Key Takeaways

- Russell 2000 ETFs offer broad access to small-cap U.S. stocks, reducing individual stock risk.

- IWM, VTWO, IWO, VTWV, TNA, and VTWG are among the best Russell 2000 ETFs, each with unique features.

- Expense ratio, assets under management (AUM), and dividend yield are critical when choosing an ETF.

- These ETFs suit various strategies, from long-term growth to short-term trading.

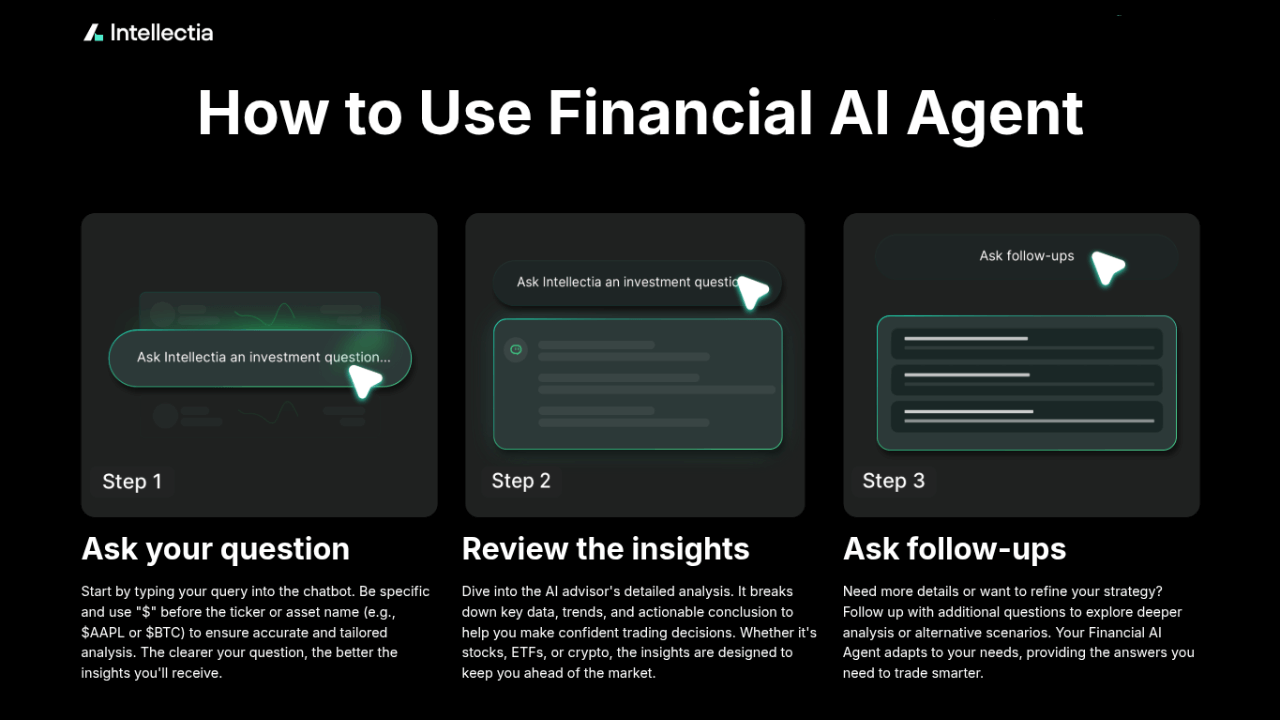

- Platforms like Intellectia.ai can help you select and time your ETF investments effectively.

Introduction

Have you ever wondered how to invest in small-cap stocks without the hassle of picking individual companies? Small-cap stocks can offer significant growth potential, but they also come with higher risk. Russell 2000 ETFs solve this problem by providing diversified exposure to approximately 2,000 small-cap U.S. companies.

Intellectia AI provides AI-powered tools to help you select the best Russell 2000 ETF for your investment strategy, whether you’re a beginner or a seasoned trader. Let’s explore why these ETFs are a smart choice and which ones stand out in 2025.

