Key Takeaways

- AI infrastructure stocks are the unseen foundation of the AI boom—if you invest only in frontline AI apps, you might miss the real growth engines.

- Leading companies, such as Microsoft, Equinix, and Arista Networks, are shaping tomorrow’s data systems.

- There are high-growth opportunities in small-cap AI infrastructure firms, but also higher risk. Use tools like Intellectia’s screeners and signals to help mitigate this risk.

- Using AI-driven tools (from Intellectia) can help you identify undervalued plays and time your entries/exits more rationally.

- Diversification matters: mix large-cap stability with small-cap upside, and utilize signals and technical indicators for informed timing.

Introduction

You’ve been told about AI every day—ChatGPT, Midjourney, self-driving cars—it's everywhere, and the applications are incredible. But here’s the thing: while everyone’s focusing on these apps, the true, foundational investment opportunity might be slipping right past you. You see, none of that cool AI stuff works without the powerful engine that makes it all possible—AI infrastructure. We're going beyond the obvious chip makers to examine the entire ecosystem, from data centers to specialized networking and memory components that are currently experiencing unprecedented demand.

At Intellectia.AI, we’ve analyzed the complex AI supply chain to identify the top AI infrastructure stocks and even uncover some potential undervalued gems. This guide will provide you with a clear roadmap on how to choose the best options and our top 5 picks for 2026. We’ll unveil the smartest strategy and how you can use tools from Intellectia (like the AI Stock Picker and AI Screener) to give yourself a true advantage.

What Are AI Infrastructure Stocks?

So, what exactly do I mean by “AI infrastructure stocks”? In simple terms, they are companies that offer the physical and digital backbone that enables artificial intelligence at scale. Not the companies selling chatbots or machine-learning apps — rather, the ones building the data centers, the servers, the networking hardware, the cooling systems, the power supplies. As one source puts it: “AI infrastructure is the physical and foundational layer that turns electricity and silicon into intelligent software.”

Let’s break it down:

- Data-center operators: These companies host massive compute clusters and rent space to hyperscale AI workloads.

- Networking hardware: When you’re training or running large AI models, you need super-fast connectivity and high throughput. That’s another piece of the infrastructure puzzle.

- Semiconductors: AI models require substantial memory, GPUs, and specialized chips — companies in this space play a crucial role in powering these advancements.

- Power: These less glamorous players matter a lot too — AI compute uses huge amounts of power and generates significant heat loads; the infrastructure supporting that is critical.

Research shows that the US data center market alone was valued at over $208 billion in 2024 and is projected to reach around $309 billion by 2030. The global AI data center market is expected to grow from approximately $13.7 billion in 2024 to roughly $165.7 billion by 2034.

So, when you invest in an “AI infrastructure stock,” you’re buying into the growth of the unseen engine room of AI.

Why Invest in AI Infrastructure Stocks?

Here’s why you should care:

1. Massive and growing demand – The rush to build AI models, generative-AI applications, and cloud AI services is pushing demand for compute, storage, and networking off the charts. For example, tech giants reported a combined capital expenditure (CAPEX) of approximately $245 billion in 2024, primarily for building data centers to support AI workloads.

2. Foundation plays an advantage – Application companies come and go, but the infrastructure layer is more durable. Whether chatbots succeed or fail, someone still needs to build data centers and run the compute.

3. Macro tailwinds – Infrastructure investments tend to follow long-term cycles, which means you could capture multi-year tailwinds. For instance, infrastructure & AI have been described as “generational opportunities” by major asset managers.

4. Diversification and leverage – If you only own “app AI” companies, you’re exposed to hype, regulation, and shifting models. Infrastructure offers a different angle — less sexy sometimes, but potentially broader and more stable. In short, if you want to position yourself not just for the application wave of AI, but for the build-out of the infrastructure wave, this is where you look.

How to Choose the Best AI Infrastructure Stocks

Okay, you’re ready to go, but you don’t want just to buy the first stock you come across. Here’s how to evaluate them:

Market Leadership & Competitive Moats

- Find companies that are operating at scale and have a structural advantage - e.g., a global footprint of data centers, recurring revenue, high switching costs for customers, and world-class networking.

- For example, a data-center operator with 200+ sites globally and extensive connections with leading service providers in the cloud is better placed than a local newcomer.

- The same applies to a networking hardware company specializing in ultra-high-speed switches, which are utilized in AI clusters: such a niche is difficult to imitate. In short: “leadership” + “moat” = key.

Growth Metrics & Valuation — Finding Undervalued AI Infrastructure Stocks

- Growth: You’ll want to see strong revenue growth, ideally accelerating due to AI demand, as well as decent gross margins and improving free cash flow.

