses see tangible returns on investment from AI, their spending on these technologies will only accelerate, driving recurring revenue for the companies you invest in.

Long-Term AI Stock Investing vs. Short-Term Trading

While short-term trading can be tempting, the AI market's true potential lies in long-term growth. Foundational companies are not just one-hit wonders; they are building ecosystems, securing multi-year contracts, and reinvesting heavily in innovation.

A long-term perspective allows you to ride out market volatility and benefit from the compounding growth of these industry leaders. Instead of trying to time the market, you can focus on accumulating shares in dominant companies that are becoming indispensable to the new economy.

Criteria for Selecting the Best AI Stocks for Long-Term Investment

Not all AI stocks are created equal. To find the top AI stocks for long-term investment in 2026, you need to look for companies with durable competitive advantages. Here are the key criteria to guide your selection process.

Strong AI Revenue Streams & Scalable Models

The most important signal is a company's ability to actually make money from AI. Look for businesses with rapidly growing AI-specific revenue. For example, Microsoft’s cloud revenue recently surpassed $49 billion for the quarter, largely fueled by demand for its AI services.

Similarly, Palantir's U.S. commercial segment, driven by its Artificial Intelligence Platform (AIP), surged 121% YoY. This kind of tangible, explosive growth demonstrates a scalable model where initial adoption leads to expanding, long-term contracts.

