Key Takeaways

- Investing in AI stocks under $20 offers a high-growth potential entry point into the artificial intelligence revolution without a massive capital outlay.

- Identifying the best cheap AI stocks involves analyzing fundamentals like revenue growth, R&D spending, and key AI-specific developments like patents and partnerships.

- Utilizing AI-powered tools, such as stock screeners and trading signals, can provide a significant edge in spotting momentum and making informed decisions.

- Companies like SoundHound AI (SOUN) and BigBear.ai (BBAI) represent strong contenders in the under-$20 category, each with unique strengths in conversational AI and national security.

- A diversified approach that combines long-term holding with strategic, technically-informed short-term trades can help manage the inherent risks of investing in lower-priced stocks.

Introduction

Have you ever felt like you're missing out on the AI boom because the most talked-about stocks have sky-high prices? It's a common frustration for many investors who see the massive potential of artificial intelligence but feel priced out of the market leaders.

You can, however, find incredible opportunities without breaking the bank. By looking beyond the headlines and focusing on key growth indicators, you can uncover promising companies quietly building the future of AI.

This article will walk you through how to identify the best AI stocks under $20 and highlight a few top contenders to add to your watchlist for 2025 and beyond.

Why Invest in AI Stocks Under $20?

Investing in the AI sector doesn't have to mean buying shares of massive corporations at hundreds of dollars apiece. The best AI stocks under $20 offer a unique combination of accessibility and explosive growth potential that can be incredibly appealing.

First, the lower price point makes it easier for you to build a diversified portfolio. Instead of putting all your capital into a single expensive stock, you can spread your investment across several promising AI companies. This diversification helps mitigate the higher risk often associated with emerging technology stocks.

Second, these smaller companies often have significantly more room to grow. A stock priced at $10 has a much clearer path to doubling than a stock priced at $1,000. As these companies secure new patents, land major partnerships, or achieve technological breakthroughs, their value can multiply quickly, delivering substantial returns to early investors. While the risk is higher, the potential for outsized rewards is a major draw.

How to Choose the Best AI Stocks Under $20

Finding the winners among the many cheap AI stocks under $20 requires a sharp eye and the right tools. You need to look past the hype and focus on tangible signs of progress and potential. Here’s what you should focus on:

Revenue Growth & R&D Intensity

Strong and consistent revenue growth is a clear indicator that a company's AI products are gaining traction in the market. Look for companies that are not just growing but accelerating their sales. At the same time, a heavy investment in research and development (R&D) signals a commitment to innovation, which is crucial for staying ahead in the fast-paced AI industry.

AI Patents / Partnerships / Product Roadmaps

A company's intellectual property, like its AI patents, can create a protective moat around its business. Pay close attention to strategic partnerships with larger, established companies, as this can validate the technology and open up massive new markets. A clear and ambitious product roadmap also shows that the leadership team has a vision for future growth.

Institutional Ownership and Sentiment

When hedge funds and other large institutions start buying a stock, it’s often a sign of confidence in the company's long-term prospects. You can track this through public filings to see who is investing. Positive sentiment from market analysts can also provide a tailwind for a stock's performance. For an inside look, you can use a hedge fund tracker to see where the smart money is flowing.

