Key Takeaways

- The eVTOL market is expected to experience enormous expansion, increasing from an estimated 1.35 billion in 2023 to 28.6 billion by 2030, driven by the need for a sustainable transportation and congestion system worldwide.

- eVTOL Pure-play investment options are primarily represented by companies such as Joby, Archer, and EHang, each pursuing its own strategy in the certification and commercialization race.

- The main characteristics should be analyzed in terms of investment, such as technological preparedness, strategic alliances (e.g., with car manufacturers and airlines), and a straightforward way to regulatory concession.

- You can mitigate the high risk associated with these new eVTOL stocks by utilizing specialized tools, such as Intellectia.ai Screener, to identify stable opportunities and receive AI-driven trading recommendations to manage volatility.

Introduction

Have you ever looked up at the gridlocked traffic below an elevated highway and wished you could simply fly over it? The problem of urban congestion and the urgent need for sustainable transportation solutions have created a perfect environment for a brand-new industry: electric vertical take-off and landing (eVTOL). This new area of aviation presents an excellent opportunity for investors. By getting in early, you’ll help your portfolio benefit from a significant shift in how people and goods get transported. Our specialty at Intellectia.ai is using AI-driven stock and crypto analysis to cut through market noise and identify which eVTOL companies are most likely to succeed. We provide an in-depth analysis of the top eVTOL stocks to watch in 2026, enabling you to make confident decisions about the future of flight.

What Are eVTOL Stocks?

An eVTOL stock is a share of a company that designs, builds, or runs electric vertical take-off and landing (eVTOL) planes that you can buy and sell on the stock market. These new planes are essentially electric helicopters or drones that can take off and land vertically. They use electric motors and batteries to run more quietly and sustainably.

Two significant trends worldwide are driving the growth of eVTOL companies. First, they reduce traffic in cities by creating a one-hour drive into a ten-minute flight. Second, they are fully electric, which aligns with global goals for net-zero emissions. The technology is already being utilized in defense for rapid troop transport and surveillance, as well as in logistics for expedited cargo delivery. Investors are interested in the entire eVTOL sector due to its diverse and rapidly growing applications.

Why Invest in eVTOL Stocks?

Investing in eVTOL stocks is a calculated bet on high-growth, transformative technology, offering exposure to the sector before mass commercialization begins.

eVTOL Market Growth Forecast (2024–2030)

The global eVTOL market is projected to surge from $1.35 billion in 2023 to a projected $28.6 billion by 2030, a phenomenal CAGR of up to 54.9%. Improvements in battery technology and clearer regulatory pathways are driving this significant growth, which reduces technical and timeline risks for leading companies.

Innovation and Regulatory Acceleration

Regulatory bodies, such as the FAA and EASA, are making significant progress in defining certification rules, a crucial step for achieving scaled production. Aircraft efficiency is improving through proprietary designs and key patents, particularly in areas such as noise reduction and battery cooling systems.

Criteria for Selecting Top eVTOL Stocks

You need to use strict standards to choose the best eVTOL stocks for your portfolio. Using tools like the AI Stock Picker to filter by key criteria can help you do this quickly.

Technological Readiness and Patents

Intellectual Property (IP) is often what gives a company an edge over its competitors. Look for companies that have their own technology in critical areas that can help UAM deal with its own problems:

- Battery Management: the advanced ability to quickly and safely recharge the plane for back-to-back flights and high usage rates.

- Propulsion Systems: Patented designs (e.g., tilt-rotor or lift-plus-cruise) that offer the best balance of range, speed, and efficiency for urban routes.

- Acoustics: Successfully developing a quiet aircraft is crucial for public acceptance and overcoming noise restrictions in densely populated urban environments.

Financial Strength and Market Cap Potential

The road to commercialization is incredibly capital-intensive. The best eVTOL companies require substantial funding to remain in business. You need to look at their balance sheets to see how much cash they have on hand and how quickly they are spending it. Most pure-plays still don't generate significant revenue. Still, they have substantial cash reserves, which allow them to cover the last, expensive stages of certification and mass production without significantly impacting shareholders.

Top 5 eVTOL Stocks to Watch in 2026

When making your eVTOL stock list, these five companies stand out as leaders. Each one is unique due to its strategy, technology, or geographic focus.

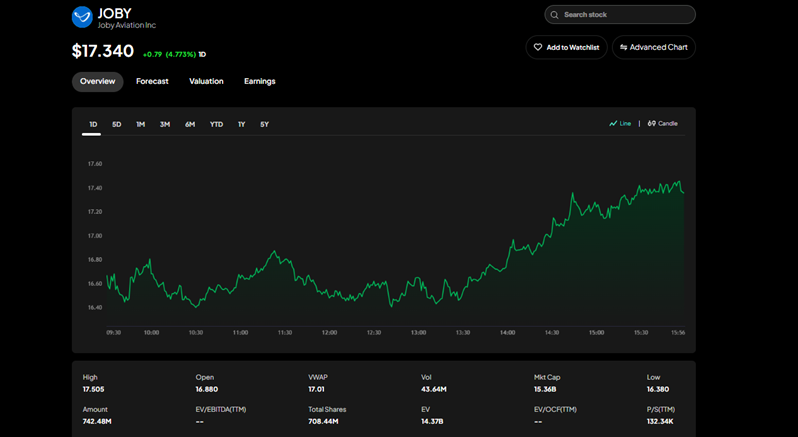

Joby Aviation (JOBY)

