Key Takeaways

- Target's stock is under pressure due to a slowdown in consumer spending, particularly in discretionary categories, as confirmed by recent retail sales data.

- Ongoing controversy surrounding Target's past DEI initiatives has impacted brand perception and contributed to market volatility and recent lawsuits.

- Profit margins are shrinking due to higher costs, inventory markdowns, and tariffs, leading to a decline in operating income.

- The announcement of an internal CEO successor was met with market skepticism, causing a significant one-day drop in the stock price as Wall Street questions Target's new direction.

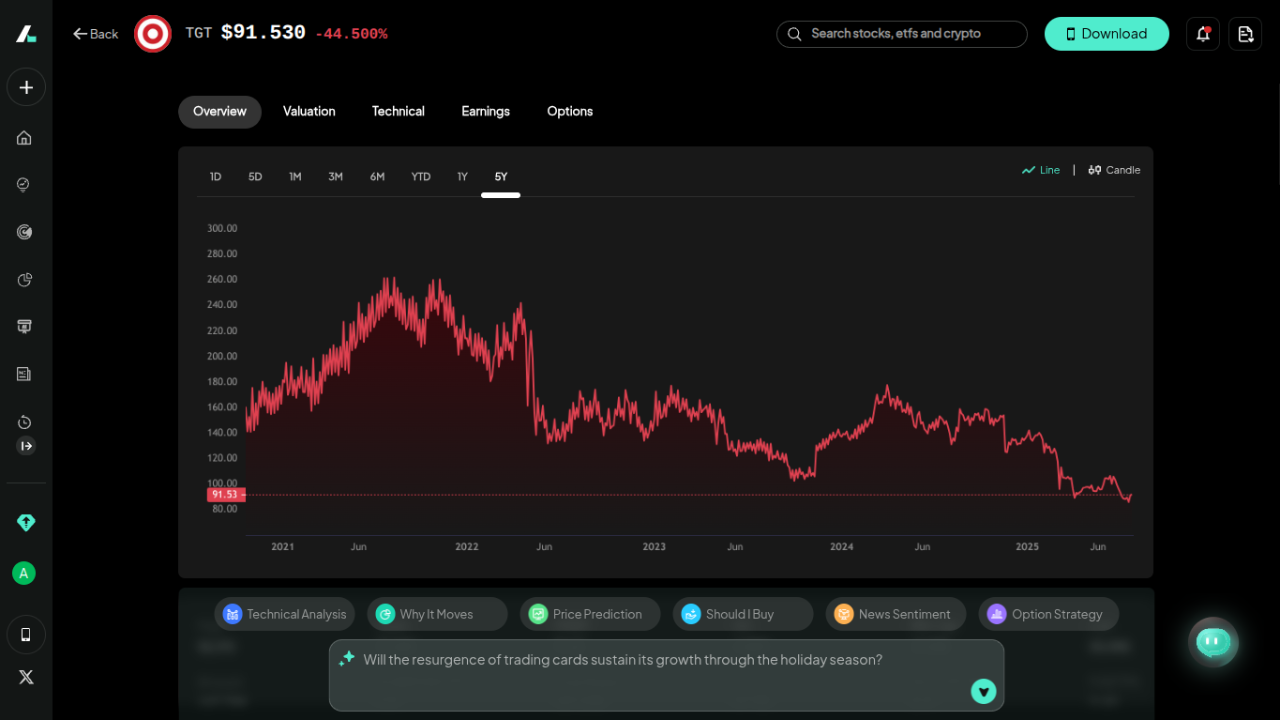

Target’s (TGT) recent stock slide has left investors wondering whether it’s a short-term dip or a sign of deeper structural problems. Let's break down the main reasons why Target stock is falling in 2025, conduct a thorough analysis of its underlying fundamentals to assess its long-term health, and explore how you can leverage powerful AI-driven tools to navigate this volatility with greater confidence.

Why Is Target Stock Falling in 2025

Target faces multiple challenges—from cautious consumer spending to reputational issues—that have fueled investor uncertainty. Here’s a more detailed look at the five primary factors that are collectively driving the stock's downward trend.

- Weaker Consumer Spending and Retail Slowdown

The most significant headwind for any retailer is a customer who is hesitant to spend, and that is precisely the challenging environment Target is navigating in 2025. Recent economic data paints an unambiguous picture of a consumer under considerable financial pressure, forcing them to prioritize needs over wants.

