13 Undervalued Stocks, Including Microsoft and Oracle, That Present Buying Opportunities

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Nov 19 2025

0mins

Source: Barron's

Market Impact: The market has experienced a downturn this month, affecting stocks across the board.

Investment Strategy: Investors can look for stocks with strong fundamentals that are currently undervalued due to the selloff.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy ORCL?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on ORCL

Wall Street analysts forecast ORCL stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for ORCL is 309.59 USD with a low forecast of 180.00 USD and a high forecast of 400.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

34 Analyst Rating

25 Buy

9 Hold

0 Sell

Moderate Buy

Current: 172.800

Low

180.00

Averages

309.59

High

400.00

Current: 172.800

Low

180.00

Averages

309.59

High

400.00

About ORCL

Oracle Corporation offers integrated suites of applications plus secure, autonomous infrastructure in the Oracle Cloud. The Company operates through three businesses: cloud and license, hardware and service. Its cloud and license business is engaged in the sale, marketing and delivery of its enterprise applications and infrastructure technologies through cloud and on-premise deployment models including its cloud services and license support offerings, and its cloud license and on-premise license offerings. Its hardware business provides infrastructure technologies including Oracle Engineered Systems, servers, storage, industry-specific hardware, operating systems, virtualization, management and other hardware-related software to support diverse IT environments. Its services business provides services to customers and partners to help maximize the performance of their investments in Oracle applications and infrastructure technologies.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

Oracle's Cloud Market Share Growth and Financial Outlook

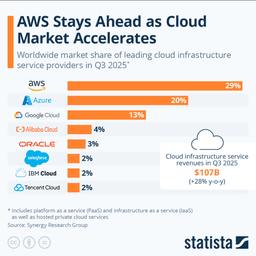

- Cloud Market Share Increase: Oracle's focus on high-performance computing has raised its cloud market share from 2% in 2024 to 3%, showcasing a competitive edge in a $944 billion industry, with expectations for further growth by 2026.

- Strong Financial Performance: For the first half of fiscal 2026 ending November 30, 2025, Oracle's cloud segment generated over $15 billion in revenue, a 31% year-over-year increase, driving overall revenue to $31 billion with the cloud segment accounting for 49%.

- Future Growth Potential: Analysts forecast a 17% revenue growth for fiscal 2026 and 29% for the following year, which could enhance Oracle's stock performance despite its current debt of $108 billion.

- Strategic Investment Returns: While Oracle's heavy investment in cloud infrastructure has increased its debt, its P/E ratio of 33 is close to the S&P 500 average of 31, indicating market confidence in its future growth prospects.

Continue Reading

U.S. Software Stock Sell-Off Triggers ETF Concerns

- Sell-Off Impact: The sell-off in U.S. software stocks led the iShares Expanded Tech-Software Sector ETF (IGV) to decline by about 5% on Thursday, marking one of its largest one-day drops since the pandemic began, indicating investor concerns about the software industry's core business model.

- Cloud Spending Sensitivity: IGV's heavy exposure to enterprise software giants like Microsoft (MSFT) and Oracle (ORCL) makes it particularly sensitive to shifts in cloud spending expectations, highlighting growing doubts about AI monetization capabilities.

- Broad Market Reaction: The Technology Select Sector SPDR ETF (XLK) also fell roughly 2%, demonstrating how megacap software names can influence overall tech performance, as investors reassess the health of the software industry rather than merely rotating trades.

- Long-Term Re-Rating Expectations: The simultaneous declines across IGV, XLK, XSW, HACK, and AOTS suggest that the market may be pricing in more profound fundamental changes rather than just short-term earnings hiccups, with software ETFs becoming a testing ground for how AI reshapes demand.

Continue Reading