Joby Aviation (NYSE: JOBY) is widely considered the US frontrunner in the race for certification. Your reason for watching Joby is its highly vertically integrated model, meaning it controls both the design (the S4 aircraft) and the planned air taxi service operations. They have strong ties to US regulators (FAA) and have gotten a lot of strategic support. They are in a strong position due to their partnerships, which include an investment from Toyota to help them scale up production and a deal with Delta Air Lines to provide airport shuttle services. Joby's plane is designed for longer-range missions, making it ideal for traveling between cities. The company hopes to launch it commercially in the UAE by 2026. If you believe that a highly integrated model with strong US regulatory and manufacturing partnerships is the most de-risked path to commercial launch, JOBY is a top pick.

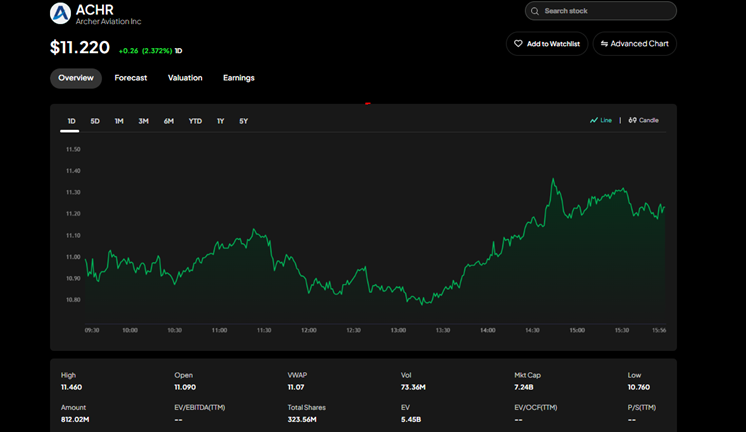

Archer Aviation (ACHR)

Archer Aviation (NYSE: ACHR) is Joby’s principal US competitor, and it has taken a different approach that should appeal to you if you value capital efficiency. Archer is focusing on a partnership model, most notably with global automaker Stellantis, to handle high-volume production of its Midnight aircraft. The Midnight is designed for shorter, rapid urban hops and quick 10-minute recharges, positioning it perfectly for dense urban air mobility (UAM). Archer has secured a substantial conditional order from United Airlines and is also making significant progress toward a commercial launch in the UAE by 2026. If you want to bet on a capital-efficient partnership model focusing on rapid, short-distance urban air mobility, ACHR is a strong choice.

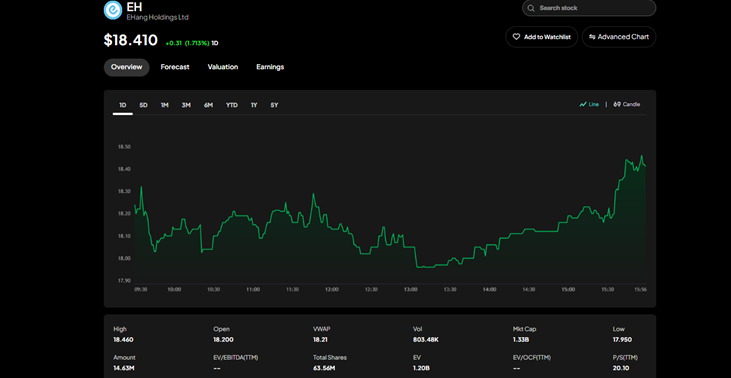

EHang Holdings (EH)

EHang Holdings (NASDAQ: EH) is the eVTOL stock for you. Headquartered in China, EHang is a pioneer in autonomous aerial vehicles (AAVs). EHang achieved the world’s first full-type, production, and airworthiness certification from China’s aviation authority (CAAC) for its EH216-S autonomous, passenger-carrying eVTOL. This means they are already flying commercially in China and generating initial revenue, giving them a significant lead over their Western counterparts, who are still tied up in the FAA’s process. Your investment thesis is based on an early-mover advantage in the world’s fastest-growing market, the Asia-Pacific region. If you're looking to invest in the only company with demonstrated commercial operations and a significant first-mover advantage in the rapidly growing Asia-Pacific market, EH is a top pick.

