Introduction

The rise of 5G technology is creating exciting investment opportunities worldwide. Investors are increasingly looking at 5G stocks and 5G investments to capitalize on the next wave of mobile technology growth. From semiconductors to infrastructure and telecom operators, 5G is transforming industries.

If you’re wondering how to invest in 5G, this guide highlights the best 5G stocks to buy, explains how to evaluate them, and shows how to build a diversified 5G portfolio for long-term growth.

What is 5G technology?

5G, the fifth generation of mobile communication, offers faster speeds, lower latency, and higher device capacity than 4G.

| Feature | 4G | 5G |

|---|---|---|

| Peak Speed | 1 Gbps | 10-20 Gbps |

| Latency | 30-50 ms | 1 ms |

| Device Connections | ~100,000/km² | 1 million/km² |

Why it matters: 5G enables IoT, autonomous vehicles, cloud computing, AR/VR, and more. This rapid growth is why investors are excited about 5G stocks.

Why invest in 5G stocks?

The 5G market is expected to grow from $15.03 billion in 2024 to $229.41 billion by 2032, at a CAGR of 40.6% (Market Research Future). The rapid deployment of 5G networks and devices creates opportunities for:

- Semiconductor manufacturers: Chips for smartphones, base stations, and networking hardware

- Infrastructure providers: Equipment makers and fiber optics companies

- Telecom operators: Companies delivering 5G services and private networks

Investing in 5G stocks allows investors to benefit from the long-term adoption cycle of this transformative technology.

How to Evaluate 5G stocks?

Evaluating 5G stocks requires a multi-angle approach. Combining market position, financial profile, and valuation analysis can help us quickly assess their investment potential.

Market Position

Market position can help us determine a stock's long-term growth potential. Since 5G technology is still in the early stages of promotion, if a company can maintain its leading edge in one or more market segments now, it is more likely to benefit from future market growth.

Financial Profile

Key financial indicators can provide insight into a company's health and growth prospects. Revenue and earnings data are key indicators of a company's health.

In addition, given that 5G requires a large capital investment, the company's cash flow situation must also be evaluated. Strong cash flow can ensure that the company maintains operations and provides funds for future 5G innovations.

Valuation Analysis

Valuation analysis helps determine whether a stock is reasonably priced. We must pay attention to the important indicator of the price-to-earnings ratio (P/E). A high P/E may mean overvaluation or high growth expectations. We must also compare this data with the industry average to determine whether the stock is undervalued or overvalued relative to its peers.

By combining these methods, investors can fully evaluate whether a 5G stock is worth investing in.

Top 5G Stocks to Consider in 2026

Here are some of the best 5G stocks to buy in 2026, organized by sector.

Category 1: 5G Infrastructure Providers

| Stock | Ticker | Market Cap | P/E | Dividend Yield | Analyst Rating | Key Advantage |

|---|---|---|---|---|---|---|

| Nokia | NOK | $30B | 18.8 | 1.2% | 4 Buy / 1 Hold | Full 5G portfolio: RAN, core networks, cloud infrastructure |

| Ericsson | ERIC | $35B | 23.1 | 1.5% | 1 Sell / 2 Hold | Powers 145+ active 5G networks worldwide |

