UBS, Newmont, McKesson, and The Cato Featured in Zacks Analyst Blog

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Oct 16 2025

0mins

Should l Buy MCK?

Source: NASDAQ.COM

Zacks Analyst Blog Highlights: The Zacks Equity Research team has featured stocks including UBS Group AG, Newmont Corp., McKesson Corp., and The Cato Corp. in their daily research reports, emphasizing their recent performance and market outlook.

Company Performance Insights: UBS has shown strong earnings but faces litigation risks; Newmont is benefiting from growth projects despite rising production costs; McKesson is expanding margins but contends with regulatory challenges; and Cato has rebounded in earnings but faces structural headwinds.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy MCK?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on MCK

Wall Street analysts forecast MCK stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for MCK is 942.83 USD with a low forecast of 880.00 USD and a high forecast of 1000.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

14 Analyst Rating

12 Buy

2 Hold

0 Sell

Strong Buy

Current: 851.120

Low

880.00

Averages

942.83

High

1000.00

Current: 851.120

Low

880.00

Averages

942.83

High

1000.00

About MCK

McKesson Corporation is a diversified healthcare services company, which focuses on advancing health outcomes for patients everywhere. Its U.S. Pharmaceutical segment distributes branded, generic, specialty, biosimilar and over-the-counter pharmaceutical drugs, and other healthcare-related products in the United States (U.S.). The Prescription Technology Solutions (RxTS) segment helps solve medication access, affordability and adherence challenges for patients by working across healthcare to connect patients, pharmacies, pharmacy benefit managers, health plans, and biopharma companies. The Medical-Surgical Solutions provides medical-surgical supply distribution, logistics, and other services to healthcare providers, including physician offices, hospital reference labs, and home healthcare agencies. The International segment provides distribution and services to wholesale, institutional, and retail customers in Canada and Norway. It also offers oncology and specialty solutions.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Significant Revenue Growth: McKesson reported Q3 revenues of $106.2 billion, an 11% year-over-year increase, with double-digit adjusted operating profit growth in oncology and multispecialty services, indicating strong performance and sustained market demand in these sectors.

- Raised EPS Guidance: The company raised its fiscal 2026 earnings per share guidance to a range of $38.80 to $39.20, reflecting a 17% to 19% year-over-year growth, demonstrating management's confidence in future performance and market opportunities.

- Technology-Driven Efficiency Gains: By applying technology and automation, McKesson's full-time employees supported 120 more patients during the annual verification season compared to last year, showcasing the company's ongoing efforts to enhance operational efficiency and customer experience.

- Successful Acquisition Integration: Management highlighted significant progress in integrating Florida Cancer Specialists and PRISM Vision, which have made meaningful contributions to the strong performance in oncology, further solidifying the company's market position.

See More

- IPO Financing Scale: Medline's IPO successfully raised $6.3 billion at a price of $29 per share, significantly enhancing the company's capital structure, with plans to use the proceeds to pay down $16.5 billion in debt, thereby improving financial health.

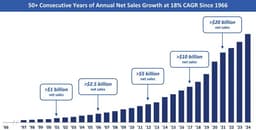

- Sales Growth Momentum: Since its founding in 1966, Medline has achieved an average annual sales growth of 18%, with projections indicating sales will reach $30 billion by 2026, demonstrating strong growth potential in the medical supply market, particularly given the resilience of healthcare demand amid economic uncertainties.

- Market Competitive Advantage: With 335,000 products and 33 manufacturing facilities, Medline offers next-day delivery to 95% of U.S. customers, leveraging its private label products to enhance margins and solidify its leadership position in the medical product supply chain.

- Superior Financial Performance: Medline boasts a gross margin of approximately 27.4%, significantly higher than key competitors, and is projected to generate $1.5 billion in free cash flow in 2025, showcasing its profitability and cash flow generation capabilities, further enhancing its investment appeal.

See More

- Strong Financial Performance: McKesson's Q3 non-GAAP EPS reached $9.34, a 16% increase from $8.03 in the prior year, exceeding market expectations by $0.07, indicating robust performance in the drug wholesale sector.

- Upgraded Outlook: The company raised its FY26 non-GAAP EPS forecast to $38.80-$39.20, up from $38.35-$38.85, reflecting increased confidence in future earnings.

- North American Growth: The growth in Q3 results was primarily driven by the North American Pharmaceutical segment, particularly due to increased prescription volumes from retail national account customers and distribution growth of oncology and multispecialty products, further solidifying market position.

- Cash Flow Status: As of the end of FY25, McKesson had approximately $3 billion in cash and cash equivalents, down from $5.7 billion on March 31, 2025, indicating the company's strategic approach to fund management in investments and operations.

See More

- Earnings Announcement Date: McKesson (MCK) is set to release its Q3 earnings on February 4th after market close, with consensus EPS expected at $9.27, reflecting a 15.4% year-over-year increase, which could further solidify its market position in the pharmaceutical distribution sector.

- Revenue Expectations: The anticipated revenue for Q3 is $105.91 billion, representing an 11.1% year-over-year growth, indicating the company's sustained strong performance in drug distribution, which may positively impact its stock price.

- Performance Beat Record: Over the past two years, McKesson has beaten EPS estimates 88% of the time, although it has only surpassed revenue estimates 38% of the time, showcasing stability in profitability while hinting at challenges in revenue growth.

- Estimate Revision Dynamics: In the last three months, EPS estimates have seen one upward revision and 13 downward adjustments, while revenue estimates experienced four upward revisions and five downward adjustments, reflecting a cautious market sentiment regarding the company's future performance.

See More

- Earnings Outlook: Next week, earnings reports from tech giants Alphabet and Amazon are highly anticipated, especially after Microsoft's report led to a 10% stock drop despite beating expectations, indicating a shift in investor scrutiny towards profitability and growth metrics.

- Job Cuts and Efficiency: Amazon announced a restructuring that will eliminate 16,000 jobs, adding to the 14,000 cuts made in October, resulting in a 10% reduction in its corporate and tech workforce, with CEO Andy Jassy emphasizing that AI-driven efficiency gains will significantly impact operational costs moving forward.

- Labor Market Insights: A crucial jobs report is set to be released next Friday, alongside the Job Openings and Labor Turnover Survey (JOLTS), providing investors with insights into the labor market, particularly after the Fed indicated an improving economic outlook, which may alter interest rate expectations.

- Government Shutdown Risks: The market is also wary of a potential partial government shutdown, as a planned Senate vote on funding has stalled, despite a strong January performance; this uncertainty could lead to increased volatility, prompting investors to remain cautious in their strategies.

See More

- Quarterly Dividend Announcement: McKesson declares a quarterly dividend of $0.82 per share, consistent with previous distributions, indicating stable cash flow and shareholder return strategy, which is expected to bolster investor confidence.

- Dividend Yield: The forward yield of 0.39% reflects the company's robust performance in the current market environment, potentially attracting income-seeking investors looking for stability.

- Shareholder Record Date: The dividend will be payable on April 1, with a record date of March 2 and an ex-dividend date also on March 2, ensuring shareholders receive their payouts promptly, thereby strengthening the shareholder base.

- 2026 Earnings Guidance: McKesson raises its 2026 EPS guidance to $38.35–$38.85, indicating ongoing advancements in oncology and specialty platforms, which enhances market confidence in the company's future growth prospects.

See More