Key Takeaways

- AI penny stocks under $1 are highly speculative investments in emerging artificial intelligence companies with significant growth potential.

- Investing in these stocks offers the chance for substantial returns but comes with high risks, including volatility and lack of financial transparency.

- Careful selection based on technology, market potential, financial health, and management is crucial for identifying promising opportunities.

- Companies like Cycurion (CYCU), Guardforce AI (GFAI), Verses AI (VRSSF), and BigBear.ai (BBAI) show potential in the AI penny stock space.

- Using advanced tools and diversified strategies can help you navigate the volatility and uncover the hidden gems in the AI penny stock market.

Introduction

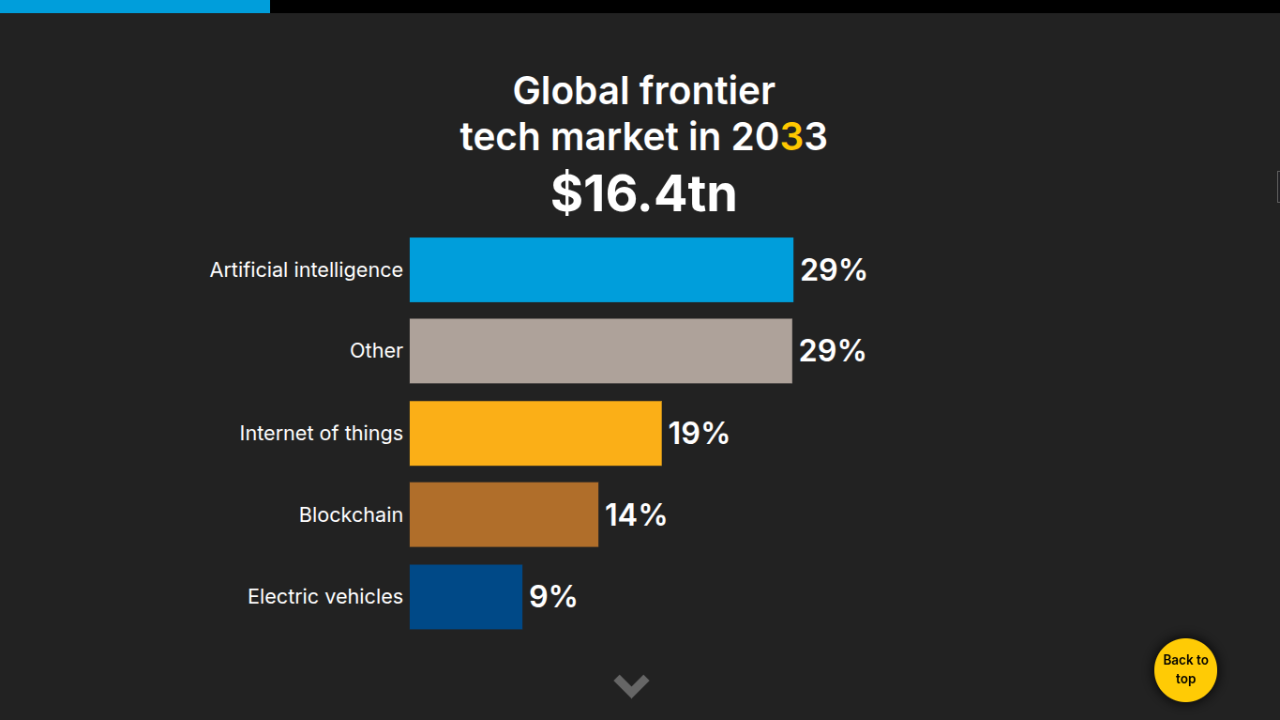

Have you ever felt like you missed the boat on the AI boom, watching from the sidelines as major tech stocks soared to unattainable prices? You see the immense potential of artificial intelligence but feel priced out of the market. It’s a common frustration for investors looking to get in on the ground floor of the next big thing without a massive budget.

