CME Group To Launch XRP Futures In May: How Did XRP Price React?

CME Group Launches XRP Futures: CME Group announced the launch of XRP futures contracts on May 19, pending regulatory approval, to cater to growing institutional and retail interest in XRP, which has seen significant price volatility.

Market Impact and Support: The new futures will be cash-settled and available in two sizes, with Robinhood supporting the contracts for retail users. This addition expands CME's cryptocurrency derivatives suite and reflects a strong demand for regulated XRP exposure, as evidenced by Teucrium's successful ETF launch.

Trade with 70% Backtested Accuracy

Analyst Views on HOOD

About HOOD

About the author

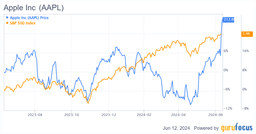

- Stock Performance: Robinhood shares fell by 8.1% following the announcement of its Q4 revenue results.

- Revenue Miss: The decline in stock price was attributed to the company missing revenue expectations for the fourth quarter.

Market Reaction: Robinhood's stock prices fell significantly after the company reported its Q4 revenue, which missed analysts' expectations.

Revenue Details: The disappointing revenue figures raised concerns about the company's growth prospects and overall financial health.

Investor Sentiment: The market's negative response reflects broader apprehensions regarding the trading platform's ability to attract and retain users.

Future Outlook: Analysts are now closely monitoring Robinhood's strategies to improve its revenue and user engagement in the coming quarters.

- Earnings Beat: Robinhood reported a Q4 GAAP EPS of $0.66, beating expectations by $0.02, indicating ongoing improvements in profitability despite slightly missing overall revenue targets.

- Revenue Growth: Total revenue reached $1.28 billion, a 26.7% year-over-year increase, yet fell short of expectations primarily due to a 38% decline in cryptocurrency revenue, negatively impacting overall performance.

- Strong Transaction Revenue: Transaction-based revenues increased by 15% year-over-year to $776 million, with other transaction revenue surging over 300% to $147 million, showcasing Robinhood's success in diversifying its revenue streams.

- Significant Asset Management Growth: Robinhood's retirement account assets under custody grew 102% year-over-year to $26.5 billion, while cash sweep and margin accounts increased by 26% and 113%, respectively, reflecting a notable rise in customer trust and platform usage.

- Earnings Release Date: Robinhood is set to release its Q4 earnings after the market close on February 10, with investors keenly watching its performance following four consecutive quarters of beating earnings expectations, indicating a strong growth trajectory.

- Earnings Decline Expected: Analysts forecast that Robinhood's earnings per share will drop to $0.63 this quarter, down from $1.01 in the same period last year, which may reflect increased market competition and fluctuations in user engagement.

- Revenue Growth Forecast: Despite the decline in earnings expectations, Robinhood's quarterly revenue is projected to reach $1.34 billion, up from $1.01 billion a year earlier, suggesting that the company continues to grow in revenue, likely due to an expanding user base.

- Stock Price Reaction: Ahead of the earnings report, Robinhood's stock rose by 4.5% to close at $86.56, indicating a positive market sentiment and investor optimism regarding the company's future performance.

- Performance Volatility: Robinhood's fourth-quarter results showed mixed outcomes, with profits exceeding expectations but revenues falling short, leading to an 8.20% drop in stock price to $71.51 on Thursday, indicating market concerns about its growth potential.

- Analyst Ratings: Despite the stock decline, analysts maintain a Buy rating on Robinhood with an average price target of $142, reflecting confidence in its growth levers such as prediction markets and international expansion.

- Bitmine Trading Dynamics: Shares of Bitmine Immersion Technologies rose slightly by 1.81% to $20.85, benefiting from Ethereum price sensitivity, with staked ETH expected to generate over $370 million in annualized rewards, showcasing its potential in the crypto market.

- Airbnb Stake Adjustment: Ark Invest trimmed its stake in Airbnb by selling 259,652 shares across its ARKF, ARKK, and ARKW funds, reflecting a cautious stance following the company's mixed fourth-quarter earnings where revenues beat but EPS missed expectations.

- Cisco's Stock Plunge: Despite beating earnings and revenue expectations, Cisco Systems Inc. (NASDAQ:CSCO) saw its shares drop over 11%, marking the worst single-day decline since May 2022, as investors expressed concerns over profit durability.

- Tech Sector Decline: The iShares Tech-Expanded Software Sector ETF (NYSE:IGV) fell 3.7%, revisiting lows from last week, indicating heightened sensitivity to AI disruption risks following Cisco's outlook.

- Small Caps Underperform: The Nasdaq 100 dropped 1.7%, while both the S&P 500 and Dow Jones Industrial Average lost 1.2%, with the Russell 2000 small-cap index sliding 2.4%, reflecting a cautious market sentiment.

- Increased Volatility: The VIX surged 16%, as investors rotated into defensive sectors, with utilities and consumer staples outperforming, highlighting a risk-off tone in the market.