Data & Compute Infrastructure Advantage

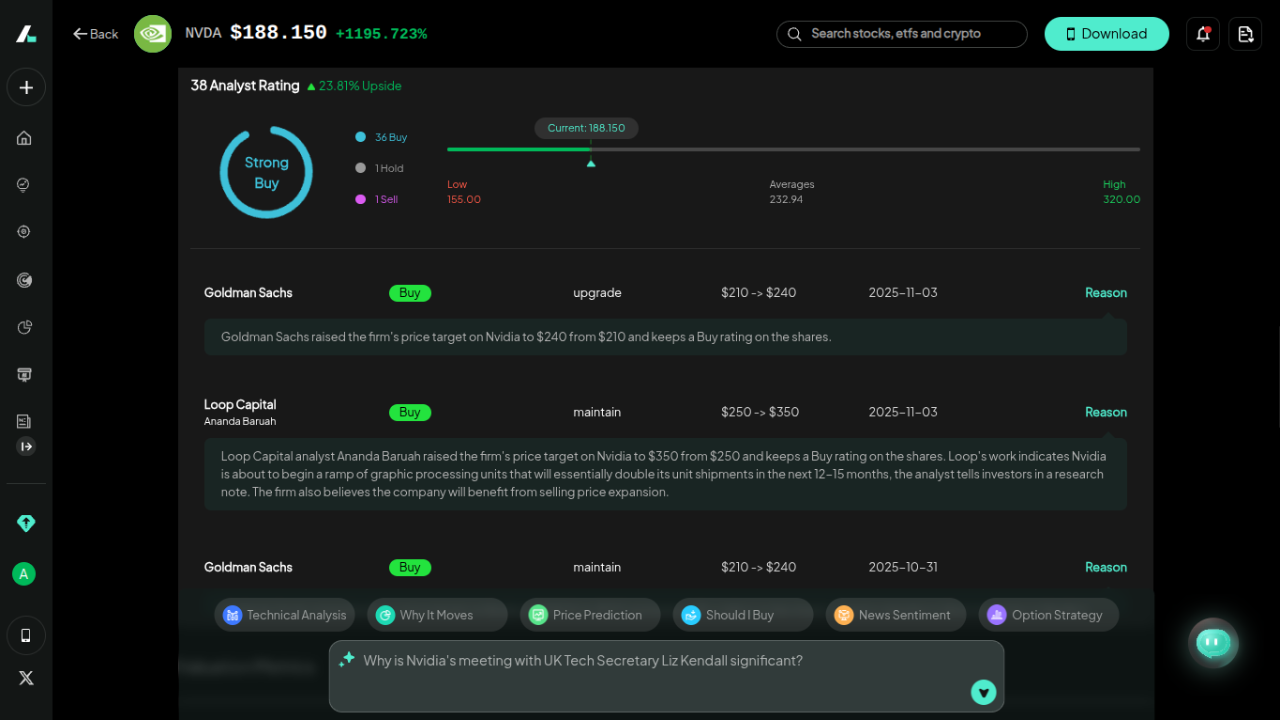

AI runs on two things: data and computing power. The companies that control this infrastructure hold the keys to the kingdom. NVIDIA’s dominance in GPUs makes it the essential hardware provider for training and running AI models. Its data center revenue grew an incredible 56% year-over-year, showing its central role.

On the data side, Salesforce’s Data Cloud has become the foundation of its agentic AI strategy, with its AI and data product line growing 120% year-over-year. A company with a strong data or compute advantage has a deep, defensible moat.

Consistent R&D and Innovation Leadership

The AI landscape evolves quickly. Long-term leaders are those who consistently innovate and stay ahead of the curve. NVIDIA maintains an aggressive "annual cadence" for its new chip architectures, ensuring it remains at the cutting edge.

Partnerships are also a key indicator of innovation. Microsoft’s deep ties with OpenAI give it premier access to the world’s most advanced models, fueling its Azure and Copilot growth. Companies that reinvest heavily in R&D are building the products that will define the market for years to come.

Institutional Ownership & Whale Activity

When major hedge funds and institutional investors take large positions in a stock, it’s a powerful vote of confidence. This "whale activity" signals that the smartest money on Wall Street believes in the company's long-term vision.

