Is Nvidia Aligned with Republicans or Democrats? These Political ETFs Have Made Their Choices.

Nvidia's Political Alignment: The question of whether Nvidia Corp. is a Republican company has emerged due to its significant holdings in conservative-focused investment funds.

Investment in Republican ETFs: Nvidia is a major holding in the Unusual Whales Subversive Republican Trading ETF, which invests in stocks associated with Republican members of Congress.

Conservative Values ETF: The company also ranks as the largest holding in the American Conservative Values ETF, aimed at investors wanting to align with conservative principles.

AI Wave Influence: Nvidia's prominence in the AI sector on Wall Street contributes to its association with these conservative investment strategies.

Trade with 70% Backtested Accuracy

Analyst Views on GOP

About the author

Investment Firm's Approach: Yorkville America Equities, the investment advisor for Trump Media & Technology's Truth Social funds, is adopting a more casual approach in its communications with investors.

Engagement Strategy: The firm may soon engage with investors by asking informal questions like "How y’all doing?" to foster a more approachable atmosphere.

Nvidia's Political Alignment: The question of whether Nvidia Corp. is a Republican company has emerged due to its significant holdings in conservative-focused investment funds.

Investment in Republican ETFs: Nvidia is a major holding in the Unusual Whales Subversive Republican Trading ETF, which invests in stocks associated with Republican members of Congress.

Conservative Values ETF: The company also ranks as the largest holding in the American Conservative Values ETF, aimed at investors wanting to align with conservative principles.

AI Wave Influence: Nvidia's prominence in the AI sector on Wall Street contributes to its association with these conservative investment strategies.

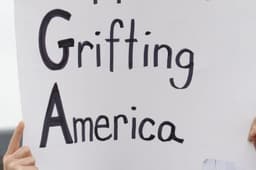

New ETF Launch: Tuttle Capital Management has filed to launch a new ETF, GRFT, which aims to invest in companies with political ties, leveraging perceived favoritism for potential investment gains, while charging a 0.75% fee.

Market Context and Reception: The fund's approach is seen as provocative and unique in the crowded ETF market, especially amid increasing scrutiny of government officials' financial dealings; previous similar funds have shown mixed performance against the S&P 500.

Congressional Trading Insights: A report from Wolfe Research indicates that certain trades made by U.S. lawmakers can be predictive of market trends, influenced by factors such as political power and trade disclosure timing.

Factors Affecting Predictive Power: The analysts highlight that the size of a trade and the conditions surrounding it significantly impact its potential to predict market movements.

PELOSI Act Reintroduction: Senator Josh Hawley has reintroduced the PELOSI Act, which aims to ban members of Congress from trading individual stocks and options, citing concerns over conflicts of interest and the need to restore public trust in lawmakers.

Legislative Support and Challenges: The bill has garnered support from figures like President Trump and outgoing President Biden, but faces low odds of passing in Congress, with only a 17% chance predicted for a stock trading ban by 2025.