- Valuation: Infrastructure stocks can have lower multiples compared to pure “app” AI firms, but you still need to check whether the stock price already baked in all the hype.

- Utilize tools like the AI Screener or Stock Technical Analysis modules from Intellectia to filter for high-growth, yet undervalued companies.

- Also watch for “small-cap” opportunities, but treat them carefully (see the next section).

Risk Factors & Avoiding “Bubble” Stocks

- Infrastructure stocks aren’t immune to hype: Some small companies may promise big growth but lack scale or margin. According to Investopedia, many AI-related stocks carry elevated valuations and higher volatility. (Investopedia)

- Risks include high capital expenditures (capex), power/energy constraints, supply-chain bottlenecks, regulatory/geopolitical risks (especially in data centers), and technology obsolescence.

- Use trading signals such as the Day Trading Center or the Earnings Trading tools from Intellectia to identify early pullbacks or entry points, and avoid getting caught in the froth. In short: the upside is big — but you still need discipline and tools.

5 Top AI Infrastructure Stocks for 2026

Here are five picks worth your attention. (You should, of course, do your own research and align with your risk profile.)

| Company | Ticker | Sector | Market Cap | Key Strengths |

|---|---|---|---|---|

| Microsoft | MSFT | Cloud / AI Infrastructure | $3T+ | Massive cloud/AI investments globally |

| Equinix | EQIX | Data Centers / Colocation | $80B+ | Global footprint of 270+ data centers, AI-ready infrastructure |

| Arista Networks | ANET | Networking / Switches | $160B+ | AI-centric networking gear for hyperscale clusters |

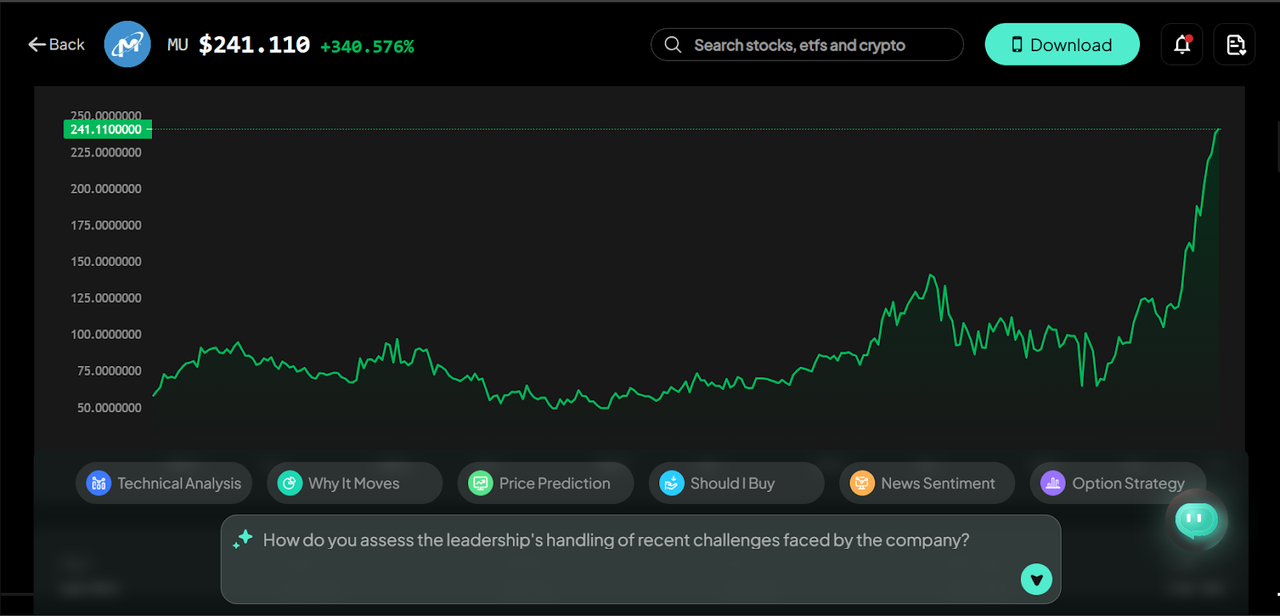

| Micron Technology | MU | Semiconductors / Memory | $270B+ | Memory chips critical for AI workloads |

| Vertiv Holdings | VRT | Data-center Power & Cooling | $60B+ | Power/cooling infrastructure for high-density AI sites |

Microsoft (MSFT)

You know Microsoft. What you might not know is just how dramatically they’re building out their AI infrastructure. For example, they recently announced a $10 billion investment in a data-center hub in Portugal, focused on AI workloads. Alongside that, Microsoft has secured deals to scale AI computing with tens of thousands of GPUs. As a company, Microsoft already has Azure cloud, enterprise clients, and global reach — so when you buy MSFT, you’re getting an infrastructure giant embedded in the AI ecosystem. If you believe AI adoption will keep accelerating (and there’s plenty of data to back that), Microsoft is a top pick for infrastructure exposure.

