March GL Plans $60 Million Investment for Oil Exploration in Greenland

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jan 10 2026

0mins

Source: Yahoo Finance

- Resource Potential: U.S. government studies suggest that the Arctic could hold up to 90 billion barrels of oil and nearly 1,700 trillion cubic feet of natural gas, which, if successfully developed, could have a profound impact on the global energy market.

- Strategic Investment Plan: March GL plans to raise hundreds of millions through an upcoming SPAC merger, with drilling of the first well at Jameson Land set for 2026, budgeting $40 million for the first well and approximately $20 million for the second, demonstrating confidence in future oil and gas markets.

- Geopolitical Implications: As the U.S. seeks to reduce dependence on Russian oil, the development of Greenland's oil resources could inject new supply into U.S. and European markets, potentially altering the current energy landscape.

- Operational Challenges: Due to Greenland's harsh climate, March GL faces delays in transporting equipment, with plans to begin road construction to drilling sites only after thawing in spring, reflecting the complexities of operating in the region.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy BP?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on BP

Wall Street analysts forecast BP stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for BP is 84.26 USD with a low forecast of 6.38 USD and a high forecast of 503.69 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

11 Analyst Rating

5 Buy

5 Hold

1 Sell

Moderate Buy

Current: 38.040

Low

6.38

Averages

84.26

High

503.69

Current: 38.040

Low

6.38

Averages

84.26

High

503.69

About BP

BP p.l.c. is a United Kingdom-based integrated energy company. The Company's segments include Gas & low carbon energy, Oil production & operations, Customers & products, and Other businesses & corporate. Its gas business includes regions with upstream activities that produce natural gas, integrated gas and power, and gas trading. Its low carbon business includes solar, offshore and onshore wind, hydrogen and carbon capture and storage and power trading. Oil production & operations segment comprises regions with upstream activities that predominantly produce crude oil, including bpx energy. Customers & products segment comprises its customer-focused businesses, which include convenience and retail fuels, electric vehicle charging, as well as Castrol, aviation and business to business and midstream. It also includes its products businesses, refining and oil trading, as well as its bioenergy businesses. Other businesses & corporate segment comprises technology and bp ventures.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

BP and Shell Seek US Licenses for Natural Gas Development

- Gas Development Licenses: BP and Shell are seeking U.S. licenses to develop natural gas fields shared with Venezuela, indicating their strong interest in the Latin American energy market.

- Loran-Manatee Discovery: Shell aims to secure a license for the Loran-Manatee field, which holds approximately 10 trillion cubic feet of natural gas, with 7.3 trillion cubic feet on the Venezuelan side, potentially enhancing its competitive position in the region.

- Cocuina-Manakin Project: BP plans to develop the Cocuina-Manakin field, with the Venezuelan portion linked to the idled Plataforma Deltana offshore gas project that has 1 trillion cubic feet of proven reserves, which could facilitate its expansion in Latin America if approved.

- Dragon Field Production Plans: Production at the Dragon field is expected to commence in Q4 2027, with an output of 350 million cubic feet per day, further solidifying Trinidad and Tobago's status as Latin America's largest LNG exporter.

Continue Reading

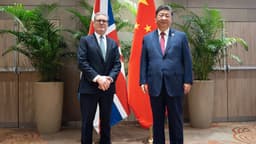

UK Prime Minister Starmer's Visit to China Aims to Reset Relations

- Trade Relationship Review: In 2015, then-Chancellor Osborne predicted UK exports to China would exceed £30 billion, yet actual exports in 2020 were only £14.5 billion, a 39% drop from 2019, highlighting the significant impact of Brexit and the pandemic on trade.

- High-Level Visit Context: Starmer's trip marks the first visit by a UK Prime Minister since Theresa May eight years ago, aiming to reset relations with China and attract more investment to support the UK's economic recovery.

- Business Delegation Participation: Accompanying Starmer are executives from top UK firms like BP, Rolls-Royce, and AstraZeneca, underscoring the government's commitment to strengthening economic ties with China, particularly in the green energy sector.

- Human Rights Issues Addressed: Starmer is expected to raise human rights concerns with Xi, including the case of imprisoned Hong Kong businessman Jimmy Lai, indicating that while seeking to reset relations, the UK government remains attentive to moral and security issues with China.

Continue Reading