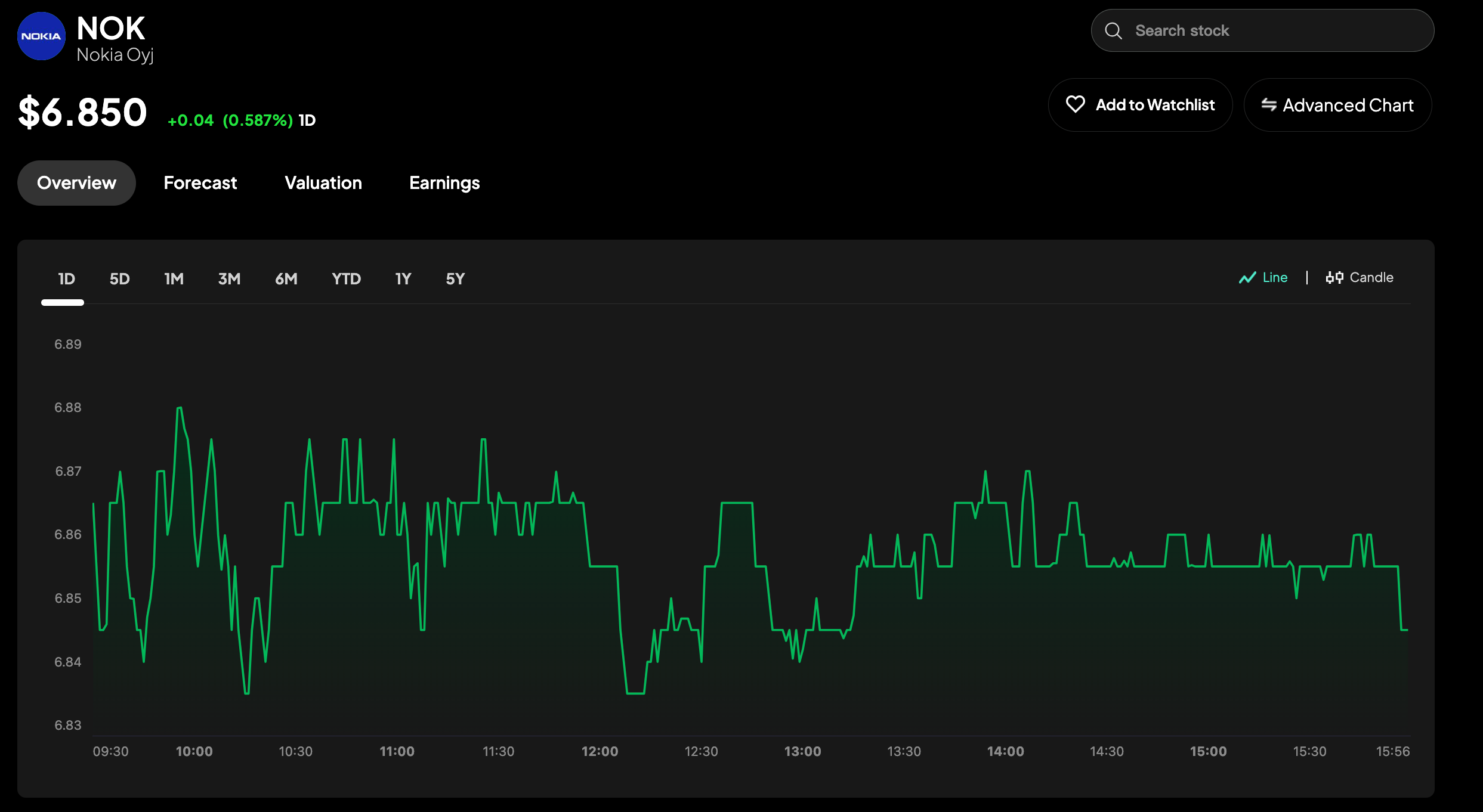

1. Nokia (NOK)

Nokia holds a strong position in the 5G infrastructure market. Its competitive advantage arises from a comprehensive end-to-end portfolio that includes radio access networks, core networks, and cloud infrastructure. The company's emphasis on research and development, particularly in network slicing, keeps it at the forefront of 5G innovation.

In the fourth quarter of 2024, Nokia reported revenue growth of 10.3%, surpassing expectations and achieving a comparable operating margin of 19.1%. The company also generated €0.5 million in free cash flow and proposed a dividend of €0.14 per share.

According to Intellectia, Nokia's price-to-earnings ratio is 18.8, slightly above the industry average. Five analysts have updated their ratings on Nokia in the past 12 months, with four giving it a "Buy" rating.

