Best ETFs of Last Week

- Wall Street Performance: Wall Street saw a rally led by tech stocks on Friday, but all major U.S. equity indexes ended the week in negative territory due to uncertainty about Federal Reserve interest rate cuts.

- Economic Highlights: The U.S. labor market performed well in March, adding 303,000 jobs and lowering the unemployment rate to 3.8%, exceeding expectations.

- Market Volatility: Investors faced volatility throughout the week due to economic indicators, corporate updates, and tensions in the Middle East, with the U.S. manufacturing sector growing for the first time in one-and-a-half years.

- Oil Prices: Oil prices remained near six-month highs driven by concerns over supply disruptions due to tensions between Israel and Iran.

- ETF Winners: Highlighted winning ETFs of the week include Silver Mining ETFs, Volatility ETFs, ETFs to Fight Rising Rates, and Uranium Miner ETFs.

Trade with 70% Backtested Accuracy

Analyst Views on SLVP

No data

About the author

Precious Metals Performance: Gold has risen over 55% this year, while silver has surged nearly 75%, driven by concerns over the dollar, fiscal deficits, and geopolitical instability.

Market Dynamics: Central-bank buying has significantly contributed to gold's rise, and expectations of interest-rate cuts have increased the appeal of non-yielding assets like gold and silver.

Silver's Unique Position: Silver reached an all-time high recently, surpassing a record from 1980, with strong demand from industrial applications and stagnant supply contributing to price pressures.

Consumer Trends: India and China are the largest consumers of silver, with increased purchases during festival and wedding seasons, as high gold prices have pushed many buyers towards silver.

Canada's 2025 Federal Budget: The budget allocates billions to expand the mining sector, including a 2 billion Canadian dollar fund for critical minerals, despite a projected 78.3 billion Canadian dollar deficit.

Investment and Tax Incentives: The plan includes tax incentives and funding for mining companies, aiming to enhance Canada's position as a global supplier of critical minerals, with expanded eligibility for the Critical Mineral Exploration Tax Credit.

Industry Response: The Mining Association of Canada supports the government's measures, viewing them as a strong signal to investors, while experts express concerns about the long-term sustainability and market implications of direct government involvement in mining.

Political Support and Risks: Analysts warn that the cyclical nature of mining requires bipartisan support for sustained investment, emphasizing the need for ongoing political commitment beyond a single budget cycle.

Wall Street Performance: Wall Street has experienced a strong rally in 2025, with major indices like the S&P 500, Dow Jones, and Nasdaq hitting all-time highs, driven by a tech boom and recovering from earlier trade tensions.

ETF Gains: Significant gains have been observed in various ETFs, particularly in gold and silver mining, with the iShares MSCI Global Silver and Metals Miners ETF up 129.9%, and the CoinShares Bitcoin Mining ETF up 93.3%, reflecting increased interest in safe-haven assets and cryptocurrencies.

Nuclear Energy Interest: The demand for uranium is rising due to increasing global electricity needs and a shift towards nuclear energy, with the Global X Uranium ETF up 88.1%, despite facing regulatory challenges.

Defense Spending Surge: Geopolitical tensions have led to a rise in global defense spending, particularly in Europe, with the Select STOXX Europe Aerospace & Defense ETF up 86.9%, as EU member states are expected to significantly increase their defense budgets in the coming years.

U.S. Fund for Critical Minerals: The U.S. is set to launch a $5 billion fund through the International Development Finance Corporation (DFC) in partnership with Orion Resource Partners to secure critical mineral supplies, with both parties committing at least $600 million.

Strategic Investments and Partnerships: This initiative aims to reduce dependence on Chinese supply chains and includes significant past investments, such as loans to Syrah Resources and upgrades to the Lobito Corridor rail line, highlighting the DFC's role in supporting strategic overseas investments.

Urgency and Long-term Concerns: The initiative addresses immediate concerns over China's dominance in processing key minerals and anticipates long-term shortages due to declining ore grades and underinvestment in mining.

Broader Government Involvement: The U.S. government is increasing its engagement in critical minerals through various agencies, including a recent $67 million financing interest from the Export-Import Bank for a major scandium project in Australia.

Silver Price Surge: Silver has reached a multi-year high of $40.7 per ounce, driven by expectations of a Federal Reserve interest rate cut, supply constraints, and political instability in Europe, with a projected increase to $43 by the end of 2025.

Global Demand Insights: A study highlights the distinct roles of various countries in silver demand, noting that while India drives consumption through jewelry and investment, the U.S. market benefits from tax advantages, although political shifts may impact future demand.

Funding for Critical Minerals: The U.S. Department of Energy plans to allocate nearly $1 billion to enhance domestic mining, processing, and manufacturing technologies for critical minerals, aiming to reduce reliance on foreign sources and strengthen national security.

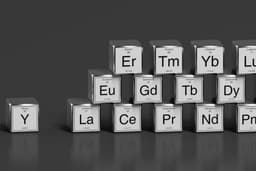

Targeted Investments: Various DOE offices will distribute funds for specific projects, including $50 million for rare-earth magnet supply chains, $250 million for mineral recovery from industrial processes, and $500 million for battery materials processing and recycling.