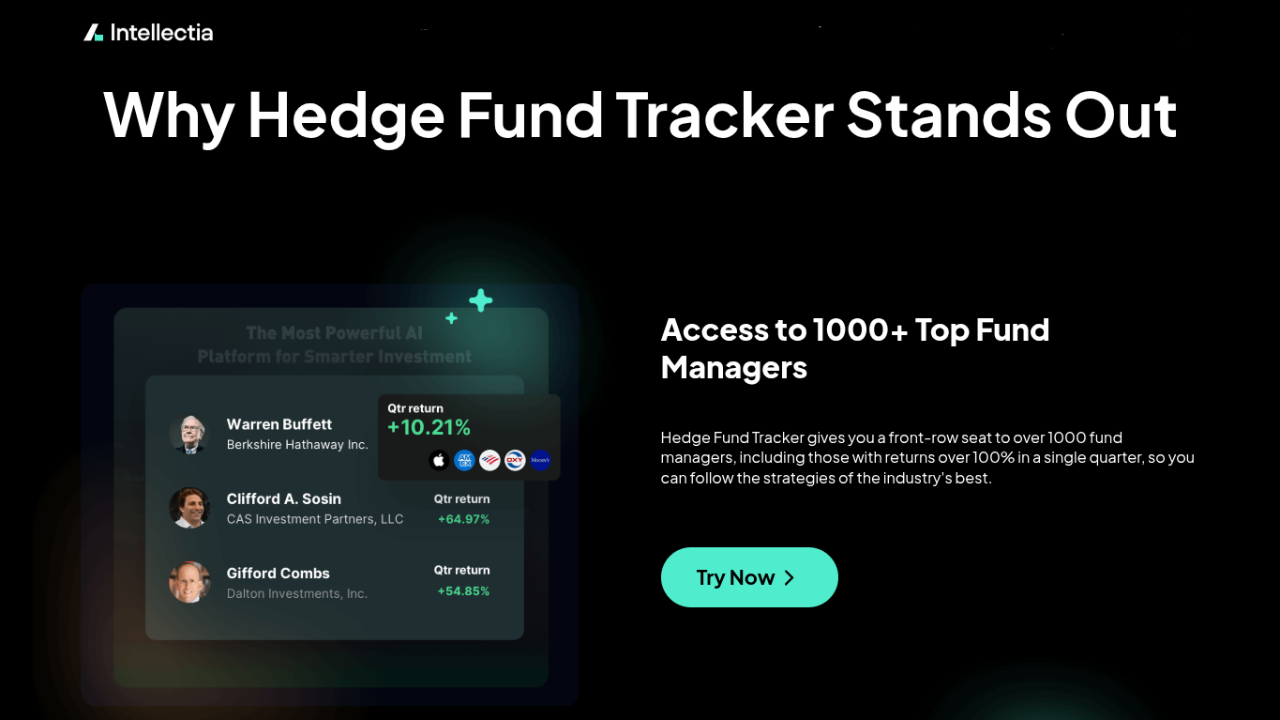

For example, various investment funds have recently initiated or increased their positions in companies like Salesforce and Nvidia. Tracking this activity, which you can do with tools like the Intellectia.ai Hedge Fund Tracker, provides valuable insight into which stocks have strong institutional backing.

5 Best AI Stocks for Long-Term Investment in 2026

Based on the criteria above, five companies stand out as the best AI stocks for long-term investment. Each holds a dominant and strategic position in the AI ecosystem, positioning them for sustained growth through 2026 and beyond.

| Company Name | Ticker Symbol | Sector | Market Cap | Key Strengths |

|---|---|---|---|---|

| NVIDIA Corporation | NVDA | Technology | $4.5T+ | GPU dominance, full-stack platform (CUDA), essential for AI infrastructure. |

| Microsoft Corporation | MSFT | Technology | $3.7T+ | Leading cloud platform (Azure), deep OpenAI integration, enterprise software ecosystem. |

| Palantir Technologies | PLTR | Technology | $424B+ | Leader in operational AI & data ontology, rapidly growing commercial business. |

| Super Micro Computer | SMCI | Technology | $24B+ | Key provider of AI servers & data center solutions, strong NVIDIA partnership. |

| Salesforce, Inc. | CRM | Technology | $228B+ | Dominant CRM platform, leader in "agentic enterprise" with AI and Data Cloud. |

NVIDIA (NVDA)

NVIDIA is the undisputed leader in accelerated computing. Its graphics processing units (GPUs) are the engine behind the AI revolution, making it the quintessential "picks and shovels" play for the industry's explosive growth.

In its Q2 2026 earnings, NVIDIA reported data center revenue of $46.7 billion, a stunning 56% year-over-year increase. The company is seeing massive demand for its Blackwell platform, including the GB200 and GB300 systems, which are the foundation for next-generation AI factories.

NVIDIA's CUDA software platform creates a deep competitive moat, locking developers into its ecosystem. As CEO Jensen Huang noted, the company is at the center of a $3-$4 trillion AI infrastructure opportunity. With a clear roadmap of annual product releases, its dominance is set to continue.

Microsoft (MSFT)