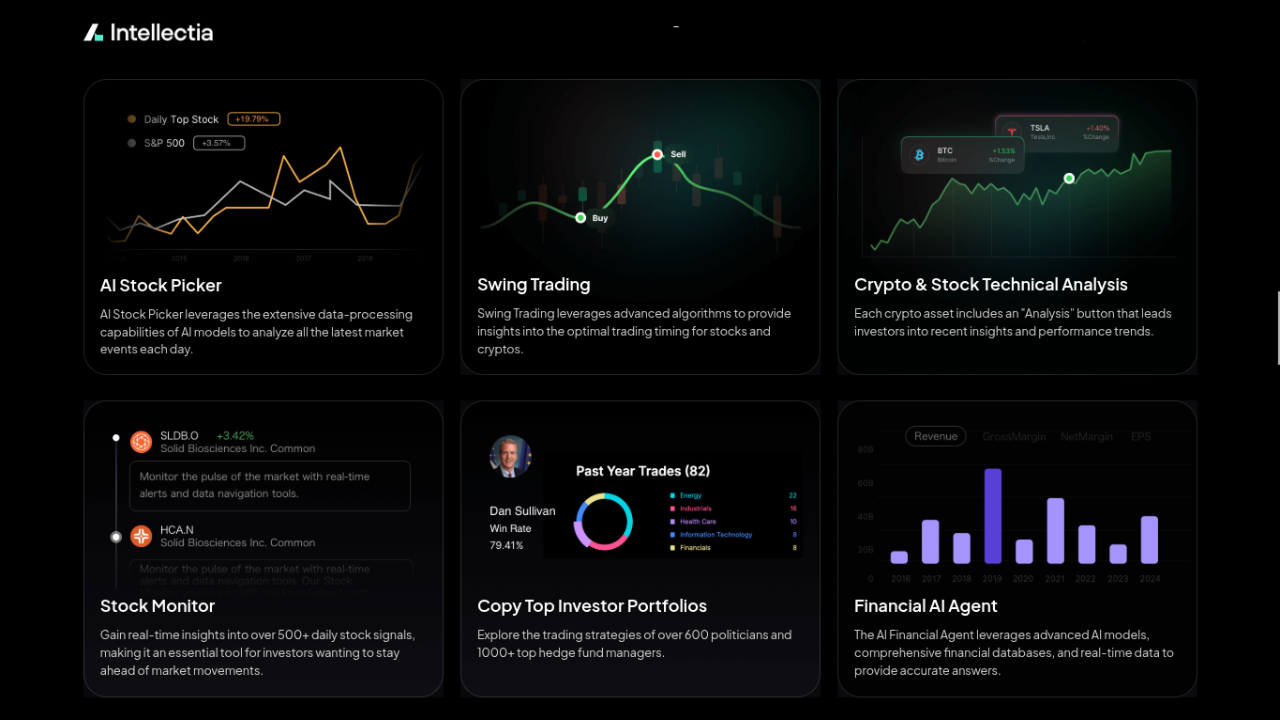

The solution might lie in exploring AI penny stocks under $1, which offer an accessible entry point into the revolutionary world of AI. You can use Intellectia.ai‘s AI-powered tools to identify, analyze, and monitor the best ai penny stocks under $1.

What Are AI Penny Stocks Under $1?

AI penny stocks under $1 are shares of small, publicly-traded companies that are involved in the artificial intelligence sector and trade for less than one dollar per share. These companies are often in the early stages of development, working on innovative AI technologies, applications, or services.

Because of their low price and smaller market capitalization, these stocks are considered highly speculative. You're essentially investing in the potential of the company's vision and its ability to execute on its AI-driven business model. The "penny stock" label signifies that these are not established blue-chip companies but rather emerging players with a high-risk, high-reward profile.

Investing in these stocks is a bet on the future. You are backing startups and small-cap companies that could one day become leaders in niche AI fields, from cybersecurity and robotics to data analytics and beyond.

Why Invest in AI Penny Stocks Under $1?

The primary allure of AI penny stocks under $1 is their explosive growth potential. A small investment could multiply significantly if the company achieves a breakthrough, secures a major contract, or gets acquired by a larger firm. For just a few hundred dollars, you can purchase a substantial number of shares, giving you more exposure to a potential upside.

These stocks also provide an opportunity to get in on the ground floor of the AI revolution. You’re investing in the pioneers and innovators who are building the technologies of tomorrow. It’s a chance to be part of the story from the very beginning, long before the company becomes a household name.

