Key Takeaways

- Rivian's future success is heavily dependent on the successful, on-time launch and scaling of its more affordable R2 vehicle, slated for the first half of 2026.

- The company faces significant short-term challenges, including high cash burn, lack of profitability, and the expiration of federal EV tax credits, which can dampen demand.

- A major partnership with Volkswagen validates Rivian's advanced software and electrical architecture, opening up a potential high-margin revenue stream through technology licensing.

- Despite recent layoffs and production hurdles, Rivian has a strong brand identity in the "adventure vehicle" niche and a significant cash reserve to fund operations in the near term.

Have you noticed Rivian Automotive, Inc.’s (RIVN) dramatic post-IPO drop and wondered whether this is a generational opportunity—or a warning sign? The EV market is more crowded than ever, and Rivian’s future hinges on execution.

With intensifying competition and fading government incentives, assessing Rivian requires a clear look not just at headlines—and stock swings—but at strategic execution and timing. This analysis will break down Rivian's current financial health, its competitive standing in the crowded EV space, and its future growth catalysts to provide you with a clearer picture. By the end, you'll have the comprehensive data needed to decide if Rivian stock is a good buy for your personal portfolio and risk tolerance.

What Is Rivian Automotive (RIVN)?

Rivian Automotive, founded in 2009 by CEO R.J. Scaringe, targets the niche of premium electric "adventure vehicles," with the R1T pickup and R1S SUV. It also serves commercial customers with its Electric Delivery Vans (EDVs)—notably with Amazon.com, Inc. as a major client. Distinctively, Rivian’s vehicles use a proprietary “skateboard” platform that integrates battery, drive units, cooling and suspension into one flexible architecture—giving the company operational leverage for future body styles and cost efficiency.

Rivian’s Market Position and Competitive Edge

Even as Tesla, Inc. dominates broader EV markets, Rivian has carved a differentiated niche in adventure-utility and off-road EVs. Its appeal lies in three pillars: a lifestyle-driven brand, vertical integration, and premium pricing power.

The company’s unique selling points are what truly differentiate it from a sea of competitors:

- Focus on Adventure: Unlike the vast majority of EV makers focusing on sedans, crossovers, or hypercars, Rivian's brand is authentically built around adventure, utility, and the outdoors. This has attracted a dedicated and loyal customer base with active lifestyles who see their vehicle as an enabler of their passions.

- Vertical Integration: Rivian maintains tight control over its core technology by designing and manufacturing key components in-house, including its battery packs, electric motors, and vehicle software. This control allows for rapid innovation and optimization but also presents significant capital expenditure challenges.

- Strong Brand Perception: The company has successfully cultivated a premium, eco-conscious image that resonates deeply with its target demographic. The brand is often compared to outdoor lifestyle giants like Patagonia, but for the automotive world, which allows it to command premium pricing.