What is the Russell 2000 ETF

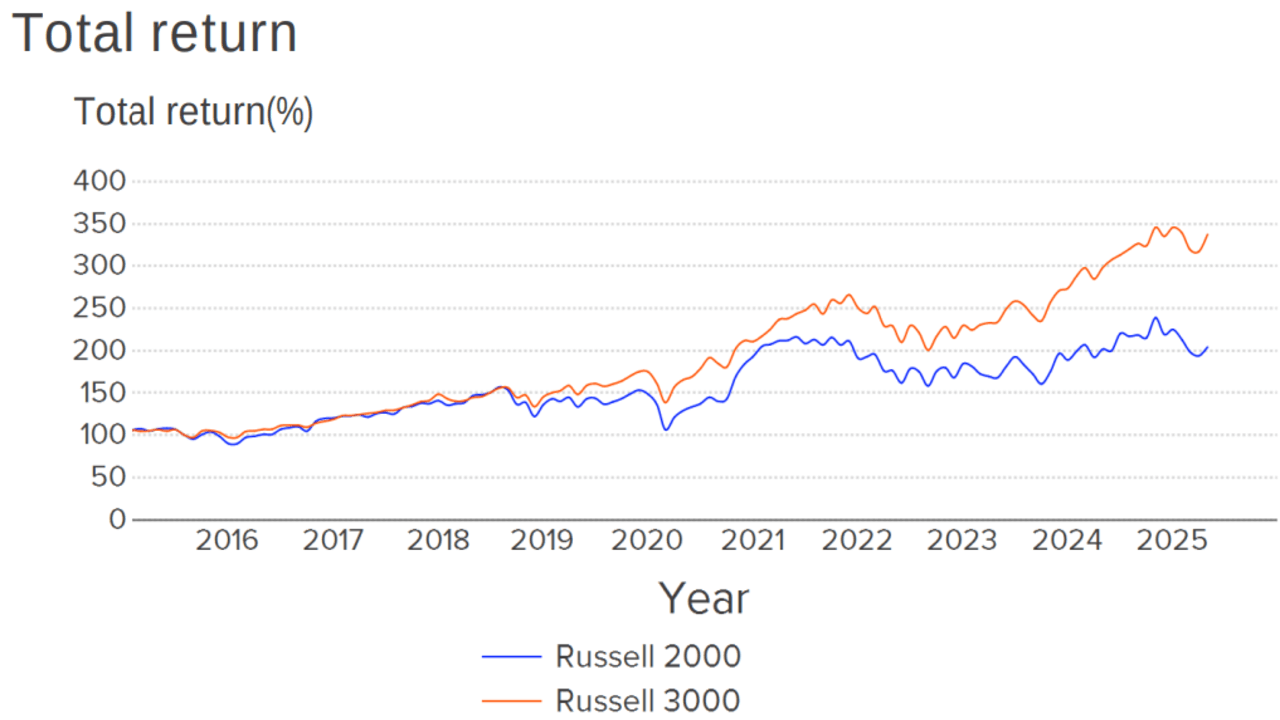

The Russell 2000 Index, administered by FTSE Russell, tracks the performance of about 2,000 small-cap companies in the U.S., representing the smallest firms in the broader Russell 3000 Index. These companies typically have market capitalizations ranging from $300 million to $2 billion. Unlike the S&P 500, which focuses on large-cap stocks, the Russell 2000 targets smaller firms with higher growth potential but greater volatility.

The index is weighted by free float market capitalization, meaning companies with larger market caps have a greater influence on its performance. Small-cap stocks are crucial for portfolio diversification and are often more sensitive to economic changes, potentially outperforming large-cap stocks during economic recoveries.

Russell 2000 ETFs aim to replicate the performance of this index, offering investors an easy way to gain exposure to this dynamic market segment.

Source: lseg.com

Why Invest in Russell 2000 ETFs

Investing in Russell 2000 ETFs offers several advantages:

- Diversification: By holding around 2,000 stocks, these ETFs reduce the risk associated with individual company performance.

- Liquidity: Traded on major exchanges, Russell 2000 ETFs allow you to buy and sell shares easily throughout the trading day.

- Lower Risk: Compared to picking individual small-cap stocks, ETFs spread risk across a broad portfolio.

- Growth Potential: Small-cap stocks have historically delivered higher long-term returns, especially in favorable economic conditions.

- Cost-Effectiveness: ETFs typically have lower expense ratios than actively managed mutual funds.

However, small-cap stocks can be more volatile than large-cap stocks, so you should assess your risk tolerance before investing. Russell 2000 ETFs are ideal for those seeking growth while maintaining diversification.