However, it's crucial to acknowledge the risks. These stocks are notoriously volatile, with prices that can swing dramatically on news, rumors, or market sentiment. They often suffer from low trading volume, which can make buying or selling large quantities difficult without affecting the price. There's also the risk of the company failing or being delisted from the stock exchange, which could lead to a total loss of your investment.

How to Choose the Best AI Penny Stocks Under $1

Finding the diamonds in the rough requires careful research and a clear strategy. You can't just pick a stock based on its low price. Instead, you need to dig deeper into the company's fundamentals and future prospects.

Start by looking at the company's market capitalization and trading volume. A higher volume indicates more investor interest and better liquidity. Next, examine the company's specific AI technology or application. Is it working on something truly innovative with a large addressable market? Look for recent news about product launches, partnerships, or patents that validate its technology.

Financial health is another critical factor. While many penny stocks are not yet profitable, you should look for signs of revenue growth, a manageable level of debt, and a clear path to profitability. The experience and track record of the management team are also important indicators of the company's potential for success.

Finally, consider the broader market sentiment. Is there positive analyst coverage or buzz from reputable investors? Tools that analyze market sentiment can provide valuable insights into how a stock might perform in the near term.

4 Best AI Penny Stocks Under $1 to Watch in 2026

| Company Name | Ticker Symbol | Sector | Market Cap | Key Strengths |

|---|---|---|---|---|

| Cycurion, Inc. | CYCU | Cybersecurity | ~$8M | AI-driven cybersecurity solutions, strategic acquisitions, growing backlog |

| Guardforce AI Co., Limited | GFAI | Robotics & AI | ~$22M | Robotics-as-a-Service (RaaS), AI-powered travel planning, expanding retail presence |

| Verses AI Inc. | VRSSF | AI & Spatial Computing | ~$37M | Development of "Genius" an intelligent software platform, focus on the Spatial Web |

| BigBear.ai Holdings, Inc. | BBAI | AI & Machine Learning | ~$3B | AI-powered decision intelligence, strong government contracts, expanding into commercial markets |