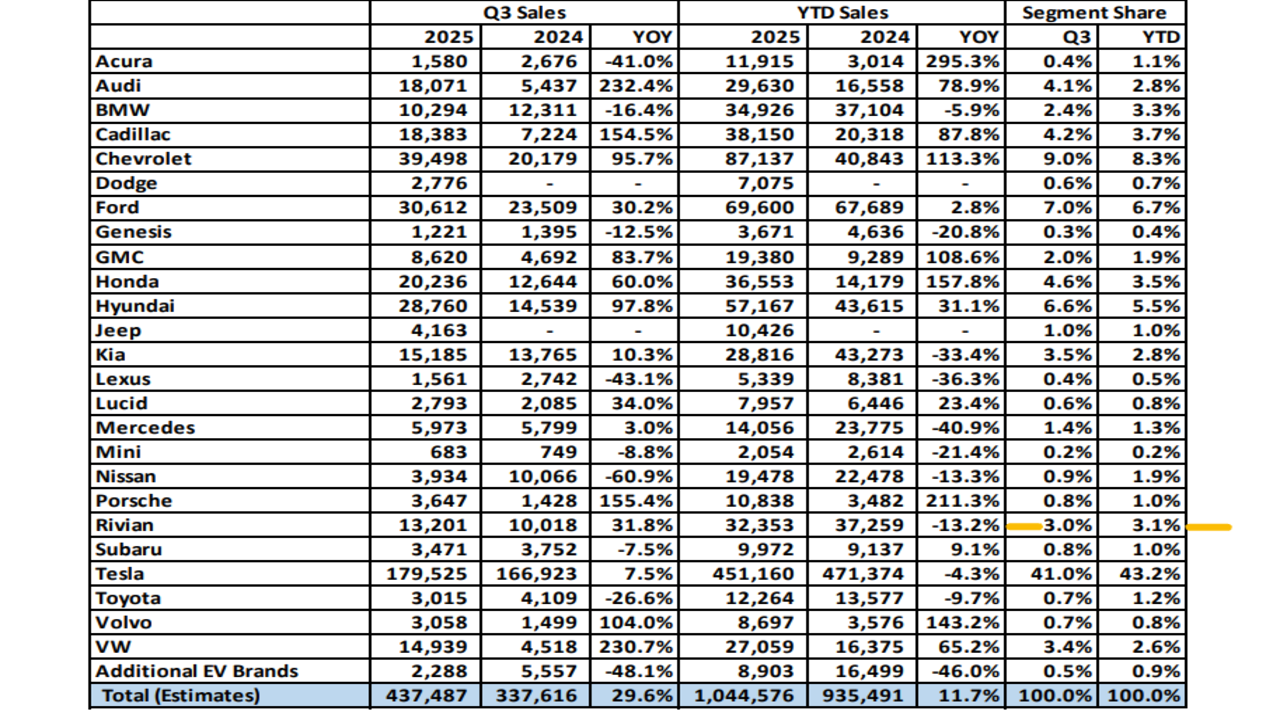

To assess RIVN stock market cap upside potentials based on EV sales units, here's a brief look at how Rivian stacks up against some key competitors as of late 2025:

| Ticker | RIVN | TSLA | F | LCID | VWAGY |

|---|---|---|---|---|---|

| Company Name | Rivian Automotive, Inc. | Tesla, Inc. | Ford Motor Company | Lucid Group, Inc. | Volkswagen AG |

| Market Cap in $ | 15.68B | 1.46T | 49.47B | 5.68B | 52.32B |

| Q3 2025 Sales in Units | 13,201 | 179,525 | 30,612 | 2,793 | 14,939 |

| YTD 2025 Sales in Units | 32,353 | 451,160 | 69,600 | 7,957 | 27,059 |

Does Rivian Have a Future?

The critical question of whether Rivian has a long-term future is the central debate surrounding its investment thesis. The company is at a pivotal inflection point, with its ultimate survival and success hinging on the execution of a few key strategic initiatives over the next 24 months.

The most important catalyst by far is the R2 vehicle platform. With a projected starting price of around $45,000, the R2 is Rivian's answer to the mass market. It is designed to be a high-volume seller that can compete directly in the largest and most profitable segment of the global SUV market. CEO RJ Scaringe has explicitly stated that the R2 is the "most important program we've had" and is the primary vehicle—both literally and figuratively—for the company to achieve positive free cash flow.

A successful, on-time launch and a smooth ramp-up of R2 production in 2026 is an absolute necessity for Rivian's long-term sustainability. Another foundational pillar of Rivian's future is its rapidly growing technology licensing potential. The landmark joint venture formed with Volkswagen, which includes an investment of up to $5 billion, is a massive vote of confidence in Rivian's superior software and next-generation electrical architecture.

This partnership not only provides a crucial injection of non-dilutive capital but also creates a valuable blueprint for licensing its technology stack to other legacy automakers. This opens up a potential high-margin business that diversifies its revenue streams away from the capital-intensive process of selling vehicles.

