Victorias Secret Becomes Oversold (VSCO)

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Feb 03 2025

0mins

Source: NASDAQ.COM

Stock Performance Overview: Victorias Secret & Co (VSCO) shares have reached an oversold status with an RSI of 29.7, indicating potential buying opportunities as the stock trades around $34.53, significantly below its 52-week high of $48.73.

Market Context: The current RSI for the S&P 500 ETF is at 48.9, suggesting that VSCO's recent selling pressure may be waning, prompting bullish investors to consider entry points for purchasing the stock.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy VSCO?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on VSCO

Wall Street analysts forecast VSCO stock price to fall over the next 12 months. According to Wall Street analysts, the average 1-year price target for VSCO is 53.40 USD with a low forecast of 29.00 USD and a high forecast of 73.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

11 Analyst Rating

4 Buy

7 Hold

0 Sell

Moderate Buy

Current: 56.000

Low

29.00

Averages

53.40

High

73.00

Current: 56.000

Low

29.00

Averages

53.40

High

73.00

About VSCO

Victoria's Secret & Co. is a specialty retailer of women's intimate and other apparel and beauty products marketed under the Victoria's Secret, PINK, and Adore Me brand names. The Company offers a range of products including bras, panties, lingerie, casual sleepwear, apparel, sport and swim, as well as prestige fragrances and body care. Victoria’s Secret brand offers bras, panties, lingerie, casual sleepwear, swim, lounge and sport, as well as fragrances and body care. PINK is a lifestyle brand for young women providing variety of collections and heritage pieces, including apparel, loungewear, activewear, bras, panties, accessories, beauty, and others. Adore Me is a direct-to-consumer lingerie and apparel brand that is focused on serving women of all sizes and budgets.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

Victoria's Secret Stock Valuation Analysis

- Stock Performance: Victoria's Secret shares closed at $54.51, reflecting a 49.9% return over the past year, a 2.2% gain year-to-date, a 0.6% increase over the last 30 days, but an 8.8% decline last week, indicating increased short-term volatility that may affect investor confidence.

- Valuation Assessment: The DCF model indicates that Victoria's Secret's free cash flow was $282.9 million over the past twelve months, with projections of $448.0 million by 2028, suggesting the stock is undervalued by 41.3%, which could attract value-focused investors.

- P/E Ratio Analysis: Currently, Victoria's Secret trades at a P/E ratio of 25.74x, above the industry average of 19.29x and peer average of 16.66x, indicating potential overvaluation, prompting investors to carefully assess risk versus reward.

- Future Outlook: Despite valuation debates, Victoria's Secret retains potential in brand strength and profit expectations, with investors encouraged to engage with community discussions for insights on the company's future developments.

Continue Reading

Victoria's Secret (NYSE:VSCO) Stock Rallies to $65, Concealing Structural Risks

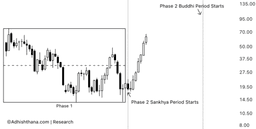

- Price Surge: Since August 2025, Victoria's Secret's stock has surged from around $18 to nearly $65, presenting a strong facade while concealing underlying structural risks that investors should not overlook.

- Phase Analysis: The stock is currently in Phase 2 of the Adhishthana cycle, still within the Sankhya period, which typically features consolidation and sluggish price movements rather than a persistent rally.

- Volatility Risks: Aggressive rallies during the Sankhya period are often unstable, with historical patterns indicating that such deviations tend to be corrected as the stock transitions into the Buddhi period, potentially leading to sharp price reversals.

- Investor Outlook: While the stock may continue to rise in the short term, the unfavorable structural positioning raises concerns about long-term sustainability, necessitating vigilance and risk management as volatility is likely to increase with the approaching Buddhi transition.

Continue Reading