Needham Downgrades Penumbra to Hold Following Acquisition Deal

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jan 16 2026

0mins

Should l Buy BSX?

Needham downgraded Penumbra (PEN) to Hold from Buy following the announcement of a deal to be acquired by Boston Scientific (BSX). The firm notes the "significant" premium that Boston Scientific is paying and also contends that competing bids are unlikely given potential antitrust issues for other large-cap med tech companies, the analyst tells investors in a research note.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy BSX?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on BSX

Wall Street analysts forecast BSX stock price to rise

22 Analyst Rating

22 Buy

0 Hold

0 Sell

Strong Buy

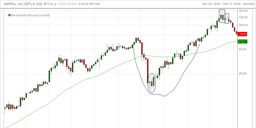

Current: 76.290

Low

94.00

Averages

108.14

High

132.00

Current: 76.290

Low

94.00

Averages

108.14

High

132.00

About BSX

Boston Scientific Corporation is a global developer, manufacturer and marketer of medical devices that are used in a range of interventional medical specialties. The Company's MedSurg segment includes Endoscopy, Urology, and Neuromodulation. Its Endoscopy business develops and manufactures devices to diagnose and treat a range of gastrointestinal conditions with less-invasive technologies. Its Urology business develops and manufactures devices to treat various urological conditions for both male and female anatomies, including kidney stones, benign prostatic hyperplasia, prostate cancer, erectile dysfunction, and incontinence. Its Neuromodulation business develops and manufactures devices to treat various neurological movement disorders and manage chronic pain. Its Cardiovascular segment includes Cardiology and Peripheral Interventions. The Cardiology includes interventional cardiology therapies, watchman, cardiac rhythm management, and electrophysiology.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

Market Cycles: Markets operate in cycles, indicating that trends and leadership positions are temporary.

Leadership Rotation: Leadership within markets rotates, consolidates, and eventually reemerges over time.

See More

- Conference Participation: Boston Scientific will participate in TD Cowen's 46th Annual Health Care Conference on March 3, 2026, with CEO Mike Mahoney and CMO Kenneth Stein engaging in a 30-minute Q&A session, highlighting the company's leadership in medical technology.

- Live and Replay Access: The Q&A session is scheduled for approximately 9:10 a.m. ET, and both live and replay access will be available on the company's investor website, ensuring timely information dissemination to investors and the public.

- Company Background: With over 45 years in the medical technology field, Boston Scientific is dedicated to improving global patient health through innovative technologies, offering a wide range of high-performance solutions to address unmet patient needs.

- Product Portfolio: The company's devices and therapies assist in diagnosing and treating complex cardiovascular, respiratory, digestive, oncological, neurological, and urological diseases, aiming to reduce healthcare costs while enhancing patient quality of life.

See More

- Intensifying Market Competition: Becton, Dickinson faces fierce competition in the medical device distribution sector, particularly as Boston Scientific's dominance in the pulse field ablation market is challenged, indicating that changing market dynamics could impact the company's performance.

- Investment Potential Assessment: While Becton, Dickinson is viewed as a potential investment, analysts suggest that certain AI stocks may offer greater upside potential and lower downside risk, implying that investors should be cautious in their selections.

- Diverse Medical Supply Portfolio: Becton, Dickinson sells a significant variety of medical supplies, diagnostic tools, and lab equipment, widely used by healthcare professionals and researchers, highlighting its importance and demand in the healthcare industry.

- Market Dynamics Observation: Jim Cramer expresses a bullish view on Becton, Dickinson, suggesting that its performance in the medical device sector is worth monitoring, reflecting investor optimism about the company's future prospects.

See More

- Stellantis Loss Warning: Stellantis (NYSE:STLA) plummeted 26.24% this week after the company warned of a full-year net loss, significantly eroding investor confidence and potentially impacting future financing capabilities.

- Gartner Earnings Miss: Gartner (NYSE:IT) fell 25.41% this week following the release of its fourth-quarter financial results and a downward revision of its FY26 guidance, with analysts' pessimistic outlook likely to exert further pressure on the stock.

- Reddit Stock Decline: Reddit (NYSE:RDDT) dropped 23.10% this week as multiple analysts lowered their price forecasts, reflecting market concerns over its profitability and potentially hindering its financing and expansion plans.

- Analyst Downgrades: Several analysts adjusted their price targets downward for these companies, indicating a widespread bearish sentiment regarding their future performance, which may lead investors to reassess their portfolios.

See More

- Investigation Initiated: The Law Offices of Howard G. Smith has announced an investigation into Boston Scientific for potential violations of federal securities laws, aimed at safeguarding investors' rights.

- Disappointing Earnings: On February 4, 2026, Boston Scientific reported its fourth-quarter 2025 financial results, revealing lower-than-expected sales in its electrophysiology division, which undermined investor confidence.

- Stock Price Plunge: Following the earnings report, Boston Scientific's stock price fell by $16.12, or 17.6%, closing at $75.50 per share on February 4, 2026, resulting in significant losses for investors.

- Legal Consultation Opportunity: The law firm is urging affected investors to reach out to discuss potential claims for recovery, emphasizing the legal rights and possible compensation avenues available to investors in this matter.

See More

- Investigation Announcement: The Law Offices of Frank R. Cruz has initiated an investigation into Boston Scientific Corporation regarding potential violations of federal securities laws, aiming to protect investor rights and pursue claims for losses.

- Disappointing Financial Results: On February 4, 2026, Boston Scientific reported its fourth-quarter 2025 financial results, revealing lower-than-expected sales in its electrophysiology division, which has raised concerns among investors.

- Stock Price Decline: Following the disappointing earnings report, Boston Scientific's stock price plummeted by $16.12, or 17.6%, closing at $75.50 per share on February 4, 2026, significantly impacting investor asset values.

- Investor Rights Advocacy: The law firm is urging investors who purchased Boston Scientific securities to reach out for information on potential claims to recover losses, highlighting the importance of safeguarding investor interests.

See More