Movado Group to Hold Q3 2026 Earnings Conference Call at 9:00 AM ET

Conference Call Announcement: Movado Group (MOV) will hold a conference call on November 25, 2025, at 9:00 AM ET to discuss its Q3 26 earnings results.

Access Information: The live webcast can be accessed at Movado Group's investor relations website, and listeners can join the call by dialing (877) 407-0784 with Conference ID 85359.

Replay Details: For those who wish to listen to a replay of the call, they can dial (844) 512-2921 and use Conference ID 13757189.

Disclaimer: The opinions expressed in the announcement are those of the author and do not necessarily reflect the views of Nasdaq, Inc.

Trade with 70% Backtested Accuracy

Analyst Views on MOV

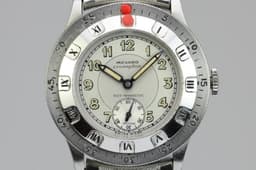

About MOV

About the author

Three Overlooked Stocks That Wall Street Supports—And There's a Good Reason Why

Market Trends: Despite major gains by smaller mega-cap tech firms in 2025, investors are increasingly looking at lesser-known stocks with strong potential, such as Lumentum Holdings and AST SpaceMobile, which have shown impressive growth.

Movado Group Performance: Movado Group has reported steady growth in sales and operating income, despite facing challenges from tariffs. The company remains optimistic about its brand strength and product momentum, with expectations for significant earnings growth in the coming year.

Nomad Foods Outlook: Nomad Foods experienced a tough year in 2025, with declining shares due to reduced promotions and weather challenges. However, the company is optimistic about new leadership and goals for accelerating organic growth, aiming to maintain strong cash flow and dividend yields.

Mosaic Company Challenges: Mosaic Company has faced a significant decline in shares due to tariff impacts and changes in global trade patterns. Despite these challenges, demand for agricultural products remains strong, and analysts predict potential recovery in share prices as the company navigates the changing ecosystem.

Ideal Stock Portfolio: December 2025 Update

Global Market Trends: Investors are currently favoring narratives over financial fundamentals, leading to many companies trading below their book value despite strong balance sheets and financial health, particularly in the U.S., Europe, Japan, and China.

U.S. Market Insights: In the U.S., many asset-intensive businesses, especially in the financial sector, are undervalued despite solid capital positions and liquidity, reflecting a market mindset of crisis rather than current financial realities.

European Financial Strength: European banks and industrial companies are well-capitalized and generating profits, yet they are trading below tangible book value due to market perceptions of impending downturns, creating investment opportunities.

Japanese and Chinese Opportunities: Japan's companies often have strong balance sheets with net cash positions, while in China, a distinction exists between companies with solid financials and those facing real risks, presenting a selective investment landscape focused on financial strength.