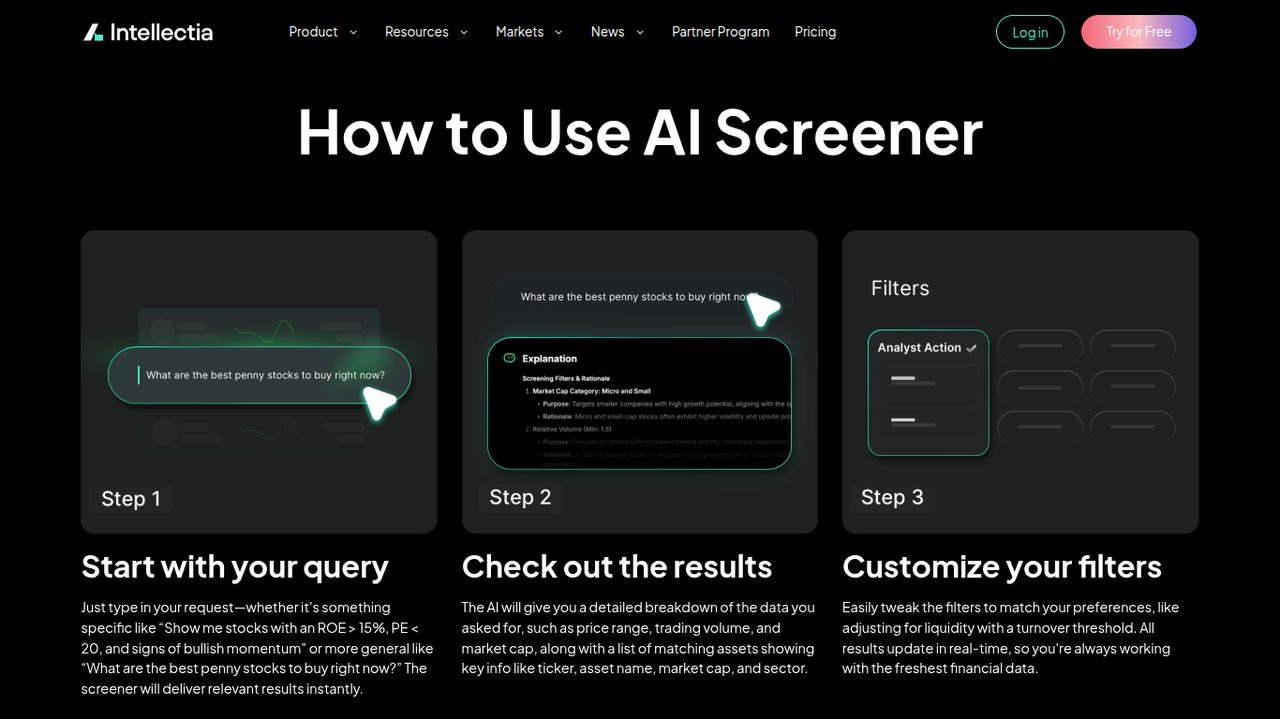

AI Signals & Stock Momentum

In today's market, using AI to analyze stocks can give you a powerful advantage. Tools like Intellectia.ai's AI Screenercan help you filter for stocks with strong technical signals and positive momentum. By leveraging AI trading signals, you can better identify optimal entry and exit points, turning market data into actionable insights.

5 Top AI Stocks Under $20 to Watch in 2026

Finding the right companies requires careful analysis. Here are five of the top AI stocks under $20 that are showing promising signs, based on their recent performance, strategic initiatives, and growth potential.

| Company Name | Ticker Symbol | Sector | Market Cap | Key Strengths |

|---|---|---|---|---|

| SoundHound AI, Inc. | SOUN | Technology | ~$4.8B | Leading conversational & voice AI, strong automotive/IoT presence |

| BigBear.ai Holdings, Inc. | BBAI | Technology | ~$2.4B | AI for defense & national security, strategic acquisitions |

| Duos Technologies Group, Inc. | DUOT | Technology | ~$165M | AI-powered railcar inspection, expanding into data centers |

| Pagaya Technologies Ltd. | PGY | Financial Tech | ~$1.79B | AI network for lenders, strong revenue and EBITDA growth |

| Rekor Systems, Inc. | REKR | Technology | ~$243M | AI for traffic management and public safety, government contracts |

SoundHound AI, Inc. (SOUN)

SoundHound AI is a leader in voice artificial intelligence and conversational intelligence technologies. Its platform allows humans to interact with products and services just like they interact with each other—by speaking naturally. The technology is used in everything from cars and smart devices to restaurant ordering systems.

SoundHound has been on a tear, reporting record year-to-date revenue of $114 million, a 127% increase. The company recently raised its full-year 2025 revenue outlook to between $165 million and $180 million. Analysts are bullish, with some projecting near breakeven profitability levels in 2026 as it continues its high-growth trajectory.

With a strong foothold in the automotive and IoT sectors and a clear path to profitability, SOUN is a standout among the best AI stocks under 20 dollars. Its proven technology and expanding customer base position it for sustained growth as voice AI becomes more integrated into daily life.

