Baidu Expected to Surge Over 69%: 10 Leading Analyst Predictions for Monday

Analyst Upgrades and Price Target Increases: JP Morgan upgraded Cipher Mining Inc and Baidu Inc, raising their price targets significantly, while B of A Securities upgraded Barrick Mining Corp's rating and price target as well.

Analyst Downgrades and Price Target Reductions: HC Wainwright & Co. downgraded BioNano Genomics Inc, and Jefferies downgraded Exact Sciences Corp despite increasing their price targets.

Mixed Analyst Ratings: Various analysts maintained or adjusted ratings for companies like Mp Materials Corp and Flutter Entertainment PLC, with some upgrades and downgrades occurring simultaneously.

Current Stock Prices: The article provides the latest closing prices for the mentioned stocks, indicating market performance and analyst sentiment.

Trade with 70% Backtested Accuracy

Analyst Views on LITE

About LITE

About the author

- Revenue Growth: Coherent Corp reported quarterly revenue of $1.69 billion, an 18% year-over-year increase and a 7% sequential rise, surpassing the market expectation of $1.64 billion, indicating strong market performance.

- Profitability Improvement: The non-GAAP earnings per share came in at $1.29, exceeding the consensus estimate of $1.21, demonstrating significant progress in cost control and operational efficiency.

- Analyst Rating Upgrades: Analyst Mike Genovese from Rosenblatt Securities raised the price target from $220 to $300, while Needham maintained a Buy rating with a $235 target, reflecting market confidence in the company's future growth.

- Capacity Expansion Plan: The company plans to increase its internal indium phosphide (InP) capacity by 100% by 2026, which will help enhance revenue and margins over the next several quarters to meet the rapid growth demands in AI and cloud computing.

- Market Fluctuations: The S&P 500 Index is up 0.08%, the Dow Jones Industrial Average is up 0.54%, while the Nasdaq 100 Index is down 0.56%, indicating the complexity of market sentiment amid mixed corporate earnings results.

- Divergent Corporate Performance: Super Micro Computer forecasts Q3 net sales of at least $12.3 billion, significantly above the $10.25 billion consensus, leading to a stock price increase of over 15%; conversely, Advanced Micro Devices' weak Q1 sales forecast results in a stock decline of over 13%, reflecting a reassessment of tech stocks.

- Labor Market Signals: The January ADP employment change rose by 22,000, below the expected 45,000, indicating weakness in the labor market that could influence future monetary policy decisions.

- Government Funding Plan: The funding package signed by President Trump extends funding for the Department of Homeland Security through February 13, while other departments are funded until September 30, alleviating concerns over a government shutdown and boosting investor confidence.

- Surge in AI Infrastructure Demand: Lumentum's Q2 fiscal 2026 results indicate that the unprecedented demand for AI network infrastructure is a key long-term growth driver, with analysts projecting continued benefits from this trend.

- New Product Lines Driving Growth: Significant order increases for new product lines, including optical circuit switches and co-packaged optics, are expected to accelerate delivery in C2H26 and C1H27, enhancing the company's competitive position.

- Substantial Capital Expenditure Increase: Needham raised Lumentum's price target from $470 to $550, while B. Riley Securities increased its target from $147 to $526, reflecting strong market confidence in the company's future growth potential.

- Capacity Expansion Strategy: Lumentum plans a 40% front-loaded expansion of its InP capacity in 2026 to meet surging demand for laser chips, which is expected to significantly enhance its market share.

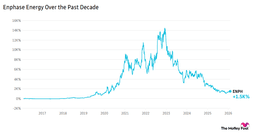

- Enphase Energy Upgrade: BMO Capital analyst Ameet Thakkar upgraded Enphase Energy Inc (NASDAQ:ENPH) from Underperform to Market Perform, raising the price target from $31 to $41, reflecting confidence in its future growth; the stock closed at $37.28 on Tuesday, indicating a positive market response.

- Cloudflare Rating Increase: BTIG analyst Gray Powell upgraded Cloudflare Inc (NYSE:NET) from Neutral to Buy with a price target of $199, closing at $170.31 on Tuesday, suggesting optimistic expectations for its future performance, potentially attracting more investor interest.

- Lumentum Holdings Upgrade: B. Riley Securities analyst Dave Kang upgraded Lumentum Holdings Inc (NASDAQ:LITE) from Neutral to Buy, significantly raising the price target from $147 to $526, with the stock closing at $435.10 on Tuesday, demonstrating strong confidence in its market potential and likely driving further stock price increases.

- Impact of Analyst Changes: These rating upgrades not only reflect analysts' confidence in the future performance of these companies but may also influence investor decisions, further driving the market performance of the related stocks, highlighting the critical role analysts play in the market.

- Optimistic Earnings Outlook: Enphase Energy's stock surged over 20% in early trading despite a 24% year-over-year earnings drop to $0.71 in Q4, as the results exceeded expectations of $0.54, indicating strong market confidence in future growth.

- Strong Revenue Guidance: The company provided Q1 revenue guidance of $270-$300 million, which, while seen as a low point, reflects CEO Kothandarayanan's optimism about demand growth expected in the second half of 2026, suggesting a recovery trajectory.

- Dominance in U.S. Market: U.S. revenue accounted for 89% of total sales, driven by increased domestic solar and battery installations ahead of the expiring Section 25D tax credit, highlighting the significant impact of policy incentives on market demand.

- Stable Gross Margin: Enphase achieved a non-GAAP gross margin of 46% in Q4 despite a 5% impact from reciprocal tariffs, demonstrating resilience in cost management and profitability, which strengthens its competitive position in the renewable energy sector.

- Earnings Beat: Lumentum reported Q2 earnings of $1.67 per share, surpassing analyst expectations of $1.40, indicating strong profitability growth and boosting market confidence in its future performance.

- Sales Surge: The company achieved quarterly sales of $665.5 million, exceeding analyst estimates of $646.7 million, with over 65% year-over-year growth, demonstrating robust product demand and expanding market share.

- Positive Outlook: Lumentum forecasts Q3 adjusted EPS between $2.15 and $2.35, significantly above market estimates of $1.55, reflecting the company's confidence in future performance and positive market response.

- Stock Price Increase: Following the earnings announcement, Lumentum shares rose 11.7% to $486.51 in pre-market trading, indicating investor recognition of the company's strong results and optimistic outlook.