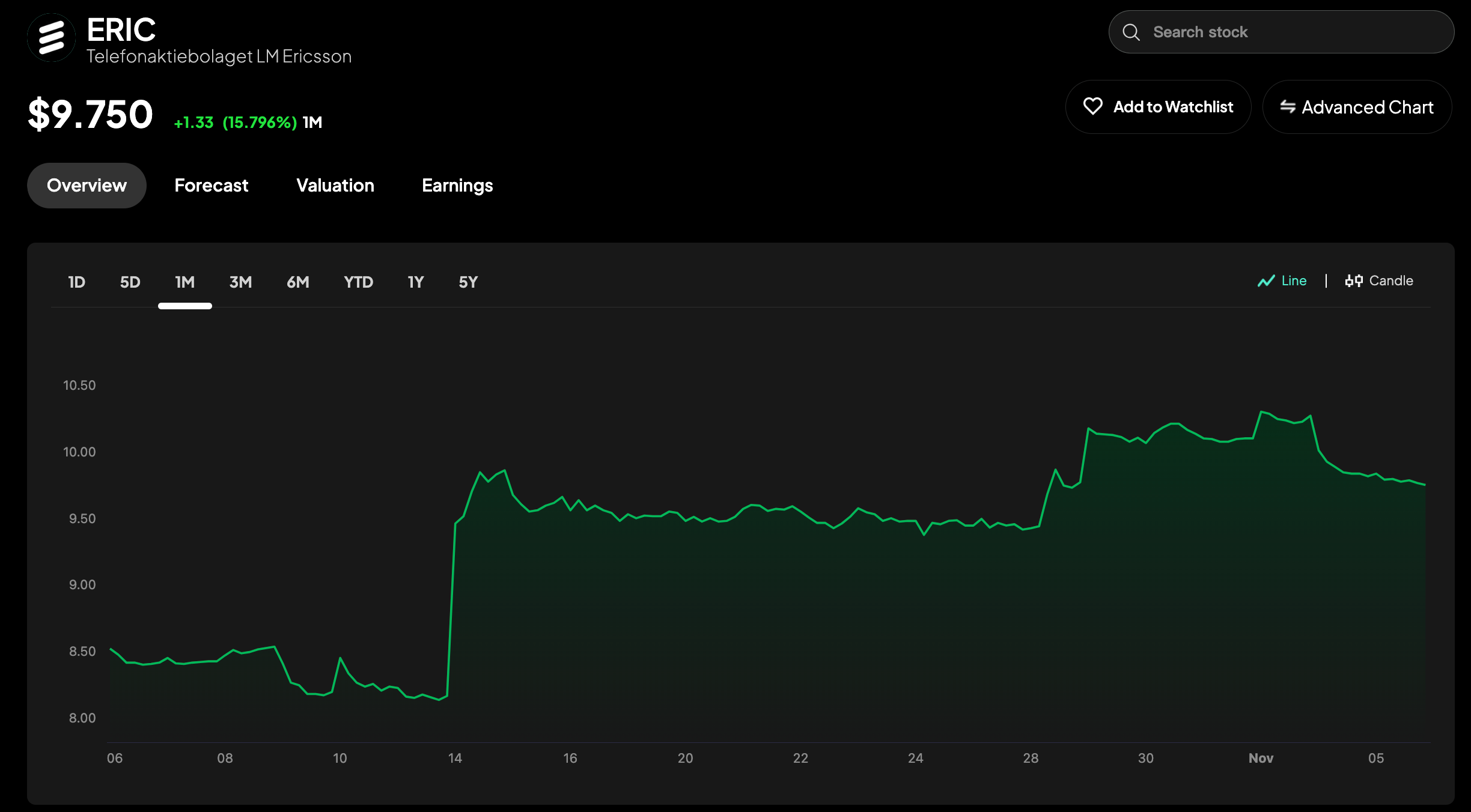

2. Ericsson (ERIC)

Ericsson is a global leader in providing 5G infrastructure. Its extensive patent portfolio and robust R&D efforts ensure that it maintains this position and reaps the benefits of the increasing global demand for 5G infrastructure. Ericsson powers over 145 active 5G networks across more than 70 countries and collaborates with major operators like Verizon and Vodafone.

In the fourth quarter of 2024, Ericsson's gross margin improved to 46.3%, up from 41.1% the previous year. Sales saw a 1% annual increase, driven by robust performance in North America, where sales surged by 54%. Ericsson also reports a strong balance sheet, with net cash of 37.8 billion Swedish kronor. This provides flexibility for research and development and dividend payments.

Ericsson's P/E is 23.1, which is mid-range. Analysts are cautious about Ericsson's prospects due to pressure from competitors such as Huawei. Intellectia data shows that three analysts have updated their ratings on Ericsson in the past 12 months, two "Hold" ratings and one "Sell" rating.

Category 2: Semiconductor Companies

| Stock | Ticker | Market Cap | P/E | Dividend Yield | Analyst Rating | Key Advantage |

|---|---|---|---|---|---|---|

| Qualcomm | QCOM | $193.9B | 18.1 | 1.94% | 12 Buy / 9 Hold | Leading 5G modem & patent portfolio; automotive growth |

| Broadcom | AVGO | $1.7T | 183 | 0.66% | 24 Buy / 3 Hold | Chips for 5G infrastructure, strong cash flow |

