Key Takeaways

- Graphene is often called the “wonder material” of the future, as it’s the strongest, lightest, and most conductive material known to science, with a market CAGR projected to exceed 30% through 2033.

- The market is highly volatile, transitioning from R&D to commercial application, primarily in EV batteries, advanced semiconductors, and high-performance composites.

- Pure-play graphene stocks like NanoXplore and Zentek offer direct exposure to the material’s steep adoption curve, which is key for investors seeking disruptive growth.

- Diversification is crucial; you can also get exposure through equipment providers like CVD Equipment or specialized application companies, which helps mitigate early-stage risk.

- You can leverage Intellectia.ai’s AI Stock Picker and AI Screener to analyze these complex, early-stage stocks, giving you data-driven signals on when to enter or exit a position.

Introduction

Graphene is often called the “wonder material” of the 21st century — a substance so strong, light, and conductive that it could transform everything from smartphones to EV batteries. Much like silicon reshaped the digital age, graphene may define the next technological era.

Yet investing in this breakthrough isn’t simple. Most graphene companies are small and volatile. In this article, we’ll uncover the most promising graphene stocks for 2026, explain the technology behind them, and show how Intellectia.ai’s data-driven insights can help you identify real winners.

What Are Graphene Stocks?

Graphene is a one-atom-thick sheet of carbon arranged in a hexagonal lattice. Despite its simplicity, it’s 200 times stronger than steel, highly conductive, and almost weightless — qualities that make it the “material of the future.”

Types of Graphene-Related Companies

When you’re looking at graphene stocks, you’ll find that they typically fall into three main buckets:

- Graphene Producers and Miners (Upstream): Firms like NanoXplore that manufacture graphene powder or nanoplatelets at industrial scale.

- Material Innovators and Integrators (Mid-Stream): Firms like NanoXplore that manufacture graphene powder or nanoplatelets at industrial scale.

- Tech Companies Leveraging Graphene (Downstream): Tech companies leveraging graphene for batteries, semiconductors, or sensors.

Why Invest in Graphene Stocks

You don't want to invest in a scientific experiment; you want to invest in a thriving market. The data suggests that the graphene market is finally moving past the experimental stage and entering its growth phase.

Projected Growth and Demand Drivers

Now, analysts project a Compound Annual Growth rate (CAGR) in the global graphene market of more than 30% between 2026 and 2033, leading to a multi-billion-dollar valuation. So, what's behind this booming demand?

EV Battery Improvement: Graphene could be very useful in increasing both the energy density and the rate of charging in lithium-ion and next-generation batteries. Graphene is a key variable in the automotive industry that you should observe if you’re riding the electrical power trend with a materials play.

Graphene-Enhanced Semiconductors: Graphene can be used to substitute silicon in microchips of the future, resulting in faster, smaller, and more power-efficient processors. This is the frontier of computing power.

Composites and Aerospace Applications: Graphene is being used by manufacturers to produce lighter, stronger, and more durable composite materials for various applications, including aircraft parts and sporting goods.

Risks to Keep in Mind

We wouldn’t be doing our job if we didn’t talk about the downsides. Investing in graphene stocks isn’t like buying an established blue-chip; the risks exist:

- Early Adoption Phase: Many companies are pre-revenue or in early commercialization, which means they have limited large-scale production history.

- Supply Chain and Commercialization Hurdles: Scaling production while maintaining consistent quality is a massive technical challenge. This high barrier to entry can lead to investment volatility.

- Price and Substitution Volatility: The cost of high-quality graphene remains a huge factor, and there are other high-performance materials (like carbon nanotubes) that compete for the same applications.

Criteria for Selecting Top Graphene Stocks

But how can you separate the winners from the speculative noise? Shrewd investors apply objective standards to judge such innovative graphene firms.

- Production Capacity, Reserves, and Financial Health: Does the company possess an established, scalable, and ecologically friendly production process? NanoXplore, for instance, is the largest producer in the North American region by volume, a key strength that enables the company to fulfil large commercial orders effectively.

- Revenue Diversification: A pure-play firm is terrific, yet a firm that uses graphene in various high-growth industries (e.g., automotive, aerospace, and construction) is better placed to survive sector-specific downturns.

- Strategic Alliances: Find partners among large-scale industrial participants, such as EV makers, large chemical companies, or semiconductor giants. These partnerships legitimize the technology and provide a clear direction for market penetration.

