TikTok US Deal Valued at Just $14B

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 6d ago

0mins

The TikTok US deal values it at just around $14B, a source confirms to Axios, Sara Fischer and Christine Wang report. Fischer and Wang note that this is an "extremely low price" given that TikTok's U.S. entity makes roughly $14B annually in advertising revenues alone, per analyst estimates. Under the terms of the deal, Oracle (ORCL), private equity firm Silver Lake and Abu Dhabi-based investment firm MGX will collectively own 45% of the U.S. entity, which will be called "TikTok USDS Joint Venture LLC."

Discover Tomorrow's Bullish Stocks Today

Receive free daily stock recommendations and professional analysis to optimize your portfolio's potential.

Sign up now to unlock expert insights and stay one step ahead of the market trends.

Analyst Views on ORCL

Wall Street analysts forecast ORCL stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for ORCL is 309.59 USD with a low forecast of 180.00 USD and a high forecast of 400.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

34 Analyst Rating

25 Buy

9 Hold

0 Sell

Moderate Buy

Current: 172.800

Low

180.00

Averages

309.59

High

400.00

Current: 172.800

Low

180.00

Averages

309.59

High

400.00

About ORCL

Oracle Corporation offers integrated suites of applications plus secure, autonomous infrastructure in the Oracle Cloud. The Company operates through three businesses: cloud and license, hardware and service. Its cloud and license business is engaged in the sale, marketing and delivery of its enterprise applications and infrastructure technologies through cloud and on-premise deployment models including its cloud services and license support offerings, and its cloud license and on-premise license offerings. Its hardware business provides infrastructure technologies including Oracle Engineered Systems, servers, storage, industry-specific hardware, operating systems, virtualization, management and other hardware-related software to support diverse IT environments. Its services business provides services to customers and partners to help maximize the performance of their investments in Oracle applications and infrastructure technologies.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

Oracle's Cloud Market Share Growth and Financial Outlook

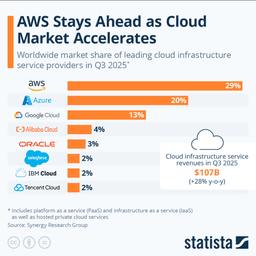

- Cloud Market Share Increase: Oracle's focus on high-performance computing has raised its cloud market share from 2% in 2024 to 3%, showcasing a competitive edge in a $944 billion industry, with expectations for further growth by 2026.

- Strong Financial Performance: For the first half of fiscal 2026 ending November 30, 2025, Oracle's cloud segment generated over $15 billion in revenue, a 31% year-over-year increase, driving overall revenue to $31 billion with the cloud segment accounting for 49%.

- Future Growth Potential: Analysts forecast a 17% revenue growth for fiscal 2026 and 29% for the following year, which could enhance Oracle's stock performance despite its current debt of $108 billion.

- Strategic Investment Returns: While Oracle's heavy investment in cloud infrastructure has increased its debt, its P/E ratio of 33 is close to the S&P 500 average of 31, indicating market confidence in its future growth prospects.

Continue Reading

Oracle OPERA Cloud Approved by IHG for Enhanced Hospitality Management

- Platform Approval: Oracle's OPERA Cloud has been approved by IHG Hotels & Resorts as a cloud-based property management system for the Americas and EMEAA regions, marking a deepening of their long-standing collaboration and enhancing franchisee technology decision-making flexibility.

- Operational Standardization: IHG properties utilizing OPERA Cloud will standardize their operations and data on a common platform, thereby enhancing visibility and intelligence to ensure consistent, high-value interactions for guests and loyalty members.

- Technological Innovation: Oracle's OPERA Cloud offers proven scalability and user-friendly features that empower data-driven decision-making, streamline operations, and enhance experiences for both guests and staff, thereby strengthening market competitiveness.

- Global Support: Currently live in 236 countries and territories, OPERA Cloud supports fiscal compliance and helps hotels maintain high operational standards with enterprise-class reliability and continuous innovation, minimizing IT intervention needs.

Continue Reading