IBM or Oracle: Which Tech Stock is Poised for Greater Success in 2026?

IBM's Growth and Focus: IBM's shares have risen 41.5% in 2025, driven by its focus on AI, cloud services, and quantum computing, with a strong recurring revenue of $22.7 billion in fiscal Q3. Analysts predict a 21.9% earnings surge despite a 4.5% revenue growth forecast.

Oracle's Performance and Valuation Concerns: Oracle's stock has increased by 24.2% in 2025, benefiting from its cloud infrastructure and AI partnerships, with expected revenue growth of 9.7% and earnings growth of 11.2%. However, analysts express concerns about its high valuation.

Analyst Ratings Comparison: Both IBM and Oracle hold a Moderate Buy rating from analysts, with IBM's average price target suggesting a slight downside risk, while Oracle's target indicates significant upside potential of 73.5%.

Future Outlook: IBM is positioned for steady earnings growth, while Oracle is expected to lead in revenue expansion through its aggressive cloud and AI strategies, raising the question of which company is better positioned for 2026.

Trade with 70% Backtested Accuracy

Analyst Views on ORCL

About ORCL

About the author

Oracle's Cloud Market Share Growth and Financial Outlook

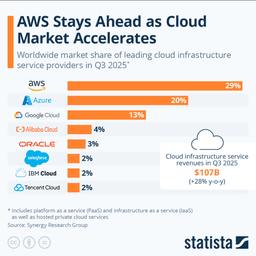

- Cloud Market Share Increase: Oracle's focus on high-performance computing has raised its cloud market share from 2% in 2024 to 3%, showcasing a competitive edge in a $944 billion industry, with expectations for further growth by 2026.

- Strong Financial Performance: For the first half of fiscal 2026 ending November 30, 2025, Oracle's cloud segment generated over $15 billion in revenue, a 31% year-over-year increase, driving overall revenue to $31 billion with the cloud segment accounting for 49%.

- Future Growth Potential: Analysts forecast a 17% revenue growth for fiscal 2026 and 29% for the following year, which could enhance Oracle's stock performance despite its current debt of $108 billion.

- Strategic Investment Returns: While Oracle's heavy investment in cloud infrastructure has increased its debt, its P/E ratio of 33 is close to the S&P 500 average of 31, indicating market confidence in its future growth prospects.

Dan Ives: Wall Street's Top Performer – Is He Worth Your Trust?

- Dan Ives' Busy Schedule: Dan Ives is currently managing a demanding workload, indicating his active involvement in the financial sector.

- Market Insights: He is likely providing insights and analysis on market trends, reflecting his expertise and influence in the industry.