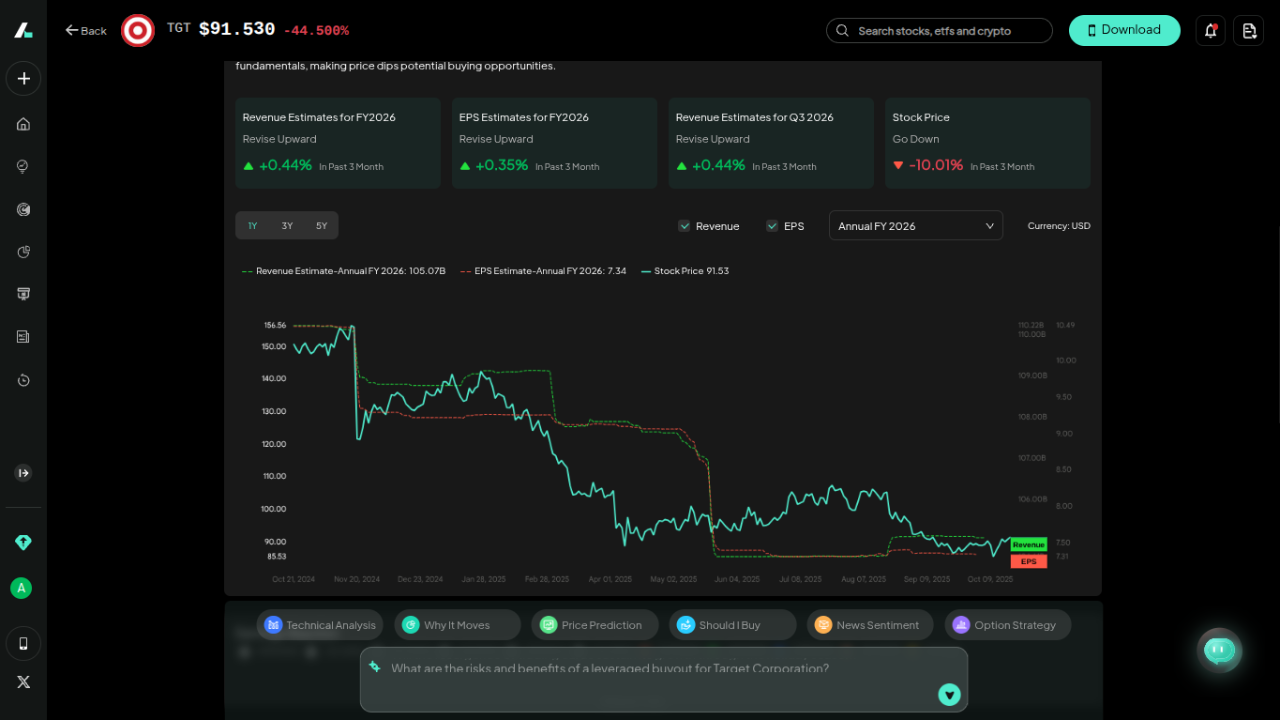

A comprehensive PricewaterhouseCoopers survey issued a stark warning that U.S. holiday spending is projected to see its sharpest decline since the pandemic. The survey found that a staggering 84% of consumers are actively planning to reduce their spending in the coming months, particularly on non-essential categories like clothing, home decor, and dining out—all critical areas for Target. This is also observable in Target’s reduced topline and bottomline estimates .

This isn't just a future forecast; it's a present reality. The September 2025 CNBC/NRF Retail Monitor, which leverages real-time credit and debit card data, revealed a month-over-month decline in overall retail sales. More concerning for Target, the "General Merchandise" category, which is Target's heartland, experienced a 0.62% drop. This specific decline signals that shoppers are making deliberate cuts to the very non-essential, discretionary goods that form the cornerstone of Target's unique "Tarzhay" appeal.

