Shell CEO Exceeds Expectations in Three Years of Leadership

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 4d ago

0mins

Should l Buy PWP?

Source: CNBC

- Earnings Beat: Shell has exceeded earnings expectations in five of the last eight quarters, notably reporting $5.4 billion in Q3 last year, surpassing the $5.1 billion forecast, highlighting its operational resilience amid falling oil prices.

- Share Buyback Program: The company has announced over $3 billion in share buybacks for 16 consecutive quarters, establishing itself as a best-in-class performer in capital discipline, despite the challenges posed by declining crude prices.

- Cost Control Targets: Shell raised its cost reduction target from $2-3 billion to $5-7 billion by 2028 and lowered its capital expenditure target from $22-25 billion to $20-22 billion, indicating a strong focus on maintaining financial health in a volatile market.

- Investment Enthusiasm in Nigeria: Shell's investments in Nigeria have reached $5 billion, including the Bonga North deepwater project and HI gas field, reflecting a strategic pivot towards the region that could enhance its global energy market position.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy PWP?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on PWP

Wall Street analysts forecast PWP stock price to fall over the next 12 months. According to Wall Street analysts, the average 1-year price target for PWP is 20.00 USD with a low forecast of 20.00 USD and a high forecast of 20.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

1 Analyst Rating

0 Buy

1 Hold

0 Sell

Hold

Current: 21.530

Low

20.00

Averages

20.00

High

20.00

Current: 21.530

Low

20.00

Averages

20.00

High

20.00

About PWP

Perella Weinberg Partners is an independent advisory company that provides strategic and financial advice to clients across active industry sectors and international markets. Its single business segment is to provide advisory services, including advice related to strategic and financial decisions, mergers and acquisitions execution, shareholder engagement advisory, financing and capital solutions advice, with a focus on restructuring and liability management, capital markets advisory, and private capital placement, as well as specialized underwriting and research services for the energy and related industries. Its range of global clients includes large public multinational corporations, mid-sized public and private companies, financial sponsors, individual entrepreneurs, private and institutional investors, creditor committees and government institutions. Its areas of industry focus include consumer and retail, energy & energy transition, financial services & fintech, and others.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Significant Revenue Growth: Perella Weinberg Partners reported full-year revenues of $751 million and fourth-quarter revenues of $219 million, marking the third-highest revenue year in the firm's 20-year history, demonstrating strong business resilience amid market fluctuations.

- Innovative Talent Investment: The firm added 23 senior bankers in 2025 and two more partners in early 2026, indicating a proactive strategy in recruiting and promoting talent aimed at enhancing service quality and market competitiveness.

- Robust Shareholder Returns: In 2025, the company returned over $163 million to equity holders through dividends, RSU settlements, and share repurchases, retiring 6.5 million shares, reflecting strong capital management practices.

- Optimistic Outlook: Management expressed confidence in 2026, anticipating continued benefits from strong client demand and record-high business pipelines, particularly in large-scale M&A transactions, indicating significant growth potential ahead.

See More

- Quarterly Dividend Announcement: Perella Weinberg Partners has declared a quarterly dividend of $0.07 per share, consistent with previous distributions, demonstrating the company's ongoing ability to maintain stable cash flow, which is likely to attract income-seeking investors.

- Dividend Yield: The forward yield of 1.3% reflects the company's appeal in the current market environment, potentially increasing investor interest in its stock, especially in a low-interest-rate context.

- Consistent Dividend Record: The company has now announced a $0.07 dividend for nineteen consecutive quarters, indicating consistency and stability in its dividend policy, which enhances investor confidence in its financial health.

- Shareholder Record Dates: The dividend will be payable on March 9, with a record date of February 17 and an ex-dividend date also on February 17, ensuring shareholders receive their dividends promptly, further solidifying the relationship between the company and its investors.

See More

- Earnings Beat: Perella Weinberg Partners reported a Q4 non-GAAP EPS of $0.17, exceeding expectations by $0.07, indicating the company's ability to maintain profitability in a competitive market.

- Revenue Performance: The company's Q4 revenue reached $219 million, a 3.1% year-over-year decline, yet it surpassed analyst expectations by $47.36 million, demonstrating relative revenue stability amid challenging market conditions.

- Dividend Declaration: The Board of Directors declared a quarterly dividend of $0.07 per share, payable on March 9, 2026, to Class A common stockholders of record on February 17, 2026, reflecting the company's commitment to shareholder returns.

- Market Environment Challenges: Despite facing year-over-year challenges, the company did not experience significant sequential declines, showcasing its resilience and adaptability in the current economic landscape.

See More

- Earnings Beat: Shell has exceeded earnings expectations in five of the last eight quarters, notably reporting $5.4 billion in Q3 last year, surpassing the $5.1 billion forecast, highlighting its operational resilience amid falling oil prices.

- Share Buyback Program: The company has announced over $3 billion in share buybacks for 16 consecutive quarters, establishing itself as a best-in-class performer in capital discipline, despite the challenges posed by declining crude prices.

- Cost Control Targets: Shell raised its cost reduction target from $2-3 billion to $5-7 billion by 2028 and lowered its capital expenditure target from $22-25 billion to $20-22 billion, indicating a strong focus on maintaining financial health in a volatile market.

- Investment Enthusiasm in Nigeria: Shell's investments in Nigeria have reached $5 billion, including the Bonga North deepwater project and HI gas field, reflecting a strategic pivot towards the region that could enhance its global energy market position.

See More

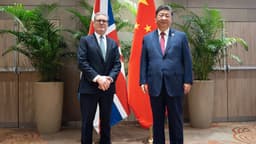

- Trade Relationship Review: In 2015, then-Chancellor Osborne predicted UK exports to China would exceed £30 billion, yet actual exports in 2020 were only £14.5 billion, a 39% drop from 2019, highlighting the significant impact of Brexit and the pandemic on trade.

- High-Level Visit Context: Starmer's trip marks the first visit by a UK Prime Minister since Theresa May eight years ago, aiming to reset relations with China and attract more investment to support the UK's economic recovery.

- Business Delegation Participation: Accompanying Starmer are executives from top UK firms like BP, Rolls-Royce, and AstraZeneca, underscoring the government's commitment to strengthening economic ties with China, particularly in the green energy sector.

- Human Rights Issues Addressed: Starmer is expected to raise human rights concerns with Xi, including the case of imprisoned Hong Kong businessman Jimmy Lai, indicating that while seeking to reset relations, the UK government remains attentive to moral and security issues with China.

See More

- Trump's Threat: Trump accused the UK of showing 'great stupidity and total weakness' in ceding sovereignty of the Chagos Islands to Mauritius, which has strained the special relationship and could impact future diplomatic interactions.

- Tariff Risks: Prime Minister Starmer emphasized he does not support retaliatory tariffs in response to Trump's threats against eight European countries, highlighting the importance of maintaining ties with the US, despite potential domestic criticism.

- Economic Dependence: In 2024, UK goods exports to the US totaled $68.2 billion, with the automotive sector alone accounting for £10 billion ($13.4 billion), underscoring the UK's significant economic reliance on the US market.

- Market Reaction: Following Trump's remarks, investors began selling off US assets in favor of safe-haven investments like gold, reflecting market anxiety over future trade relations and the potential for a slowdown in UK economic growth.

See More