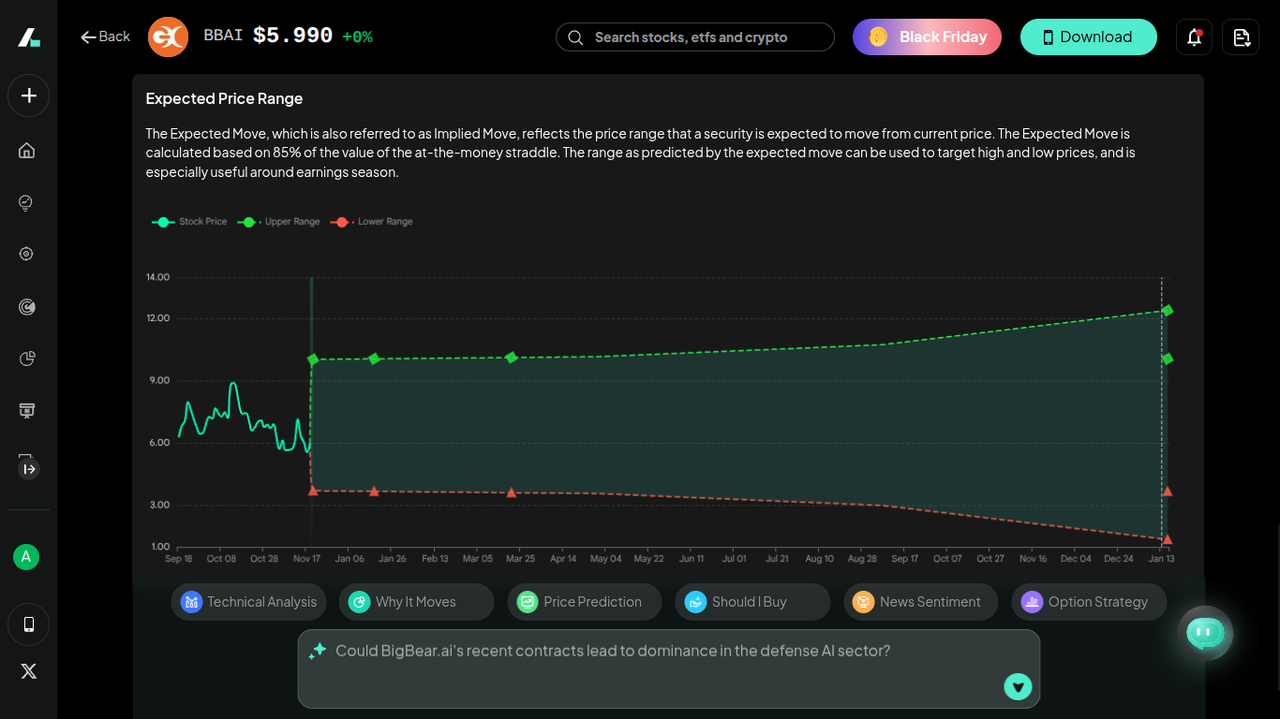

BigBear.ai Holdings, Inc. (BBAI)

BigBear.ai provides artificial intelligence-powered decision intelligence solutions primarily for the U.S. national security and defense communities. The company's platform helps organizations make sense of complex data environments to gain a strategic advantage.

BBAI made a major strategic move by announcing the acquisition of Ask Sage for $250 million. Ask Sage is a generative AI platform built for the defense sector and is projected to generate $25 million in annual recurring revenue in 2025. This acquisition significantly expands BigBear.ai's market and strengthens its leadership position in AI for national security.

BBAI's focus on a critical, high-growth niche and its smart acquisition strategy make it a compelling choice. The Ask Sage deal is expected to be margin accretive and, combined with BBAI's $715 million in cash and investments, gives the company substantial firepower for future growth.