Criteria for Selecting Best Russell 2000 ETF

Choosing the best Russell 2000 ETF requires evaluating several factors:

- Tracking Accuracy: Ensure the ETF closely follows the Russell 2000 Index’s performance, minimizing tracking error.

- Expense Ratio: Lower fees reduce the impact on your returns over time.

- Fund Size and Liquidity: Larger AUM and higher trading volumes indicate better liquidity and narrower bid-ask spreads.

- Holdings and Sector Exposure: Verify that the ETF’s holdings align with the index’s composition for true exposure.

- Performance History: While past performance isn’t a guarantee of future results, it can indicate the ETF’s reliability.

- Dividend Yield: If you’re seeking income, consider ETFs with higher dividend yields.

- Issuer Reputation: Choose ETFs from reputable providers like iShares, Vanguard, or Direxion for reliability.

By weighing these criteria, you can select an ETF that aligns with your investment goals. Tools like Intellectia.ai’s AI Screener can assist in analyzing these factors.

6 Best Russell 2000 ETFs

Here’s a comparative overview of six top Russell 2000 ETFs, based on expense ratio, AUM, and dividend yield as of June 2025:

| ETF Name | Ticker | Expense Ratio | AUM | Dividend Yield |

|---|---|---|---|---|

| iShares Russell 2000 ETF | IWM | 0.19% | $62.3B | 1.20% |

| Vanguard Russell 2000 ETF | VTWO | 0.07% | $12.39B | 1.37% |