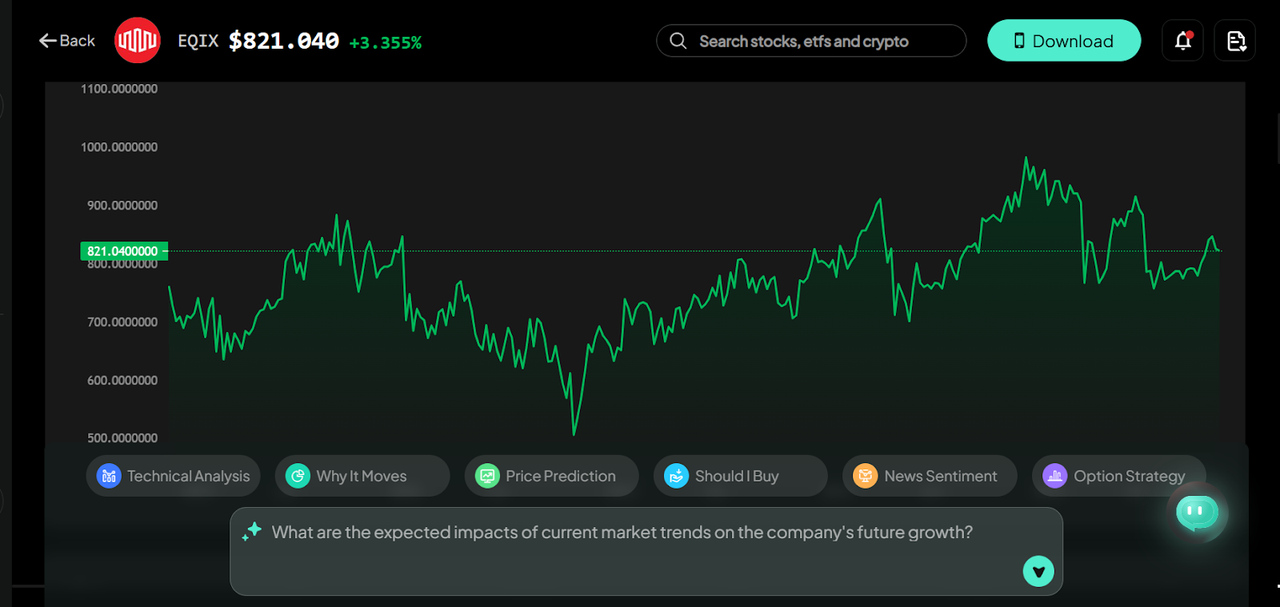

Equinix (EQIX)

Now let’s talk about a company that specializes in the “space and power” side of this story. Equinix operates over 270 data-center sites in 77 markets worldwide. They recently launched what they call “Distributed AI Infrastructure” — essentially building an AI-optimized backbone that links many of their locations. In the AI world, it’s increasingly about data that’s distributed, training that happens across geographies, and infrastructure that needs to be globally interconnected. Equinix is positioned right in that sweet spot. If you want to play infrastructure in a less “pure app” way and more “hardware + connectivity” way, EQIX deserves your attention.