2. Profit Margin Pressure and Shrinking Operating Income

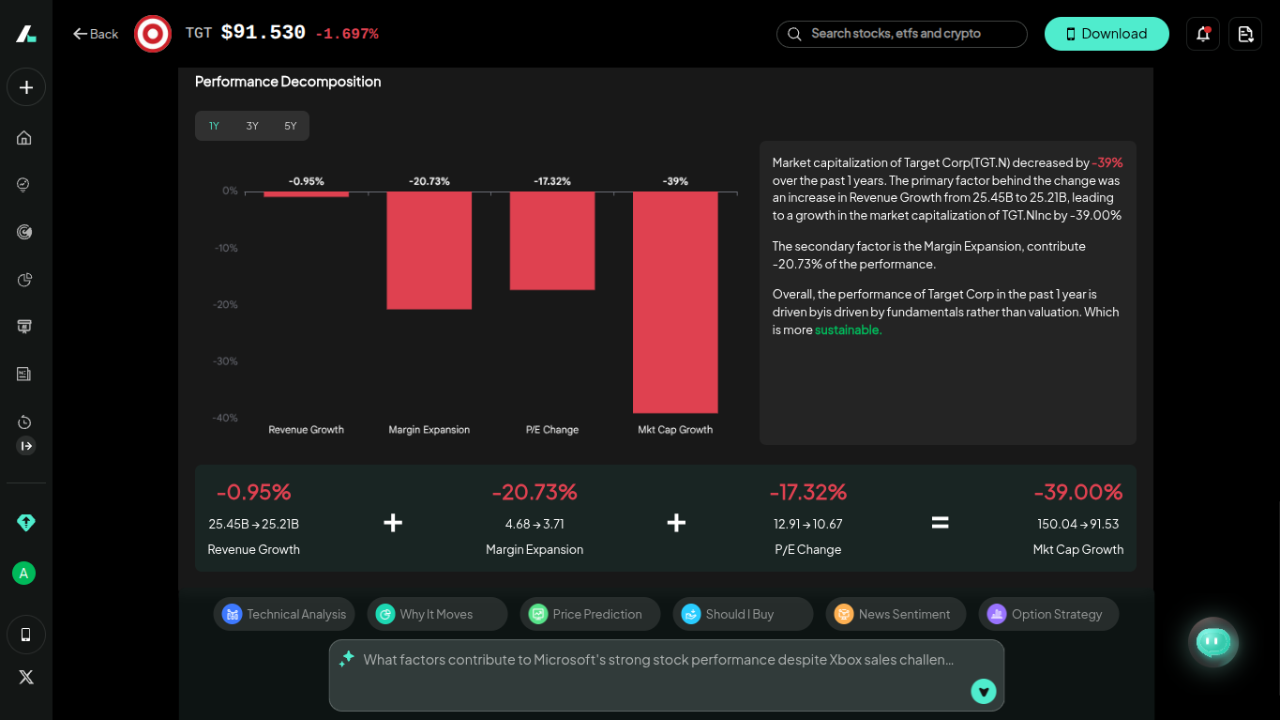

Target’s gross margin slipped to 29% in Q2 2025, down from 30% last year. The drop stems from steep markdowns, canceled purchase orders, and tariff pressure—all eating into profits. With operating income sliding each quarter, Wall Street doubts whether Target can reignite growth, keeping valuation multiples under pressure.

