TechTarget gets Nasdaq non-compliance letter over delayed annual report filing

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Apr 21 2025

0mins

Source: SeekingAlpha

Compliance Notification: TechTarget received a deficiency notification from Nasdaq for failing to timely file its Annual Report on Form 10-K for the year ended December 31, 2024, but this does not immediately affect its stock listing or trading.

Plan Submission: The company has 60 days to submit a compliance plan to Nasdaq and expects to file its Form 10-K by April 29, 2025, which it anticipates will restore compliance with Nasdaq Listing Rules.

Get Free Real-Time Notifications for Any Stock

Monitor tickers like TTGT with instant alerts to capture every critical market movement.

Sign up for free to build your custom watchlist and receive professional-grade stock notifications.

Analyst Views on TTGT

Wall Street analysts forecast TTGT stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for TTGT is 11.67 USD with a low forecast of 10.00 USD and a high forecast of 15.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

3 Analyst Rating

3 Buy

0 Hold

0 Sell

Strong Buy

Current: 5.400

Low

10.00

Averages

11.67

High

15.00

Current: 5.400

Low

10.00

Averages

11.67

High

15.00

About TTGT

TechTarget, Inc., which also refers to itself as Informa TechTarget, is a business-to-business (B2B) growth accelerator that informs, influences and connects the world’s technology buyers and sellers, helping accelerate growth from R&D to return on investment (ROI). It has scale in permissioned B2B first-party data and a unique end-to-end portfolio of data-driven solutions that services the full B2B product lifecycle, from R&D to ROI: from strategy, messaging and content development to in-market activation via brand, demand generation, purchase intent data and sales enablement. In intelligence and advisory, it offers expert analyst, data-driven intelligence products and advisory services to product managers, corporate strategists and the C-suite, challenging market strategies and sharpening product roadmaps. In brand and content, it provides expert editorial, data-driven brand products and content marketing services for brand marketers, product marketers and content marketers.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

TechTarget Schedules Q4 and Full-Year 2025 Earnings Call

- Earnings Release Schedule: TechTarget will release its Q4 and full-year financial results for 2025 after market close on March 11, 2026, highlighting the company's growth potential in the B2B technology sector.

- Call Timing and Participation: CEO Gary Nugent and CFO Dan Noreck will host a conference call at 5:00 p.m. ET on the same day, allowing investors to access financial results via the company's website and engage in discussions.

- Global Dial-In Information: The conference offers dial-in options for multiple countries, including toll-free numbers for the U.S. and U.K., ensuring global investor participation and enhancing company transparency and investor relations.

- Replay Information: A replay of the conference call will be available starting one hour after the call until April 10, 2026, allowing investors who missed the live event to access key information, further strengthening communication between the company and its investors.

Continue Reading

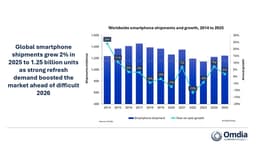

Global Smartphone Shipments Grow 2% in 2025, Led by Apple and Samsung

- Market Growth Trend: Global smartphone shipments reached 1.25 billion units in 2025, marking a 2% year-over-year increase and the highest annual volume since 2021, although Greater China saw a slight decline due to the fading subsidy effects.

- Apple's Strong Performance: Apple achieved its highest-ever shipment volume in 2025, with iPhone shipments growing 7% to 240.6 million units, maintaining its position as the world's largest vendor for the third consecutive year, particularly thriving in China with a 26% year-on-year growth.

- Samsung's Significant Rebound: After three consecutive years of decline, Samsung's shipments grew 7% year-on-year in 2025, culminating in a 16% increase in Q4, driven by strong flagship demand and a recovery in entry-level markets, indicating a positive shift in market share.

- Emerging Brands Rising: Nothing emerged as the fastest-growing vendor in 2025, with an 86% increase in shipments surpassing 3 million units, while vivo claimed the fourth spot for the first time, growing 4% to 105.3 million units, highlighting intensified market competition and brand diversification.

Continue Reading