Nvidia, Microsoft, BlackRock Seal $40B AI Data Center Deal

Details of the $40 Billion Acquisition

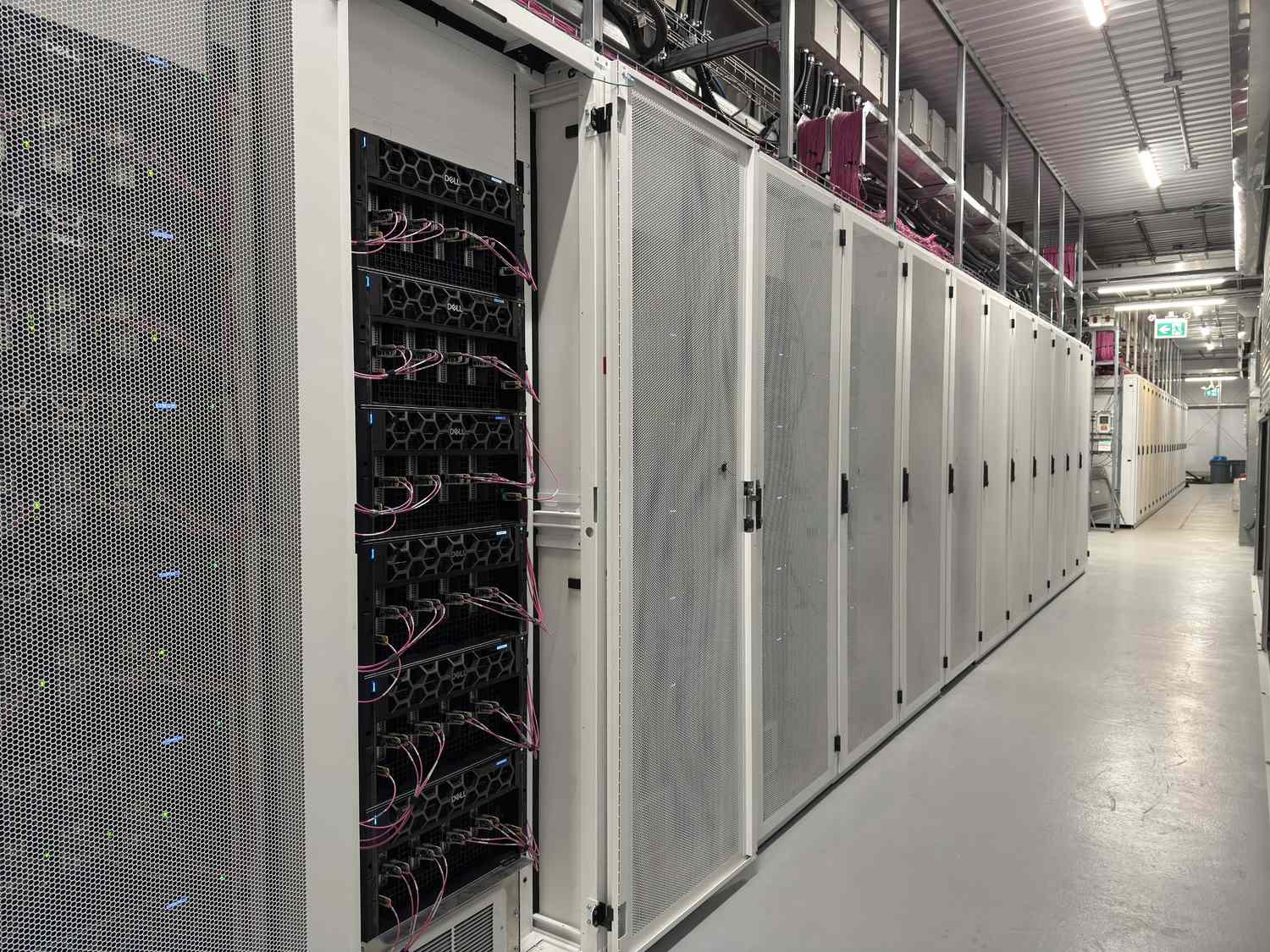

A consortium comprising Nvidia, Microsoft, BlackRock, and Global Infrastructure Partners (GIP) has announced the acquisition of Aligned Data Centers in a deal valued at $40 billion. Aligned Data Centers is among the largest and fastest-growing operators in the data center industry, with a portfolio that includes 50 campuses across the U.S. and Latin America and a capacity of 5 gigawatts, including planned expansions. This acquisition underscores the strategic importance of securing large-scale computing capacity to meet the demands of artificial intelligence (AI) and cloud services.

The consortium’s investment reflects confidence in Aligned Data Centers’ ability to scale next-generation AI and cloud infrastructure efficiently. Aligned Data Centers has been a key player in enabling AI-driven operations for its clients, which include major technology platforms like Nutanix and Datto. The transaction is part of a broader trend of increasing private capital inflows into critical infrastructure sectors, positioning Aligned as a cornerstone in the rapidly evolving AI ecosystem.

Strategic Importance of the Deal

This acquisition is pivotal in addressing the surging demand for AI-driven computing infrastructure. As AI applications become more sophisticated and widespread, the need for high-performance data centers capable of supporting advanced workloads has grown exponentially. Aligned Data Centers’ infrastructure will play a crucial role in expanding the capacity required for AI model training, cloud computing, and data storage.

For Nvidia, the deal complements its leadership in AI hardware and software, providing a robust infrastructure layer to support its GPUs and AI solutions. For Microsoft, it strengthens its Azure cloud capabilities, aligning with its commitment to AI and cloud innovation. BlackRock’s involvement highlights the increasing investor interest in infrastructure as an asset class, especially in sectors tied to transformative technologies like AI. The consortium’s collective strategy signals a long-term commitment to AI-driven growth, leveraging Aligned’s assets to power future innovations.

Market Implications and Future Outlook

The acquisition represents a significant milestone in AI-related investments, further establishing data centers as a critical component of the global AI infrastructure. According to Morgan Stanley, major tech companies are expected to spend approximately $400 billion annually on AI infrastructure, underscoring the scale of the opportunity. This deal positions the consortium to capitalize on this trend, as demand for scalable and energy-efficient data centers continues to rise.

Globally, the move sets a precedent for more investments in AI infrastructure, potentially driving consolidation in the data center industry. The involvement of sovereign wealth funds and state-owned investors, such as the Kuwait Investment Authority and Temasek, underscores the international importance of AI infrastructure development. As AI continues to reshape industries, this acquisition not only enhances the strategic positioning of its stakeholders but also accelerates the global race to establish a robust foundation for AI innovation.

Sources

Sources- Nvidia, Microsoft, BlackRock Struck Massive AI Data Center Deal

investopedia

investopedia - Nvidia, Microsoft, BlackRock Struck Massive AI Data Center Deal

yahoo

yahoo - BlackRock, Nvidia-backed group strikes $40 billion AI data center deal

yahoo

yahoo

Keep Reading

Keep ReadingAbout the author

Top News

Related Articles

Latest Newswire

- Nvidia, Microsoft, BlackRock Struck Massive AI Data Center Deal

investopedia

investopedia - Nvidia, Microsoft, BlackRock Struck Massive AI Data Center Deal

yahoo

yahoo - BlackRock, Nvidia-backed group strikes $40 billion AI data center deal

yahoo

yahoo