SoFi Reports Q4 Earnings Exceeding Expectations

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 1h ago

0mins

Source: Yahoo Finance

- Significant Earnings Growth: SoFi reported earnings of 13 cents per share for the December quarter, marking a 160% increase year-over-year, which underscores the company's robust performance in the fintech sector and boosts investor confidence.

- Revenue Surge: The company achieved a net adjusted revenue of $1.025 billion, up 40% year-over-year, reflecting SoFi's success in user growth and product diversification, further solidifying its market position.

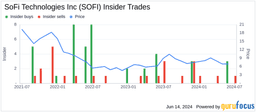

- Market Volatility: Although SoFi's stock initially rose by 5% following the earnings report, it reversed course after the earnings call with Wall Street analysts, indicating a cautious market sentiment regarding future outlooks that could affect investor mood.

- Analyst Attention: The earnings report sparked discussions among analysts about SoFi's future growth potential; despite short-term stock fluctuations, the long-term outlook remains positive, potentially attracting more investor interest.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy SOFI?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on SOFI

Wall Street analysts forecast SOFI stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for SOFI is 28.31 USD with a low forecast of 18.00 USD and a high forecast of 38.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

14 Analyst Rating

5 Buy

6 Hold

3 Sell

Hold

Current: 24.360

Low

18.00

Averages

28.31

High

38.00

Current: 24.360

Low

18.00

Averages

28.31

High

38.00

About SOFI

SoFi Technologies, Inc. is a member-centric, one-stop shop for digital financial services. The Company, through its lending and financial services products, allows members to borrow, save, spend, invest and protect their money. The Company's segments include Lending, Technology Platform and Financial Services. The Lending segment offers personal loans, student loans, home loans and related servicing to help its members with a variety of financial needs. Its platform supports the full transaction lifecycle, including credit application, underwriting, approval, funding and servicing. The Technology Platform segment provides services through a diversified suite of offerings which include an event and authorization platform accessed via application programming interfaces, a cloud-native digital and core banking platform and services related to both platforms. The Financial Services segment offers a suite of financial services solutions, including SoFi Money and SoFi Invest.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

SoFi Technologies Reports Record Growth in Q4 2025 Earnings Call

- Significant Member Growth: SoFi added 1 million members in Q4 2025, bringing the total to 13.7 million, which is over 20 times the 650,000 members in 2018, reflecting the company's strong market appeal and brand awareness rising to nearly 10%.

- Record Financial Performance: The adjusted net revenue for 2025 reached $3.6 billion, a 38% year-over-year increase, with adjusted EBITDA of $1.1 billion marking the first time surpassing $1 billion, and net income of $481 million, showcasing a significant improvement in profitability.

- New Product Launches: SoFi introduced SoFi Pay leveraging blockchain, relaunched SoFi Crypto, and debuted SoFi USD, its own stablecoin, further expanding its product offerings and enhancing its competitive edge, particularly in the crypto and payments sectors.

- Optimistic Future Outlook: Management expects adjusted net revenue for 2026 to be approximately $4.655 billion, reflecting a 30% year-over-year growth, and plans to achieve at least 30% compounded annual revenue growth from 2025 to 2028, demonstrating strong confidence in future growth prospects.

Continue Reading

SoFi Reports Q4 Earnings Exceeding Expectations

- Significant Earnings Growth: SoFi reported earnings of 13 cents per share for the December quarter, marking a 160% increase year-over-year, which underscores the company's robust performance in the fintech sector and boosts investor confidence.

- Revenue Surge: The company achieved a net adjusted revenue of $1.025 billion, up 40% year-over-year, reflecting SoFi's success in user growth and product diversification, further solidifying its market position.

- Market Volatility: Although SoFi's stock initially rose by 5% following the earnings report, it reversed course after the earnings call with Wall Street analysts, indicating a cautious market sentiment regarding future outlooks that could affect investor mood.

- Analyst Attention: The earnings report sparked discussions among analysts about SoFi's future growth potential; despite short-term stock fluctuations, the long-term outlook remains positive, potentially attracting more investor interest.

Continue Reading