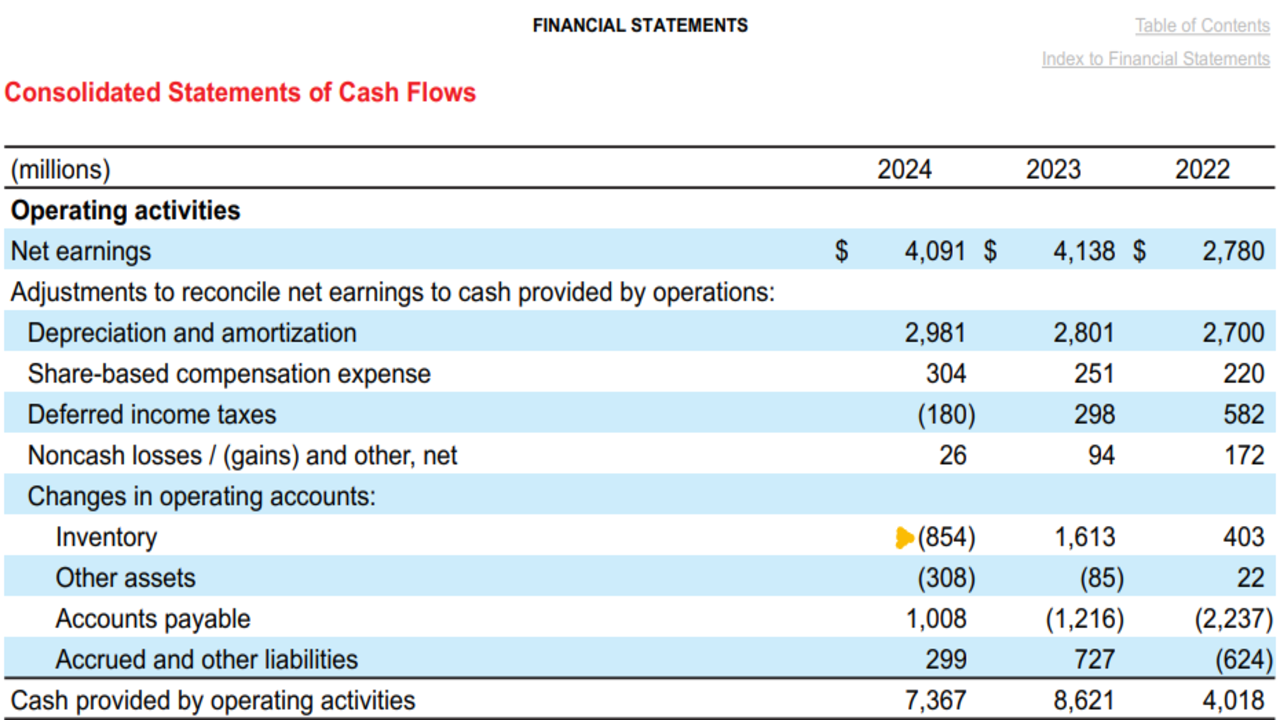

3. Inventory Challenges and Supply Chain Costs

Target’s 2024 report shows rising 'inventory shrink' from theft and damage, alongside costly markdowns to clear excess stock—both dragging margins and cash flow.

Simultaneously, Target has been forced to take on substantial "inventory adjustment costs," as mentioned in its earnings calls, to clear out excess merchandise from previous quarters when it failed to accurately predict shifting consumer demand. These aggressive markdowns, while necessary to make room for new products, are a direct hit to profitability and eat away at gross margins. This combination of lost and discounted inventory creates a significant financial drag.

