REITs Poised for Recovery as Fed Cuts Rates, 2025 AFFO Growth Expected

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jan 19 2026

0mins

Should l Buy DLR?

Source: Fool

- REIT Market Recovery: With the Fed cutting rates six times in a row in 2024 and 2025, the attractiveness of Real Estate Investment Trusts (REITs) is rising again, likely drawing in more income-driven investors and driving up valuations.

- Realty Income's Strong Performance: Realty Income, owning over 15,500 commercial properties, reported a 98.7% occupancy rate in the latest quarter and expects its adjusted funds from operations (AFFO) to grow 1%-2% to $4.25-$4.27 per share in 2025, ensuring its $3.22 per share dividend payment.

- Vici Properties' Rent Growth: Vici Properties has maintained a 100% occupancy rate since its 2018 IPO and expects its AFFO per share to rise 4%-5% to $2.36-$2.37 in 2025, supporting its $1.80 per share dividend, showcasing strong resilience against economic headwinds.

- Digital Realty's Recovery Outlook: Despite a decline in AFFO over the past four years, Digital Realty anticipates an 8%-9% growth in core FFO to $7.25-$7.30 per share in 2025, with occupancy rates expected to rise to 84.9%-85.9%, securing its $4.88 per share dividend.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy DLR?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on DLR

Wall Street analysts forecast DLR stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for DLR is 189.06 USD with a low forecast of 139.00 USD and a high forecast of 220.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

18 Analyst Rating

15 Buy

2 Hold

1 Sell

Strong Buy

Current: 164.650

Low

139.00

Averages

189.06

High

220.00

Current: 164.650

Low

139.00

Averages

189.06

High

220.00

About DLR

Digital Realty Trust, Inc. is a real estate investment trust. The Company owns, acquires, develops, and operates data centers through its operating partnership subsidiary, Digital Realty Trust, L.P. The Company is focused on providing data center, colocation, and interconnection solutions for domestic and international customers across a variety of industry verticals ranging from cloud and information technology services, communications and social networking to financial services, manufacturing, energy, healthcare, and consumer products. Its portfolio consists of over 308 data centers, of which 121 are located in the United States, 112 are located in Europe, 36 are located in Latin America, 16 are located in Africa, 16 are located in Asia, six are located in Australia and three are located in Canada. Its PlatformDIGITAL is a global data center platform for scaling digital business which enables customers to deploy their critical infrastructure with a global data center provider.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Investor Trends: Investors are moving away from AI investments despite a significant market surge today.

- Data Center REITs: The only exception to this trend is the continued interest in data center real estate investment trusts (REITs).

See More

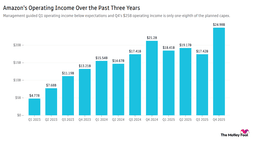

- Amazon's Capital Expenditure Surge: Amazon plans to increase its capital expenditure to $200 billion in 2026, nearly matching its total revenue of $213 billion for Q4, leading to an over 8% drop in stock price during morning trading, indicating market concerns about its financial health.

- Accelerating AWS Growth: CEO Andy Jassy reported a 24% growth rate for AWS, the fastest in 13 quarters, with an annualized revenue of $142 billion; however, management anticipates Q1 operating income will fall short of analyst expectations, reflecting intensified market competition.

- Bitcoin Price Volatility: Bitcoin has dropped 50% from its 2025 peak, falling to around $60,000, which reflects waning confidence in government support for cryptocurrencies, although some analysts suggest this is merely a market correction rather than the end of crypto.

- Severe Market Reactions: Despite a 10% revenue increase in Q3, DOCS and PIDoximity saw their stock plunge over 30% due to declining net income under margin pressure, highlighting investors' acute sensitivity to profitability.

See More

- Price Adjustment: Stifel has reduced the target price for Digital Realty Trust Inc. from $210 to $200.

- Market Impact: This adjustment reflects changes in market conditions and expectations for the company's performance.

See More

- Record Financial Performance: Digital Realty Trust achieved a core FFO of $7.39 per share in 2025, marking a 10% increase over 2024, which underscores the company's robust growth momentum in the data center industry and solidifies its market leadership.

- Leasing Performance Breakthrough: The company signed over $1 billion in new leases in 2025, setting a historical record, while the 0 to 1 megawatt interconnection product category established a new quarterly leasing record in Q4, indicating sustained strong market demand.

- Strategic Expansion Initiatives: Digital Realty expanded into Indonesia and Malaysia in the Asia-Pacific region and successfully attracted over $3.2 billion in LP equity commitments, demonstrating its strong appeal in private markets and potential for future growth.

- Optimistic Future Outlook: The company projects core FFO guidance for 2026 to be between $7.90 and $8.00 per share, reflecting an 8% year-over-year growth, while anticipating total revenue and adjusted EBITDA growth of over 10%, indicating sustained strength in its business and balanced investment spending.

See More

- Core FFO Growth: Digital Realty Trust reported a core FFO of $1.86 per share for Q4 2025 and $7.39 for the full year, marking a 10% increase over 2024, indicating robust performance and sustained profitability in the data center sector.

- Record Leasing Performance: The company signed over $1 billion in new leases for 2025, achieving a historic high, with zero to one megawatt interconnection bookings reaching $96 million in Q4, a 7% increase over the previous record, reflecting strong demand for data center capacity.

- Increased Capital Commitments: By the end of 2025, Digital Realty Trust secured over $3.2 billion in LP equity commitments for its inaugural closed-end fund, marking a successful entry into private markets and further supporting its growth strategy for hyperscale data centers.

- Optimistic Future Outlook: The company anticipates an 8% growth in core FFO per share for 2026, setting a guidance range of $7.90 to $8.00, reflecting confidence in the ongoing demand for cloud and AI services while planning to increase capital expenditures by $3.25 billion to $3.75 billion over the next two years.

See More