Vail Resorts (MTN) Upgraded to Buy by Jefferies with $165 Price Target

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jan 13 2026

0mins

Source: seekingalpha

- Leadership Change: The establishment of a new leadership team at Vail Resorts, combined with a discounted share price, makes it an attractive long-term investment, prompting Jefferies to upgrade its rating from Hold to Buy, reflecting market confidence in the company's future.

- Revenue Growth Outlook: Despite potential disappointments in the 2025/2026 ski season due to suboptimal weather, a projected 4% increase in skier numbers and total revenue for FY27 indicates the best performance since FY23, showcasing the resilience of the company's business model.

- EBITDA Expectations: Analyst David Katz anticipates adjusted EBITDA of $933 million for FY27, suggesting that the new lift ticket pricing and marketing strategies will significantly enhance profitability, boosting investor confidence.

- Price Target Increase: Katz raised the price target for Vail Resorts by 4% to $165, indicating a 17% upside from Monday's closing price, further validating the optimistic outlook for the company's growth trajectory.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy MTN?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on MTN

Wall Street analysts forecast MTN stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for MTN is 169.54 USD with a low forecast of 145.00 USD and a high forecast of 234.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

9 Analyst Rating

3 Buy

5 Hold

1 Sell

Hold

Current: 132.970

Low

145.00

Averages

169.54

High

234.00

Current: 132.970

Low

145.00

Averages

169.54

High

234.00

About MTN

Vail Resorts, Inc. is a network of destination and close-to-home ski resorts in the world including Vail Mountain, Breckenridge, Park City Mountain, Whistler Blackcomb, Stowe, and 32 additional resorts across North America; Andermatt-Sedrun and Crans-Montana Mountain Resort in Switzerland; and Perisher, Hotham, and Falls Creek in Australia - all available on the Company's Epic Pass. The Company's segments include Mountain, Lodging and Real Estate. It also provides ancillary services, primarily including ski school, dining and retail/rental operations. The Company owns and/or manages a collection of elegant hotels under the RockResorts brand, a portfolio of vacation rentals, condominiums and branded hotels located in close proximity to its mountain destinations, as well as the Grand Teton Lodge Company in Jackson Hole, Wyo. The Company operates more than 250 retail and rental locations across North America. It owns, develops and sells real estate in and around its resort communities.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

U.S. Policy Affects Canadian Tourist Trends

- Visitor Decline Trend: U.S. ski resorts report a sharp drop in Canadian visitors, particularly in the New England region, despite excellent snowfall this winter, indicating a direct impact of policy on tourism.

- Canadian Tourist Reaction: Inntopia data reveals that Canadian bookings tend to drop significantly within 48 hours following any controversial geopolitical statement by President Trump, reflecting their dissatisfaction and resistance to U.S. policies.

- Sense of Betrayal: Tom Foley, Inntopia's director of business intelligence, states that Canadians feel betrayed by a longtime friend, exacerbating their resistance to U.S. ski resorts and affecting tourism stability.

- Impact on Las Vegas: There is also a notable decline in Canadian tourists visiting Las Vegas compared to last year, further demonstrating the negative impact of U.S. policies on tourism across other popular destinations.

Continue Reading

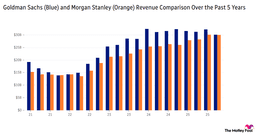

Morgan Stanley CEO Predicts Strong M&A Activity in 2026

- Optimistic M&A Outlook: Morgan Stanley CEO Ted Pick forecasts a prosperous year for M&A and capital markets in 2026, driven by interest rate cuts and geopolitical volatility, with the five major banks reporting a 15% increase in trading revenue for 2025, marking the largest jump in five years.

- Walmart International CEO Resignation: Walmart International CEO Kathryn McLay announced her resignation at the end of the month, despite an 11% sales growth in overseas markets, highlighting potential strategic shifts following her failure to secure the group CEO role.

- Taiwan Trade Agreement Signed: President Trump confirmed a trade deal with Taiwan, reducing tariffs on imports from 20% to 15%, with Taiwanese tech firms pledging at least $250 billion in U.S. investments, aiming to enhance U.S. semiconductor self-sufficiency.

- Decline in Skier Visits: Vail Resorts reported a 20% drop in skier visits compared to last year, and despite a 6.26% dividend yield, analysts suggest management should consider cutting dividends to strengthen the balance sheet.

Continue Reading