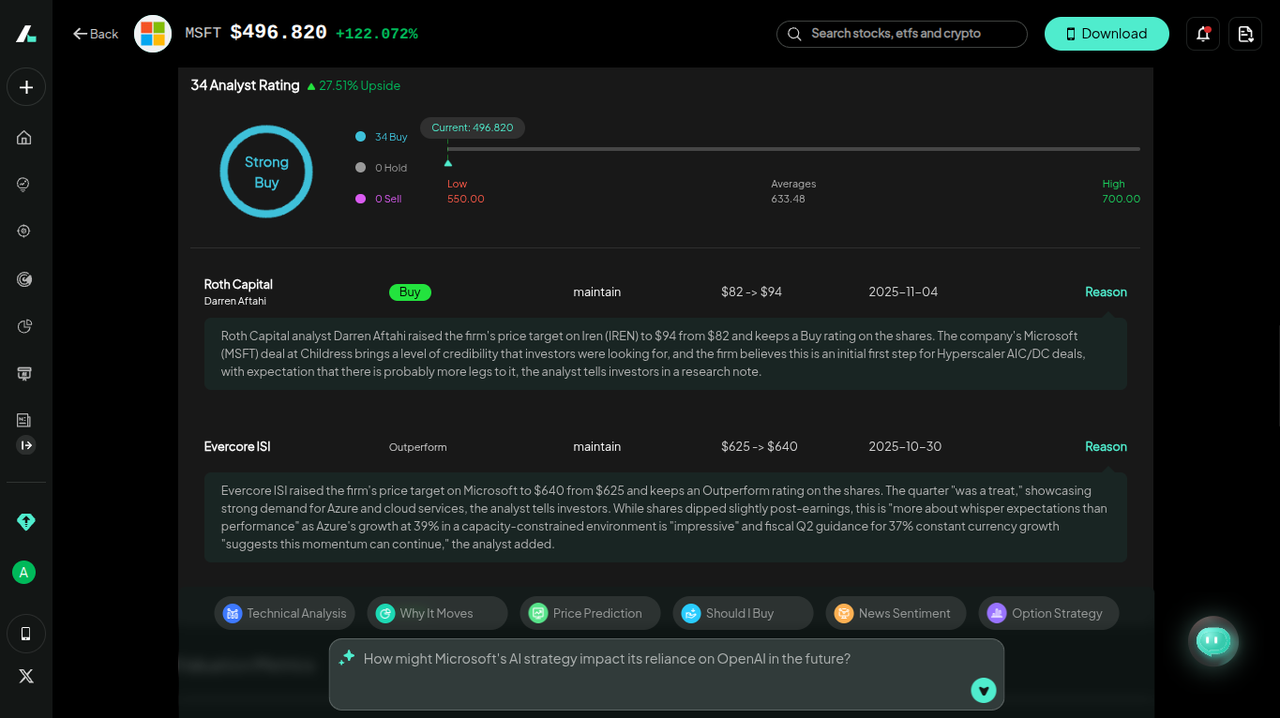

Microsoft is a global technology powerhouse, leveraging its dominant position in enterprise software and cloud computing to become a leader in the AI era. Its Azure cloud is the backbone for thousands of companies' AI strategies.

Microsoft's partnership with OpenAI is a massive growth driver. In its Q1 2026 report, the company highlighted an incremental $250 billion Azure services contract with OpenAI and announced plans to increase its total AI capacity by over 80%. Its Copilot AI assistants have already surpassed 150 million monthly active users.

Microsoft's strategy is to infuse AI into every product it offers, from Azure to Microsoft 365 and Dynamics. This gives it an unparalleled distribution channel to monetize AI across its massive enterprise customer base, making it a cornerstone for any AI stocks long-term investment portfolio.

