Klarna Investors Urged to Act on Losses

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 1h ago

0mins

Should l Buy KLAR?

Source: PRnewswire

- Lawsuit Notification: Hagens Berman law firm is notifying investors in Klarna Group plc (NYSE:KLAR) about the upcoming February 20, 2026, lead plaintiff deadline concerning allegations of misstatements in Klarna's September 2025 IPO documents.

- Investor Losses: Investors who purchased Klarna shares and suffered significant losses, particularly due to the company's aggressive lending practices to financially unsophisticated consumers, are encouraged to contact the firm for legal support.

- Surge in Credit Losses: Just weeks after the IPO, Klarna reported a staggering 102% year-over-year increase in its credit loss provisions, raising serious questions about the transparency of its IPO documents and causing shares to plummet well below the $40 IPO price.

- Whistleblower Program: Hagens Berman is also encouraging whistleblowers with non-public information regarding Klarna to assist in the investigation, as the new SEC Whistleblower program offers rewards of up to 30% of any successful recovery for original information provided.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy KLAR?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on KLAR

Wall Street analysts forecast KLAR stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for KLAR is 44.36 USD with a low forecast of 36.00 USD and a high forecast of 55.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

11 Analyst Rating

9 Buy

2 Hold

0 Sell

Strong Buy

Current: 21.720

Low

36.00

Averages

44.36

High

55.00

Current: 21.720

Low

36.00

Averages

44.36

High

55.00

About KLAR

Klarna Group Plc is a United Kingdom-based technology company focused on developing commerce networks. The Company is an artificial intelligence (AI)-powered global payments network and shopping assistant. It provides consumers and merchants with a range of solutions, including payment, advertising and digital retail banking, through several channels. Its online payments solution is designed to bridge uncertainty in the transactions between consumers and merchants by providing short-term credit to consumers interest-free. Its range of payment options allows consumers to purchase what they choose, both online and offline. Its payment solutions include Pay in Full, Pay Later and Fair Financing. Its Pay in Full instantly settles purchases at the time of the transaction. Its Pay Later enables consumers to purchase goods or services at the time of the transaction and pay the full amount at a later date. Its Fair Financing allows consumers to pay for their purchase over a longer duration.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

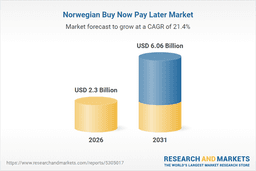

- Market Growth Potential: Norway's Buy Now Pay Later market is projected to reach $2.3 billion by 2026, with an annual growth rate of 25.7%, indicating a sustained consumer demand for flexible payment options that drives rapid retail and e-commerce expansion.

- Long-Term Growth Trend: From 2026 to 2031, the market is expected to grow at a compound annual growth rate of 21.4%, with a projected market size of approximately $6.06 billion by 2031, providing a solid foundation for investors seeking long-term opportunities and strategic positioning.

- Consumer Behavior Insights: The report offers an in-depth analysis of consumer attitudes and spending behaviors, including expenditure shares segmented by age and income, which will aid businesses in better understanding their target markets and formulating appropriate marketing strategies.

- Competitive Landscape Assessment: The BNPL market in Norway is highly competitive, with key players like Klarna and Vipps Pay Later; market share analysis will provide valuable benchmarks for new entrants to develop effective market entry and expansion strategies.

See More

- Lawsuit Background: Levi & Korsinsky LLP has notified investors that Klarna Group plc is facing a class action securities lawsuit aimed at recovering losses for affected investors who purchased securities during the IPO on September 10, 2025.

- Allegations Details: The complaint alleges that the defendants failed to adequately disclose the risk of a significant increase in loss reserves shortly after the IPO, resulting in materially false and misleading public statements at all relevant times.

- Investor Rights: Affected investors have until February 20, 2026, to request to be appointed as lead plaintiff, with no out-of-pocket costs or fees required to participate in the lawsuit.

- Law Firm's Strength: With 20 years of experience in securities litigation, Levi & Korsinsky has secured hundreds of millions for aggrieved shareholders and has been recognized as one of the top securities litigation firms in the U.S. for seven consecutive years.

See More

- Lawsuit Notification: Hagens Berman law firm is notifying investors in Klarna Group plc (NYSE:KLAR) about the upcoming February 20, 2026, lead plaintiff deadline concerning allegations of misstatements in Klarna's September 2025 IPO documents.

- Investor Losses: Investors who purchased Klarna shares and suffered significant losses, particularly due to the company's aggressive lending practices to financially unsophisticated consumers, are encouraged to contact the firm for legal support.

- Surge in Credit Losses: Just weeks after the IPO, Klarna reported a staggering 102% year-over-year increase in its credit loss provisions, raising serious questions about the transparency of its IPO documents and causing shares to plummet well below the $40 IPO price.

- Whistleblower Program: Hagens Berman is also encouraging whistleblowers with non-public information regarding Klarna to assist in the investigation, as the new SEC Whistleblower program offers rewards of up to 30% of any successful recovery for original information provided.

See More

- Class Action Filed: The Schall Law Firm has initiated a class action lawsuit against Klarna Group for violations of federal securities laws related to its IPO on September 10, 2025, impacting investor rights significantly.

- False Statements Revealed: The complaint alleges that Klarna downplayed the risks associated with its loss reserves, misleading investors and resulting in financial damages when the truth emerged, indicating serious deficiencies in the company's disclosures.

- Investor Rights Advocacy: The firm encourages investors who purchased Klarna securities before February 20, 2026, to contact them to participate in the lawsuit and seek compensation, highlighting the importance of protecting investor rights.

- Lawsuit Not Yet Certified: The class action has not yet been certified by the court, meaning investors are not currently represented by an attorney, underscoring the urgency for timely action to safeguard their interests.

See More

- Lawsuit Background: The Gross Law Firm has issued a notice encouraging shareholders who purchased KLAR shares during the September 10, 2025 IPO to contact them regarding potential lead plaintiff appointments, indicating that this lawsuit pertains to possible claims against Klarna securities.

- Allegations: The complaint alleges that Klarna failed to adequately disclose the risk of significantly increased loss reserves shortly after the IPO, resulting in materially false and misleading public statements that affected investor confidence during the relevant period.

- Registration Deadline: Shareholders must register for this class action by February 20, 2026, emphasizing the importance of timely action as unregistered shareholders will be unable to participate in any recovery.

- Law Firm's Strength: The Gross Law Firm is committed to protecting investor rights and emphasizes its expertise in handling fraud and illegal business practices, aiming to recover losses for investors affected by misleading statements.

See More

- Class Action Notice: Rosen Law Firm reminds purchasers of Klarna Group securities that they must apply to be lead plaintiff by February 20, 2026, to participate in the class action related to the September 2025 IPO, potentially receiving compensation without any out-of-pocket costs.

- Lawsuit Background: The lawsuit alleges that Klarna's Registration Statement contained false and misleading statements, failing to disclose the significant risk of increased loss reserves shortly after the IPO, which led to investor losses when the true information became public.

- Law Firm Credentials: Rosen Law Firm specializes in securities class actions, having recovered over $438 million for investors in 2019 alone, and was ranked first in 2017 for the number of securities class action settlements, demonstrating its expertise and success in this field.

- Participation Instructions: Investors can visit the specified website or call the toll-free number for more information, emphasizing the importance of selecting experienced legal counsel to protect their rights in the class action.

See More