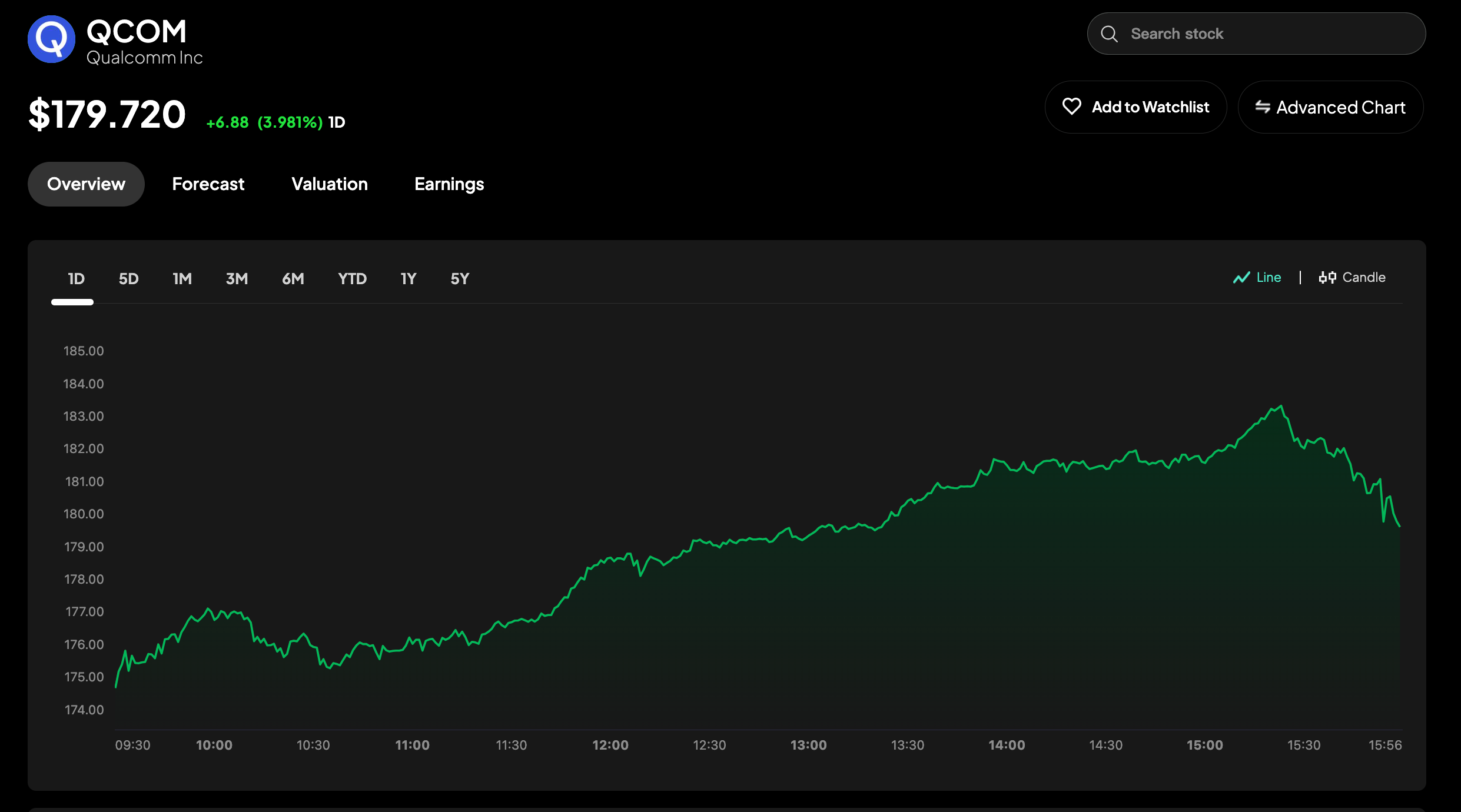

3. Qualcomm (QCOM)

As a global leader in 5G modem and RF front-end technology, Qualcomm supports hundreds of millions of devices, including smartphones, automobiles, and industrial equipment. Qualcomm's licensing division (QTL) also holds a substantial number of 5G patents, which generates significant fees each year.

Qualcomm's financial performance is strong. Revenues increased by 17% yoy to $11.67 billion in the first quarter of 2025, driven by high demand for Android phones and automotive solutions. Notably, the company's automotive division showed significant growth, with revenue climbing 68% yoy.