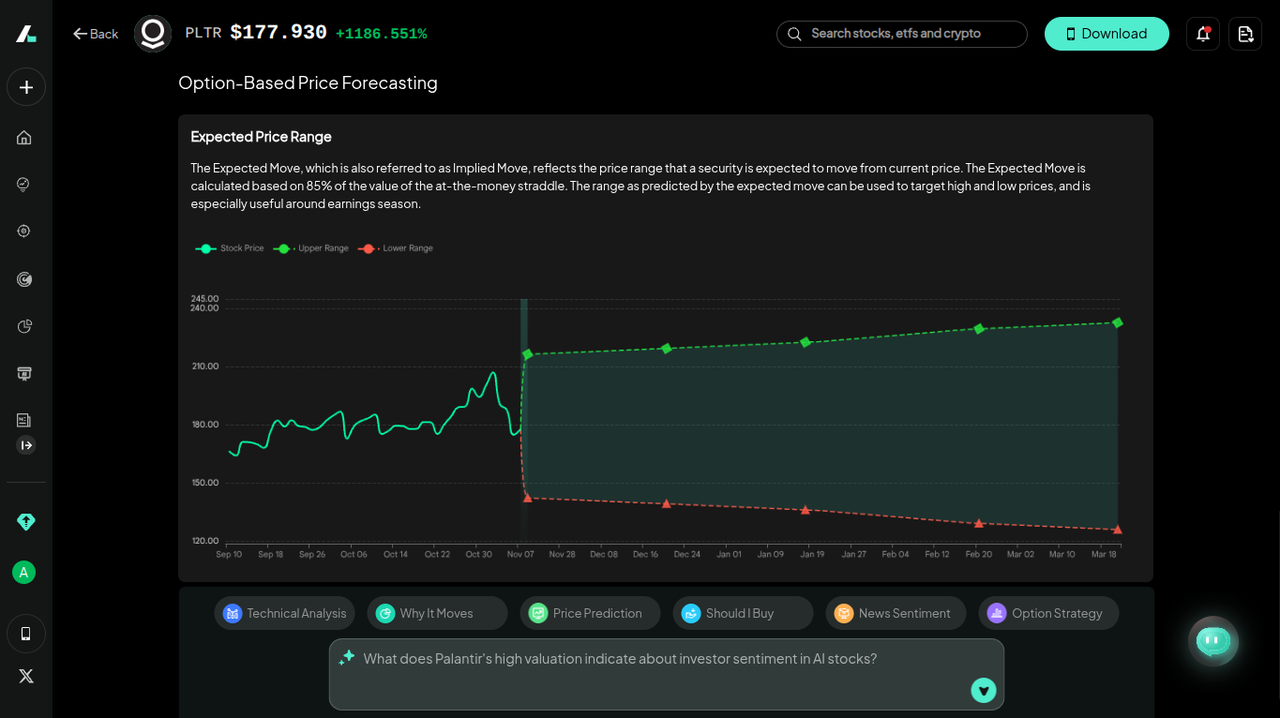

Palantir Technologies (PLTR)

Palantir specializes in big data analytics and its Artificial Intelligence Platform (AIP) helps government and commercial clients build "operational AI" systems. Its unique "ontology" technology allows AI models to understand and interact with complex operational data.

Palantir announced what CEO Alex Karp called "arguably the best results that any software company has ever delivered" in its Q3 2025 earnings. Revenue grew 63% year-over-year, driven by a 121% surge in its U.S. commercial business as companies flock to its AIP platform.

While others focus on general models, Palantir helps organizations deploy AI to solve specific, high-value operational problems. This focus on tangible ROI is driving rapid adoption and expansion, particularly in the commercial sector, giving it tremendous long-term growth potential.