| iShares Russell 2000 Growth ETF | IWO | 0.24% | $11.18B | 0.87% |

| Vanguard Russell 2000 Value ETF | VTWV | 0.10% | $755.3M | 2.03% |

| Direxion Daily Small Cap Bull 3X Shares | TNA | 1.03% | $1.83B | 1.60% |

| Vanguard Russell 2000 Growth ETF | VTWG | 0.10% | $1.11B | 0.55% |

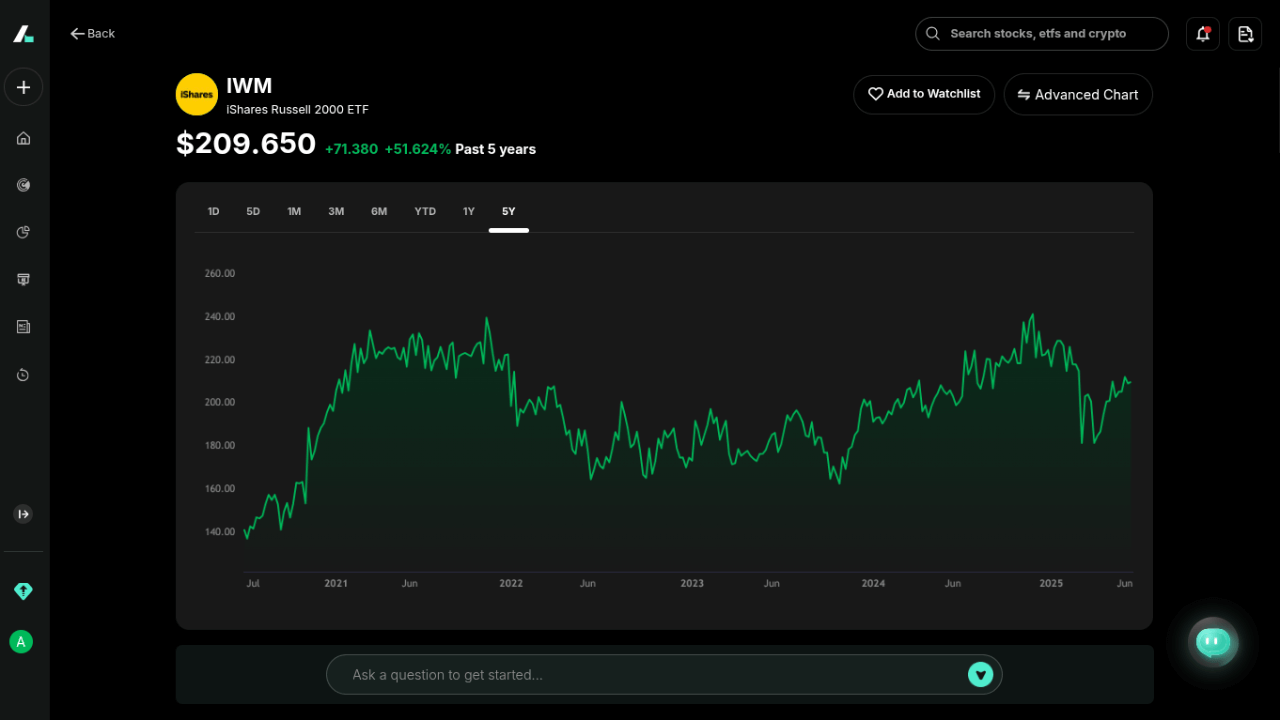

iShares Russell 2000 ETF (IWM)

The iShares Russell 2000 ETF (IWM) is a cornerstone for investors seeking small-cap exposure, with an impressive AUM of $62.3 billion and a competitive expense ratio of 0.19%.

Holding 1,933 stocks, IWM spans diverse sectors like finance (23%), healthcare (17%), and technology (15%), ensuring comprehensive coverage of the Russell 2000 Index. Its high liquidity, with an average daily trading volume of over 32 million shares, makes it ideal for both long-term investors and active traders. The ETF’s dividend yield of 1.20% provides a modest income stream, appealing to those balancing growth and income.

IWM’s established track record, backed by BlackRock’s reputation, and its ability to closely track the index make it a top choice.

Source: intellectia.ai

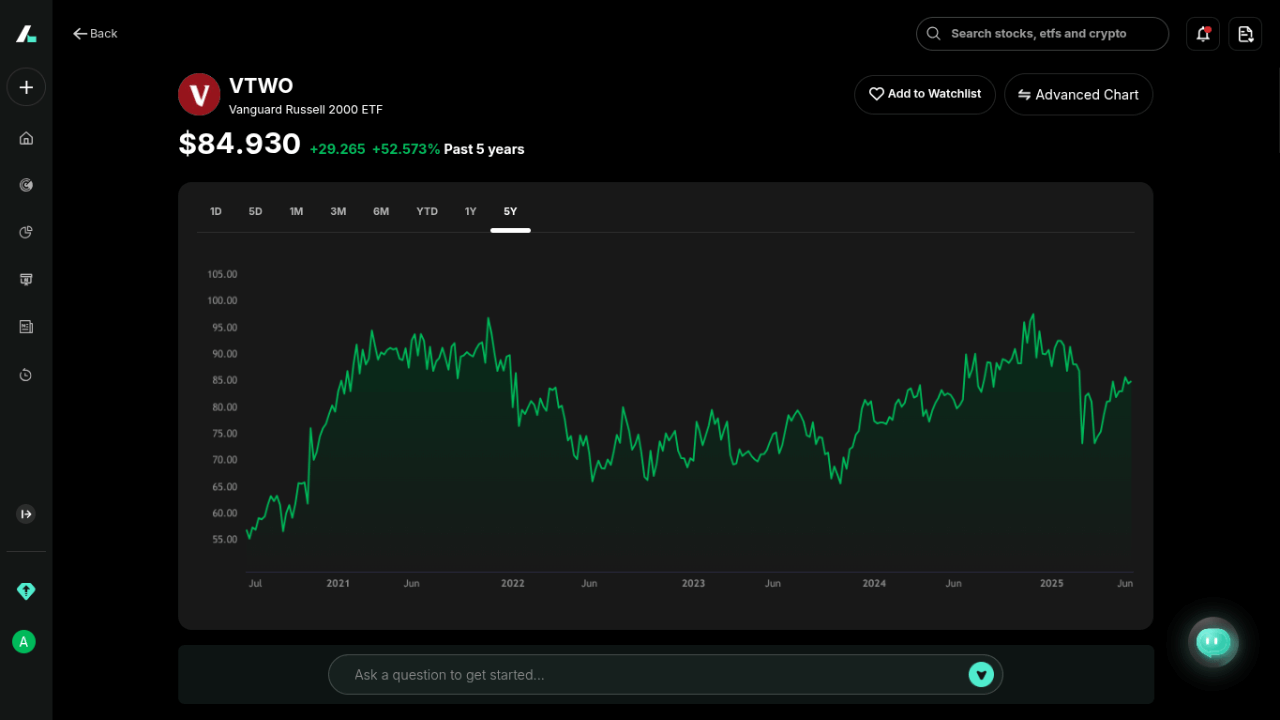

Vanguard Russell 2000 ETF (VTWO)

The Vanguard Russell 2000 ETF (VTWO) is a standout for cost-conscious investors, featuring an ultra-low expense ratio of 0.07%, among the lowest in its category.