Qualcomm's valuation appears attractive, featuring a P/E ratio of 18.1, which is lower than that of its peers, as reported by Intellectia. Over the past 12 months, Qualcomm has received 12 "Buy" ratings and 9 "Hold" ratings. According to analysts' target prices, the stock holds a potential upside of 15-20%, positioning it as a compelling investment for long-term growth.

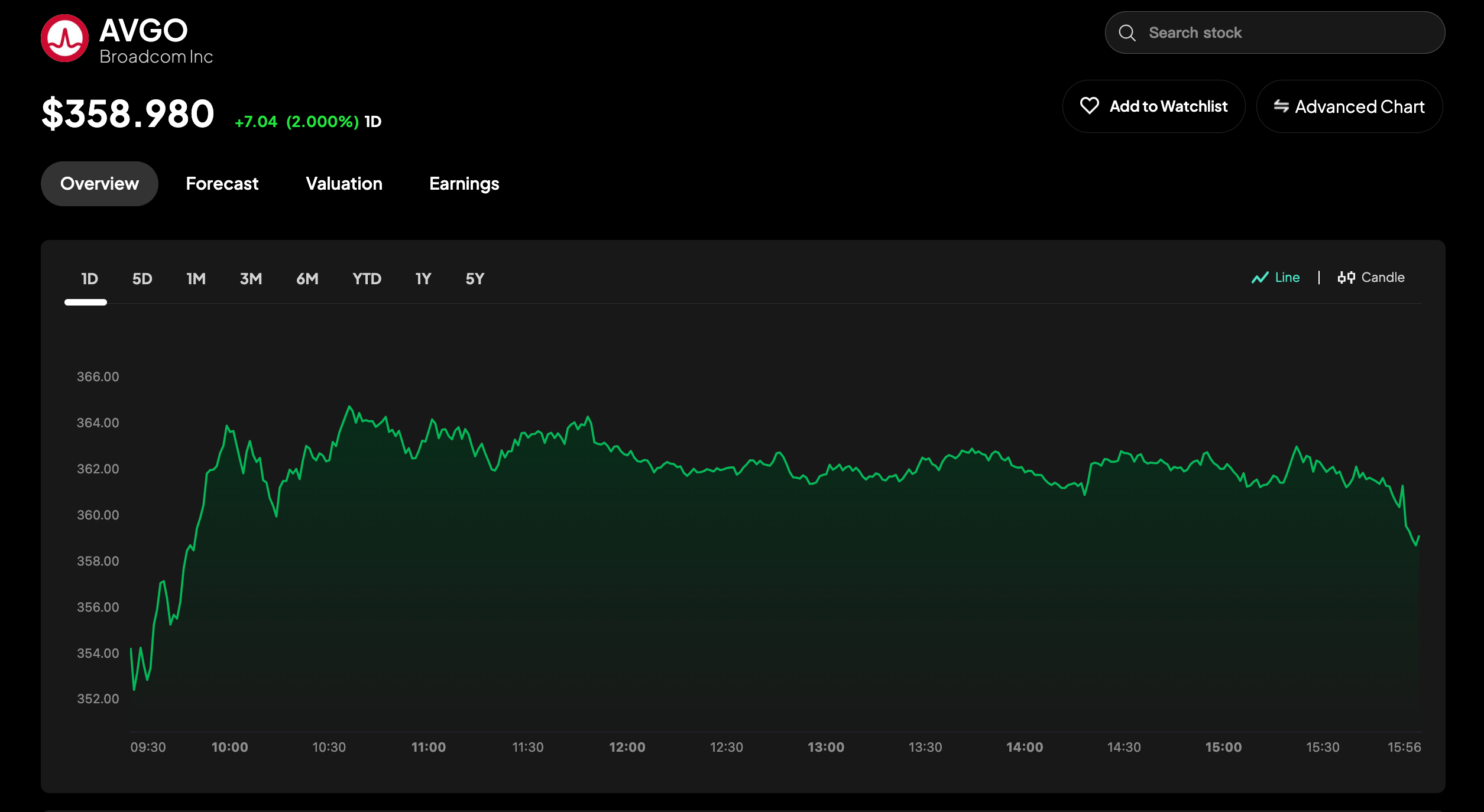

4. Broadcom (AVGO)

Broadcom is a major player in the 5G ecosystem. It offers essential semiconductor solutions for infrastructure, including base stations and optical networks. The company supplies vital 5G components such as RF front-end modules, ASICs, and network chips to major clients like Apple, Samsung, Cisco, and Nokia.

