Japan's PM Takaichi Adopts Softer Approach to Soothe Markets Amid Rising Yields Challenging Fiscal Credibility

Market Concerns: PM Sanae Takaichi's $137bn stimulus plan has raised fears about Japan's fiscal sustainability, with rising long-end bond yields and a weak yen contributing to market anxiety.

Government Response: Takaichi is softening her stance on Bank of Japan tightening, promising to limit borrowing and reduce wasteful spending while emphasizing fiscal sustainability.

Market Reactions: The yield on 10-year JGBs has reached its highest level since 2007, leading to increased shorting of the yen and concerns over policy overstretch, with the yen falling approximately 5% since Takaichi took office.

Investor Sentiment: While some investors view yen weakness as inevitable, others believe a stronger yen could emerge if the economy improves, with current JGB buying interest remaining low until clearer issuance guidance is provided.

Trade with 70% Backtested Accuracy

Analyst Views on JPY

About the author

USD Overview: The US dollar remains rangebound following a hot NFP report and soft CPI data, with market expectations for rate cuts by year-end. Key upcoming data includes US Flash PMIs and Q4 GDP, which will influence future outlooks.

JPY Overview: The Japanese yen experienced a "sell the fact" reaction after Takaichi's election victory, with no new developments from the Bank of Japan. Governor Ueda indicated that future rate hikes depend on economic data, particularly in April.

USDJPY Technical Analysis: The daily chart shows USDJPY consolidating at a major trendline, with buyers positioned for a potential rally towards 159.00, while sellers are looking for a break below to target 150.00.

Upcoming Catalysts: Key economic releases this week include FOMC Meeting Minutes, US Jobless Claims, Japanese CPI, US Q4 GDP, PCE price index, Flash PMIs, and a potential Supreme Court decision on Trump's tariffs.

Investor Sentiment Shift: Mark Nash of Jupiter Asset Management has turned bullish on Japanese government bonds (JGBs) and the yen following Prime Minister Sanae Takaichi’s election victory, closing a long-standing short position and anticipating a sustained rally.

Political Stability Impact: The election outcome has provided political stability and clarity, leading to a significant drop in Japanese bond yields and a reassessment of risk among investors.

Foreign Exchange Strategy: Nash is also betting on the yen's appreciation against the US dollar, sterling, and particularly the Swiss franc, forecasting a potential 8-9% increase due to Japan's improved fiscal and political backdrop.

Market Diversification Trend: This shift in strategy reflects a broader trend of diversifying away from US assets amid policy uncertainty, suggesting a potential structural change in global currency positioning if the yen's underperformance reverses.

USD Overview: The US Dollar initially rose after a strong NFP report but lost gains as the market anticipates the upcoming US CPI report, which could significantly impact rate expectations and the dollar's strength.

JPY Overview: Following Takaichi's election victory, the JPY experienced a "sell the fact" reaction, with no new developments from the Bank of Japan, which maintains a steady interest rate while hinting at potential future hikes based on economic data.

USDJPY Technical Analysis - Daily: The USDJPY has retraced to a major trendline, where buyers are expected to enter, aiming for a rally towards 159.00, while sellers will look for a break below to target 145.00.

Upcoming Economic Data: Key economic indicators, including US Jobless Claims and the US CPI report, are set to be released, which will likely influence market movements and sentiment.

Hedge Funds Shift to Bullish Yen Positions: Hedge funds are reversing their stance and rebuilding bullish positions on the yen, driven by a growing "buy Japan" narrative, despite strong US jobs data that previously supported dollar strength.

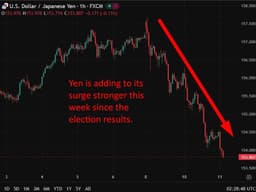

Yen Strengthens Against the Dollar: The yen has appreciated for three consecutive sessions against the dollar, indicating a significant shift in market sentiment and positioning, particularly after Japan's recent election results.

Increased Demand for Yen Protection: Options markets are showing heightened demand for downside protection on the dollar-yen pair, with trading volumes for put contracts significantly surpassing call options, reflecting a growing appetite for yen upside exposure.

Political Stability and Market Reactions: The recent election victory of Japan's Liberal Democratic Party has contributed to perceptions of political stability, further supporting the yen and Japanese equities, while authorities signal readiness to manage excessive currency fluctuations.

Market Sentiment: Traders are cautious amid intervention risks, with the recent snap election in Japan strengthening Prime Minister Takaichi's mandate for fiscal plans, yet the anticipated "Takaichi trade" has not gained momentum this week.

Currency Movements: The USD/JPY pair is experiencing downward pressure, with a third consecutive daily drop and a significant break below the 100-day moving average, indicating a shift in bullish momentum.

Technical Levels: Key support levels to watch include the end-January low near 152.10-15, with potential further retracement towards the 200-day moving average and the 150.00 mark if this level is breached.

Future Outlook: Despite current selling pressure, analysts predict that USD/JPY could eventually rise towards 160.00 before any potential intervention from Tokyo, as profit-taking strategies are likely in play amid concerns over the yen's stability.

Japanese Markets: Japanese markets are closed for a holiday, leading to thinner yen trading in other centers.

Market News: There is no fresh news impacting the markets today.

NFP Preview: The consensus for January's non-farm payrolls is high, indicating expectations for strong job growth.

Goldman Analysis: Goldman Sachs has flagged substantial downside risks to the upcoming January jobs report.