Key Takeaways

- Quantum computing is an emerging technology that could transform industries, making it a hot area for investment.

- You can gain early exposure to this field by investing in lesser-known quantum computing stocks with high growth potential.

- These companies stand out due to their innovation, partnerships, and unique approaches to quantum technology.

- While risks are present, these stocks could offer substantial rewards if you’re willing to take a long-term perspective.

Introduction

Quantum computing has become a big buzzword across today's markets, especially the hype surrounding quantum stocks. With the promise of lucrative future returns, where do you begin searching for these stocks?

After diving into the industry myself, on the search for which quantum stocks could produce the highest future returns, I stumbled upon these 5, somewhat, undiscovered stocks that could be your ticket to riding this wave.

In this article, I’ll break down these hidden opportunities and show you why they’re worth your attention right now.

What is quantum computing?

Quantum computing is not a technology that's currently designed for mainstream use, but it's certainly a game-changer. Unlike traditional computers, which use 0s & 1s to communicate, quantum uses something called Qubits,

These Qubits can exist in multiple states at once thanks to quantum mechanics principles like superposition and entanglement. But, I won't go down that rabbit hole.

What does this mean to you? It’s a system that can tackle problems, such as cracking codes or designing drugs, way faster than any computer on Earth. Imagine solving puzzles that would take billions of years reduced to mere minutes.

That’s the promise of quantum technology, and it’s why quantum computing stocks are catching investors’ eyes, and should be capturing yours too.

List of the best quantum computing stocks

Here’s the lineup of five undiscovered quantum computing stocks you should be paying close attention to:

- IonQ (IONQ)

- Rigetti Computing (RGTI)

- D-Wave Quantum (QBTS)

- Quantum Computing Inc. (QUBT)

- Arqit Quantum (ARQQ)

Why these quantum computing stocks?

How did I pick these quantum computing stocks for you? I looked at what makes a company stand out in this cutting-edge field and so I based these findings on certain criteria listed below:

- Innovation in quantum technology: Are they pushing boundaries with unique solutions?

- Strategic partnerships: Do they have ties with big players or government agencies for credibility and resources?

- Financial stability: Can they weather the early-stage storm with solid cash reserves?

- Undiscovered status: Are they flying under the radar, giving you a chance to get in early?

If a quantum stock company is able to fulfill these criteria, I have added it to this list. There are, of course, numerous other facets that we must take into consideration, but at this early stage in technology's lifecycle, it's hard to pinpoint specifics.

Quantum computing stocks you should buy

Let’s dive into each of these quantum computing stocks so you can see why they’re worth your investment.

IonQ (IONQ)

IonQ is a pure-play quantum computing company using trapped-ion tech to build scalable quantum systems. Since going public in 2021 via a Special Purpose Acquisition Company SPAC, it’s been turning heads with its technological advancements.

Key features:

- Trapped-ion qubits for high accuracy and stability, leading to more reliability combined with enterprise-grade security.

- Cloud access through platforms like Amazon Braket and Microsoft Azure, creating a globally accessible quantum computer for businesses.

- A $54.5 million U.S. Air Force contract boosted its credibility and provided investors with a level of confidence in the company's future development.

| Pros | Cons |

|

|

What makes IonQ special? It’s not just experimenting, it’s making quantum computing usable now. If you want a front-runner in this space, IonQ’s a solid bet.

Rigetti Computing (RGTI)

Rigetti Computing, a company that is at the forefront of developing quantum processors and offering cloud services.

The comapny's solution dives into the practicallities of quantum and integrating it into everyday consumer lives, although it still has a long way to go, but in general Regetti is blending quantum and classical computing for real-world solutions.

A highly overlooked quantum stock, that found some popularity, briefly becoming a meme stock, during Trump's presidential election, but soon falling after Nvidia's CEO implied quantum technology was 30 years away.

Key features:

- Hybrid quantum-classical systems for practical applications.

- Quantum Cloud Services for remote algorithm testing.

- Partnerships with Amazon and Microsoft.

| Pros | Cons |

|---|---|

|

|

Rigetti’s hybrid approach sets it apart, it’s bridging today’s tech with tomorrow’s quantum leaps. For you, it’s a chance to invest in accessibility and innovation.

D-Wave Quantum (QBTS)

D-Wave provides customers with access to its quantum computing systems via the cloud, offering quantum computing as a service and making its technology accessible today.

Additionally, the company offers professional services to assist customers in identifying and implementing quantum computing applications into their businesses.

Recently, D-Wave announced its new Leap Quantum LaunchPad program, designed to accelerate the adoption of quantum computing applications.

Key features:

- Quantum technology is being implemented to solve real-world challenges.

- Massive scale with commercial-ready systems and a current user base of 135 businesses.

- As of 2025, QBTS stock has a market cap valued at $2.14 billion.

| Pros | Cons |

|---|---|

|

|

D-Wave’s niche focus makes it unique. If you’re eyeing industries needing optimization, this stock could deliver potentially highly profitable future returns.

