Atlassian Reports Strong Q2 Earnings, Beats Estimates

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 1h ago

0mins

Should l Buy TEAM?

Source: Benzinga

- Significant Revenue Growth: Atlassian reported Q2 revenue of $1.59 billion, surpassing analyst expectations of $1.54 billion, with a year-over-year increase of 23%, showcasing the company's robust performance in cloud services.

- Improved Profitability: Adjusted earnings per share reached $1.22, exceeding the analyst estimate of $1.14, while operating income hit $430.2 million, with an operating margin rising from 26% last year to 27%, reflecting effective cost control and efficiency improvements.

- Strong Cash Flow: The company generated $177.8 million in operating cash flow and $168.5 million in free cash flow during the quarter, ending with $1.6 billion in cash and cash equivalents, providing ample funding for future investments.

- Optimistic Outlook: Atlassian expects Q3 revenue to range between $1.689 billion and $1.697 billion, with cloud revenue projected to grow around 23%, and has raised its fiscal 2026 sales outlook to $6.362 billion, indicating strong confidence in future growth.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy TEAM?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on TEAM

Wall Street analysts forecast TEAM stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for TEAM is 235.57 USD with a low forecast of 185.00 USD and a high forecast of 320.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

23 Analyst Rating

19 Buy

4 Hold

0 Sell

Strong Buy

Current: 105.040

Low

185.00

Averages

235.57

High

320.00

Current: 105.040

Low

185.00

Averages

235.57

High

320.00

About TEAM

Atlassian Corporation is a provider of team collaboration and productivity software. The Company specializes in software development, work management, and enterprise service management software, which enables enterprises to connect their business and technology teams with an artificial intelligence (AI)-powered system of work. Its interconnected portfolio of apps, AI agents, and Collections, each with discrete value propositions, delivers solutions for software teams, IT operations and support teams, leadership, and business teams. Its apps, agents, and Collections are all built on the Atlassian Cloud Platform and data model: a common technology foundation that connects teams, information, and workflows throughout an organization. Its apps include Jira, Confluence, Loom, Jira Service Management, Rovo, Bitbucket, Compass, Jira Product Discovery, Jira Align, Focus and Talent. It offers team collaboration products on its Data Center deployment option. It operates the Dia and Arc browsers.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Revenue Growth Outlook: Atlassian raised its fiscal 2026 revenue growth forecast to approximately 22%, up from the previous 20.8%, reflecting strong confidence in demand for enterprise software services amid increasing AI adoption by clients.

- Cloud Revenue Milestone: The company achieved its first-ever quarter with over $1 billion in cloud revenue, growing 26% year-over-year, with customer count surpassing 350,000, indicating the competitive strength and appeal of its cloud services in the market.

- User Engagement Surge: Rovo surpassed 5 million monthly active users, demonstrating clients' strong reliance on its team management and data analysis tools, further solidifying Atlassian's market position in the enterprise software sector.

- Cash Flow Decline: Despite reporting second-quarter revenue of $1.59 billion, exceeding market expectations, free cash flow fell by approximately 51% to $168.5 million, which may exert pressure on investor confidence and impact stock performance.

See More

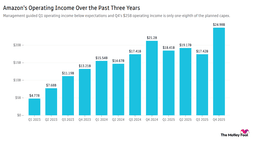

- Amazon's Capital Expenditure Surge: Amazon plans to increase its capital expenditure to $200 billion in 2026, nearly matching its total revenue of $213 billion for Q4, leading to an over 8% drop in stock price during morning trading, indicating market concerns about its financial health.

- Accelerating AWS Growth: CEO Andy Jassy reported a 24% growth rate for AWS, the fastest in 13 quarters, with an annualized revenue of $142 billion; however, management anticipates Q1 operating income will fall short of analyst expectations, reflecting intensified market competition.

- Bitcoin Price Volatility: Bitcoin has dropped 50% from its 2025 peak, falling to around $60,000, which reflects waning confidence in government support for cryptocurrencies, although some analysts suggest this is merely a market correction rather than the end of crypto.