With an AUM of $12.39 billion and 1,946 holdings, VTWO mirrors the Russell 2000 Index closely, covering sectors like industrials (18%) and financials (22%). Its dividend yield of 1.37% surpasses IWM’s, making it attractive for income-focused investors.

VTWO’s average daily trading volume of 1.8 million shares ensures strong liquidity, facilitating easy entry and exit. Vanguard’s reputation for low-cost, reliable funds enhances VTWO’s appeal.

Source: intellectia.ai

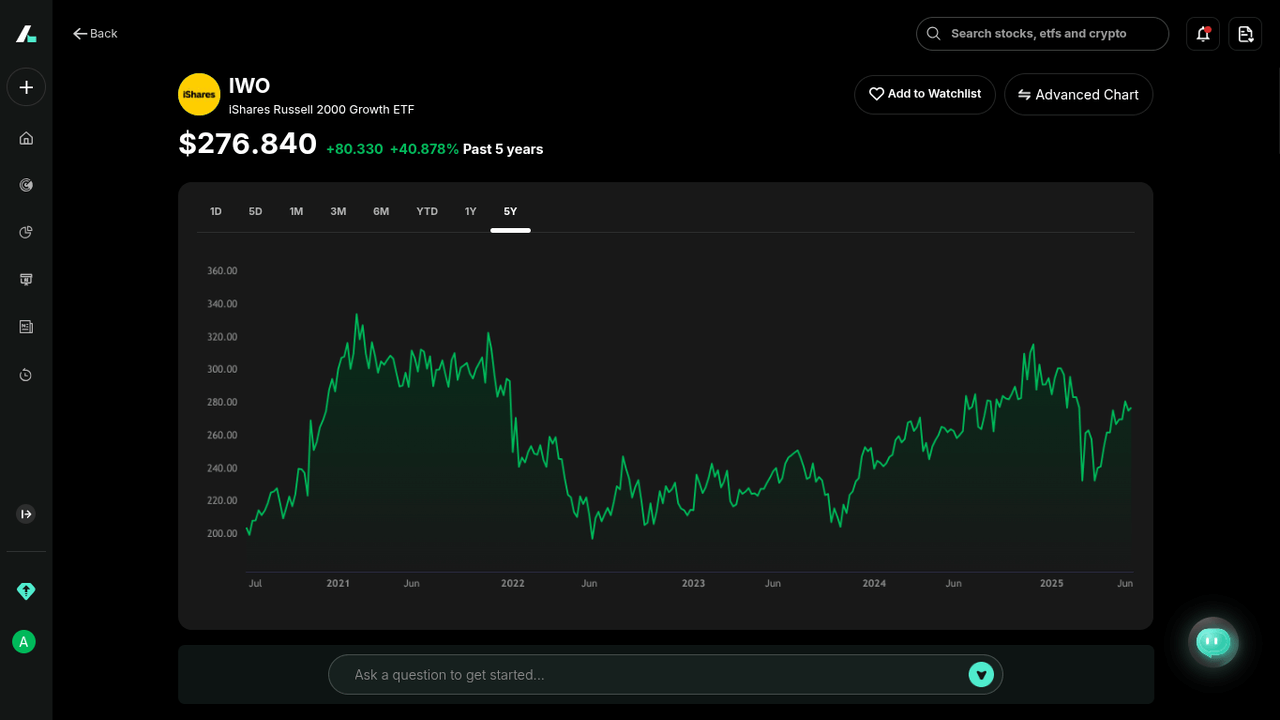

iShares Russell 2000 Growth ETF (IWO)

The iShares Russell 2000 Growth ETF (IWO) targets the growth segment of the Russell 2000, focusing on companies with strong earnings growth potential. With an expense ratio of 0.24% and AUM of $11.18 billion, IWO holds 1,111 stocks, heavily weighted toward healthcare (25%) and technology (20%).

Its dividend yield of 0.87% is lower, reflecting its growth orientation, but its potential for capital appreciation attracts growth investors. IWO’s average daily volume of 500,000 shares ensures adequate liquidity. Despite higher volatility, IWO’s focus on innovative small-caps makes it compelling.