Broadcom reported impressive financial results in the fourth quarter of 2024, driven by significant growth in its semiconductor and infrastructure software divisions. Revenue increased by 51.2% yearly, and the net margin approached 30%. Operating cash flow more than doubled annually, reflecting strong cash generation capability.

According to Intellectia, most analysts remain optimistic about Broadcom's prospects. Over the last 12 months, 27 analysts have updated their ratings on Broadcom, resulting in 24 "Buy" ratings and 3 "Hold" ratings.

Broadcom's P/E stands at 183, indicating elevated growth expectations. However, the company's robust financial performance, featuring an adjusted EBITDA margin of 64.7% and free cash flow of $21.9 billion, supports its valuation.

Category 3: Telecommunications Operators

| Stock | Ticker | Market Cap | Forward P/E | Dividend Yield | Analyst Rating | Key Advantage |

|---|---|---|---|---|---|---|

| Verizon | VZ | $240B | 8.3 | 6.7% | 6 Buy / 10 Hold | Largest US 5G network, strong dividend |

| AT&T | T | $210B | 11 | 4.7% | 20 Buy / 4 Hold | Extensive US coverage, private 5G networks |

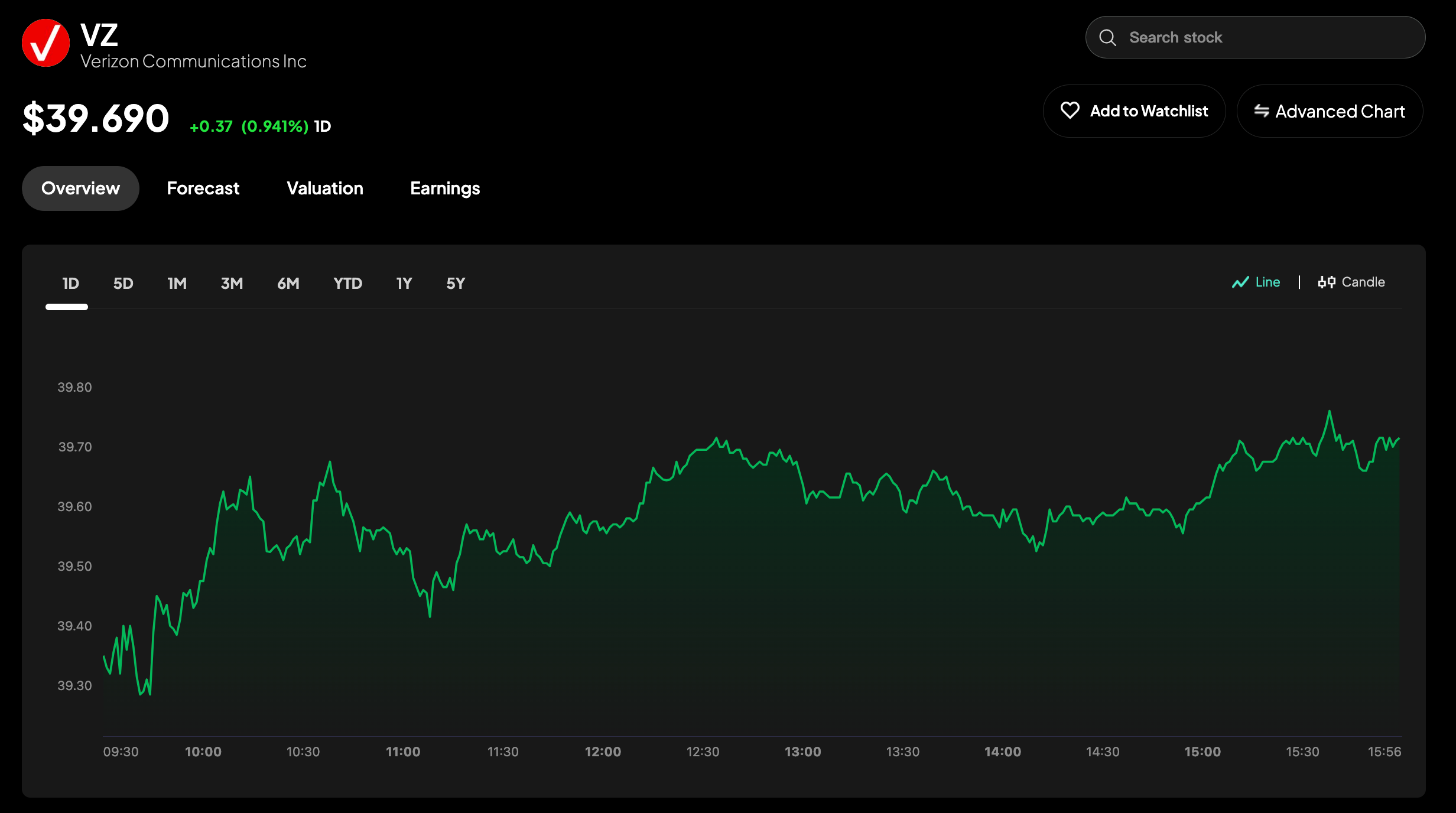

5. Verizon (VZ)

Verizon is the largest wireless carrier in the United States. Verizon claims more than 280 million people will already use Verizon's 5G Ultra Wideband network by February 2025. Verizon's vast infrastructure and collaborations with tech giants like Apple and Samsung on 5G devices and enterprise private networks have positioned it as a leader in 5G adoption.

Verizon's financial stability and appealing dividend make it a compelling investment. In the fourth quarter of 2024, Verizon reported a year-over-year increase of 1.6% in total revenue, fueled by robust growth in wireless and broadband services. Wireless service revenue rose by 3.1% to $20 billion, marking its 18th consecutive quarter of growth.

Verizon offers a high dividend yield of 6.7%, making it one of the highest dividend-paying stocks in the S&P 500. Its $19.8 billion free cash flow in 2024 can comfortably cover its dividend. Additionally, Verizon's forward P/E ratio of 8.3 is lower than the industry average, suggesting it is undervalued compared to its peers.

According to Intellectia, 16 analysts have updated their ratings on Verizon in the past 12 months. Six analysts assigned the stock a "Buy" rating, while the remainder gave it a "Hold" rating. Analysts' price targets for Verizon range from $44 to $55, suggesting upside potential for the stock.