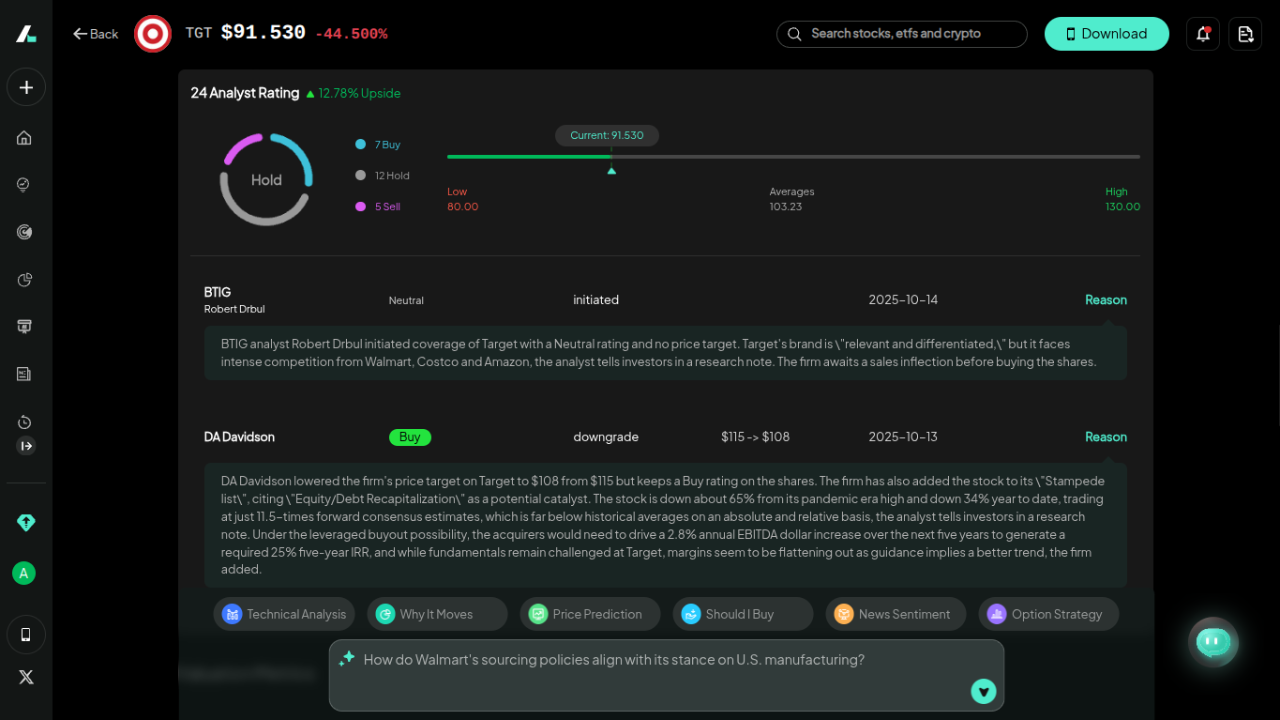

4. Market Sentiment and Skeptical Analysts

Wall Street’s confidence in Target has waned. Out of the 24 analysts currently covering Target, a significant majority of 12 rate the stock a "Hold." This indicates a widespread lack of conviction in its short-term growth prospects and a "wait-and-see" approach from the financial community.

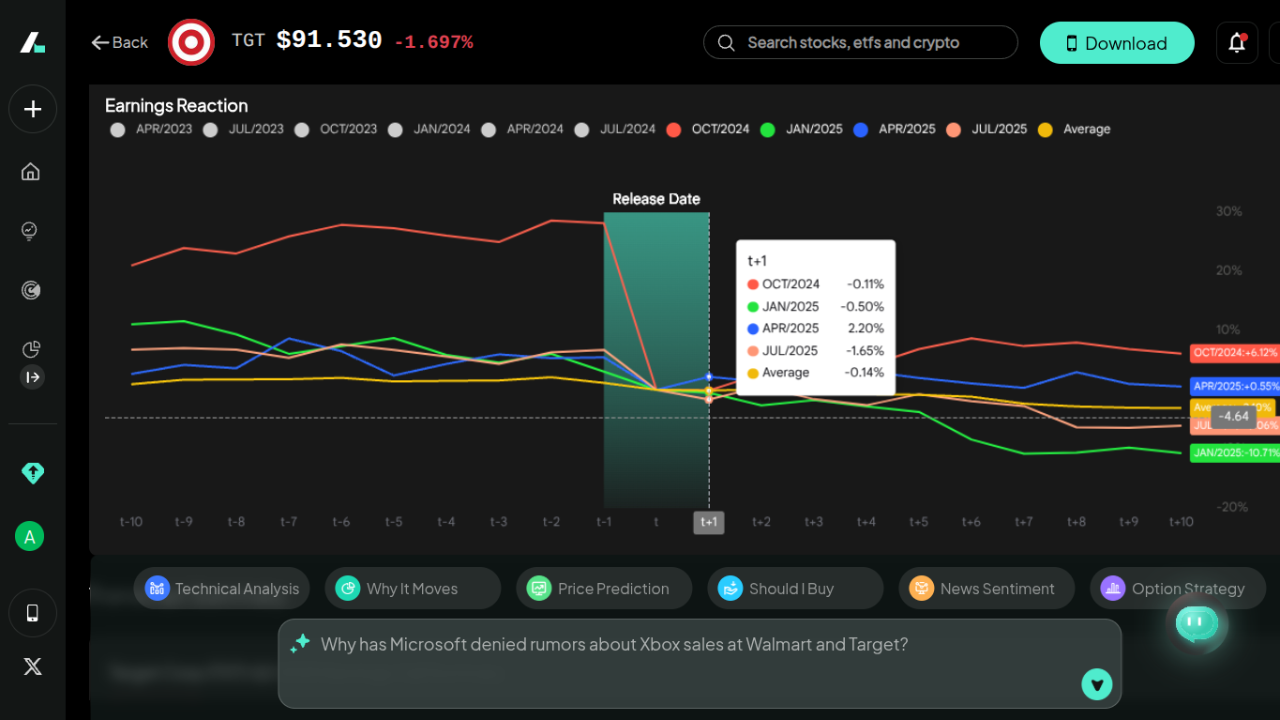

This deep-seated skepticism was on full display following the pivotal August 20, 2025, announcement of Target's CEO succession plan. The Board's decision to promote an insider, longtime executive Michael Fiddelke, to succeed Brian Cornell was met with considerable concern. Many on Wall Street had been advocating for an outside hire to inject a fresh perspective and drive transformative change. As one UBS analyst pointed out in a note to clients, the market is now seriously questioning how Target’s "trajectory could change meaningfully" with an internal leader who has been part of the existing strategy.

