Onto Innovation Inc Reaches 20-Day High on Positive Market Sentiment

Onto Innovation Inc. has seen a price increase of 5.67%, reaching a 20-day high. This movement reflects strong investor interest and positive sentiment in the market.

The Nasdaq-100 is up 0.94% and the S&P 500 is up 0.36%, indicating a broader market rally that has positively influenced tech stocks like Onto Innovation Inc.

This upward trend may suggest increased confidence in the company's future performance, potentially leading to further gains as market conditions remain favorable.

Trade with 70% Backtested Accuracy

Analyst Views on ONTO

About ONTO

About the author

- Semiconductor Surge: Taiwan Semiconductor's blockbuster earnings reignited enthusiasm, leading AMD and ASML shares to rise about 6% each, reflecting a robust recovery in the AI supply chain and boosting market confidence.

- Strong Financials: Goldman Sachs and Morgan Stanley saw their stocks rise by 4% and 5% respectively after reporting earnings, reassuring investors about the profitability of major financial institutions amid mixed sector results.

- Regional Bank Rebound: The SPDR S&P Regional Banking ETF's surge helped lift small-cap stocks, with the Russell 2000 index hitting record highs for the tenth consecutive session, pushing year-to-date gains above 7%, indicating optimism towards small businesses.

- Positive Economic Data: Initial jobless claims fell to 198,000, significantly below the forecast of 215,000, showcasing the resilience of the U.S. labor market and further bolstering investor confidence in economic recovery.

Market Opening: U.S. stock markets are set to open in two hours.

Penumbra Inc. Performance: Penumbra Inc. (PEN) saw a 14.0% increase in pre-market trading.

Talen Energy Corp. Performance: Talen Energy Corp. (TLN) experienced a 10.2% rise in pre-market trading.

Overall Market Sentiment: The pre-market gains indicate positive sentiment among investors for these companies.

- Price Target Increase: Wells Fargo raised the price target for Packaging Corp Of America from $222 to $233, with analyst Gabe Hajde upgrading the stock from Equal-Weight to Overweight, reflecting confidence in the company's future growth prospects.

- Market Performance: Packaging Corp shares closed at $211.13 on Monday, indicating a potential upside of 10.4% based on the new target, which may attract more investor interest in the stock.

- Other Rating Changes: Needham increased the price target for Onto Innovation from $150 to $200 while maintaining a Buy rating, demonstrating strong optimism regarding the company's innovation capabilities.

- Industry Dynamics: BTIG raised the price target for Expedia Group from $275 to $330, maintaining a Buy rating, indicating analysts' optimistic outlook on the recovery of the travel industry.

- AI-Driven Demand Surge: Nova, as a supplier of semiconductor manufacturing equipment, is experiencing strong business growth driven by the AI megatrend, highlighting the company's significant position in a rapidly evolving market.

- Increased Market Recognition: The widespread application of AI technologies has led to a notable increase in demand for Nova's products, further solidifying its leadership in the semiconductor industry.

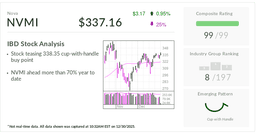

- Rising Investor Interest: Being named IBD Stock Of The Day reflects heightened investor recognition of Nova's future growth potential, which could drive stock price appreciation.

- Strategic Market Positioning: The company's robust performance in AI-related sectors indicates a strategic alignment with market trends, likely attracting more investor attention moving forward.

- Stake Increase: Bridge City Capital disclosed an acquisition of 31,096 additional shares of Onto Innovation, raising its total holdings to 47,342 shares valued at $6.12 million as of September 30, 2025, indicating sustained confidence in the semiconductor sector.

- Asset Allocation: Onto Innovation now represents 1.63% of Bridge City Capital's 13F reportable assets, highlighting its significance in the portfolio and potentially influencing future investment decisions.

- Market Performance: As of November 11, 2025, Onto Innovation shares were priced at $133.44, down 23.59% over the past year, underperforming the S&P 500 by 38.39 percentage points, which may present a buying opportunity for investors.

- Industry Outlook: Given the strong demand for AI chips, Bridge City Capital's increased stake likely reflects optimistic expectations for semiconductor process control companies, especially in the context of current low valuations that may attract more investor interest.

Stock Performance: Onto Innovation (ONTO) closed at $156.36, down 2.5%, underperforming the S&P 500, but has seen a 23.62% increase over the past month, significantly outpacing sector gains.

Earnings Forecast: The company is expected to report an EPS of $1.27, a 15.89% decrease from last year, with projected revenue of $266.11 million, reflecting a slight increase.

Analyst Confidence: Onto Innovation has a Zacks Rank of #2 (Buy), indicating positive analyst sentiment, with recent EPS estimates rising by 0.9% over the past month.

Valuation Metrics: The stock's Forward P/E ratio is 32.33, matching the industry average, and it has a PEG ratio of 1.08, suggesting a balanced valuation relative to expected earnings growth.