i-80 Gold Corp Reports Significant 2025 Drilling Results, Expanding Mineral Resource Potential at South Pacific Zone

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jan 20 2026

0mins

Should l Buy IAUX?

Source: Newsfilter

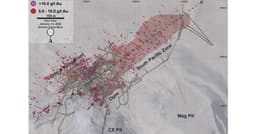

- Significant Drilling Results: The 2025 drilling campaign at the Granite Creek Underground project revealed robust high-grade mineralization across 40 holes, confirming the potential for mineral resource expansion in the South Pacific Zone.

- Resource Estimate Enhancement: As of December 31, 2024, Granite Creek Underground hosts a measured and indicated gold resource estimate of 261,000 ounces at 10.5 g/t and an inferred resource of 326,000 ounces at 13.0 g/t, indicating strong economic potential for the project.

- Drilling Program Progress: The 2025 drilling program involved 16,000 meters across 46 holes, primarily focused on infill drilling to support resource classification conversion, with results expected to inform the feasibility study planned for 2026.

- Future Development Strategy: The company plans to continue step-out and infill drilling at the South Pacific Zone in 2026, aiming to further confirm mineralization continuity and extend the project's mine life, thereby strengthening its market position in Nevada.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy IAUX?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on IAUX

Wall Street analysts forecast IAUX stock price to fall over the next 12 months. According to Wall Street analysts, the average 1-year price target for IAUX is 1.23 USD with a low forecast of 1.10 USD and a high forecast of 1.47 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

3 Analyst Rating

3 Buy

0 Hold

0 Sell

Strong Buy

Current: 1.700

Low

1.10

Averages

1.23

High

1.47

Current: 1.700

Low

1.10

Averages

1.23

High

1.47

About IAUX

i-80 Gold Corp. is a mining company. The Company is a gold and silver producer engaged in the exploration, development, and extraction of gold and silver. Its operations include Lone Tree, Ruby Hill, Granite Creek and McCoy-Cove. The Company owns a 100% interest in the Lone Tree and Buffalo Mountain gold deposits and Lone Tree processing complex (collectively, the Lone Tree Project). The total land package of the Lone Tree property consists of approximately 12,000 acres. The Company holds a 100% interest in the Ruby Hill property located along the Battle Mountain-Eureka Trend in Eureka County, Nevada. It owns a 100% interest in the Granite Creek gold project located at the intersection of the Getchell gold belt and the Battle Mountain-Eureka Trend in Humboldt County, Nevada. It owns a 100% interest in the McCoy-Cove project. The Company holds a 100% interest in the FAD project located along the Battle Mountain-Eureka Trend in Eureka County, Nevada.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Board Expansion: i-80 Gold Corp. announces the appointment of Ronald Butler Jr., Michael Jalonen, and Steven Yopps as independent directors effective February 1, 2026, increasing the board to nine members to enhance governance and support growth strategies in Nevada.

- Rich Industry Experience: Each new director brings extensive backgrounds in mining, finance, and capital markets, with Ron Clayton stating their expertise will provide valuable insights and guidance for the company's development plans across five gold projects and the refurbishment of the Lone Tree autoclave processing facility, aimed at creating long-term shareholder value.

- Ronald Butler's Background: Ronald Butler Jr. has over 30 years of experience in audit and financial strategic planning, having served as Managing Partner at Ernst & Young, where he led various public sector initiatives, showcasing his significant influence in the mining and finance sectors.

- Michael Jalonen's Achievements: Michael Jalonen spent nearly 30 years as a senior precious metals analyst at Bank of America Securities, covering 30 major precious metals producers, and his capital markets expertise will provide crucial support for i-80 Gold's investment decisions.

See More

- Board Expansion: i-80 Gold Corp. announces the appointment of Ronald Butler Jr., Michael Jalonen, and Steven Yopps as independent directors effective February 1, 2026, increasing the board to nine members to enhance governance and support growth strategies in Nevada.

- Diverse Industry Expertise: The new directors bring extensive experience in mining, finance, and capital markets, with Ron Clayton stating that their expertise will provide valuable insights and guidance for the company's development plans across five gold projects and the refurbishment of the Lone Tree autoclave processing facility.

- Ronald Butler's Credentials: Ronald Butler Jr. has over 30 years of experience in audit and strategic financial planning, having served as Managing Partner at Ernst & Young, where he led over 500 professionals and possesses deep knowledge of the mining and metals sector, providing strong financial leadership for the company.

- Contributions of Michael Jalonen and Steven Yopps: Michael Jalonen spent nearly 40 years as a senior precious metals analyst at Bank of America, showcasing strong market analysis skills, while Steven Yopps held executive roles at major mining companies, bringing valuable technical and project development experience to support i-80 Gold's future growth.

See More

- Accelerated Resource Development: RUA GOLD's latest drilling results at the Auld Creek project in New Zealand's Reefton Goldfield show 3.0m @ 21.27 g/t AuEq, successfully extending the deposit strike length by 250 meters to a total of 870 meters, with expectations to increase the resource to over 300,000 ounces, significantly enhancing the company's competitiveness in the global antimony market.

- Legislative Support: The company plans to leverage New Zealand's FAST TRACK legislation to expedite production permits for the Auld Creek project, aiming for approval within six months, which provides RUA GOLD with a strategic advantage in the global critical minerals supply chain.

- Strong Financial Position: With $14 million in cash on hand and a leadership team behind $11 billion in prior exits, RUA GOLD is well-positioned to ensure financial stability in resource development and market competition, effectively navigating market fluctuations.

- Optimistic Market Outlook: As global gold prices are projected to reach $5,055 per ounce by Q4 2026, RUA GOLD's projects will benefit from capital inflows into efficient platforms, driving the company's long-term growth potential in the gold and antimony sectors.

See More

- Mineral Expansion Potential: The 2025 drilling program involved 46 holes over 16,000 meters, revealing continuous high-grade mineralization in the South Pacific Zone, which is expected to enhance the company's competitive position in Nevada through resource expansion.

- Resource Estimate Update: As of December 31, 2024, Granite Creek Underground hosts a gold resource estimate of 261,000 ounces at 10.5 grams per tonne, with an updated estimate expected in Q1 2026, potentially enhancing the project's economic viability.

- Feasibility Study Advancement: Results from the 2025 drilling will be integrated with data from 2023 and 2024 to support the upcoming feasibility study, anticipated to be completed in Q2 2026, laying the groundwork for future production plans.

- Strategic Investment Confidence: The company expresses strong confidence in the 2026 drilling plans for the Archimedes underground and Ruby Hill projects, believing similar successes will further enhance the economic value of the mineral resources, thereby extending the project's mine life.

See More

- Significant Drilling Results: The 2025 drilling campaign at the Granite Creek Underground project revealed robust high-grade mineralization across 40 holes, confirming the potential for mineral resource expansion in the South Pacific Zone.

- Resource Estimate Enhancement: As of December 31, 2024, Granite Creek Underground hosts a measured and indicated gold resource estimate of 261,000 ounces at 10.5 g/t and an inferred resource of 326,000 ounces at 13.0 g/t, indicating strong economic potential for the project.

- Drilling Program Progress: The 2025 drilling program involved 16,000 meters across 46 holes, primarily focused on infill drilling to support resource classification conversion, with results expected to inform the feasibility study planned for 2026.

- Future Development Strategy: The company plans to continue step-out and infill drilling at the South Pacific Zone in 2026, aiming to further confirm mineralization continuity and extend the project's mine life, thereby strengthening its market position in Nevada.

See More