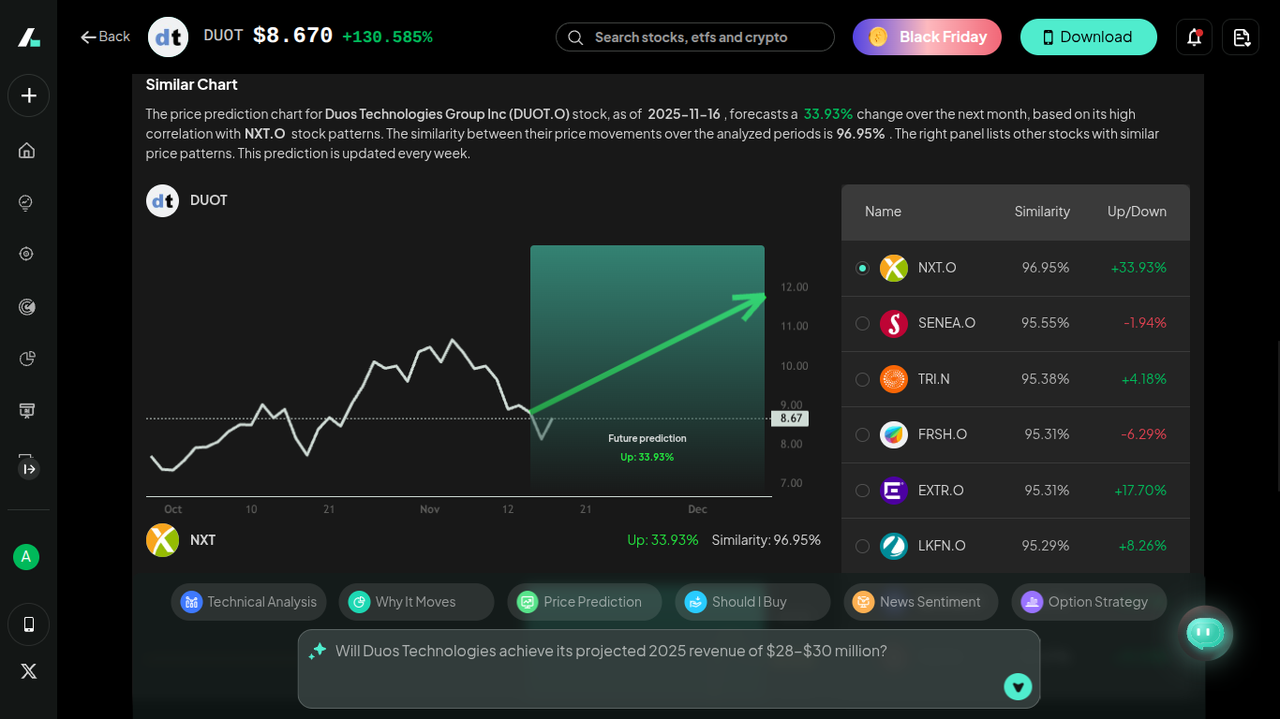

Duos Technologies Group, Inc. (DUOT)

Duos Technologies provides advanced, intelligent technology solutions, with a strong focus on its AI-powered railcar inspection portal. This technology helps detect potential issues with trains, improving safety and efficiency in the logistics industry.

DUOT has executed a strategic pivot into the Edge Computing and data center space to capitalize on the AI arms race. The company reported a stunning 112% year-over-year revenue increase in its Q3 2025 earnings call and achieved positive adjusted EBITDA one quarter ahead of projections. It expects total 2025 revenue to be between $28 million and $30 million.

DUOT's successful pivot demonstrates a nimble and forward-thinking management team. By leveraging its existing AI expertise to enter the booming data center market, the company has created new, high-growth revenue streams that could drive significant value for shareholders.