- Severe Market Reactions: Despite a 10% revenue increase in Q3, DOCS and PIDoximity saw their stock plunge over 30% due to declining net income under margin pressure, highlighting investors' acute sensitivity to profitability.

See More

- Significant Revenue Growth: Atlassian reported Q2 revenue of $1.59 billion, surpassing analyst expectations of $1.54 billion, with a year-over-year increase of 23%, showcasing the company's robust performance in cloud services.

- Improved Profitability: Adjusted earnings per share reached $1.22, exceeding the analyst estimate of $1.14, while operating income hit $430.2 million, with an operating margin rising from 26% last year to 27%, reflecting effective cost control and efficiency improvements.

- Strong Cash Flow: The company generated $177.8 million in operating cash flow and $168.5 million in free cash flow during the quarter, ending with $1.6 billion in cash and cash equivalents, providing ample funding for future investments.

- Optimistic Outlook: Atlassian expects Q3 revenue to range between $1.689 billion and $1.697 billion, with cloud revenue projected to grow around 23%, and has raised its fiscal 2026 sales outlook to $6.362 billion, indicating strong confidence in future growth.

See More

- Tech Sector Decline: Qualcomm's (QCOM) forecast of weaker-than-expected Q2 revenue led to an over 8% drop in its stock, triggering a sell-off across the tech sector, with the Nasdaq 100 index hitting a 2.5-month low, indicating waning investor confidence in technology stocks.

- Weak Labor Market Signals: Challenger's report revealed a staggering 117.8% year-over-year increase in job cuts for January, totaling 108,435, the highest for January since 2009, while initial jobless claims rose by 22,000 to 231,000, highlighting vulnerabilities in the US labor market that could hinder economic recovery.

- Bitcoin Plunge: Bitcoin (^BTCUSD) plummeted over 12% to a 1.25-year low, reflecting deepening negative momentum in the cryptocurrency market, with approximately $2 billion flowing out of Bitcoin ETFs in the past month, signaling a decline in investor confidence.

- Earnings Season Impact: Despite 150 S&P 500 companies set to report earnings this week, market focus on economic data intensifies, with S&P 500 earnings expected to grow by 8.4% in Q4, yet overall market sentiment remains suppressed by recent economic weakness.

See More

- Record Cloud Revenue: Atlassian achieved its first-ever $1 billion cloud revenue quarter in Q2, representing a 26% year-over-year increase, which signifies robust growth in its cloud business and is expected to further drive future revenue expansion.

- Strong Enterprise Sales: The company recorded over 1,000 customers upgrading to the Teamwork Collection in Q2, purchasing more than 1 million seats, indicating a strong preference for standardizing on the Atlassian system, thereby reinforcing its market position.

- Accelerated AI Adoption: Rovo surpassed 5 million monthly active users, demonstrating the rapid adoption of AI capabilities that are transforming work processes and directly driving business growth and customer demand.

- Long-Term Growth Confidence: Management reaffirmed a target of over 20% compounded annual revenue growth through FY27, along with a commitment to maintain a non-GAAP operating margin above 25%, reflecting confidence in future market opportunities.

See More

- Amazon Earnings Miss: Amazon reported fourth-quarter earnings of $1.95 per share, falling short of the $1.97 consensus estimate, resulting in a 9% drop in shares, highlighting pressures in the competitive e-commerce landscape.

- Reddit Stock Surge: Reddit's stock rose 4% after its fourth-quarter earnings exceeded expectations, coupled with a $1 billion share buyback program, which is expected to boost investor confidence and enhance future shareholder returns.

- Molina Healthcare Loss: Molina Healthcare posted an adjusted loss of $2.75 per share, leading to a 33% decline in shares, primarily due to pressures from Medicaid premium adjustments and Medicare costs, with full-year revenue projected at $44.5 billion, below the $46.55 billion forecasted by analysts.

- Envista Strong Performance: Envista reported fourth-quarter earnings of 38 cents per share and revenue of $750.6 million, resulting in a 14% increase in shares, with expectations of 2% to 4% core sales growth in 2026, indicating robust performance in the dental products market.

See More