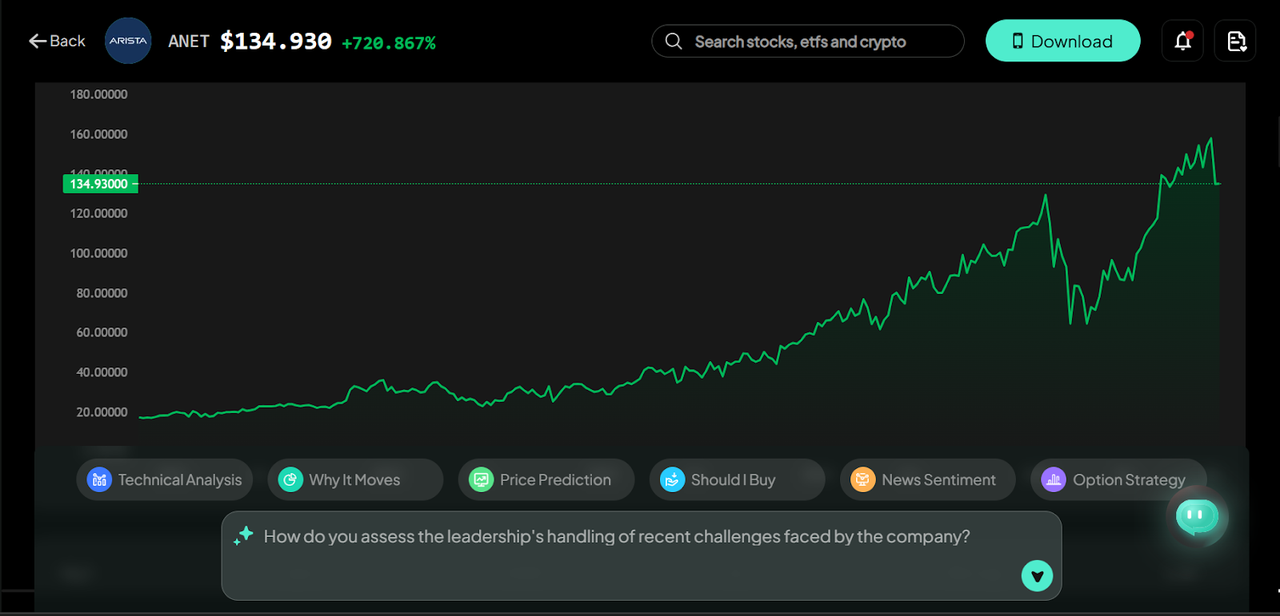

Arista Networks (ANET)

This is the company that handles the high-speed networking gear inside the data centers. Arista offers advanced Ethernet and networking solutions tailored to the bandwidth and latency requirements of AI clusters. When you’re training an AI model with thousands of GPUs, the network becomes a bottleneck. Arista’s gear helps remove that bottleneck, making it a key enabler of AI infrastructure. If you believe AI growth is real (and you should), Arista is a more specialized play — potentially higher reward, higher risk.

Micron Technology (MU)

Memory and storage are often underappreciated components of this puzzle. AI models require vast amounts of high-speed memory and persistent storage. Micron is a leader in memory technologies. Why pick them? They may benefit indirectly from the AI infrastructure build-out through increased demand for memory chips, DRAM, and flash storage, as the memory supply is somewhat constrained, creating potential upside.

Vertiv Holdings (VRT)

Here’s one that’s off the typical radar: Vertiv Holdings handles the electric cooling infrastructure for data centers, especially high-density AI sites. Remember: computer chips are power-hungry and generate enormous heat — someone has to keep it all running.

What makes this venture even more interesting is that AI infrastructure often involves space for operation, power, and cooling technology, which many investors ignore. If you want diversification within the infrastructure, Vertiv provides you with exposure to that essential support layer.

Investment Strategies for Top AI Infrastructure Stocks

Okay — now that you’ve got the pick list, how do you play it?

- Diversify your stock portfolio: Don’t put all your eggs in one infrastructure stock, or in just one layer (such as networking). Use a spread: big-cap stable (Microsoft, Equinix) + mid/small-cap higher growth (Arista, Vertiv).

- Long-term vs short-term strategy:

o Long-term: If you think the AI infrastructure wave will take 5-10 years, buy and hold these firms.

o Short-term/trading: Use technical analysis and signals to determine entry/exit points (for example, via Intellectia’sTechnical Analysis Tools or Day Trading Center signals).

- Utilize technical indicators and signals: Monitor momentum, volume spikes, and relative strength. For example, if an infrastructure company announces a large data center or a major capital expenditure, this can trigger a breakout.

- Follow institutional activity by using tools like the Hedge Fund Tracker. If several hedge funds are stockpiling a specific infrastructure stock, it can be a bullish signal.

- Set alerts: Intellectia AI offers the opportunity to create alerts on your target stocks, such as when a new data center deal is announced or when an infrastructure company updates its guidance.

- Time your entries/exits: Infrastructure build-out takes time — capex is upfront, revenue comes later. If you buy too early, you may have to wait. Consider using pullbacks or consolidation phases as entry points.

- And one more thing: always keep risk management in mind. AI infrastructure stocks, too, can suffer if there’s a power grid disruption, a regulation change, or a cost escalation.

Conclusion

If you’re serious about catching the next wave of AI innovation, don’t just look at the “app-layer” companies — look deeper. The companies building the infrastructure — the servers, networking, data centers, memory, cooling — are the real long-term enablers. From cloud giants like Microsoft, to global data-center players like Equinix, to networking experts like Arista, to memory specialists and power/cooling firms — there’s a diversified set of stocks you can pick. Combine that with smart tools and signals provided by Intellectia (e.g., the AI Stock Picker and alert system), and you give yourself a tactical edge. Sign up for daily AI stock picks, trading signals, and strategy alerts from Intellectia — your infrastructure-oriented play could be the one that ends up defining the next three to five years of AI growth.