Intuitive Machines (LUNR) Raises Price Target to $25 Amid Lanteris Acquisition

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Dec 30 2025

0mins

Should l Buy LUNR?

Source: Benzinga

- Acquisition Catalyst: Clear Street analyst maintains a Buy rating on Intuitive Machines and raises the price target from $17 to $25, primarily driven by the pending acquisition of Lanteris, which is expected to significantly enhance the combined revenue outlook.

- Financial Strength: The analyst noted that Intuitive Machines has more cash than debt on its balance sheet, indicating a solid financial position that supports future growth initiatives.

- Market Opportunities: The acquisition positions Intuitive Machines as a next-generation space prime contractor with exposure to multi-billion-dollar lunar programs, particularly amid increased U.S. focus on lunar exploration.

- Revenue Projections: The combined revenue of Intuitive Machines and Lanteris is projected to reach $1.045 billion by 2027, a substantial increase from the previous estimate of $452 million, reflecting the potential benefits of the acquisition and market expansion opportunities.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy LUNR?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on LUNR

Wall Street analysts forecast LUNR stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for LUNR is 17.74 USD with a low forecast of 9.50 USD and a high forecast of 25.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

10 Analyst Rating

8 Buy

1 Hold

1 Sell

Moderate Buy

Current: 14.790

Low

9.50

Averages

17.74

High

25.00

Current: 14.790

Low

9.50

Averages

17.74

High

25.00

About LUNR

Intuitive Machines, Inc. is a space technology, infrastructure, and services company. It is a provider and supplier of space products and services that enable sustained robotic and human exploration to the Moon, Mars, and beyond. Its services include delivery services, data transmission services, and infrastructure as a service. Its delivery services provide transportation and delivery of payloads, such as satellites, scientific instruments and cargo to various destinations in space, in addition to rideshare delivery and lunar surface access. Its data transmission services offerings include the collection, processing, and interpretation of space-based data, utilizing applications, such as command, control, communications, reconnaissance and prospecting. Its infrastructure as a service delivers space assets, performing tasks and making decisions without human intervention that are designed to perform essential functions, such as navigation, scientific data collection, and others.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- IPO Anticipation: SpaceX's potential IPO in 2026, valued at $1.5 trillion, is drawing investor attention while simultaneously causing capital outflows from other space companies, indicating a strong market preference for SpaceX.

- Capital Rotation: As investors shift funds from established public players to SpaceX, many public peers have experienced significant double-digit declines over the past 30 days, reflecting a cautious market sentiment towards emerging space companies.

- Divergent Stock Performance: While AST SpaceMobile has shown resilience due to its satellite-to-phone milestones, hardware and launch providers like Rocket Lab and Sidus Space have suffered greater losses, highlighting varying levels of market confidence among different companies.

- Challenges for Rocket Lab: Rocket Lab is racing to deploy its reusable Neutron rocket, but remains at a disadvantage until it transitions from the expendable Electron model, impacting its competitive position in the market.

See More

- Market Volatility Impact: Intuitive Machines (NASDAQ:LUNR) shares fell 18.87% to $15.91 on Wednesday, reflecting a broader sell-off in technology stocks as the Nasdaq index dropped 0.98%, indicating a bearish market sentiment.

- Mixed Technical Indicators: Currently, LUNR is trading 10.9% below its 20-day simple moving average while being 34.2% above its 100-day SMA, suggesting short-term weakness but maintaining long-term strength in its price performance.

- Upcoming Earnings Report: Investors are looking forward to the earnings report on March 23, 2026, with an EPS estimate of a loss of 5 cents (an improvement from -2.08 cents YoY) and a revenue estimate of $53.34 million (down from $54.66 million YoY), highlighting the challenges the company faces.

- Analyst Ratings and Targets: Despite current stock volatility, LUNR holds a “Buy” rating with an average price target of $18.00, while Keybanc raised its target to $26.00, reflecting analysts' confidence in the company's future prospects.

See More

- Rocket Lab's Market Performance: Rocket Lab has successfully launched its Electron rocket 81 times, deploying over 248 satellites, and plans to introduce its Neutron rocket this year to carry heavier payloads, with revenue expected to grow from $600 million in 2025 to $1.29 billion in 2027, indicating strong long-term potential in the space transportation market.

- Key Contract Signing: Rocket Lab secured an $816 million contract with the U.S. Space Development Agency to design and manufacture 18 satellites, marking a critical step in diversifying its business away from core launch services.

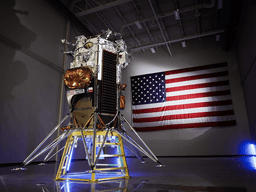

- Intuitive Machines' Lunar Exploration: Intuitive Machines has successfully sent two Nova-C landers to the moon, with IM-1 marking the first successful U.S. moon landing since 1972, and revenue projected to increase from $219 million in 2025 to $1.04 billion in 2027, showcasing robust growth potential in commercial lunar services.

- Acquisition and Business Expansion: Intuitive Machines recently acquired Lanteris Space Systems to further diversify its business, aiming for profitability in 2026 and a fivefold increase in net income by 2027, reflecting its strategic vision as a

See More

- NASA Selection: Intuitive Machines was selected by NASA as one of 34 global volunteers to track the Artemis II mission, utilizing its Space Data Network and ground station infrastructure to monitor radio waves from the in-flight Orion spacecraft, highlighting the company's pivotal role in the aerospace sector.

- Launch Delay: NASA announced that the potential launch of Artemis II has been postponed to February 8 from the originally scheduled February 6 due to cold weather and high winds in Florida, underscoring the significant impact of weather on space launch schedules.

- Stock Volatility: Shares of Intuitive Machines fell over 5% last week and have dropped more than 12% in the past year, reflecting market caution ahead of the Artemis II mission and affecting investor confidence.

- Analyst Optimism: KeyBanc analyst raised the price target for Intuitive Machines from $20 to $26, citing an ideal macro environment expected to drive significant growth opportunities in the space and defense technology sectors, indicating a positive outlook for the company's future.

See More

- Stock Price Surge: Intuitive Machines (LUNR) saw over a 3% increase in after-hours trading on Monday, reflecting market optimism following its selection by NASA to track the Artemis II Mission, indicating investor confidence in the company's future prospects.

- Global Volunteer Network: The company is now one of 34 global volunteers chosen by NASA to track this crewed lunar mission, highlighting its recognition and influence in the aerospace sector, which may pave the way for future contracts and collaborations.

- Significance of Artemis Program: The Artemis II Mission represents the first crewed flight of the Artemis program, scheduled to launch no earlier than February 6, marking a significant step in humanity's return to the Moon, with Intuitive's involvement potentially enhancing its standing in the aerospace market.

- Increased Market Attention: As the mission approaches, investor and market attention on Intuitive Machines is likely to rise, potentially driving further development in aerospace technology and bolstering investor confidence.

See More

- NASA Partnership: Intuitive Machines is recognized as one of NASA's top 20 partners by contract value for 2024, highlighting its significance in the Artemis program and expected to drive future business growth.

- Satellite Infrastructure Orders: The company has secured contracts totaling $4.82 billion from NASA for lunar satellite infrastructure, further solidifying its market position in the aerospace industry.

- Financial Improvement: Revenue for Q3 2025 reached $52.4 million, with net losses significantly reduced from $81.1 million in 2024 to $10.3 million, indicating substantial progress in the company's financial health.

- Strong Cash Reserves: As of the most recent quarter, Intuitive Machines holds $622 million in cash reserves against $371 million in debt, providing robust financial support for future projects and expansions.

See More