5 Best Top Graphene Stocks

Based on current market information and the strict criteria above, we’ve identified five key players in the graphene ecosystem.

Comparative Overview Table

| Company Name | Ticker | Sector | Market Cap (Approx.) | Key Strengths/Focus | GrapheneExposure |

|---|---|---|---|---|---|

| NanoXplore Inc. | GRA (TSX-V) | Materials | C$350M | Bulk Graphene Powder for Plastics & EV Batteries | High-Volume Producer (Pure-Play) |

| CVD Equipment Corp. | CVV (NASDAQ) | Equipment | US$19M | Chemical Vapor Deposition (CVD) Systems | Equipment Supplier for Graphene Production |

| Zentek Ltd. | ZTEK (TSX-V) | Technology | C$70M | Speciality Graphene Coatings & IP Development | Application Specialist (Pure-Play) |

| Black Swan Graphene | SWAN (TSX-V) | Materials | C$40M | High-Purity Graphene Nanoplatelets and Masterbatches | Emerging Bulk Producer (Pure-Play) |

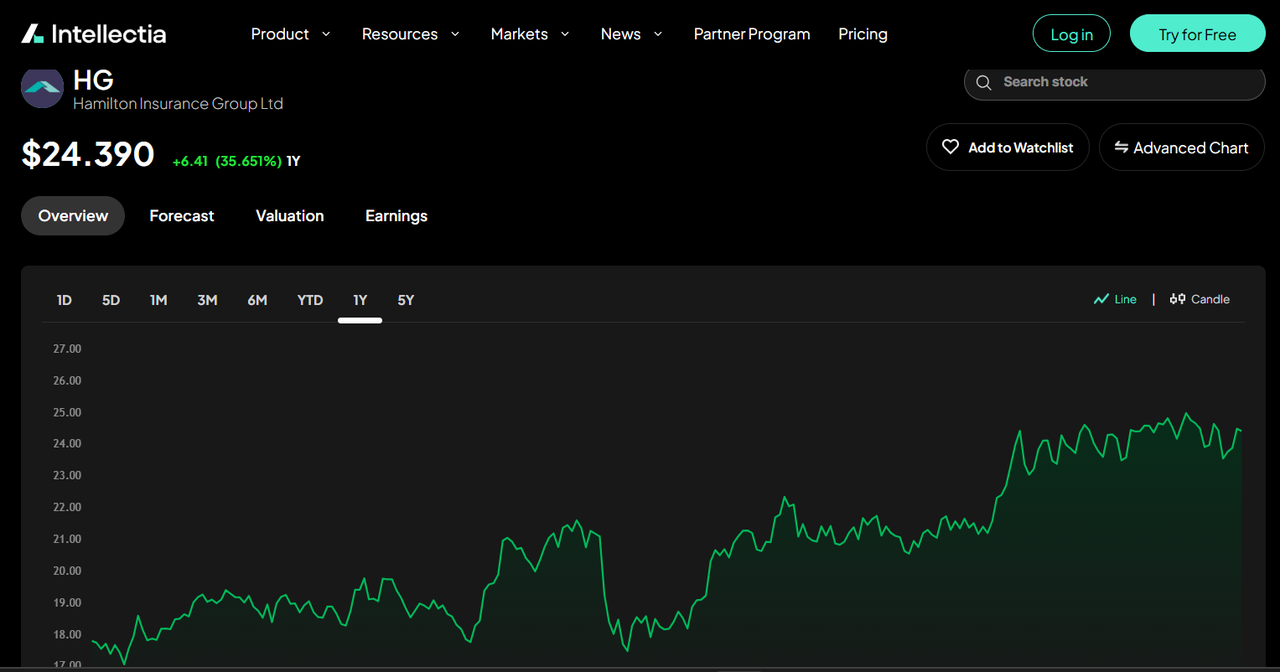

| HydroGraph Clean Power | HG (CSE) | Technology | C$50M | Patented Detonation-Process Graphene | Cost-Effective Innovator (Pure-Play) |

NanoXplore Inc. (GRA)

NanoXplore is one of the most established high-volume manufacturers in North America. They have successfully scaled their process to produce thousands of tons of cost-effective graphene powder annually, a significant differentiator in the market. Their primary focus is selling their “GrapheneBlack™” products to improve plastics and composites, especially for the automotive sector and EV battery components. They’re solving the key problem of commercial accessibility.

