Tractor Supply Misses Q4 Earnings Estimates, Shares Drop

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 3h ago

0mins

Source: seekingalpha

- Sales Growth Weakness: Tractor Supply's Q4 sales rose 3.3% year-over-year to $3.9 billion, driven by new store openings and comparable store sales growth, yet fell short of the 3.0% analyst expectation, indicating weak market demand.

- Margin Compression: The company's gross margin rate dipped 10 basis points to 35.1%, primarily impacted by higher tariffs, increased promotional activity, and rising transportation costs, despite some offset from cost management initiatives, reflecting pressure on profitability.

- Operating Income Decline: Operating income decreased by 6.5% to $297.7 million in Q4, with EPS reported at $0.43, missing the consensus estimate of $0.46, highlighting challenges in maintaining profitability.

- Cautious Outlook: Tractor Supply anticipates full-year sales growth of 4% to 6% and EPS between $2.13 and $2.23, below the market expectation of $2.30, with the CEO emphasizing a focus on executing the 2030 strategic plan amid economic uncertainties.

Discover Tomorrow's Bullish Stocks Today

Receive free daily stock recommendations and professional analysis to optimize your portfolio's potential.

Sign up now to unlock expert insights and stay one step ahead of the market trends.

Analyst Views on TSCO

Wall Street analysts forecast TSCO stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for TSCO is 59.82 USD with a low forecast of 6.92 USD and a high forecast of 70.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

20 Analyst Rating

13 Buy

7 Hold

0 Sell

Moderate Buy

Current: 55.140

Low

6.92

Averages

59.82

High

70.00

Current: 55.140

Low

6.92

Averages

59.82

High

70.00

About TSCO

Tractor Supply Company is a rural lifestyle retailer in the United States. The Company is focused on supplying the needs of recreational farmers and ranchers. It operates retail stores under the names Tractor Supply Company and Petsense by Tractor Supply. Its stores are located in towns outlying various metropolitan markets and in rural communities. It also offers an expanded assortment of products through the Tractor Supply mobile application and online at TractorSupply.com and Petsense.com. The Company's selection of merchandise consists of various product categories, including livestock, equine and agriculture; companion animal; seasonal and recreation; truck, tool, and hardware, and clothing, gift, and decor. Its brands consist of 4health, American Farmworks, Bit & Bridle, Blue Mountain, C.E. Schmidt, Country Lane, Countyline, Country Tuff, Dumor, Farm Table, Groundwork, Huskee, and JobSmart.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

Tractor Supply Reports Quarterly Miss Amid Consumer Spending Shift

- Quarterly Performance Decline: Tractor Supply reported fourth-quarter earnings per share of 43 cents, missing the analyst consensus of 47 cents, with sales of $3.898 billion falling short of the $4 billion expectation, indicating a shift in consumer spending towards essentials that impacted overall performance.

- Margin Pressure: Gross profit rose 3% to $1.37 billion, yet gross margin edged down to 35.1% due to rising tariffs, promotions, and transportation costs, highlighting challenges in cost control for the company.

- New Store Openings and Inventory: The company opened 31 new Tractor Supply stores and one Petsense store in Q4, with total inventory at $3.08 billion and cash equivalents at $194.109 million, indicating a balance between expansion and liquidity management.

- Cautious Future Outlook: Tractor Supply expects fiscal 2026 GAAP earnings between $2.13 and $2.23 per share, lower than the $2.32 analyst estimate, with projected net sales growth of 4% to 6%, reflecting a cautious stance towards future market conditions.

Continue Reading

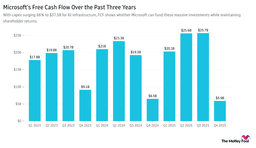

Microsoft Shares Drop as Spending Surges

- Microsoft Performance Decline: Microsoft (MSFT) shares fell over 5% in pre-market trading due to disappointing quarterly results, despite a 39% growth in Azure cloud revenue and a 66% increase in capital expenditures, highlighting a tension between significant AI investments and market concerns.

- AI Investment Confidence: CEO Satya Nadella reassured investors that Microsoft's AI business has surpassed some major franchises, indicating strong future growth potential, especially as cloud orders exceed capacity, despite fears of an AI bubble.

- Mineral Stocks Drop: Stocks like MP Materials and United States Antimony Corp fell nearly 10% in early trading after the U.S. government walked back plans to guarantee minimum prices for critical minerals, reflecting a negative impact on market confidence due to policy shifts.

- Consumer Spending Shift: Tractor Supply (TSCO) dropped over 5% after reporting results below expectations, citing a shift in consumer spending as net income remained flat year-over-year, indicating pressure on the retail sector from the current economic environment.

Continue Reading