The market's reaction was immediate, decisive, and harsh: Target's shares tumbled by as much as 10% on the day of the announcement, representing a clear and powerful vote of no-confidence from Wall Street that remain unconvinced about the new leadership's ability to steer Target in a bold new direction.

5. DEI and Management Controversy

Target has suffered significant, self-inflicted damage in recent years that continues to have financial repercussions. Target's own financial filings now directly acknowledge the adverse financial impact stemming from its Diversity, Equity, and Inclusion (DEI) initiatives, a rare admission for a major corporation.

The most prominent example was the intense public backlash to its 2023 Pride Month merchandise collection. This event triggered a viral and highly organized boycott campaign that, according to widespread news reports, was a key factor in driving the stock down in the months that followed. In its official 10-K filing with the U.S. Securities and Exchange Commission, Target soberly confirms that adverse public reactions to its product assortments have led directly to "consumer boycotts and litigation."

SEC filings now explicitly warn that social or political reactions to product assortments pose material risks—a rare admission for a major retailer. These reputational wounds are keeping many investors on the sidelines.

Target’s Fundamentals: Should I Buy Target Stock?

Target is clearly navigating one of its most challenging periods in recent years, but its underlying strengths and long-term advantages remain intact.

The company still operates a massive retail empire of nearly 2,000 stores across the United States, giving it unmatched physical reach and brand visibility. This national footprint, combined with Target’s unique ability to cultivate customer loyalty—reflected in how many consumers affectionately call their local branch “My Target”—remains a key differentiator in the retail landscape.

From a valuation standpoint, Target’s stock looks relatively attractive. Its trailing twelve-month (TTM) P/E ratio hovers around 12, significantly below Walmart’s ~43 and Costco’s ~51. This steep discount suggests that the market may have overreacted to Target’s recent challenges, potentially creating an opportunity for long-term investors who believe in its recovery story.

How You Can Respond to Target’s Stock Drop

Successfully navigating this kind of market volatility requires access to timely data, sophisticated analytics, and tools that can help you cut through the noise, regardless of whether you are a short-term trader or a long-term investor.

For active traders who are looking to capitalize on the stock's significant price swings, staying ahead of rapidly changing market sentiment and identifying technical indicators are absolutely critical. Intellectia.ai’s AI Trading Signals are designed for this very purpose. They analyze millions of data points—including market trends, news sentiment, and technical patterns—to help you identify potential entry and exit points with a higher degree of confidence, giving you an indispensable algorithmic edge in a volatile and unpredictable market.

For long-term investors focused on Target's fundamental recovery, earnings reports are make-or-break moments that can define the stock's trajectory for months to come. With Target's profitability under an intense microscope, Intellectia.ai's Earnings Trading and Prediction tool provides crucial pre-earnings alerts, in-depth historical performance analysis, and AI-driven predictions to help you anticipate potential earnings surprises. This allows you to prepare for various outcomes instead of just reacting to the market's knee-jerk response on earnings day.

Finally, if Target's heightened risk profile no longer aligns with your personal investment strategy, the AI Stock Screener and Stock Picker can empower you to discover other promising opportunities. You can filter for companies within the broader consumer staples sector that exhibit stronger growth metrics, more stable profitability, or better market momentum. This enables you to efficiently find high-quality alternatives that better align with your financial goals and risk tolerance.

What’s Next for Target Stock?

Target's leadership team is keenly aware of the challenges and is not standing still in the face of this adversity. The incoming CEO, Michael Fiddelke, has already publicly laid out a strategic three-point plan designed to orchestrate a comprehensive turnaround and return Target to a path of sustainable growth.

- Refocus merchandising on trend-forward products;

- Enhance customer experience both in-store and online;

- Leverage AI and technology to improve inventory forecasting and fulfillment.

Conclusion

Target faces a rare convergence of weak consumer demand, profit erosion, and reputational risk. Yet its core assets—brand equity, scale, and pricing power—remain intact.

Whether you see TGT’s decline as danger or opportunity depends on your conviction in its turnaround story. Use Intellectia.ai to track key metrics, sentiment shifts, and valuation changes in real time—and decide when the odds truly favor a rebound.