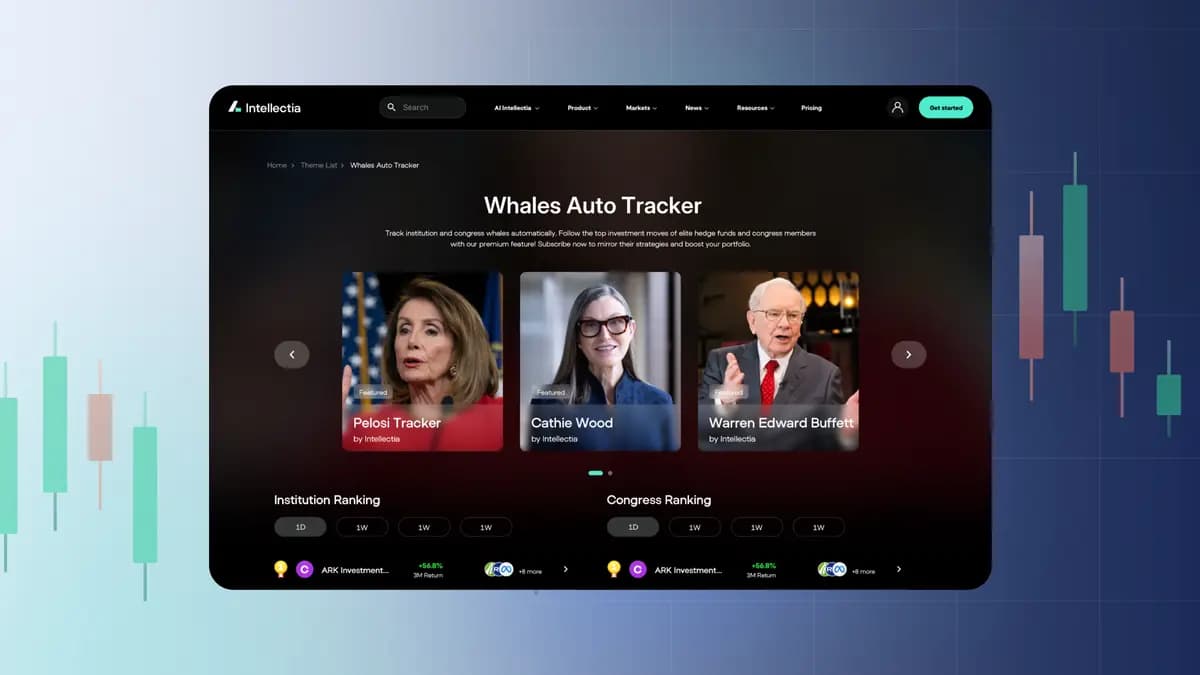

Most investors try to react faster than the market, chasing every movement and headline in hopes of gaining an edge. Yet the best investors in the world rarely do that. They move quietly, think in years rather than days, and adjust their positions only when their conviction truly changes. This deliberate rhythm is what separates them from the crowd—and it is exactly what Whales Auto Tracker is designed to capture. To see how it works in practice, let’s walk through a real example.

A real practice case: tracking Warren Buffett’s Berkshire Hathaway

When you open the Berkshire Hathaway Inc. (Warren Buffett) tracker page, the first thing you see is not a stock tip, but a portfolio.

As of January 5, 2026, the simulated Berkshire tracker portfolio shows:

Total Holdings: 20 stocks

Portfolio Market Value: $269.33B

Total Return: +15.04%

Annualized Return: +30.68%

Sharpe Ratio: 1.94

More importantly, you see how this performance was built.

The net value curve is updated daily and plotted directly against the S&P 500. Over the same period, the tracker portfolio consistently stayed above the index, with smoother drawdowns and stronger rebounds.

This is not hindsight. It is an evolving portfolio.

Seeing the portfolio, not just the trades

Scroll down, and the picture becomes even clearer.

The Current Holdings panel shows exactly how capital is allocated:

Apple (AAPL): 23.90% position size, +39.01% P&L

American Express (AXP): 20.84%, +22.02%

Bank of America (BAC): 11.72%, +21.99%

You also see sector exposure in real time, with non bank financials, technology, and consumer businesses clearly dominating the portfolio.

This is not a static list. We rebalance it whenever Berkshire does.

Real trade updates, exactly as they happen

Now comes the part most investors care about.

On January 5, the tracker recorded multiple rebalance actions, including:

Sell AAPL at a fill price of $268.64

Sell AMZN at $227.81

Buy AXP at $376.21

Each update shows the trade date, direction, fill price, and the resulting position weight change.

If you follow this whale, you receive these updates via push or email alerts. You do not need to guess when a position changes. You see it.

Why this is different from other Intellectia strategies

It is important to be clear.

CoinSwing and SwingMax focus on technical timing and trade signals.

Whales Auto Tracker focuses on capital allocation decisions made by institutions and Congress members.

There is no leverage here. No intraday noise. No emotional chasing.

You are observing how long term capital is deployed, trimmed, and rotated by investors who move markets slowly, but decisively.

Who this feature is for

Whales Auto Tracker is designed for investors who want:

To learn how top funds and lawmakers actually manage portfolios

To track real buy and sell decisions with price transparency

To benchmark institutional performance against the S&P 500

To build conviction through discipline, not prediction

Get started

If you want to stop guessing and start observing how giants move, this is where you begin.

Follow the whales.

Let patience do the heavy lifting.