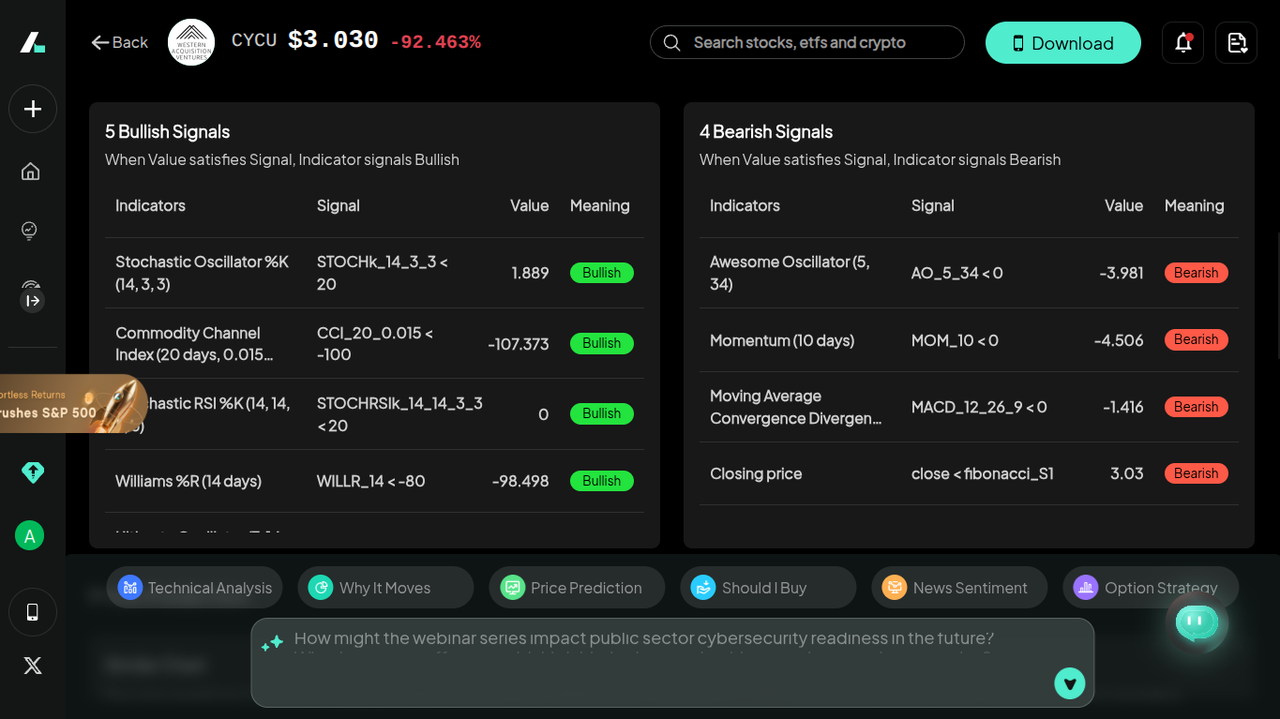

Cycurion, Inc. (CYCU)

Cycurion is a cybersecurity firm that leverages artificial intelligence to provide advanced threat detection and IT solutions. The company is positioning itself as a key player in the AI-cybersecurity revolution, with proprietary platforms like ARx and Cyber Shield.

Cycurion has been focused on expanding its margins and building recurring revenue. The company recently announced a record-breaking backlog of $73.6 million, fueled by new multi-year contracts in government, healthcare, and public safety sectors. It has also undergone a reverse stock split to enhance its stock value and attract institutional investors.

Additionally, Cycurion's strategic acquisitions of companies like Axxum Technologies and Cloudburst Security have enriched its portfolio with advanced AI algorithms and quantum-resistant cybersecurity capabilities.

In short, Cycurion’s focus on high-margin, AI-driven cybersecurity services and its growing backlog provide a clear path to future revenue. The company's proactive steps to strengthen its balance sheet and attract investors signal a commitment to long-term growth. As cybersecurity threats become more sophisticated, the demand for AI-powered solutions is set to soar, placing CYCU in a strong position.

Guardforce AI Co., Limited (GFAI)

Guardforce AI is a global integrated security solutions provider that is rapidly expanding its Robotics-as-a-Service (RaaS) offerings. The company is leveraging AI to innovate in both the physical security and online service spaces.

Recently, Guardforce AI has been making significant strides in AI innovation, including the launch of its first AI-powered travel planning agent, DVGO (DeepVoyage Go). The company is transitioning towards a higher-margin revenue mix, with its Guardforce Digital Machine products seeing remarkable year-over-year growth of 39.5%. It maintains a strong balance sheet with approximately $23.4 million in cash, which it plans to use to accelerate its AI solution strategies.

GFAI's dual focus on secure logistics and emerging AI agent technology gives it a unique market position. With over 25,000 retail clients, the company has a strong foundation to introduce and scale its AI solutions. The development of AI agents for travel, retail, and education signals a forward-thinking strategy that could unlock new, high-margin revenue streams and drive long-term growth.

