Significant ETF Withdrawals: TCAF, PTC, BDX, ROP

TCAF Stock Performance: TCAF's share price has a 52-week low of $28.28 and a high of $37.10, with the last trade recorded at $36.86.

200-Day Moving Average: The article suggests using the 200-day moving average as a technical analysis tool to compare recent share prices.

ETFs Trading Mechanism: Exchange-traded funds (ETFs) function like stocks but involve trading 'units' that can be created or destroyed based on investor demand.

Monitoring ETF Flows: Weekly monitoring of ETFs is conducted to observe significant inflows or outflows, which can affect the underlying assets held within those ETFs.

Trade with 70% Backtested Accuracy

Analyst Views on PTC

About PTC

About the author

- System Upgrade: SPG Company has opted to replace its legacy PLM system with PTC's FlexPLM, aiming to leverage a cloud-based platform that supports faster development cycles and consistent data management, thereby enhancing overall operational efficiency.

- Business Expansion Needs: As SPG's product portfolio and customer base continue to grow, the complexity and customization of its legacy PLM system have limited performance; the implementation of FlexPLM will address issues of data inconsistency and workflow bottlenecks, facilitating business growth.

- Cross-Department Collaboration: The introduction of FlexPLM is set to improve data accuracy and cross-department collaboration, enabling SPG's designers and product developers to work more efficiently, thus accelerating product development cycles and enhancing market responsiveness.

- Vision for Intelligent Product Lifecycle: PTC is advancing its vision for the Intelligent Product Lifecycle through FlexPLM, allowing SPG to utilize product data to accelerate AI-driven transformation, improve product quality, and better meet compliance standards.

- System Upgrade: SPG Company has chosen to replace its complex legacy PLM system with PTC's FlexPLM, aiming to leverage a cloud-based platform that supports faster development cycles and consistent data management, thereby enhancing overall product development efficiency.

- Business Expansion Needs: As SPG's customer base and product portfolio continue to grow, the company requires a scalable, enterprise-grade PLM platform to support its rapidly expanding licensed product business, ensuring it remains competitive in the market.

- Workflow Optimization: The implementation of FlexPLM is expected to address SPG's challenges with data inconsistency and workflow bottlenecks, accelerating product development cycles and improving cross-functional collaboration, which will enhance the company's market responsiveness.

- Foundation for Future Growth: By establishing a reliable product data foundation, SPG can better manage product complexity and accelerate AI-driven transformation, ensuring the rapid launch of high-quality products while meeting compliance standards.

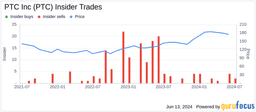

Share Sale Announcement: Kristian Talvitie plans to sell 28,196 shares of PTC Inc. on February 6, with a total market value of approximately $4.39 million.

Reduction in Shareholding: Talvitie has reduced his shareholding in PTC Inc. by 54,949 shares since December 5, 2025, with a total value of around $9.52 million.

- Strong Financial Performance: PTC reported a constant currency ARR of $2.341 billion in Q1, reflecting a 9% year-over-year growth, while including Kepware and ThingWorx, the ARR reached $2.5 billion, up 8.4%, indicating robust market growth and solid cash flow performance.

- Share Repurchase Program: The company repurchased $200 million of common stock in Q1 and plans to increase buybacks to $250 million in Q2, aiming to reduce the diluted share count to approximately 119 million shares, thereby enhancing shareholder value and market confidence.

- Accelerating Strategic Transformation: Management emphasized that PTC is at a strategic inflection point with accelerating product roadmap releases and record deferred ARR under contract, showcasing the company's strong demand capture capabilities under its Intelligent Product Lifecycle vision.

- Optimistic Future Outlook: CFO DiRico reaffirmed fiscal 2026 ARR growth guidance of 7.5%-9.5% and projected Q2 free cash flow between $310 million and $315 million, reflecting the company's confidence in future performance and ongoing financial health.

- Earnings Announcement: PTC is set to release its Q1 earnings report on February 4, with consensus EPS estimates at $1.56, reflecting a 41.8% year-over-year increase, which could further solidify its profitability in the industry.

- Revenue Expectations: The anticipated revenue of $634.33 million represents a 12.3% year-over-year growth, indicating that the company is maintaining strong performance in a continuously growing market, potentially attracting more investor interest.

- Historical Performance: Over the past two years, PTC has achieved a 100% accuracy rate in EPS estimates and an 88% accuracy rate in revenue estimates, showcasing its strong forecasting capabilities and enhancing market confidence in its future performance.

- Estimate Revision Dynamics: In the last three months, EPS estimates have seen 8 upward revisions and 4 downward revisions, while revenue estimates experienced 5 upward and 7 downward revisions, reflecting varying market perceptions of PTC's future performance, which may influence investor decisions.

- Surge in Natural Gas Demand: The massive snowstorm has led to a significant rise in natural gas demand, drawing attention to midstream companies like Targa Resources, whose stock is nearing all-time highs, reflecting market interest in energy infrastructure.

- Strong Performance by Targa Resources: Targa Resources reported a record adjusted EBITDA of $1.27 billion for Q3 2025, a 19% year-over-year increase, with net income reaching $478.4 million, showcasing robust growth in the natural gas transmission sector.

- Devon Energy Merger Talks: Devon Energy achieved an oil production average of 390,000 barrels per day in Q3 2025 and is in discussions to merge with Coterra Energy, potentially creating a $57 billion independent U.S. shale producer, indicating a trend towards industry consolidation.

- Corteva Raises Guidance: Corteva has raised its full-year 2025 EBITDA guidance to between $3.8 billion and $3.9 billion, representing a 14% growth, highlighting strong performance and renewed market confidence in the agricultural sector.