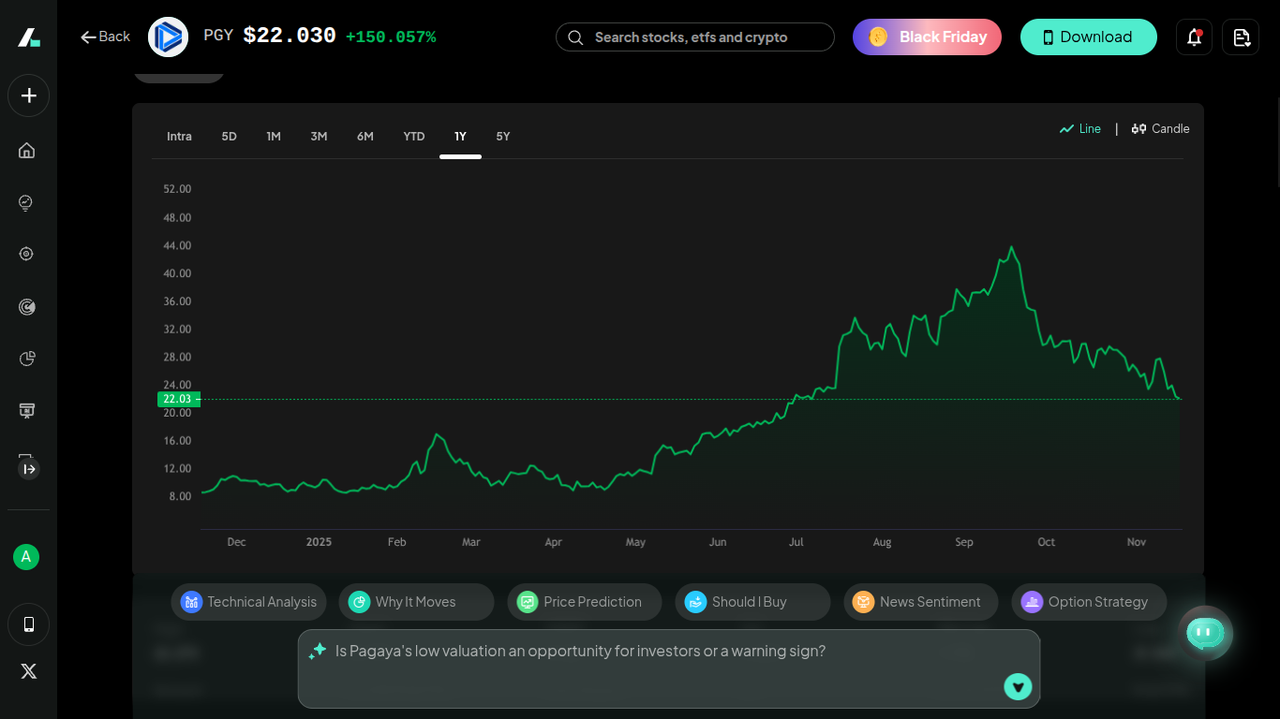

Pagaya Technologies Ltd. (PGY)

Pagaya Technologies operates a proprietary AI network that enables lenders, like banks and fintechs, to approve more loans and access new customers. Its AI analyzes vast amounts of data to make more accurate credit assessments than traditional models.

Pagaya has been delivering impressive financial results. The company reported a record adjusted EBITDA of $107 million for Q3 2025, a 91% year-over-year increase. It also raised its full-year guidance, now expecting adjusted EBITDA of $372 million to $382 million, showcasing strong momentum and profitability.

Why It's a Top Pick: While its stock price often hovers right around the $20 mark, PGY's powerful business model and stellar financial performance make it a must-watch. The company is proving that its AI can deliver real value in the massive consumer credit market, and its rapidly accelerating partner onboarding suggests a long runway for growth.

