Wednesday's ETF Movers: URA, APIE

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jan 22 2025

0mins

Should l Buy GDS?

Source: NASDAQ.COM

ETF Performance: The ActivePassive International Equity ETF is underperforming, down approximately 5.2% in Wednesday afternoon trading, with GDS Holdings and Iperionx showing significant declines of 8.2% and 6.3%, respectively.

Author's Perspective: The opinions expressed in the article reflect the author's views and do not necessarily represent those of Nasdaq, Inc.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy GDS?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on GDS

Wall Street analysts forecast GDS stock price to fall

8 Analyst Rating

8 Buy

0 Hold

0 Sell

Strong Buy

Current: 46.840

Low

6.29

Averages

43.76

High

67.12

Current: 46.840

Low

6.29

Averages

43.76

High

67.12

About GDS

GDS Holdings Ltd is a holding company mainly engaged in the development and operation of high-performance data centers. The Company’s main businesses include the planning and sourcing of new data centers, developing facilities, as well as providing customers with colocation and managed services, which include managed hosting services and managed cloud services. The Company also provides certain other services, including consulting services. The colocation services primarily comprise the provision of critical facilities space, customer-available power, racks and cooling. The suite of managed hosting services includes business continuity and disaster recovery solutions, network management services, data storage services, system security services, operating system services, database services and server middleware services.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Overseas Opportunities: Beeneet Kothari, founder of Tekne Capital Management, suggests that the best tech investment opportunities are currently found outside the U.S.

- Investor Mindset: The article highlights a common instinct among investors to focus on U.S. technology stocks, contrasting it with Kothari's perspective on global markets.

See More

- Equity Buyback Transaction: GDS Holdings agreed to repurchase ordinary shares from DayOne Data Centers for $385 million, with the buyback price matching DayOne's recent convertible preferred share issue price, demonstrating the company's agility in capital management.

- Significant Investment Return: This buyback allows GDS to recover nearly 95% of its invested capital, achieving a return of approximately 6.5 times, indicating successful management and capital efficiency in high-risk investments.

- Future Strategic Deployment: GDS plans to redeploy the proceeds from the buyback into new projects within its core China operations, aiming to generate strong returns as it expands its data center platform and further solidifies its market position.

- Financial Outlook Reaffirmed: On November 19, GDS reiterated its fiscal 2025 total revenue guidance of 11.29 billion to 11.59 billion yuan, adjusted EBITDA guidance of 5.19 billion to 5.39 billion yuan, and capital expenditure of 2.7 billion yuan, reflecting the company's confidence in future growth.

See More

- Share Buyback Agreement: GDS has entered into a definitive agreement with DayOne Data Centers to repurchase ordinary shares for approximately $385 million, matching the price of its recently announced Series C convertible preferred share issuance, reflecting the company's focus on investment returns.

- Investment Recovery Multiple: The transaction allows GDS to recycle about 95% of its principal investment, achieving a nearly 6.5x multiple on invested capital, indicating high efficiency and profitability in capital operations.

- Retained Minority Stake: Post-transaction, GDS will retain a minority stake valued at over $2.2 billion based on Series C pricing, which not only strengthens the company's balance sheet but also provides flexibility for future capital operations.

- Reinvestment Strategy: GDS plans to reallocate the proceeds from this buyback transaction towards new investment opportunities in its core China data center business, aiming for attractive return potential and further solidifying its market position.

See More

- Share Buyback Agreement: GDS Holdings has entered into a definitive agreement with Singapore's DayOne Data Centers to repurchase ordinary shares valued at $385 million, with the buyback price matching DayOne's recently announced $2 billion Series C convertible preferred share issuance, reflecting confidence in the investment's value.

- Investment Return Multiple: The buyback will allow GDS to recycle approximately 95% of its principal investment, achieving a return multiple of nearly 6.5 times, indicating significant success in its investment strategy within the high-performance data center sector and enhancing financial flexibility.

- Remaining Equity Value: The remaining equity interest of GDS in DayOne is valued at over $2.2 billion based on the new preferred share issuance price, equivalent to $11.18 per GDS American Depositary Share, showcasing market recognition of its future growth potential.

- Reinvestment Strategy: GDS intends to reallocate the proceeds from the buyback to invest in compelling new business opportunities within its core operations in China, aiming to capitalize on attractive return potential and further solidify its market position.

See More

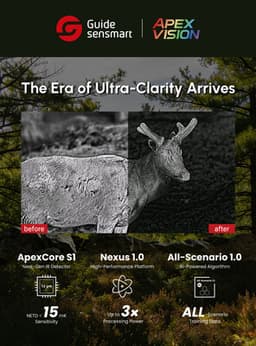

- Technological Innovation: Guide Sensmart's launch of the ApexVision thermal imaging technology at CES 2026 integrates the high-sensitivity ApexCore S1 detector and Nexus 1.0 processing platform, successfully overcoming challenges like low contrast and motion blur in complex environments, thereby significantly enhancing the clarity and precision of thermal imaging devices.

- Market Response: The live demonstrations of ApexVision at the show attracted strong attention from industry analysts and media, with professional visitors praising its reliable 'what-you-see-is-what-you-get' clarity, which is expected to directly enhance operational efficiency and decision-making confidence, indicating strong market demand for this technology.

- Wide Applications: The ApexVision technology not only improves the stability and accuracy of thermography tools (e.g., E3S and H6S thermal cameras) but also enables outdoor hunting optics (e.g., TD650LS monocular) to clearly identify wildlife in complete darkness, showcasing its broad applicability across various scenarios.

- Strategic Significance: This technology launch marks a significant breakthrough for Guide Sensmart in the thermal imaging sector, advancing the industry into the Ultra-Clarity Era and promising to provide users with safer and more efficient solutions, thereby further solidifying its market leadership.

See More

- Stock Surge: VNET Group surged 10.85% on Thursday to close at $10.32, reflecting strong investor interest in Chinese AI companies and indicating a bullish market sentiment towards the sector.

- Industry Backing: Goldman Sachs forecasts continued growth for Chinese stocks in 2026, with the MSCI China Index expected to rise by 20% and the CSI 300 Index by 12%, providing robust earnings support for VNET and its peers.

- Green Computing Initiative: VNET plans to develop 10 GW of green computing capacity over the next few years across China and overseas markets, showcasing its strategic focus on sustainability and technological innovation.

- Data Center Innovation: VNET's Hyperscale 2.0 initiative emphasizes AI data center innovation, with plans to establish MW-level racks and GW-scale campuses in regions like Inner Mongolia, Hebei, Beijing, and the Yangtze River area, further solidifying its market leadership.

See More