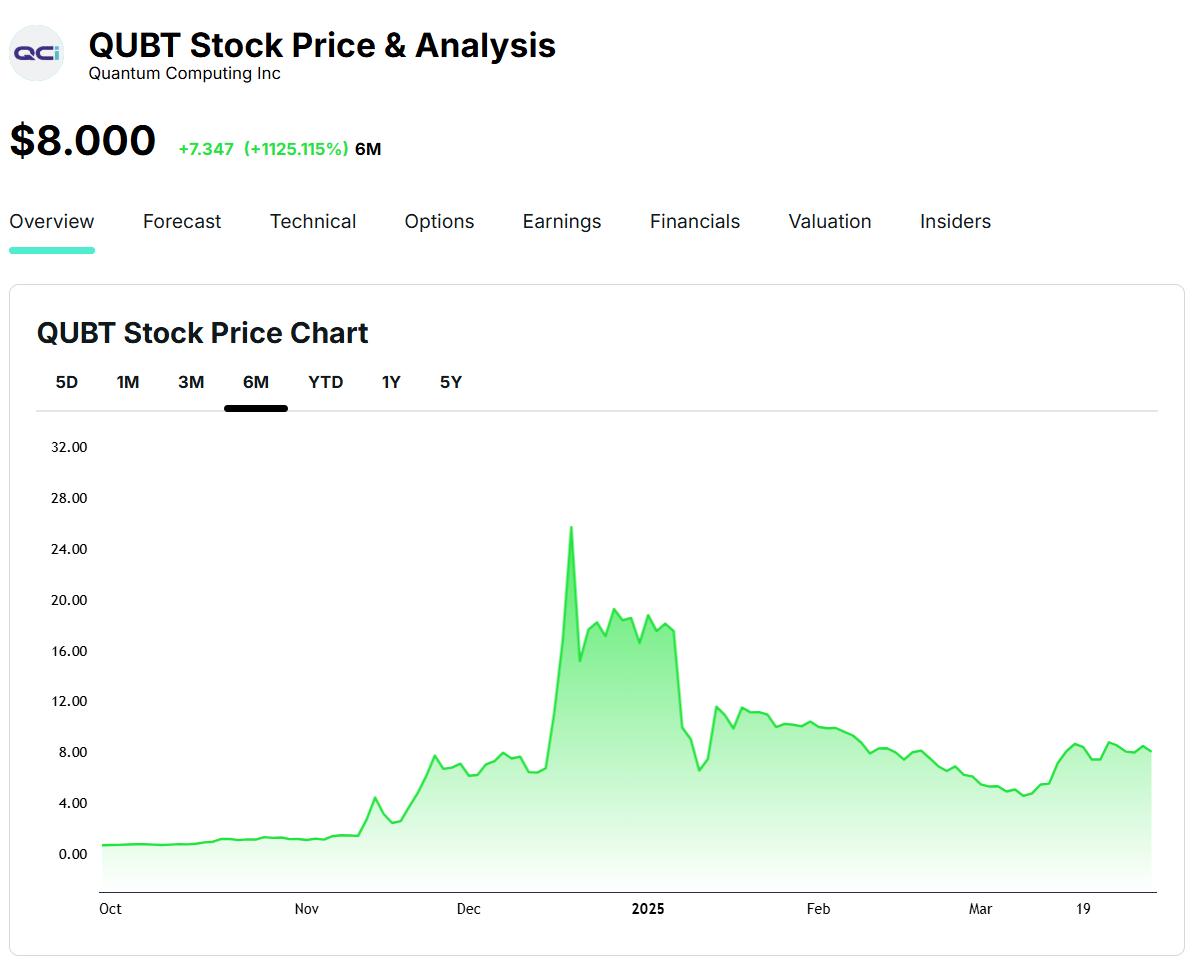

Quantum Computing Inc. (QUBT)

Quantum Computing Inc. aims to make quantum tech affordable and portable with products like the Dirac system, plus extras like quantum authentication for future encryption security.

The company specializes in the production and deployment of quantum machines, designed to operate at room temperature at affordable prices, something very unique, as it makes quantum machines more practical.

Key features:

- Portable quantum machines that work at room temperature and are designed using existing technology.

- Diverse offerings, from computing to security.

- Recent demos show 12% faster performance than classical systems.

| Pros | Cons |

|---|---|

|

|

QCi’s push for affordability is its edge. If you’re betting on quantum going mainstream, then adding QUBT stock to your portfolio could generate substantial future returns.

Arqit Quantum (ARQQ)

Arqit is a cybersecurity company harnessing quantum technology to deliver quantum-safe encryption solutions.

Its goal? To shield data from future threats, including those posed by quantum computers capable of cracking traditional encryption.

While it’s not a pure-play quantum computing company, ARQQ is an industry leader in ensuring that the future of online security is secure.

Key features:

- ARQQ’s flagship products use symmetric key agreement to provide quantum-safe encryption, protecting communications from quantum threats.

- Collaborations with big names like Intel (via the Intel Partner Alliance) and Sparkle (for quantum-safe Network-as-a-Service) boost its credibility and market reach.

- Named a 2024 IDC Innovator for post-quantum cryptography, ARQQ is carving a niche in next-gen encryption.

| Pros | Cons |

|---|---|

|

|

I’d peg ARQQ as a Speculative Buy. It’s a compelling play if you’re sold on the quantum encryption story and can handle the risks. The potential rewards are substantial, but so are the pitfalls.

Keep your stake modest, and track key catalysts like revenue growth, new contracts, and financial stability.

Conclusion

The future is pointing toward quantum technology, and above are my 5 top quantum stocks to consider at this point in time. As market adoption becomes more mainstream for quantum technology, these stocks should see strong future returns.

Each brings something unique, from groundbreaking tech to stable foundations. Sure, the risks are real, early-stage tech always is, but the rewards could be massive if you’re patient.

Do your homework, weigh your risk tolerance, and consider adding these to your portfolio. The future’s quantum, and you could be part of it.