Source: intellectia.ai

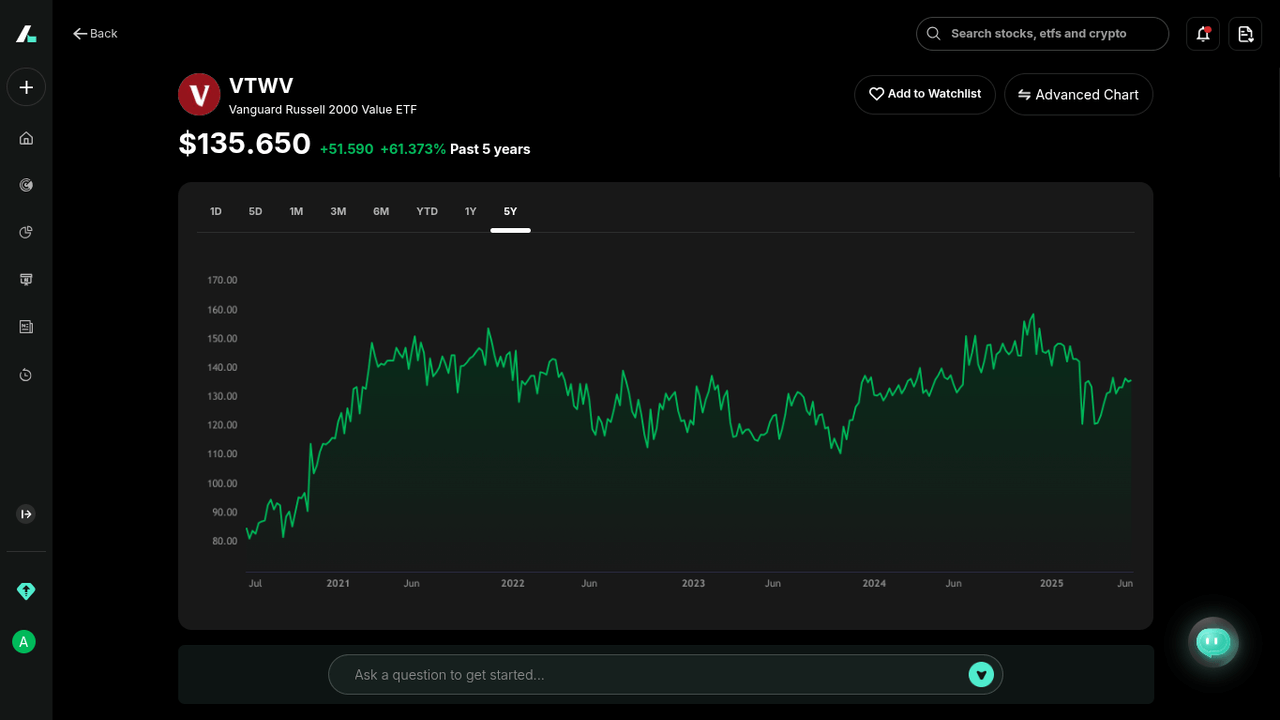

Vanguard Russell 2000 Value ETF (VTWV)

The Vanguard Russell 2000 Value ETF (VTWV) emphasizes value stocks within the Russell 2000, offering a low expense ratio of 0.10% and AUM of $755.3 million. With 1,421 holdings, VTWV focuses on sectors like finance (30%) and utilities (10%), which are typically more stable.

Its dividend yield of 2.03%, the highest among these ETFs, appeals to income-seeking investors. VTWV’s average daily trading volume of 50,000 shares provides sufficient liquidity for most investors. Its value-oriented approach offers stability within the volatile small-cap space.

