Tesla Aims for Full Self-Driving Approval in Europe by February 2026

Tesla's FSD Approval Plans: Tesla Inc. is seeking approval for its Full Self-Driving (FSD) feature in Europe by February 2026, having engaged with EU regulators for over a year and conducted extensive internal testing across 17 countries.

Collaboration with Dutch Authorities: The company is working with the Dutch approval authority, RDW, to obtain exemptions for FSD features, aiming for national approval in the Netherlands, which could facilitate an EU-wide rollout.

Improvements in FSD Technology: Recent advancements in Tesla's FSD v14 have been praised by industry experts, highlighting significant upgrades over previous versions and improved performance with fewer critical disengagements.

Expert Endorsements: Notable figures, including Ross Gerber and Andrej Karpathy, have commended the enhancements in Tesla's FSD technology, comparing its operation to a magnetic levitation train and emphasizing the capabilities of the new hardware.

Trade with 70% Backtested Accuracy

Analyst Views on TSLA

About TSLA

About the author

- Surge in Capex: Tesla's capital expenditures totaled $8.5 billion in 2025 and are projected to exceed $20 billion in 2026, reflecting the company's ambitious plans in AI and robotics to enhance long-term competitiveness.

- Investment in Key Projects: The company is investing in six new factories and plans to expand its robotaxi and Optimus fleets to meet future market demands while ensuring supply chain stability.

- Strong Financial Position: Despite an 11% drop in auto sales and operating income in Q4 2025, Tesla generated $6.2 billion in free cash flow and has $44 billion in cash and investments, providing a solid financial foundation for future investments.

- Diversified Financing Strategy: Tesla's management is in discussions with banks regarding funding needs, potentially considering debt financing to bolster liquidity, while its $1.2 trillion market cap and a high P/E ratio of 365 offer options for raising equity capital with minimal dilution.

- Merger Valuation Surge: Musk's merger of SpaceX with xAI creates a new entity valued at $1.25 trillion, boosting his net worth to approximately $845 billion, reflecting his ambitions in aerospace and AI sectors.

- Wealth Shift: Post-merger, Musk's ownership in the new entity is estimated at 43%, valued at over $530 billion, indicating a shift in his wealth focus from Tesla to SpaceX, which now constitutes nearly two-thirds of his wealth.

- Market Potential: The merger is seen as a strategic move to access larger capital markets, particularly as xAI's AI model development requires significant funding, potentially opening up greater business opportunities for Musk.

- Future Challenges: While Musk aims to become the world's first trillionaire, SpaceX needs to reach a valuation of approximately $1.6 trillion, facing regulatory scrutiny and ongoing investigations into xAI, which could impact his financial strategy.

- Lunar Mission Competition: Musk stated that he would congratulate Bezos if Blue Origin successfully lands on the Moon before SpaceX, emphasizing that the future hinges on the ability to transport 'millions of tons of equipment and people' to the lunar surface, indicating a strategic pivot for SpaceX towards lunar exploration.

- Accessibility of Lunar Travel: In a post on social media, Musk announced that SpaceX would create a system allowing anyone to travel to the Moon, showcasing the company's vision and potentially driving the democratization of commercial space travel, thereby enhancing SpaceX's market position.

- Revenue Source Shift: Musk revealed that by 2026, NASA would account for only 5% of SpaceX's revenue, with the majority coming from the Starlink satellite internet service, highlighting the diversification of the company's business model and a positive outlook for future income.

- Financial Performance: SpaceX is projected to generate nearly $16 billion in revenue and $8 billion in profit in 2025, with Starlink contributing 50% to 80% of that revenue, indicating strong growth potential in the commercial space sector.

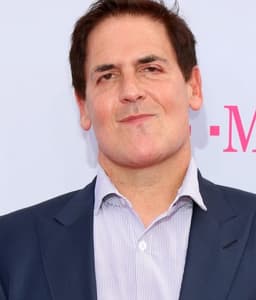

- Patents vs. Trade Secrets: Billionaire investor Mark Cuban argues that as artificial intelligence rises, companies will increasingly skip patents in favor of trade secrets to adapt to the changing economics of intellectual property.

- Impact of Open Source: Cuban shared a clip of Elon Musk's interview where Musk mentioned Tesla's open-sourcing of patents, leading Cuban to assert that avoiding patents will become more common since once a patent is published, it can be circumvented by anyone.

- Revaluation of Data: Cuban emphasizes that in an AI-driven economy, data and information will be more valuable than gold or oil, urging companies to protect key datasets and develop their own models instead of relying on third-party tools.

- Skepticism of Patent System: Cuban has long questioned the patent system, funding initiatives to eliminate “stupid patents” and calling for the abolition of software patents, arguing they stifle small business innovation.

- Moon City Development: Musk announced on social media that SpaceX is now focusing on building a city on the Moon, which is expected to be achieved in less than 10 years, while the Mars city would take over 20 years, indicating a strategic shift that could accelerate the company's space exploration initiatives.

- Cost Optimization Potential: Winton noted that by investing in the Moon instead of Mars, the cost to service the Starlink constellation could be reduced to $200 million, which, compared to a $300 billion revenue opportunity, significantly enhances the company's cash flow generation capabilities.

- Market Potential Unlocked: Winton emphasized that the combination of lunar activities and AI compute would yield a more meaningful capital accumulation for Mars development, likely making it more attractive than the previous Starlink and Starship strategy, thus driving long-term growth for SpaceX.

- Retail Sentiment Surge: According to Stocktwits data, retail sentiment on SpaceX is in the 'extremely bullish' territory, with message volumes surging by 350% in the last 24 hours, indicating a significant increase in market confidence regarding the company's future prospects.

- Executive Departure: Tesla VP Raj Jegannathan announced his departure after 13 years, indicating instability at the executive level, which could negatively impact employee morale and investor confidence.

- Sales Team Restructuring: Recently tasked with leading Tesla's sales team after the dismissal of the North America sales head, Jegannathan's exit highlights the urgent need for strategic adjustments to address declining core automotive sales.

- Revenue Decline: Tesla's revenue dropped 3% in 2025, marking the first recorded decline, which underscores the unprecedented pressure the company faces to innovate and revitalize sales growth.

- Brand Reputation Crisis: The aging EV lineup and CEO Elon Musk's controversial rhetoric have tarnished Tesla's brand reputation, exacerbating consumer backlash and intensifying competitive pressures in the market.