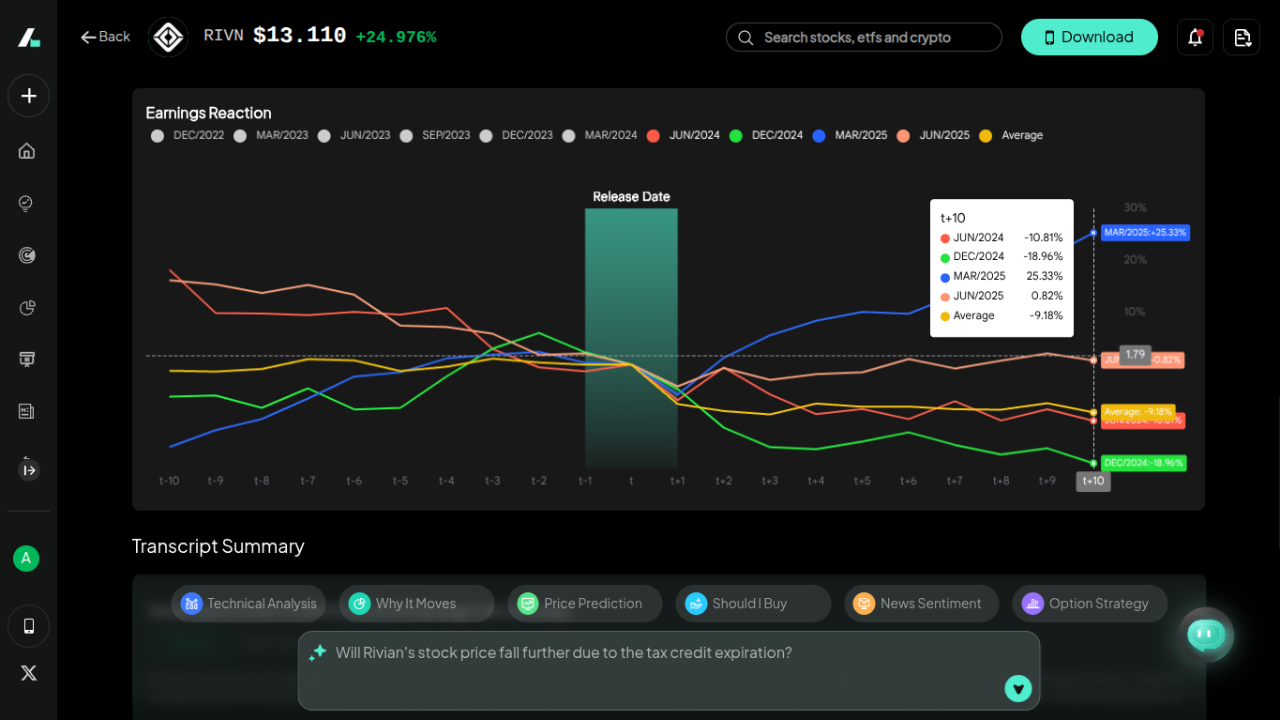

While the road ahead is undeniably challenging, especially with the loss of federal tax credits that can soften demand and a continued high rate of cash burn, Rivian's strategy is now sharply focused. It aims to transition from a niche, high-end producer to a mass-market player underpinned by a valuable technology backbone. Considering RIVN stock earnings reaction, if it can successfully execute this complex transition, its future appears bright and full of potential.

Is Rivian Stock a Good Buy?