Source: intellectia.ai

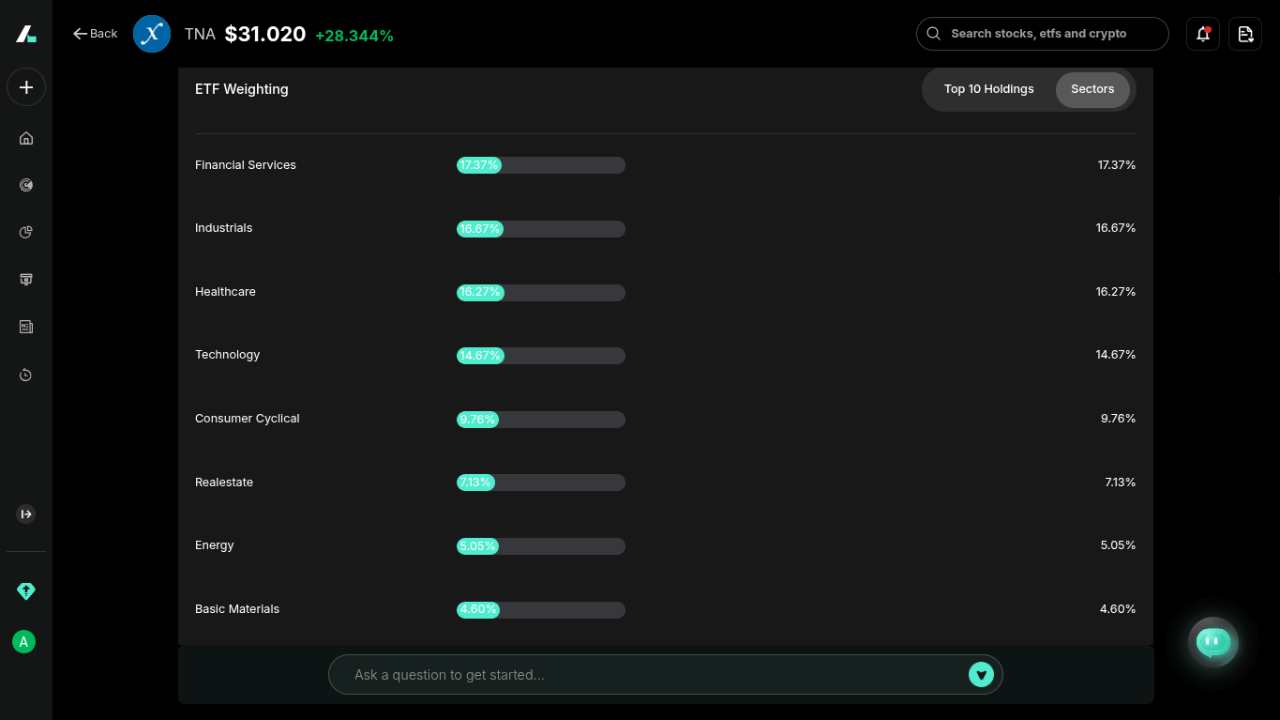

Direxion Daily Small Cap Bull 3X Shares (TNA)

The Direxion Daily Small Cap Bull 3X Shares (TNA) is a leveraged ETF designed to deliver 300% of the Russell 2000 Index’s daily performance, with an expense ratio of 1.03% and AUM of $1.83 billion. Holding derivatives to achieve its leverage.

TNA is suited for short-term trading or hedging, not long-term investment due to daily rebalancing and high volatility. Its dividend yield of 1.60% is notable, but its risk profile demands caution. With an average daily volume of 15 million shares, TNA offers excellent liquidity for active traders.

Only experienced investors with high risk tolerance should consider TNA.

