OPEC Turns The Output Tap On: What It Means For Oil ETFs

OPEC+ Production Increase: Oil-focused ETFs, particularly the USO and BNO, faced significant losses this week due to OPEC+'s announcement of a production increase of 547,000 barrels per day starting in September, raising concerns about an oversupplied market.

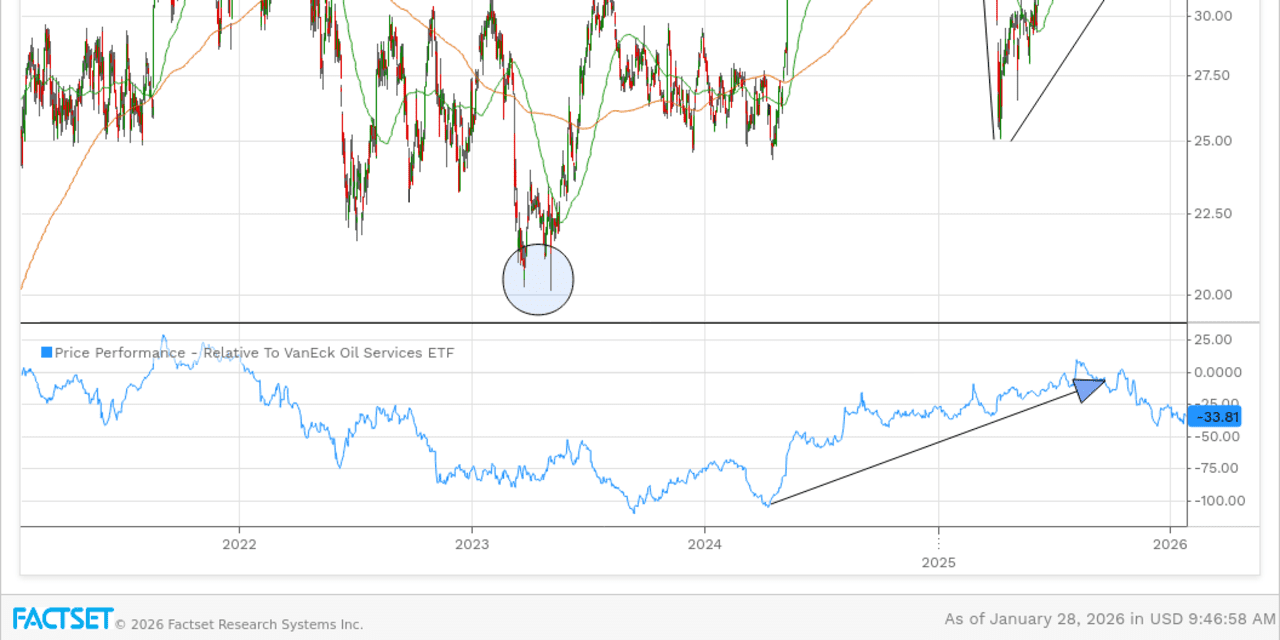

Impact on Different ETFs: While futures-heavy ETFs suffered declines of over 5%, equity-based funds like XLE and OIH showed more resilience, losing only around 1.7%, as they are expected to benefit from increased drilling activity amidst rising geopolitical tensions.

Trade with 70% Backtested Accuracy

Analyst Views on OIH

About the author

Trump's Stance on Iran: President Trump expressed dissatisfaction with Iran's negotiation approach, indicating that they are not willing to compromise significantly.

Concerns Over Enrichment: Trump emphasized that there should be no enrichment of uranium by Iran, reiterating a hardline stance on nuclear negotiations.

Frustration with Current Negotiations: He conveyed that the current state of negotiations with Iran is unsatisfactory and does not meet U.S. expectations.

Overall Sentiment: Trump's comments reflect a broader frustration with Iran's actions and the ongoing diplomatic efforts surrounding their nuclear program.

- Market Opportunities: Investors may find renewed opportunities in previously recommended stocks from healthcare, oil services, and consumer staples sectors.

- Signs of Momentum: These stocks are showing signs of renewed momentum, suggesting potential upside for investors.

- Sector Rotation: The leadership in these sectors has already rotated, indicating a shift in market dynamics.

- Investor Consideration: Investors are encouraged to take a fresh look at these stocks as they may present attractive investment options.

- Energy Sector Performance: The energy sector has underperformed over the past year, ranking ninth out of eleven major sectors.

- State Street ETF Ranking: The State Street Energy Select Sector ETF reflects this lagging performance within the broader market context.

U.S. Military Action: Escalating military actions by the U.S. against Venezuela are influencing global oil markets.

Impact on Oil Prices: The potential for regime change in Venezuela is leading investors to raise oil prices, anticipating access to significant oil reserves.

J.P. Morgan's Upgrade: Helmerich & Payne (HP) received an upgrade to Overweight from Neutral by J.P. Morgan, which anticipates a rebound in Saudi Arabian activity and sees potential for the stock to outperform due to attractive valuations and earnings growth prospects.

Cautious Sector Outlook: Despite the upgrade, J.P. Morgan maintains a cautious stance on the oilfield services sector, highlighting headwinds such as declining capital intensity in North America and a weakening spending picture, which may affect overall performance in 2026.

Stock Selection Importance: Analysts emphasize the importance of stock selection in a challenging macro environment, with companies demonstrating earnings resiliency being better positioned for relative share price performance amid anticipated market loosening.

Mixed Prospects for Offshore Drillers: J.P. Morgan downgraded several offshore drilling stocks due to potential earnings risks and full valuations, while upgrading Liberty Energy and ProPetro as beneficiaries of the growing demand for modular power solutions.

Energy Sector Performance: The energy sector is experiencing a resurgence, with exploration and production stocks beginning to align with equipment stocks.

Leading ETFs: The VanEck Oil Services ETF is leading the sector with an 8% year-to-date increase, followed by the State Street Energy Select Sector SPDR ETF at 6%.

Exploration & Production ETF: The State Street SPDR S&P Oil & Gas Exploration & Production ETF has seen a modest increase of 2% this year.

Market Trends: Overall, the performance of these ETFs indicates a positive trend in the energy market, particularly in oil services and exploration sectors.