Upcoming Ex-Dividend Dates for Avery Dennison, Linde, and SLB

Upcoming Ex-Dividend Dates: Avery Dennison Corp (AVY), Linde PLC (LIN), and SLB Ltd (SLB) will trade ex-dividend on 12/3/25, with respective dividends of $0.94, $1.50, and $0.285 scheduled for payment on 12/17/25 and 1/8/26.

Expected Price Adjustments: Following the ex-dividend date, AVY shares are expected to drop by approximately 0.55%, LIN by 0.37%, and SLB by 0.79%, based on their recent stock prices.

Dividend Yield Estimates: The estimated annualized dividend yields are 2.18% for Avery Dennison, 1.46% for Linde, and 3.15% for SLB, indicating potential stability in their dividend payments.

Current Trading Performance: As of Monday trading, shares of Avery Dennison, Linde, and SLB have seen slight increases of 0.1%, 0.6%, and 1.6%, respectively.

Discover Tomorrow's Bullish Stocks Today

Analyst Views on SLB

About SLB

About the author

Cruz Enters Joint Venture for Lithium Brine Exploration in Clayton Valley

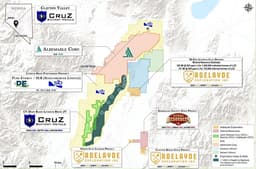

- Joint Venture Agreement: Cruz Battery Metals has signed a joint venture agreement with Sienna Resources and Adelayde Exploration to explore lithium brine potential in Clayton Valley, Nevada, covering 115 mineral claims over 2,300 acres, aimed at sharing development costs and benefits to enhance shareholder value.

- Lithium Resource Outlook: Clayton Valley hosts the only lithium brine production basin in the U.S., with Albemarle's Silver Peak lithium mine operating since the 1960s, and Cruz's new project aims to leverage this established resource, potentially boosting the company's competitive edge in the lithium market.

- Market Timing: With lithium prices surging over 150% since June 2025 and currently at a two-year high, Cruz plans to conduct a maiden resource estimate on the Solar Lithium Project, seizing this opportunity to accelerate development and significantly enhance future growth prospects.

- Technical Report Collaboration: Cruz has engaged Stantec Consulting to prepare a technical report for the Solar Lithium Project, ensuring compliance with National Instrument 43-101, which will further enhance the project's feasibility and market appeal.

Oil Prices Surge Amid Renewed Geopolitical Tensions

- Oil Price Increase: Oil prices surged approximately 1% due to President Trump's escalatory rhetoric towards Iran, with West Texas Intermediate futures nearing $63 per barrel, marking the highest level since late September 2025.

- Brent Crude Rally: Brent crude also advanced to around $68 per barrel, reflecting heightened risk premiums in global crude markets driven by fears of supply disruptions, particularly through critical energy chokepoints like the Strait of Hormuz.

- U.S. Supply Tightness: Supply disruptions from severe winter weather, particularly in the Gulf Coast and inland shale regions, have tightened near-term balances, contributing to a more than 9% increase in WTI crude this month and positioning the market to end a five-month losing streak.

- Weaker Dollar Boosts Oil: The U.S. dollar's decline towards multi-week lows has made dollar-priced commodities cheaper for foreign buyers, further supporting the rise in oil prices.