France is betting Eutelsat can become Europe's answer to Starlink — but experts aren't convinced

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jun 29 2025

0mins

Should l Buy CSCO?

Source: CNBC

Eutelsat's Strategic Moves: France's Eutelsat is attempting to establish a European alternative to Starlink by merging with OneWeb and receiving a significant investment from the French state, positioning itself as a critical infrastructure provider in the EU's technological sovereignty efforts.

Challenges Ahead: Despite these advancements, Eutelsat faces substantial challenges in competing with Starlink due to its smaller satellite constellation, limited launch capabilities, and differing technical architectures, making it unlikely to achieve parity in the mass-market satellite broadband segment within the next five years.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy CSCO?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on CSCO

Wall Street analysts forecast CSCO stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for CSCO is 89.36 USD with a low forecast of 76.00 USD and a high forecast of 100.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

14 Analyst Rating

10 Buy

4 Hold

0 Sell

Moderate Buy

Current: 85.540

Low

76.00

Averages

89.36

High

100.00

Current: 85.540

Low

76.00

Averages

89.36

High

100.00

About CSCO

Cisco Systems, Inc. designs and sells a range of technologies that power the Internet. The Company is integrating its product portfolios across networking, security, collaboration, applications and cloud. The Company's segments include the Americas; Europe, Middle East, and Africa (EMEA), and Asia Pacific, Japan, and China (APJC). Its Networking product category represents its core networking technologies of switching, routing, wireless, fifth generation (5G), silicon, optics solutions and compute products. Its Security product category consists of its cloud and application security, industrial security, network security, and user and device security offerings. Its Collaboration product category consists of its meetings, collaboration devices, calling, contact center and platform as a service (CPaaS) offering. Its Observability product category consists of its full stack observability offerings.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Cisco's Share Performance: Cisco shares fell by 6.6% following the release of its quarterly earnings report.

- Gross Margin Concerns: The company's gross margin was reported to be below market estimates, raising concerns among investors.

See More

- Cisco's Stock Plunge: Despite beating earnings and revenue expectations, Cisco Systems Inc. (NASDAQ:CSCO) saw its shares drop over 11%, marking the worst single-day decline since May 2022, as investors expressed concerns over profit durability.

- Tech Sector Decline: The iShares Tech-Expanded Software Sector ETF (NYSE:IGV) fell 3.7%, revisiting lows from last week, indicating heightened sensitivity to AI disruption risks following Cisco's outlook.

- Small Caps Underperform: The Nasdaq 100 dropped 1.7%, while both the S&P 500 and Dow Jones Industrial Average lost 1.2%, with the Russell 2000 small-cap index sliding 2.4%, reflecting a cautious market sentiment.

- Increased Volatility: The VIX surged 16%, as investors rotated into defensive sectors, with utilities and consumer staples outperforming, highlighting a risk-off tone in the market.

See More

- Tech Stock Pressure: The S&P 500 index fell by 0.52% and the Nasdaq 100 index dropped by 1.08% due to weakness in the Magnificent Seven tech stocks, indicating investor concerns that could dampen market confidence.

- Cisco Profit Warning: Cisco Systems forecasted that rising memory chip prices would erode profitability, leading to a more than 10% drop in its stock price, which may prompt investors to revise down their future performance expectations, negatively impacting overall market sentiment.

- Employment Data Impact: Initial US jobless claims fell by 5,000 to 227,000, reflecting a slightly weaker labor market, which could influence the Federal Reserve's monetary policy decisions and lower market expectations for future rate cuts.

- Chip Demand Recovery: Sandisk's stock rose over 7% following Kioxia's forecast of strong demand for NAND memory chips, indicating growth potential in the AI infrastructure sector, which may create new investment opportunities for related companies.

See More

- Market Dynamics: Wall Street experienced a decline on Thursday, particularly after the conclusion of the Morning Meeting, as the rotation from technology stocks to cyclicals continued, with industrials showing strong performance and driving portfolio results, indicating resilience in cyclical sectors.

- Stock Performance: Companies like Dupont, Dover, Honeywell, Linde, GE Vernova, and Eaton have shown extraordinary year-to-date performance, even as the S&P 500 has only seen slight gains, highlighting the significance of these cyclical stocks in the current market environment.

- Cisco Earnings Impact: Cisco's earnings report on Wednesday, despite a networking order growth exceeding 20%, saw shares drop over 10% on Thursday due to a dip in gross margins from rising memory prices, reflecting market concerns over its profitability.

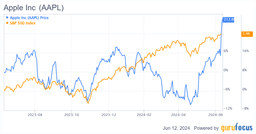

- Apple Developments: Apple's shares fell more than 3% on Thursday, influenced by Cisco's warnings, and although iPhone sales remain strong, issues with the Siri upgrade testing and a delayed full launch could impact future market performance.

See More

- Crocs Strong Guidance: Crocs shares surged 21% after the company projected adjusted earnings between $2.67 and $2.77 per share for the current quarter, exceeding the market expectation of $2.52, indicating resilience and growth potential in the current economic climate.

- Restaurant Brands Challenges: Despite reporting revenue and profit beats, Restaurant Brands' shares fell 6%, primarily due to rising costs, including beef, which pressured profits, reflecting the dual challenges of intensified industry competition and cost pressures.

- Cognex Stock Surge: Cognex shares jumped over 37% after reporting adjusted earnings and revenue beats for the fourth quarter, along with optimistic guidance for the current quarter, showcasing significant advancements in AI-enabled industrial machine vision technology.

- Equinix Exceeds Guidance: Equinix shares rose 12% after projecting adjusted EBITDA of $5.141 billion to $5.221 billion by 2026, surpassing analyst expectations, demonstrating strong growth potential in the digital infrastructure sector.

See More

- Market Tightness: Micron's stock rose 3.7% on Thursday, primarily driven by tight supply and demand for high-bandwidth memory (HBM), indicating a direct link between its profitability and HBM supply.

- Competitor Actions: Rivals like Samsung and SK Hynix are ramping up HBM production, with Samsung recently shipping its latest HBM4 chips, highlighting a surge in demand for high-priced memory.

- Profit Outlook: While rising HBM prices will boost Micron's short-term profits, the rapid production increases by competitors could lead to price declines in the future, impacting the company's long-term profitability.

- Cyclical Risks: The cyclical nature of the semiconductor industry suggests that Micron's profit growth may not be sustainable, prompting investors to remain cautious about potential market shifts.

See More