Tenable Reports Strong Q4 2025 Earnings with AI Focus

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 2d ago

0mins

Should l Buy TENB?

Source: seekingalpha

- Revenue Growth: Tenable reported $260.5 million in revenue for Q4 2025, marking an 11% year-over-year increase, with full-year growth also at 11%, indicating strong market performance.

- AI Strategy Advancement: The appointment of new CTO Vlad Korsunsky is seen as pivotal for advancing the company's AI strategy and innovation, particularly in enhancing AI-driven remediation capabilities, highlighting the company's commitment to future technological developments.

- Surge in Customer Demand: Tenable One accounted for 46% of new business this quarter, reflecting strong customer demand for AI-driven security solutions and further solidifying the company's leadership position in the industry.

- Increased Shareholder Returns: The company announced a $150 million increase in its share repurchase authorization, bringing the total to $338 million, demonstrating management's confidence in future cash flows and shareholder returns.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy TENB?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on TENB

Wall Street analysts forecast TENB stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for TENB is 36.50 USD with a low forecast of 28.00 USD and a high forecast of 45.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

18 Analyst Rating

11 Buy

7 Hold

0 Sell

Moderate Buy

Current: 19.760

Low

28.00

Averages

36.50

High

45.00

Current: 19.760

Low

28.00

Averages

36.50

High

45.00

About TENB

Tenable Holdings, Inc. is an exposure management company. It unifies security visibility, insight and action across this attack surface, equipping modern organizations to expose and close the cybersecurity gaps that erode business value, reputation and trust. The Company’s Tenable One is an AI-powered exposure management platform that gives enterprises a single, unified view of risk across all types of assets and attack pathways. The platform combines broad, vulnerability coverage, spanning information technology (IT) assets, cloud resources, containers, Web apps and identity systems. Tenable One integrates Tenable Vulnerability Management, Tenable Cloud Security, Tenable Identity Exposure, Tenable Web App Scanning, Tenable Lumin Exposure View, Tenable Attack Surface Management, Tenable Security Center and Tenable OT Security. Its Nessus product line deploys vulnerability assessment solutions in the cybersecurity industry and underpins its enterprise platform.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Revenue Growth: Tenable reported $260.5 million in revenue for Q4 2025, marking an 11% year-over-year increase, with full-year growth also at 11%, indicating strong market performance.

- AI Strategy Advancement: The appointment of new CTO Vlad Korsunsky is seen as pivotal for advancing the company's AI strategy and innovation, particularly in enhancing AI-driven remediation capabilities, highlighting the company's commitment to future technological developments.

- Surge in Customer Demand: Tenable One accounted for 46% of new business this quarter, reflecting strong customer demand for AI-driven security solutions and further solidifying the company's leadership position in the industry.

- Increased Shareholder Returns: The company announced a $150 million increase in its share repurchase authorization, bringing the total to $338 million, demonstrating management's confidence in future cash flows and shareholder returns.

See More

- Strong Earnings Report: Tenable reported adjusted earnings per share of $0.48 for Q4 2025, exceeding the consensus estimate of $0.41, indicating improved profitability and operational execution.

- Revenue Growth: The company achieved revenue of $260.5 million for the quarter, surpassing the $251.8 million estimate, reflecting strong market performance and increased customer demand.

- Positive Outlook: Tenable expects revenue for the ongoing quarter to range from $257 million to $260 million, exceeding the analyst estimate of $255.6 million, demonstrating confidence in future growth prospects.

- Share Repurchase Program: The company announced a $150 million share repurchase program, aimed at enhancing shareholder value and signaling confidence in its stock performance.

See More

- Earnings Announcement Schedule: Tenable Holdings (TENB) is set to announce its Q4 earnings on February 4 after market close, with consensus EPS estimate at $0.41 and revenue at $251.82 million, reflecting a 6.8% year-over-year growth, indicating the company's stability in ongoing growth.

- Historical Performance: Over the past two years, TENB has exceeded EPS and revenue estimates 100% of the time, showcasing the company's reliability and execution strength in financial forecasting, which boosts investor confidence.

- Estimate Revision Dynamics: In the last three months, EPS estimates saw no upward revisions and two downward revisions, while revenue estimates experienced two upward revisions with none downward, reflecting market divergence regarding TENB's future performance, which may influence investor decisions.

- Market Focus: With Tenable's presentations at Barclays and UBS Global Technology Conferences, market anticipation for its future development is high, despite Needham highlighting potential headwinds, investors remain optimistic about its improved execution and margins.

See More

- Surge in Defense Spending: U.S. defense tech spending is projected to reach $384 billion in 2026, a 71% increase from 2020, creating a high-conviction investment environment for the Electronic Design Automation (EDA) market, expected to hit $33.5 billion by 2033.

- IP Transfer Milestone: VisionWave's joint venture with Boca Jom Ltd. has completed the transfer of three EDA tools' intellectual property, including system architectures and source code, which will directly facilitate the final development, testing, and integration phases, addressing critical bottlenecks in chip manufacturing.

- Advancements in RF Imaging: VisionWave has assembled a specialized team of RF experts to advance its VisionRF platform, aimed at providing real-time situational awareness, with a proof-of-concept demonstration targeting applications in emergency response and military operations, enhancing the company's competitive edge in security.

- Expansion into Southern Europe: VisionWave has secured distribution agreements in Italy and Spain through its subsidiary Solar Drone Ltd. for critical infrastructure maintenance markets, planning to invest up to $10 million over the next six to twelve months to accelerate commercialization timelines across its technology platform.

See More

- Surge in Defense Spending: U.S. defense tech spending is projected to reach $384 billion in 2026, a 71% increase from 2020, creating a high-conviction investment environment for the Electronic Design Automation (EDA) market, expected to hit $33.5 billion by 2033.

- IP Transfer Milestone: VisionWave Holdings completed the transfer of three EDA tool IP portfolios in its joint venture with Boca Jom Ltd., covering complete system architectures and development methodologies, which is expected to accelerate semiconductor design processes and reduce design errors.

- Advancement in RF Imaging Systems: VisionWave has assembled a specialized team of RF experts to advance its VisionRF platform, aimed at providing real-time situational awareness for emergency response and military operations, with a proof-of-concept demonstration planned.

- Expansion into Southern Europe: VisionWave secured distribution agreements in Italy and Spain through its Solar Drone Ltd. subsidiary for critical infrastructure maintenance markets, planning to invest up to $10 million over the next six to twelve months to accelerate commercialization timelines across its technology platform.

See More

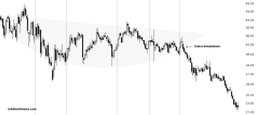

- Stock Decline Trend: Tenable's stock has declined over 44% in recent months, with selling pressure intensifying as it moves deeper into its current structural window, indicating a pessimistic market outlook for its future performance.

- Adhishthana Cycle Analysis: Currently in Phase 10 of an 18-phase Adhishthana cycle, the recent weakness is not random but reflects a larger structural shift that investors should take seriously.

- Cakra Structure Breakdown: Entering a Cakra structure in September 2021, Tenable was expected to break out in Phase 9; however, it sharply reversed and broke below the Cakra, leading to intensified selling pressure and a highly bearish market signal.

- Cautious Investor Outlook: Following the Cakra breakdown, Tenable's decline should be viewed as a normal reaction, and investors are advised to approach the stock with caution, avoiding aggressive dip-buying strategies as risks remain skewed to the downside.

See More