If you’re looking to invest in the stock with the largest production capacity and the most established business model in the pure-play graphene space, NanoXplore should be high on your list.

CVD Equipment Corporation (CVV)

CVD Equipment is a bit different because they don’t actually sell the graphene material itself. Instead, they provide the sophisticated chemical vapor deposition (CVD) equipment and process solutions that other companies need to make high-quality graphene, carbon nanotubes, and other advanced materials. This business model offers a “picks and shovels” approach to the gold rush; regardless of which graphene producer ultimately wins, they all need quality manufacturing tools. This indirect exposure can sometimes mitigate the direct risk of a material-producing startup.

If you plan to hedge your bets by investing in a reliable supplier to the entire advanced materials industry, regardless of which specific pure-play company comes out on top. In that case, CVV is a compelling choice.

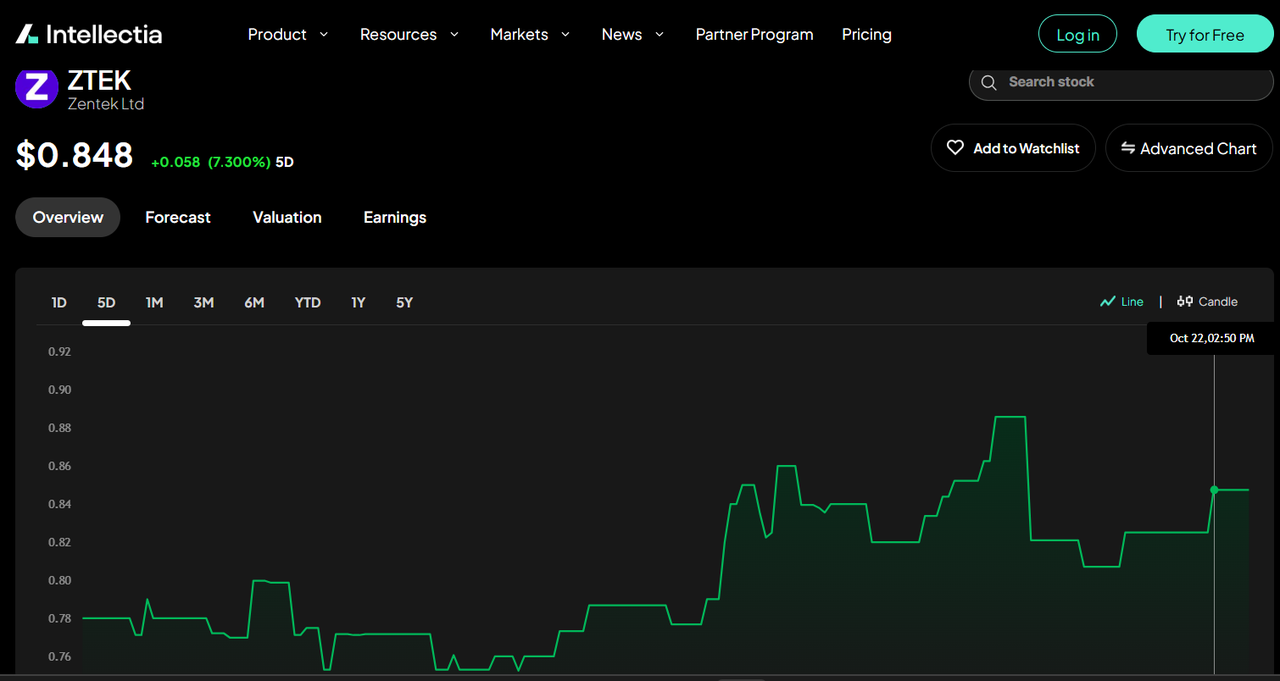

Zentek Ltd. (ZTEK)

Zentek is known for its unique proprietary intellectual property (IP), particularly in the area of speciality coatings and filtration. Their key asset is the Albany Graphite Deposit, which can produce high-purity graphite suitable for high-tech uses. Zentek’s strategy is to develop and license graphene applications, such as their ZenGUARD™ coating, which has strong potential in the medical and HVAC sectors. They’re concentrating on high-margin, specialized end-use applications rather than just bulk powder.

If you’re looking to invest in a company that focuses on high-value, defensible IP and application development in the health and advanced coating space. In that case, Zentek’s specialized focus differentiates it from the rest.

