PAGE NOT FOUND

Oops! It seems the page you are looking for does not exist...

Back to HomepageBlog

Get What You Are Looking For Here

Financial Analysis

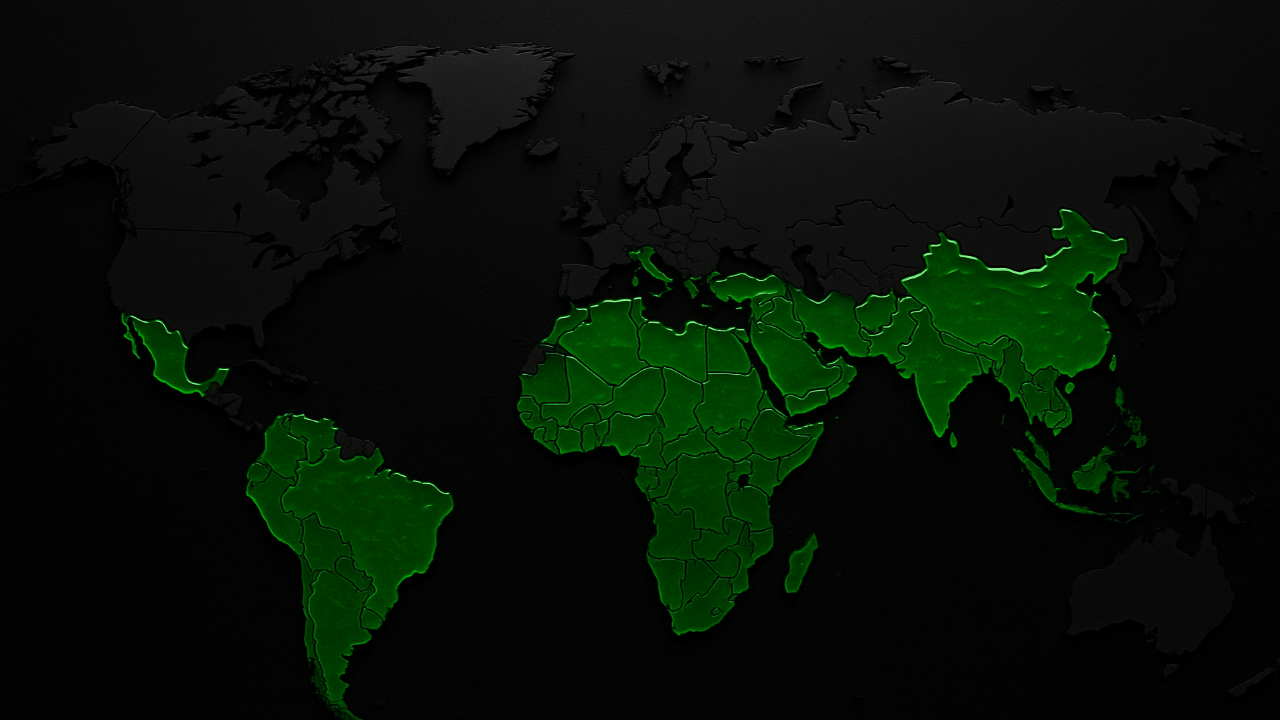

Best Emerging Markets ETFs for 2025: Unlock Global Growth Opportunities

Jason Huang3 days ago

Financial Analysis

Top Electric Vehicle Stocks to Power Your Portfolio in 2025

Jason Huang17 days ago

Educational Resources

Quantitative Trading with AI: Smarter Strategies for 2025

Jason Huang22 days ago

Crypto Analysis

Bitcoin vs Ethereum: Unpacking the Ultimate Crypto Showdown for Your Investments

Jason29 days ago

People Also Watch

NMFC

New Mountain Finance Corp

9.84USD

1.55%

ASGN

ASGN Inc

51.28USD

3.58%

FDBC

Fidelity D&D Bancorp Inc

45USD

0.36%

GRI

GRI Bio Inc

1.93USD

0.52%

TG

Tredegar Corp

8.17USD

2.00%

ORCL

Oracle Corp

296.62USD

-1.59%

FIZZ

National Beverage Corp

38.57USD

0.47%

AMPG

Amplitech Group Inc

4.14USD

0.98%

TNET

TriNet Group Inc

68.02USD

-0.06%

PETS

Petmed Express Inc

2.8USD

0.72%