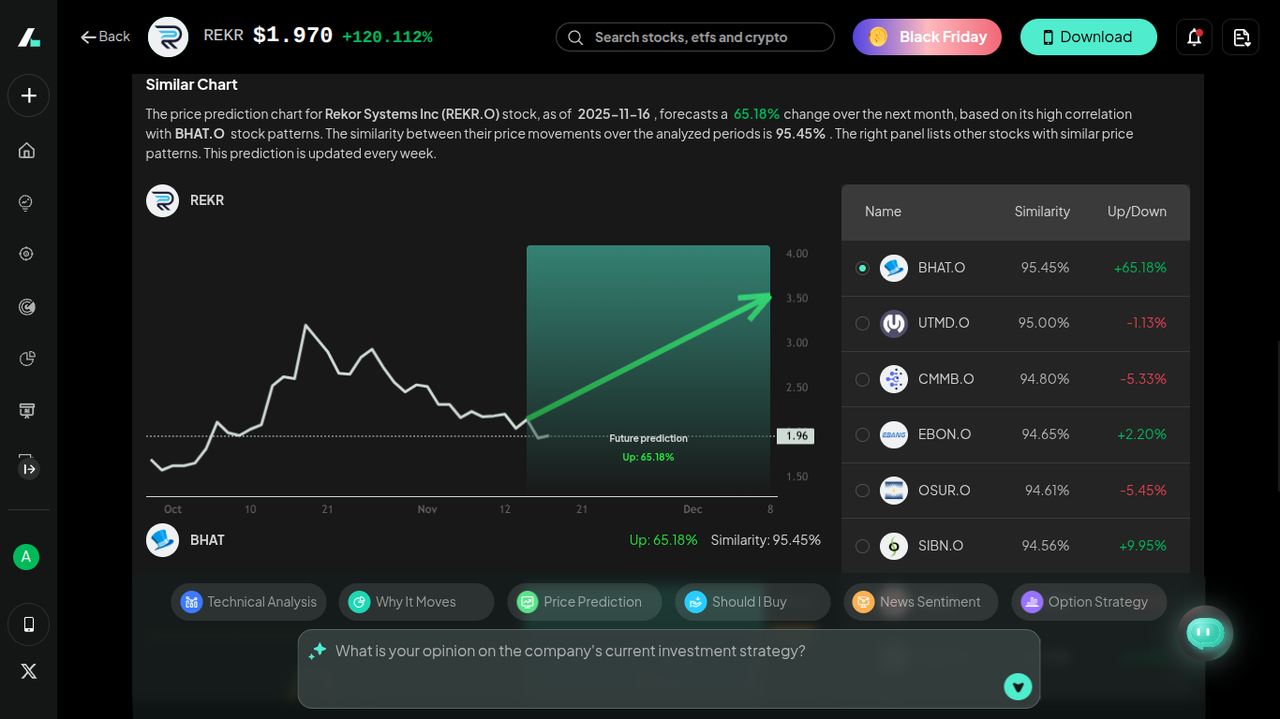

Rekor Systems, Inc. (REKR)

Rekor Systems uses AI and machine learning to create advanced vehicle recognition and roadway intelligence systems. Its technology is used by government agencies and commercial clients for everything from traffic management and tolling to enhancing public safety.

Rekor has been successfully winning and expanding government contracts. The company's technology is becoming a key part of "smart city" initiatives. According to recent reports, Rekor has been expanding its state-level contracts [like the one with Georgia Department of Transportation (GDOT)], which provides a stable and recurring revenue base.

Rekor is applying AI to solve real-world infrastructure and safety problems. With increasing government investment in intelligent transportation systems, Rekor's proven AI platform is well-positioned to capture a growing share of this market, making it one of the more intriguing best AI stocks to buy under $20.

Investment Strategies for Best AI Stocks Under $20

Navigating the world of affordable AI stocks requires a smart strategy to maximize your potential returns while managing risk.

Diversify Your Portfolio

Even with the most thorough research, betting on just one or two low-priced stocks is risky. You should spread your investment across at least 4-5 different AI stocks under $20 in various sub-sectors, such as conversational AI, defense, and fintech. This diversification ensures that a setback in one company doesn't sink your entire portfolio.

Long-Term vs. Short-Term Strategy

Decide whether you are a long-term investor or a short-term trader. A long-term strategy involves buying stocks in companies with strong fundamentals and holding them for years, trusting in their growth story. A short-term approach, like swing trading, focuses on capturing gains from price movements over a few days or weeks. This requires a deeper understanding of market trends and technical indicators.

Use Technical Analysis to Identify Entry and Exit Points

Whether you're investing for the long haul or trading short-term, technical analysis is a crucial tool. By analyzing stock chart patterns and using indicators, you can identify better moments to buy or sell. Platforms like Intellectia.ai offer powerful stock technical analysis tools and AI trading signals that can help you time your moves with greater precision.

Conclusion

The artificial intelligence revolution is here, and you don't need a massive budget to be a part of it. By focusing on companies with strong growth, innovative technology, and a clear vision, you can find incredible opportunities among the best AI stocks under $20. Companies like SoundHound, BigBear.ai, and Duos Technologies are already proving their potential and could be poised for significant growth in 2025 and beyond.

Are you ready to find the next big AI winner? Sign up for Intellectia.ai today to get daily AI stock picks, advanced trading signals, and the market analysis you need to invest with confidence. Subscribe to unlock premium features and start building your AI portfolio now.