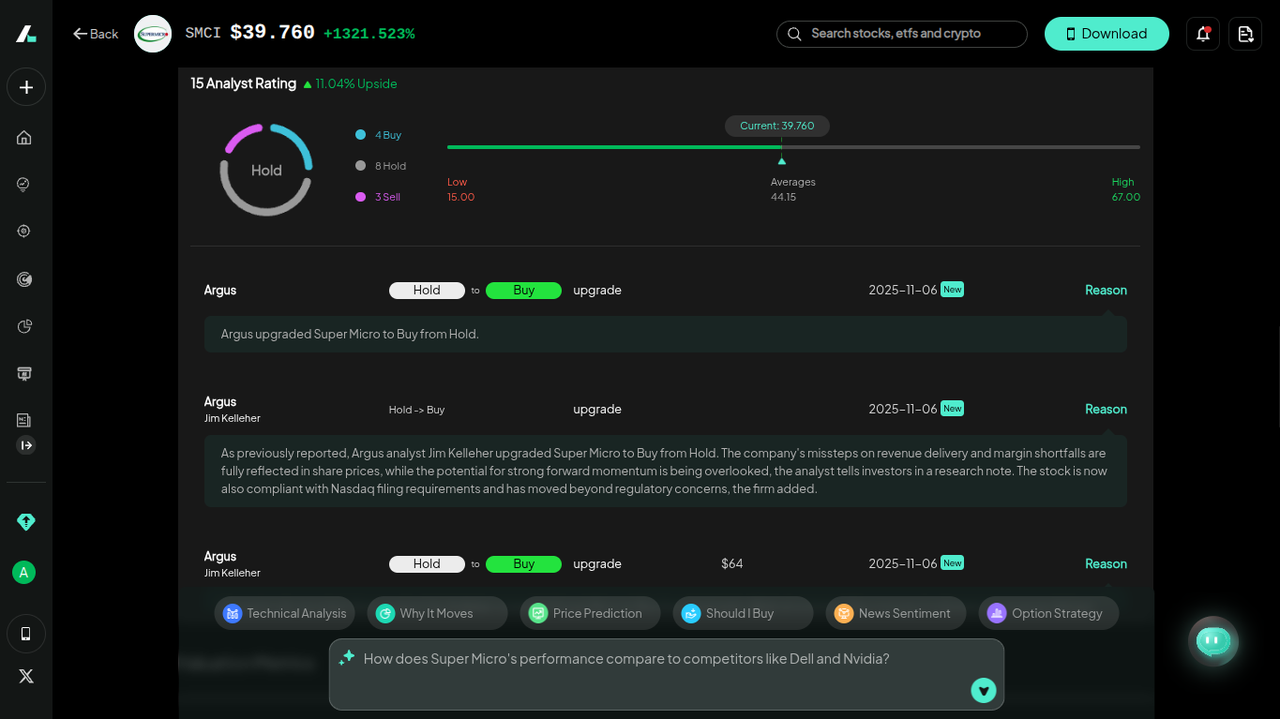

Super Micro Computer (SMCI)

Super Micro is a critical builder of the AI revolution. The company designs and manufactures high-performance servers and data center solutions optimized for AI and GPU-intensive workloads, working closely with partners like NVIDIA.

Super Micro is experiencing explosive demand, reporting a backlog of over $13 billion for NVIDIA Blackwell-based platforms. The company is aggressively expanding its global production capacity to build up to 6,000 AI racks per month and has set a revenue target of at least $36 billion for fiscal 2026.

As hyperscalers and enterprises build out their AI factories, they need the specialized, liquid-cooled, rack-scale systems that Super Micro provides. Its close relationship with NVIDIA gives it early access to new chip architectures, making it a direct and essential beneficiary of the AI infrastructure boom.

Salesforce (CRM)

