Dole Sells Ecuador Port Operations for $75 Million

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Dec 15 2025

0mins

Should l Buy DOLE?

Source: Businesswire

- Transaction Overview: Dole plc announced that its subsidiaries have signed agreements to sell its port and operations in Guayaquil, Ecuador to Terminal Investment Limited Holding S.A., with estimated net proceeds of approximately $75 million, enhancing the company's cash flow.

- Ongoing Operations: Post-transaction, Dole will continue to collaborate with the buyer to provide port terminal services, including loading and unloading of containers, ensuring business continuity and maintaining customer relationships.

- Regulatory Approval: The sale is subject to regulatory clearance in Ecuador, which may affect the timing of the transaction's completion, requiring Dole to navigate potential legal and regulatory risks.

- Strategic Realignment: This sale is part of Dole's business restructuring aimed at optimizing asset allocation and focusing resources on its core fresh produce business, thereby improving overall operational efficiency.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy DOLE?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on DOLE

About DOLE

Dole plc is an Ireland-based company, which produces, markets, and distributes a variety of fresh produce sourced locally and from around the world. Its segments include Fresh Fruit, Diversified Fresh Produce - EMEA and Diversified Fresh Produce - Americas & ROW. The Fresh Fruit segment is a vertically integrated producer and distributor of multiple varieties of bananas, pineapples and plantains which are sourced from local growers or Company-owned and leased farms, predominately located in Latin America, and sold throughout North America, Europe, Latin America and Asia. This segment also operates a commercial cargo business. The Diversified Fresh Produce - EMEA segment includes Irish, Dutch, Spanish, Portuguese, French, Italian, United Kingdom, Swedish, Danish, South African, Czech, Slovakian, Polish, German and Brazilian businesses. The Diversified Fresh Produce - Americas & ROW segment includes United States, Canadian, Mexican, Chilean, Peruvian, and Argentinian businesses.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Earnings Announcement Schedule: Dole plc will announce its financial results for Q4 and full year 2025 on February 25, 2026, prior to market opening, with management hosting a webcast at 8:00 a.m. ET to discuss the results and answer investor questions.

- Increased Transparency: Starting in 2026, Dole plc will voluntarily file reports on U.S. domestic issuer forms, including Forms 10-K, 10-Q, and 8-K, while remaining a foreign private issuer, aiming to enhance comparability and consistency with other U.S. public companies.

- Potential Market Impact: By adopting U.S. domestic forms, Dole plc anticipates improving its eligibility for inclusion in certain U.S. stock indices, potentially attracting more investor interest and enhancing market confidence.

- Company Background: Dole plc is a global leader in fresh produce, dedicated to providing a diverse range of fresh fruits and vegetables in over 85 countries, with a goal of promoting global health through sustainable practices.

See More

- Profitability Protection: Mission Produce leverages a vertically integrated operating model to control all aspects from sourcing to distribution, allowing for quick adjustments during market downturns, thereby ensuring stable profitability.

- Market Adaptability: The company's flexible global sourcing strategy enables it to redirect fruit to higher-value markets, stabilizing gross profit through increased volumes and disciplined cost management even when average selling prices decline.

- Long-term Strategic Advantage: AVO's margin-first strategy demonstrates greater resilience against external risks like weather disruptions and logistics costs compared to growth strategies reliant on favorable pricing cycles, potentially serving as a quiet driver of sustainable value creation for shareholders.

- Industry Performance Comparison: Despite a 3.5% decline in Mission Produce's stock over the past six months, the industry average drop was only 2.6%, indicating a relative disadvantage in competitiveness, necessitating a focus on profitability to enhance market performance.

See More

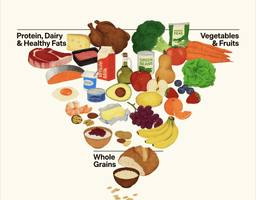

- New Food Pyramid Unveiled: Health Secretary Kennedy's new food pyramid prioritizes protein and dairy, potentially raising consumer food costs to $175 per week, leading to an annual family expenditure of $36,400, which significantly strains household budgets.

- Policy Shift Impact: The new guidelines oppose added sugars and highly processed foods, likely forcing major food companies like PepsiCo and Coca-Cola to adjust product formulations and marketing strategies to align with the government's redefined health standards.

- Meat Companies Benefit: With the new focus on high-protein foods, meat producers such as Tyson Foods and Seaboard Corporation may see increased demand and sales growth, positioning them favorably in the market.

- Health Food Stocks in Focus: As consumer interest in healthy eating rises, stocks associated with health-focused companies like Sprouts Farmers Market and Chipotle may attract investor attention, potentially impacting their market performance.

See More

- Reflection on Leadership: A diverse group of influential business leaders departed in 2025, suggesting that their selection by the Pale Horseman is enigmatic and personal.

- Necrology Overview: The article presents a selective and subjective remembrance of the deceased individuals, highlighting their impact and legacy.

See More

- Transaction Overview: Dole plc announced that its subsidiaries have signed agreements to sell its port and operations in Guayaquil, Ecuador to Terminal Investment Limited Holding S.A., with estimated net proceeds of approximately $75 million, enhancing the company's cash flow.

- Ongoing Operations: Post-transaction, Dole will continue to collaborate with the buyer to provide port terminal services, including loading and unloading of containers, ensuring business continuity and maintaining customer relationships.

- Regulatory Approval: The sale is subject to regulatory clearance in Ecuador, which may affect the timing of the transaction's completion, requiring Dole to navigate potential legal and regulatory risks.

- Strategic Realignment: This sale is part of Dole's business restructuring aimed at optimizing asset allocation and focusing resources on its core fresh produce business, thereby improving overall operational efficiency.

See More

- Transaction Overview: Dole plc announced that its subsidiaries have signed agreements to sell its port and operations in Guayaquil, Ecuador to Terminal Investment Limited Holding S.A., with expected net proceeds of approximately $75 million post-completion, enhancing the company's cash flow and financial flexibility.

- Ongoing Operations: Despite the sale of the port operations, Dole will continue to provide port terminal services under an agreement with the buyer, which not only ensures business continuity but also maintains strong relationships with its customers.

- Regulatory Approval: The transaction is subject to regulatory clearance in Ecuador, and Dole must navigate potential approval delays, which could impact the timing of the deal's completion and the company's future operational plans.

- Strategic Realignment: This sale is part of Dole's strategic restructuring aimed at optimizing asset allocation and focusing resources on core operations, which is expected to enhance the company's overall operational efficiency and market competitiveness.

See More