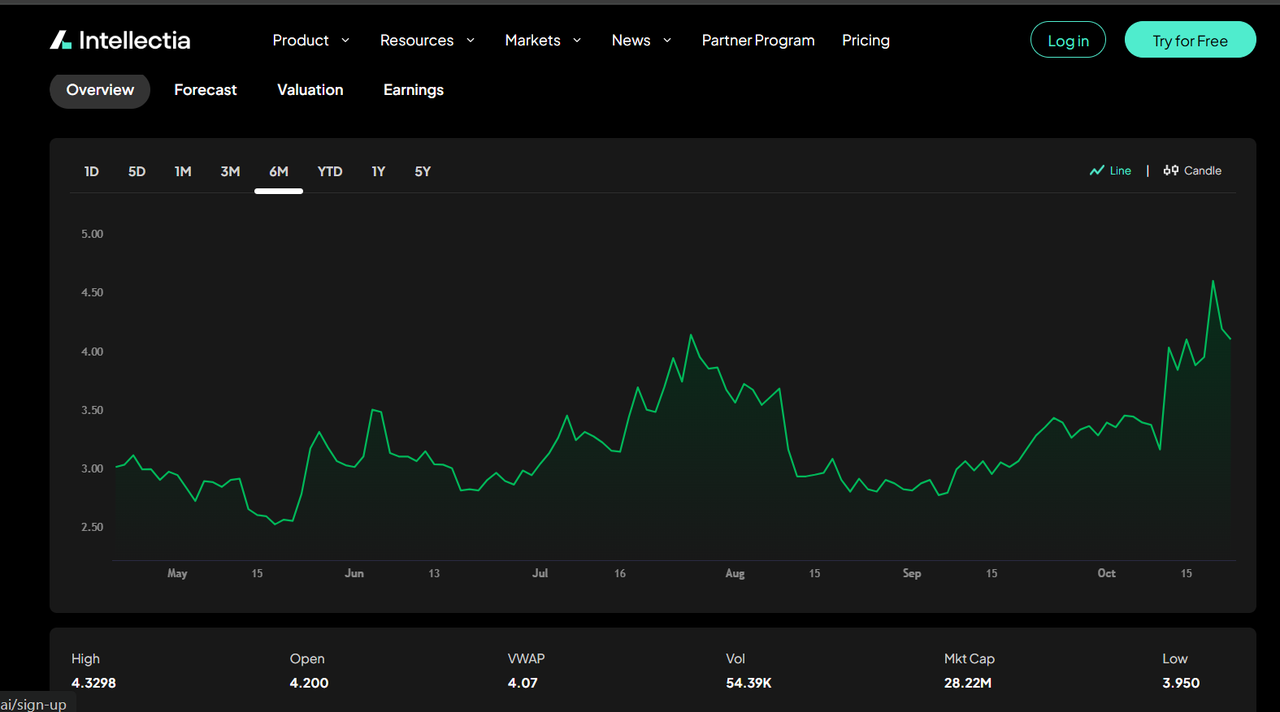

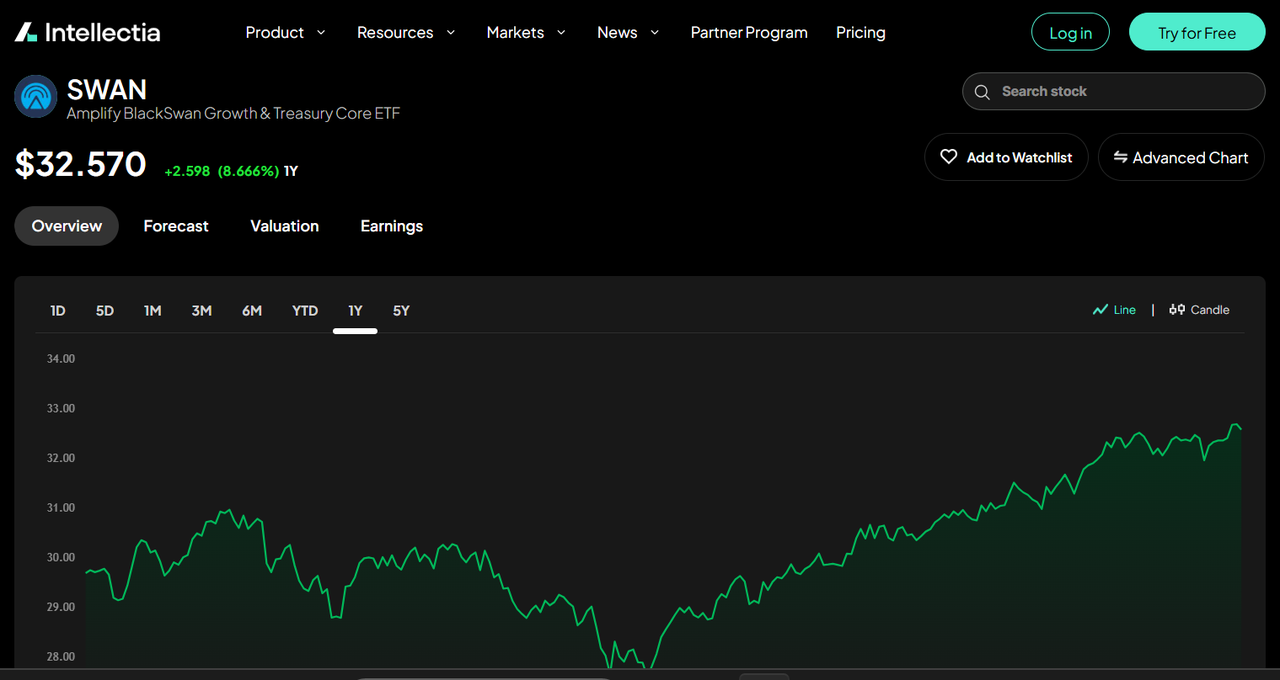

Black Swan Graphene (SWAN)

Black Swan is a newer, emerging producer aiming to become a powerhouse in the bulk graphene business. What sets them apart is their partnership with the established UK chemicals firm Thomas Swan & Co., which provides patented production IP and strong industry credibility. This collaboration offers Black Swan a pathway to develop a fully integrated supply chain, spanning from raw graphite mines to graphene-enhanced polymer masterbatches for plastic manufacturers. They are an early-stage company that is aggressively expanding capacity.

If you believe in the long-term potential of bulk graphene adoption in everyday materials and are looking for a high-growth, early-stage play backed by a reputable industry partner. In that case, Black Swan is worth investigating.

HydroGraph Clean Power (HG)

HydroGraph captivates with its new patented manufacturing process. Their technique is a detonation method, in effect, a controlled explosion, to form very high-purity graphene in one step. This process will significantly reduce the cost of graphene production, making it the only significant catalyst for mass commercial implementation across all industries. They are working on the so-called fractal graphene that can be used in high-tech composites and 3D-printed designs.

Hence, the company needs to guarantee that it recognizes the advantages of strengthening its partnership with the suppliers of its raw materials. Therefore, the company must ensure that it acknowledges the benefits of enhancing its relationship with the suppliers of its raw materials.

If you’re looking to bet on a technological breakthrough that could dramatically reduce the cost of graphene and unlock its mass-market potential in high-performance materials. In that case, HydroGraph Clean Power offers a compelling, clean-tech-focused story.