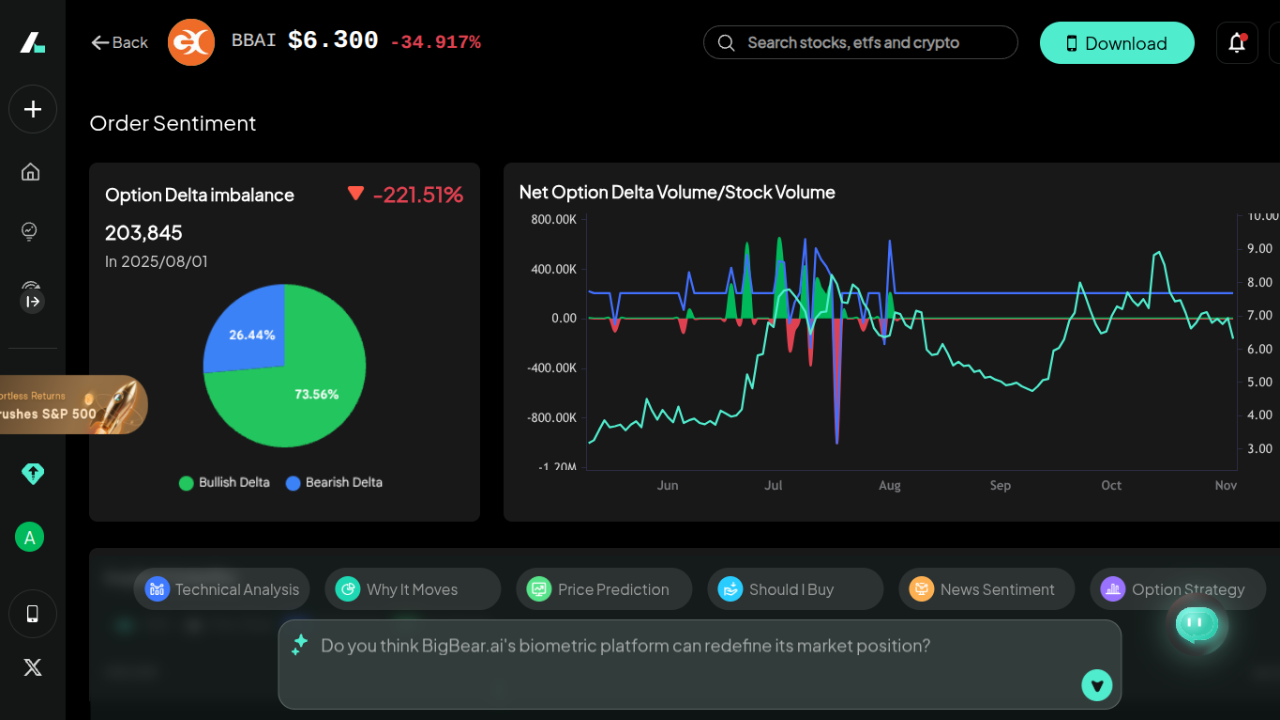

BigBear.ai Holdings, Inc. (BBAI)

BigBear.ai provides AI-powered decision intelligence solutions to the national security, defense, and commercial sectors. The company's platforms help organizations make sense of complex data and make better decisions faster.

BigBear.ai has secured a strong market position with a significant backlog of $380 million, representing a 42.9% year-over-year increase. The company has a powerful cash position with over $390 million in cash to support aggressive growth initiatives, including targeted M&A. Despite some recent disruptions in federal contracts, the company has adjusted its revenue guidance to $125-$140 million for 2025 and is strategically pivoting to capture opportunities from new government AI funding.

Overall, BBAI's established presence in the government sector provides a stable revenue base, while its expansion into commercial markets offers significant growth potential. The company's strong balance sheet gives it the flexibility to invest in innovation and pursue strategic acquisitions. With the passage of landmark government funding for AI and defense technology, BigBear.ai is well-positioned to capitalize on powerful market tailwinds.

Verses AI Inc. (VRSSF)

Verses AI is a cognitive computing company building a next-generation AI platform called Genius, designed to power the Spatial Web. The company's vision is to create an open, hyper-connected network of humans, machines, and intelligent agents.

Verses AI launched its flagship product, Genius, in April 2025, targeting enterprise clients in machine learning and data science. The platform is designed to enable the creation of intelligent, autonomous software agents. The company recently closed a public offering, raising approximately $7 million to fund further development and growth. Despite reporting a net loss, the company is investing heavily in research and development, which increased by 5% to $4.3 million in the latest quarter.

To be specific, Verses AI is tackling a highly ambitious and potentially transformative area of artificial intelligence. Its focus on building the foundational tools for the Spatial Web positions it at the forefront of a new technological paradigm. While still in the early stages, the launch of Genius and its ability to secure funding demonstrate progress and investor confidence in its long-term vision.

Investment Strategies for AI Stocks Under $1

Investing in AI penny stocks requires a different approach than traditional stock picking. Given their volatility, it's wise to diversify your portfolio across several promising companies rather than putting all your eggs in one basket. This spreads your risk and increases your chances of picking a winner.