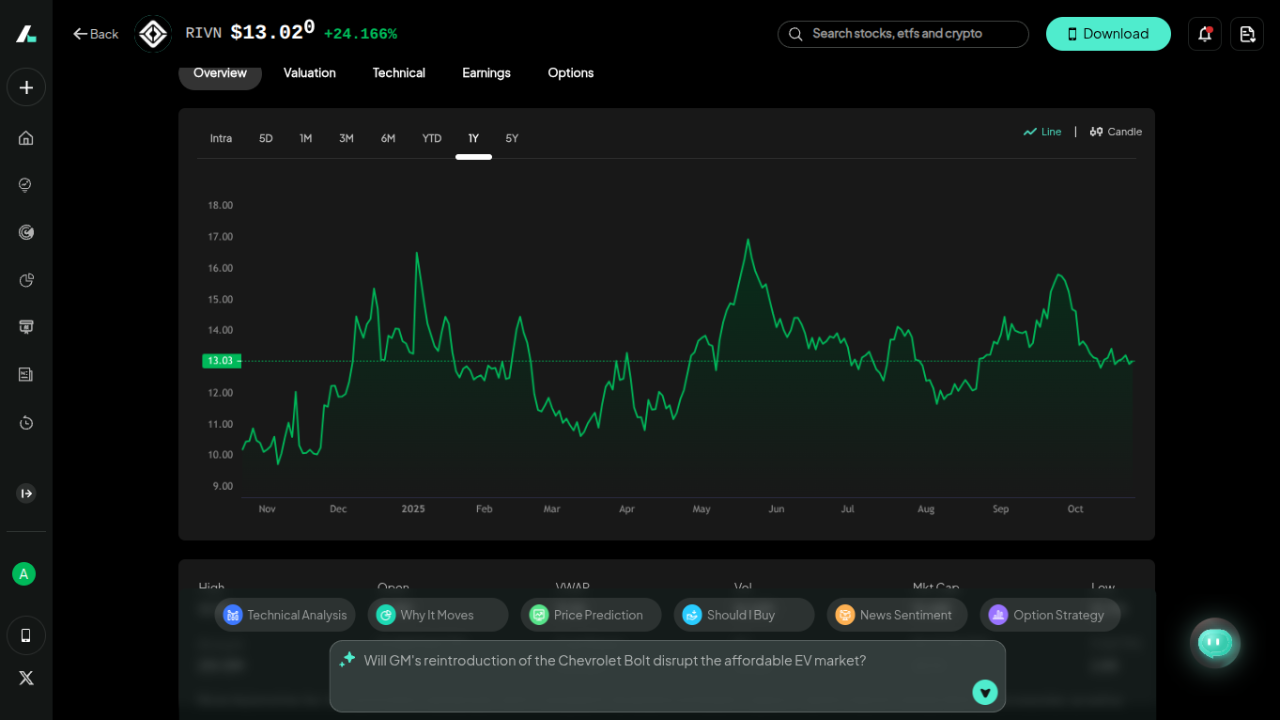

After its monumental IPO in late 2021, which saw its valuation soar past that of established automakers, Rivian's stock has experienced a prolonged and painful period of volatility. As of October 23, 2025, the stock trades at approximately $13.06 per share, a fraction of its all-time high but showing signs of stabilization.

Since its record-breaking IPO in 2021, Rivian has endured a painful comedown. As of October 2025, RIVN trades around $13, far below its highs but stabilizing as investors reassess its future.