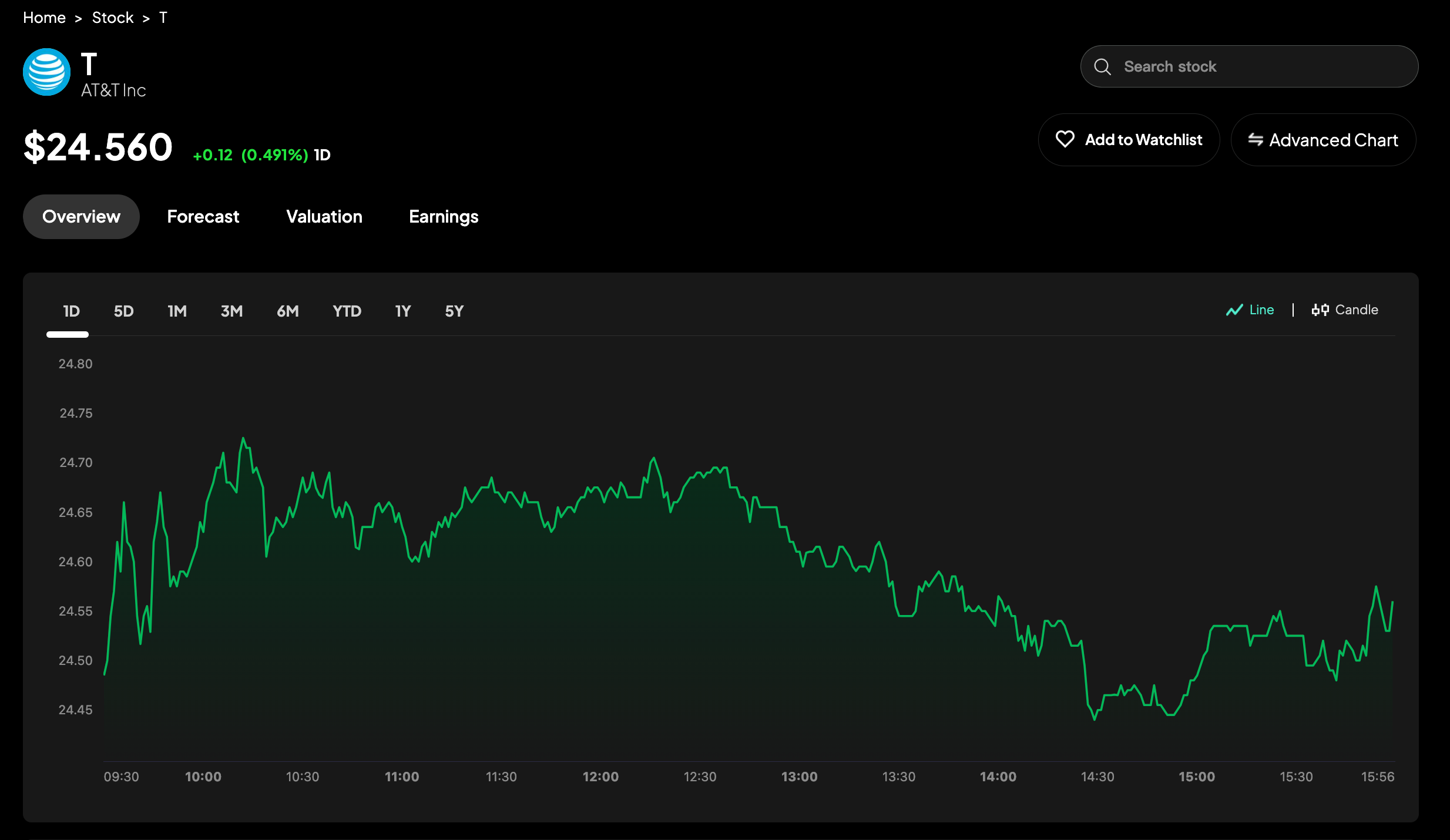

6. AT&T (T)

As the leading telecommunications provider in the United States, AT&T's 5G coverage extends to over 295 million people nationwide. AT&T maintains its market leadership through strategic equipment partnerships with companies like Apple and Samsung, along with enterprises' increasing adoption of private 5G networks.

AT&T reported solid results for the fourth quarter of 2024. Revenue increased by 3.3% year-over-year, surpassing expectations. The adjusted EPS of $0.54 exceeded the consensus estimate by 12.5%. AT&T also reported substantial free cash flow, totaling $17.6 billion in 2024, which offers financial flexibility to invest in growth initiatives and return value to shareholders through dividends and buybacks.

AT&T's forward P/E is approximately 11, which is slightly higher than Verizon's 8.3. Additionally, AT&T's dividend yield of 4.7% is less than Verizon's.

Most analysts remain optimistic about AT&T's prospects. According to Intellectia, 24 analysts have revised their ratings on Verizon over the past year, with 20 assigning "Buy" ratings and the others giving "Hold" ratings.

Stay Patient with 5G Stocks

Investing in 5G stocks has the potential for huge returns but comes with some risks.

The first issue is technical risk. There are challenges associated with the adoption of 5G technology. 5G base stations consume about three times more energy than 4G, which raises operating costs and conflicts with global carbon reduction goals. In addition, some people have misunderstandings regarding the radiation of 5G base stations, creating obstacles to their construction in certain areas.

The second concern is the company’s financial risk. 5G technology is still being developed, and companies must invest significant amounts of money to remain at the forefront of the industry. However, these high R&D costs may strain the company's financial resources.