How to Invest Smartly in Best Graphene Stocks with Intellectia AI

With the wildness and early-stage volatility of these graphene stocks, it is pointless to attempt to analyze them based on a 10-year P/E ratio. You need a fact-based advantage that can operate on R&D news and partner hype in real time. And that is precisely where the capabilities of the Intellectia AI come in.

The old financial models are ill-suited for analyzing pre-revenue materials science businesses or those dependent on a single piece of IP. The tools available to Intellectia AI are programmed to delve deeper into traditional fundamentals, providing you with unusual momentum and sentiment clues.

AI Stock Analysis: Instead of guessing where the price of a volatile pure-play like NanoXplore or Zentek might go, Intellectia.ai provides AI stock price prediction models. Our system uses advanced machine learning to forecast trends, helping you avoid speculative highs and identify high-probability entry points.

AI Trading Signals: Graphene stocks can be subject to wild swings based on R&D news or new partnerships. Our AI trading signals provide clear, actionable guidance on when momentum shifts. You can use this for specific AI trading strategies, such as swing trading or quick entries/exits, to capitalize on the volatility inherent in early-stage disruptive technology stocks.

Conclusion

Graphene is no longer just a laboratory curiosity—it’s moving toward industrial adoption across batteries, semiconductors, and aerospace. The next decade could redefine how materials power modern technology.

Use Intellectia.ai to track real-time signals, identify high-potential graphene stocks, and stay ahead of emerging market trends. Start your data-driven investing journey today with Intellectia AI.