Hidden Success: The Secrets Behind This $600M Fund Manager's Continued Outperformance of Wall Street

Focus on Obscure Money Managers: The author emphasizes the importance of analyzing lesser-known fund managers who achieve significant returns through deep research and conviction, contrasting them with high-profile investors like Buffett and Ackman.

Shah Capital's Investment Philosophy: Founded by Himanshu H. Shah, Shah Capital prioritizes long-term value creation through concentrated investments in undervalued companies, avoiding the noise of trendy market movements.

Recent Investments and Strategy: Shah Capital's recent purchases include Dole and Tronox Holdings, reflecting a contrarian approach that seeks undervalued stocks with strong fundamentals and potential for growth.

Commitment to Performance Over Growth: Shah Capital has chosen to focus on performance rather than asset gathering, maintaining a closed fund to prioritize returns for existing clients, embodying a traditional investment partnership ethos.

Trade with 70% Backtested Accuracy

Analyst Views on DOLE

About DOLE

About the author

Mission Produce Focuses on Margin Discipline to Stabilize Profitability

- Profitability Protection: Mission Produce leverages a vertically integrated operating model to control all aspects from sourcing to distribution, allowing for quick adjustments during market downturns, thereby ensuring stable profitability.

- Market Adaptability: The company's flexible global sourcing strategy enables it to redirect fruit to higher-value markets, stabilizing gross profit through increased volumes and disciplined cost management even when average selling prices decline.

- Long-term Strategic Advantage: AVO's margin-first strategy demonstrates greater resilience against external risks like weather disruptions and logistics costs compared to growth strategies reliant on favorable pricing cycles, potentially serving as a quiet driver of sustainable value creation for shareholders.

- Industry Performance Comparison: Despite a 3.5% decline in Mission Produce's stock over the past six months, the industry average drop was only 2.6%, indicating a relative disadvantage in competitiveness, necessitating a focus on profitability to enhance market performance.

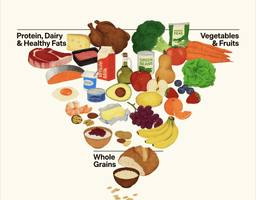

Kennedy Unveils New Food Pyramid That Could Raise Consumer Costs

- New Food Pyramid Unveiled: Health Secretary Kennedy's new food pyramid prioritizes protein and dairy, potentially raising consumer food costs to $175 per week, leading to an annual family expenditure of $36,400, which significantly strains household budgets.

- Policy Shift Impact: The new guidelines oppose added sugars and highly processed foods, likely forcing major food companies like PepsiCo and Coca-Cola to adjust product formulations and marketing strategies to align with the government's redefined health standards.

- Meat Companies Benefit: With the new focus on high-protein foods, meat producers such as Tyson Foods and Seaboard Corporation may see increased demand and sales growth, positioning them favorably in the market.

- Health Food Stocks in Focus: As consumer interest in healthy eating rises, stocks associated with health-focused companies like Sprouts Farmers Market and Chipotle may attract investor attention, potentially impacting their market performance.