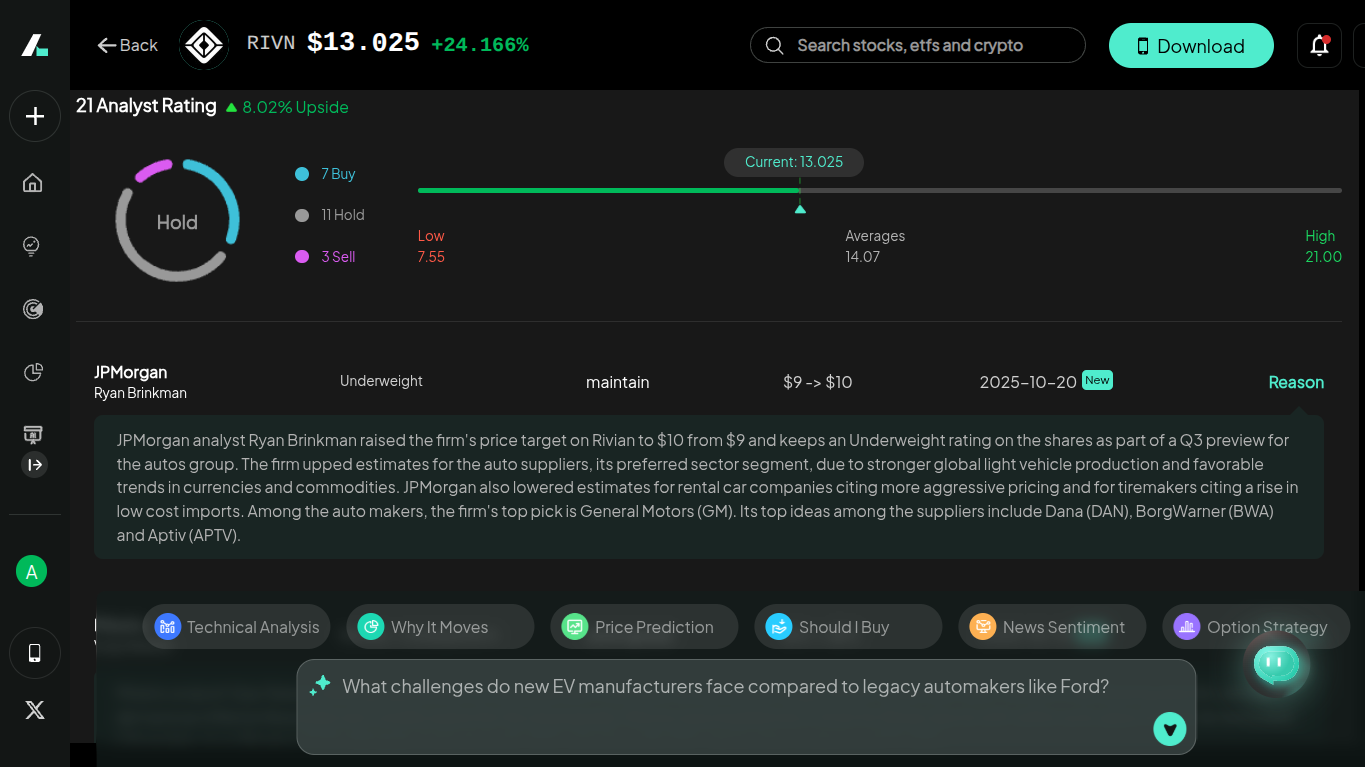

Wall Street remains cautious. Of 21 analysts, most rate it a “Hold,” with an average 12-month target near $14, reflecting a classic “wait-and-see” stance. While they recognize the transformative potential of the R2 platform, concerns about cash flow, cost control, and the loss of EV credits keep sentiment restrained.

For investors with a high risk tolerance and a long horizon, Rivian offers asymmetric potential—especially if R2 momentum and Volkswagen’s backing translate into measurable progress through 2026.

Should I Invest in Rivian?

Deciding whether to allocate capital to Rivian requires a careful balancing act, weighing its considerable long-term potential against its substantial and immediate risks.

Pros of Investing in Rivian:

- Massive Growth Potential: The R2 launch is designed to be a transformational event. If successful, it can turn Rivian into a high-volume manufacturer, leading to a dramatic increase in revenue and a clearer path to profitability.

- Validated Best-in-Class Technology: The Volkswagen partnership, valued at up to $5 billion, is a powerful external validation of its software and zonal architecture, creating a clear path for further lucrative licensing deals.

- Powerful and Differentiated Brand: In a crowded EV market, Rivian has successfully built a strong, aspirational brand that commands loyalty and premium pricing, often referred to as the "Patagonia of trucks."

- Solid Balance Sheet for Near-Term Goals: Thanks to its IPO and the VW investment, the company has a substantial cash position that is expected to be sufficient to fund its operations and the initial launch of the R2 platform.

Cons of Investing in Rivian:

- Extremely High Cash Burn: Rivian is not yet profitable and is burning through billions of dollars per year to fund R&D, scale production, and build out its service network. Its Q2 2025 adjusted EBITDA loss was a staggering $667 million.

- Significant Execution Risk: The company's entire future effectively rests on its ability to launch the R2 vehicle on time and within budget. Any major delays or quality issues can be catastrophic.

- Macroeconomic and Policy Headwinds: The end of the $7,500 federal EV tax credit and an increasingly competitive market can put significant pressure on sales volumes and pricing power.

Tips: Use Intellectia.ai’s AI Screener to benchmark Rivian’s fundamentals against peers, or tap into AI Swing Trading Signals to pinpoint optimal entries and exits during volatility. Instead of reacting to headlines, you’ll act on data-driven insights.

Conclusion

Rivian stands at a crossroads—balancing enormous potential against equally large risks. Its success depends on execution, discipline, and timing. Investing in Rivian today is a speculative bet on the company's long-term vision and its ability to execute flawlessly. The risks are high, but for investors who believe in the management team and the promise of the R2, the potential rewards can be substantial.

Join Intellectia.ai to access daily AI stock picks, predictive trading signals, and exclusive market intelligence designed to help you make smarter investment decisions.