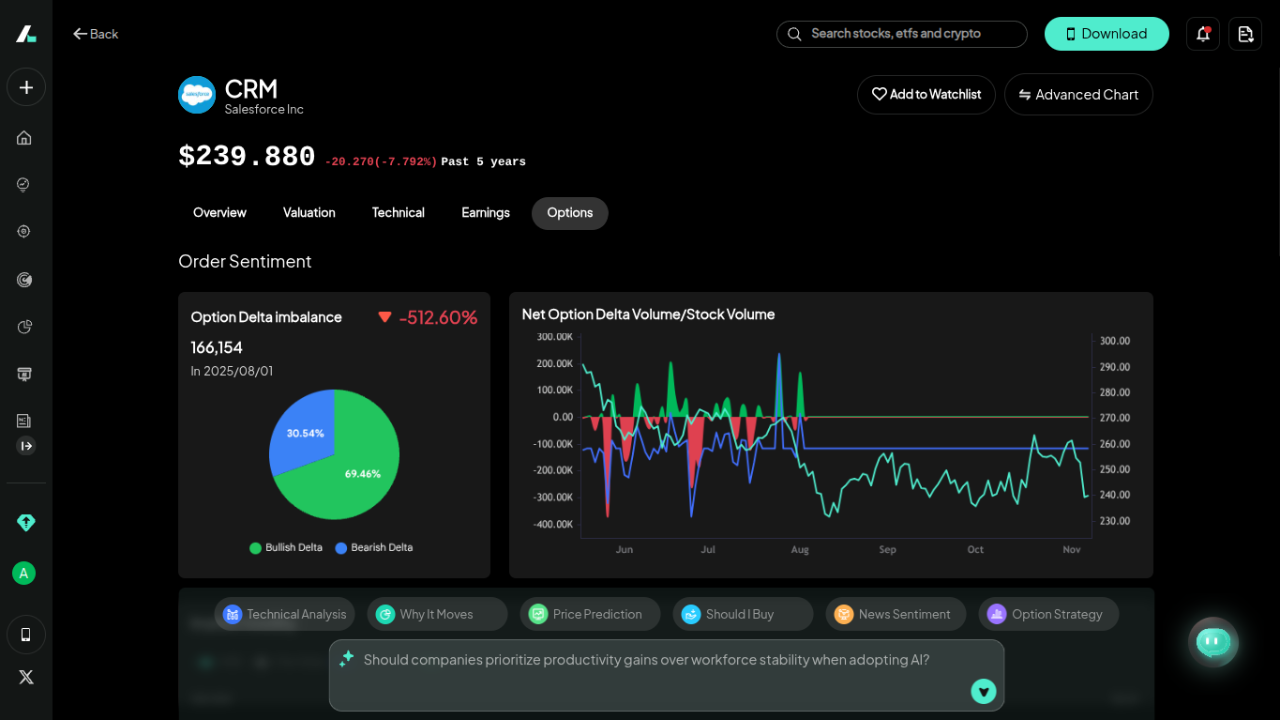

As the global leader in Customer Relationship Management (CRM) software, Salesforce is at the forefront of bringing AI to the enterprise. Its "agentic enterprise" strategy, powered by its Agentforce and Data Cloud platforms, aims to embed AI agents across sales, service, and marketing.

Salesforce's AI and data product line grew 120% year-over-year in its Q2 2026 earnings report. The company has already closed over 6,000 paid Agentforce deals and is raising its full-year revenue guidance to over $41 billion, signaling a reacceleration of growth.

Salesforce has a massive, built-in customer base to which it can sell its new AI capabilities. By transforming core business functions with AI, the company is not just adding a feature—it's creating a new, indispensable layer of intelligence that drives efficiency and growth for its customers.

Investment Strategies for Long-Term AI Stock Growth

Identifying the top AI stocks for long term investment is the first step. The next is building a resilient strategy to manage and grow your portfolio over time. Here are key approaches to consider.

Understand AI Stock Sector Fundamentals

Don't just follow the hype. Use tools to dive into the fundamentals of each company. Analyze revenue growth, profit margins, and market positioning. Understand what makes each company's technology unique and defensible. A deep understanding of the sector will give you the confidence to hold your positions through market fluctuations.

Compound Growth via Dividend & Reinvestment

While many AI stocks are growth-focused, some are beginning to return capital to shareholders. Companies like Salesforce and Nvidia have initiated dividends. Reinvesting these dividends can significantly boost your long-term returns through the power of compounding.

Consider ETFs for Broader Exposure

If you prefer diversification over picking individual stocks, AI-focused ETFs can be a great option. They offer exposure to a broad basket of companies across the AI ecosystem, from chipmakers to software providers. You can use a powerful tool like the Intellectia.ai AI Screener to discover stocks and ETFs that match your specific investment criteria, allowing you to build a diversified portfolio with ease.

Use AI-Powered Tools to Your Advantage

Leverage the power of AI to enhance your own investment strategy. Intellectia.ai offers a suite of tools designed for modern investors. The AI Stock Picker can help you discover new opportunities based on data-driven analysis. Swing Trading signals can help you identify optimal entry and exit points, even within a long-term strategy.

The Stock Monitor allows you to track your holdings and receive alerts on critical changes. By integrating these features, you can make more informed, data-backed decisions for your long-term portfolio.

Conclusion

The AI revolution is not a fleeting trend; it is a long-term, structural shift that will reshape the global economy. For investors, this presents a rare opportunity to build generational wealth by investing in the foundational companies that are making it all possible.

Companies like NVIDIA, Microsoft, Palantir, Super Micro, and Salesforce have established themselves as indispensable leaders with deep competitive moats, strong growth trajectories, and clear visions for the future. By focusing on these high-quality businesses, you can build a powerful and resilient portfolio geared for long-term success.

Ready to take your AI investing to the next level? Sign up for Intellectia.ai today to access daily AI stock picks, advanced trading signals, and data-driven market analysis. Subscribe to its premium features and start building your future-proof portfolio with confidence.