Source: intellectia.ai

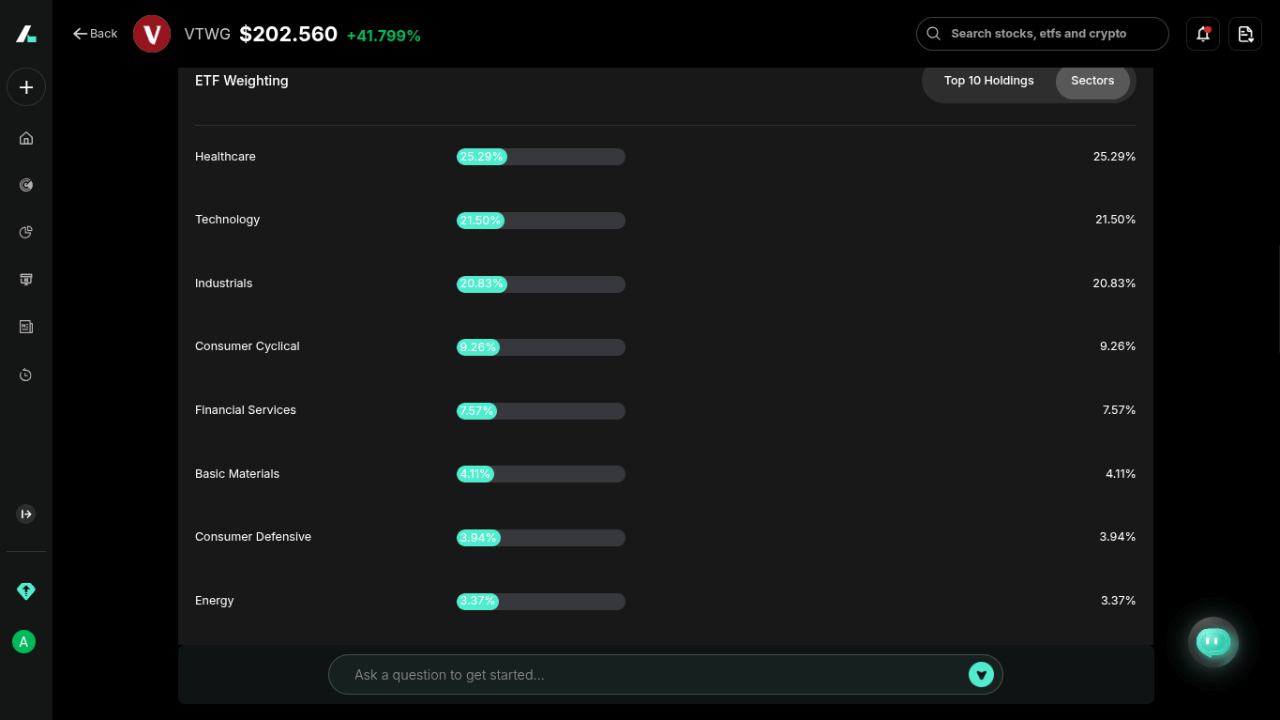

Vanguard Russell 2000 Growth ETF (VTWG)

The Vanguard Russell 2000 Growth ETF (VTWG) is a cost-effective growth-focused ETF with an expense ratio of 0.10% and AUM of $1.11 billion. Holding 1,123 stocks, VTWG targets small-cap companies with high growth potential, primarily in healthcare (23%) and technology (22%).

Its dividend yield of 0.55% is the lowest, prioritizing capital gains over income. VTWG’s average daily volume of 30,000 shares ensures reasonable liquidity. As a low-cost alternative to IWO, VTWG suits investors seeking growth at a lower cost.

Source: intellectia.ai

Investment Strategies for Best Russell 2000 ETF

You can use Russell 2000 ETFs in various ways to achieve your financial goals:

- Long-Term Growth Strategy: Invest in IWM or VTWO for broad small-cap exposure, holding for years to capitalize on potential growth. Small-cap stocks have historically outperformed large-caps over long periods, especially during economic expansions.

- Dollar-Cost Averaging: Regularly invest a fixed amount in your chosen ETF to mitigate the impact of market volatility. This strategy works well with VTWO or VTWV due to their low expense ratios.

- Leveraged Short-Term Trading: Use TNA for short-term trades to take advantage of daily market movements, but exercise caution due to its high risk. Monitor market trends closely using tools like Intellectia.ai’s Day Trading Center.

- Value and Income Focus: Choose VTWV for its higher dividend yield and value-oriented holdings, ideal for income-focused portfolios.

- Growth-Oriented Investing: Opt for IWO or VTWG if you believe small-cap growth stocks will outperform, leveraging their exposure to fast-growing sectors.

Intellectia.ai’s AI trading analysis can help you identify optimal entry and exit points for these ETFs, enhancing your investment decisions. The platform analyzes market trends, technical indicators, and sentiment to provide actionable insights.

Source: intellectia.ai

Conclusion

Russell 2000 ETFs offer a compelling way to gain exposure to small-cap U.S. stocks, balancing growth potential with diversification. Whether you prefer broad exposure (IWM, VTWO), growth (IWO, VTWG), value (VTWV), or leveraged trading (TNA), there’s an ETF to suit your needs.

By evaluating expense ratios, AUM, and your investment goals, you can make an informed choice. To stay ahead of market trends, sign up for Intellectia.ai to access daily AI stock picks, trading signals, and personalized market analysis. Start building your small-cap portfolio today.