You also need to decide on your investment horizon. A short-term strategy might involve swing trading, where you aim to profit from rapid price movements. For this, you'll need to rely heavily on technical analysis to identify optimal entry and exit points. On the other hand, a long-term strategy involves holding onto a stock for months or even years, betting on the company's fundamental growth. This requires a deep understanding of the company's technology, market, and management team.

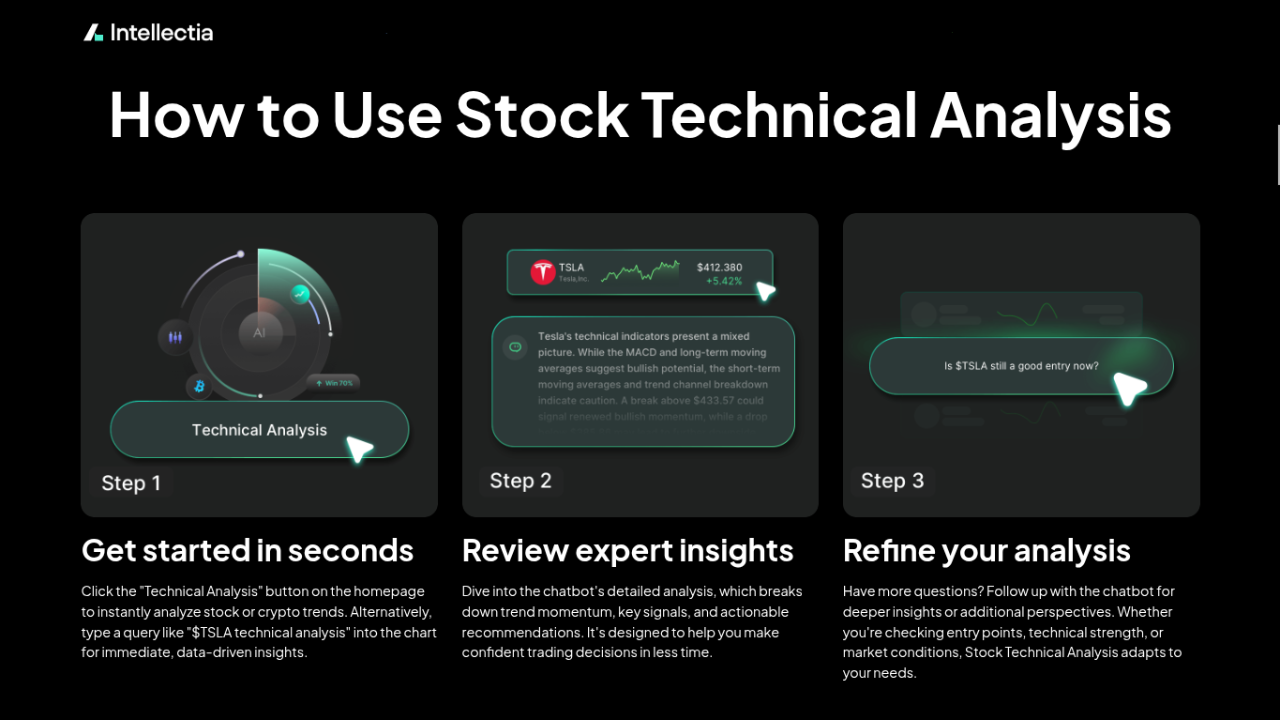

To gain an edge, consider using an AI-powered platform like Intellectia.ai. Intellectia.ai AI Screener can help you filter through thousands of stocks to find AI penny stocks that meet your specific criteria. You can also leverage its AI Swing Trading Signals to get timely alerts on potential buying or selling opportunities based on advanced algorithms that analyze market data in real time. For a deeper dive, Intellectia.ai’s stock technical analysis tools provide the insights you need to make informed trading decisions.

Conclusion

Investing in AI penny stocks under $1 can be an exciting way to gain exposure to the next wave of technological innovation without breaking the bank. While the risks are substantial, the potential rewards can be life-changing. By focusing on companies with solid technology, a clear growth strategy, and strong leadership, you can increase your chances of success.

Ready to uncover the next big AI penny stock? Sign up for Intellectia.ai today to get access to daily AI stock picks, advanced trading signals, and in-depth market analysis. Subscribe to Intellectia.ai platform and let AI empower your investment journey.