The third type is regulatory risk. Due to security concerns, governments around the world impose strict regulations on 5G deployment, particularly concerning foreign participation in critical infrastructure. These regulatory barriers may delay deployment and raise costs for companies.

The impact of these risks on 5G stocks will be long-term. Therefore, if you are serious about investing in the 5G space and expect good potential returns, you may need to exercise patience.

How to build a 5G investment portfolio?

Investing in 5G stocks enables us to take advantage of the development of 5G technology; however, we must also consider the associated risks. Therefore, building a portfolio that balances risk and reward is essential.

To minimize risk, I suggest spreading your investments across different sectors of the 5G ecosystem, such as 5G Infrastructure Providers, Semiconductor Companies, and Telecommunications Operators. For easier diversification, you might also consider 5G-focused ETFs or mutual funds.

Since 5G is an emerging technology, tracking the market's performance is essential. I recommend using artificial intelligence tools like Intellectia to assist you in monitoring stocks. Intellectia can also offer you professional, detailed stock analysis based on real-time data and advanced algorithms to support your trading decisions.

Conclusion

As 5G technology advances, I believe the 5G stocks mentioned will perform well in the long term and provide investors with returns.

As long-established and globally recognized communication infrastructure providers, Nokia and Ericsson possess solid financial reports and leading market positions, making them attractive options for investors seeking safe 5G stocks.

Qualcomm and Broadcom are solid investment options for those interested in 5G technology and the semiconductor industry. If stock dividends matter to you, then Verizon and AT&T's high dividends make them great investment choices.