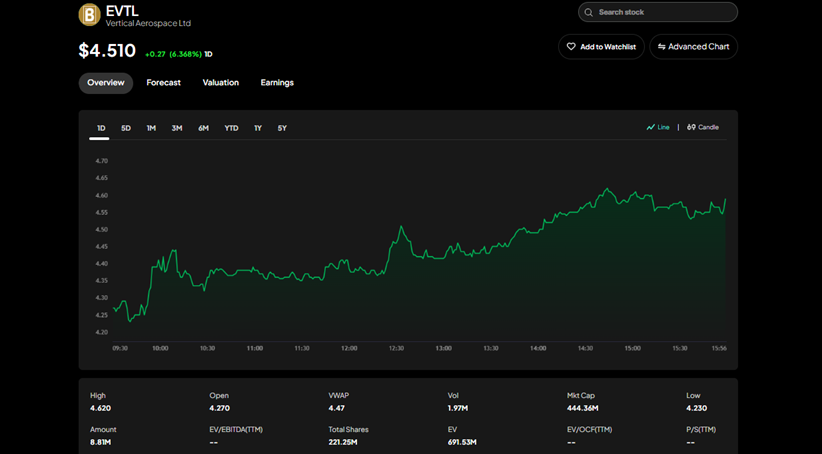

Vertical Aerospace (EVTL)

Vertical Aerospace (NYSE: EVTL) represents a strong UK-based player with deep ties to established aerospace giants. The company, backed by partners like Rolls-Royce for powertrain technology and Honeywell for avionics, is developing the VX4, a piloted, four-passenger, lift-plus-cruise aircraft. Vertical’s strength is its large, albeit non-binding, pre-order book from customers across the globe, including Virgin Atlantic. The company benefits significantly from the expertise of its legacy partners, providing a credible and de-risked path toward certification with the EASA and the FAA. If you plan to invest in a UK-based player whose path to accreditation is bolstered by deep, strategic partnerships with established aerospace giants, EVTL is a fine choice.

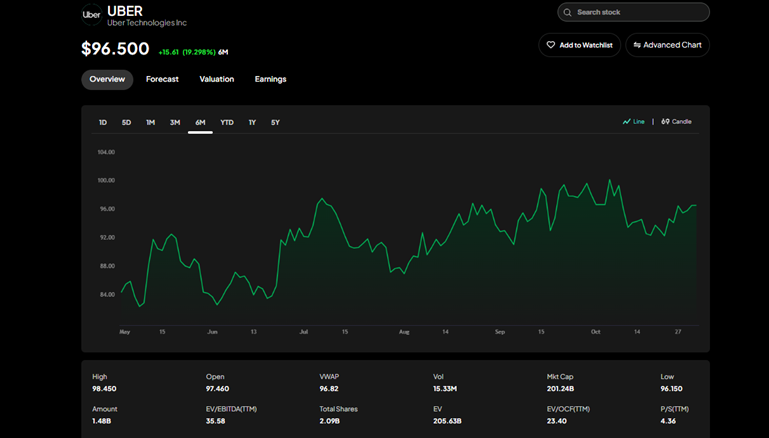

Uber Technologies (UBER)

While Uber Technologies is not an eVTOL manufacturer itself, it’s one of the most important stocks for gaining diversified exposure to the UAM ecosystem. Uber was an early champion of the eVTOL concept with its former UberElevate program. Today, Uber acts as a massive potential partner and eventual service aggregator for many of these eVTOL companies. Your investment in Uber is a bet on the network that will facilitate air travel. As the ultimate ride-sharing platform, Uber is perfectly positioned to eventually integrate eVTOL flights into its app and network, providing the essential infrastructure and consumer interface for a future air taxi service. If you want to gain diversified exposure by investing in the platform and infrastructure that will eventually facilitate all urban air travel, UBER is your go-to choice.

Investment Strategies for eVTOL Stocks

Investing in this volatile, pre-revenue sector requires a disciplined, data-driven approach based on a clear plan and the right AI trading signals.

Learn the basics of your field.

This presents an opportunity for long-term growth based on regulatory milestones. Therefore, the best way to invest is to focus on long-term growth and stability. When the market is highly volatile, utilize Intellectia.ai AI Trading Signals to execute trades during short-term price fluctuations.

Think about ETFs for more exposure.

Use Exchange-Traded Funds (ETFs) that are relevant to your investments to diversify them and reduce the risk of picking just one winner. The Intellectia AI Screener can sort "Future Mobility" ETFs by the stocks they own and how well those stocks have performed in the past.

Risk Management in Emerging Markets

The high sector risk needs to be mitigated through diversification and Dollar-Cost Averaging (DCA), which involves buying small amounts regularly to smooth out volatility. It is also crucial to utilize AI stock and crypto analysis platforms to stay informed about the latest news and market sentiment in real-time.

Conclusion

The electric vertical take-off and landing (eVTOL) industry is not just a dream for the future; it is a growing industry that is almost ready to become a reality. When you invest in the best eVTOL stocks, such as Joby, Archer, and EHang, you are putting your money into the future of green transportation and a potential solution to global traffic problems. The next few years, especially the years leading up to 2026, will be critical. Companies that possess the best technology, the most resources, and the most effective strategic partnerships will ultimately emerge as leaders.

To ensure data, not emotion, drives your decisions, your journey starts now with intelligent tools. Don't just watch the future fly by; take control! Sign up and subscribe to Intellectia.ai today for daily AI stock picks, AI trading signals & strategies, and deep market analysis to confidently navigate the markets and capture the riveting growth this industry promises.