SP& 500 29,3 2024

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Mar 29 2024

0mins

Should l Buy SPGI?

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy SPGI?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on SPGI

Wall Street analysts forecast SPGI stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for SPGI is 617.77 USD with a low forecast of 546.00 USD and a high forecast of 675.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

15 Analyst Rating

14 Buy

1 Hold

0 Sell

Strong Buy

Current: 390.760

Low

546.00

Averages

617.77

High

675.00

Current: 390.760

Low

546.00

Averages

617.77

High

675.00

About SPGI

S&P Global Inc. provides essential intelligence. Its operations consist of five businesses: S&P Global Market Intelligence (Market Intelligence), S&P Global Ratings (Ratings), S&P Global Commodity Insights (Commodity Insights), S&P Global Mobility (Mobility) and S&P Dow Jones Indices (Indices). Market Intelligence is a global provider of multi-asset-class data and analytics integrated with purpose-built workflow solutions. Ratings is an independent provider of credit ratings, research, and analytics, offering investors and other market participants information, ratings and benchmarks. Commodity Insights is an independent provider of information and benchmark prices for the commodity and energy markets. Mobility is a provider of solutions serving the full automotive value chain, including vehicle manufacturers and retailers. Indices is a global index provider that maintains a variety of valuation and index benchmarks for investment advisors, wealth managers and institutional investors.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Significant Revenue Growth: S&P Global reported a 9% revenue increase in Q4 2025, with organic constant currency revenue rising 8%, indicating strong performance across all divisions and enhancing market competitiveness.

- Earnings Per Share Increase: Adjusted diluted EPS grew by 14%, with full-year EPS reaching the high end of guidance, demonstrating the company's ability to control costs while making strategic investments that strengthen its financial foundation.

- Clear Strategic Objectives: Management outlined three main strategic goals, including advancing market leadership, expanding into high-growth areas like private markets and decentralized finance, and amplifying enterprise capabilities, with over 95% of revenue expected to be tied to proprietary benchmarks and critical workflow tools, indicating future growth potential.

- Cautious Future Outlook: While projecting organic constant currency revenue growth of 6% to 8% for 2026, management expressed caution regarding market-driven business components, emphasizing that macroeconomic and geopolitical risks could temper issuance volumes, necessitating diversification and technology investments to mitigate risks.

See More

- Earnings Report: S&P Global Inc. reported mixed fourth-quarter earnings, leading to a decline in its share price.

- Market Concerns: The drop in shares was influenced by recent concerns over profitability and growth in the software sector.

See More

- Software Sector Hit: The iShares Tech-Expanded Software Sector ETF (NYSE:IGV) has plummeted nearly 20% year-to-date, making it the worst-performing industry, as fears mount that AI tools could disintermediate traditional software providers, causing forward P/E ratios for application software to drop from 35.3 to 23.7 and systems software from 35.5 to 23.3, reflecting market concerns over future earnings durability.

- Brokerage Pressure: Investment banks and brokerage firms are under pressure following the rollout of AI tools by fintech firm Altruist, with forward P/E ratios declining from 24.7 to 15.9, as the market fears that AI could replace traditional advisors in the future, leading to long-term margin compression.

- Insurance Broker Anxiety: Insurance brokers are facing disruption due to the integration of AI-driven tools, with the S&P Insurance Brokers industry index down 4% year-to-date; while the insurance sector remains relationship-driven, there are concerns that AI could erode commissions, impacting brokers' income stability.

- Asset Management Damage: Alternative asset managers are indirectly affected by significant exposure to private software companies, with many large firms down double digits year-to-date, as declining public software valuations raise concerns about their private portfolios, shrinking exit opportunities.

See More

- Urgent Warning Issued: Fiat Chrysler Automobiles has issued a sweeping 'Do Not Drive' warning for all vehicles with unrepaired Takata airbags, affecting approximately 225,000 vehicles on U.S. roads, highlighting the life-threatening risks and urging owners to check their recall status immediately.

- Recall History: CARFAX data reveals that over 5 million vehicles nationwide still carry defective Takata airbags more than a decade after the National Highway Traffic Safety Administration (NHTSA) initiated the nationwide recall, indicating a significant lag in recall efforts.

- Widespread Impact: This warning not only affects FCA customers but may also trigger broader public safety concerns, prompting other automakers to reassess their airbag recall statuses, thereby impacting the reputation of the entire automotive industry.

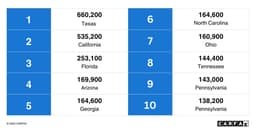

- State Distribution: The alert mentions the top ten states with the most unrepaired Takata airbags, further emphasizing regional safety hazards, which could lead local governments and transportation departments to implement stricter regulatory measures to protect public safety.

See More

- Urgent Warning Issued: Fiat Chrysler Automobiles has issued a 'Do Not Drive' warning for approximately 225,000 vehicles with unrepaired Takata airbags, emphasizing the life-threatening potential and urging owners to check their recall status immediately for safety.

- Defective Vehicle Count: CARFAX data reveals that over 5 million vehicles nationwide still carry defective Takata airbags, highlighting the urgency and complexity of the recall efforts initiated by the National Highway Traffic Safety Administration (NHTSA) over a decade ago.

- Fatal Risk Alert: Prior to FCA's warning, more than 630,000 vehicles in the U.S. were already under a 'Do Not Drive' order, indicating widespread safety hazards that could lead to serious injuries or fatalities, not all of which are related to Takata airbags.

- Public Awareness Initiative: The Vehicle Recall Search Service, developed by CARFAX in partnership with the Alliance for Automotive Innovation, aims to raise awareness about unrepaired recalls, with participating states including California, Texas, and New York, thereby helping to reduce the number of unrepaired recalls nationwide.

See More

- Dow Jones Slightly Up: The Dow Jones Industrial Average rose by 0.1% to close at 50,188.14, indicating a slight optimism in the market despite mixed overall performance across major indices.

- Spotify Stock Surge: Spotify's stock jumped 14.75% to $476.02, with first-quarter revenue guidance of EUR 4.5 billion, reflecting strong user growth and market confidence, as Goldman Sachs reiterated a Buy rating with a $700 price target.

- S&P Global Performance Decline: S&P Global's stock fell 9.71% to $401.08, despite a 9% year-over-year revenue increase to $3.916 billion in Q4, as adjusted EPS slightly missed expectations, leading to diminished investor confidence.

- Intel Stock Drop: Intel's stock decreased by 6.19% to $47.13, reflecting market concerns over future growth, despite a 52-week range of $54.60 to $17.67, indicating significant volatility.

See More